Aragvi holding (Trans-Oil group), Moldova’s largest agro-producer, recently posted IFRS financials for six months ended 31 December 2019 followed by the conference-call. We view the released figures as moderately positive. At the same time the data doesn’t reflect sharp deterioration of economic environment due to the situation with the global spread of coronavirus. We suggest refraining from forming long positions in HY instruments during the periods of high volatility. Still Aragvi 24 (YTM 18.5%) can become an appealing buying opportunity after the market sentiment improves and the liquidity in 3-tier names recovers (there have been no deals with the note recently). We believe the price could rebounce up to recent historical high (109%) as soon as demand for risk is back.

1H2020 Financial highlights:

- The top line came out 64.5% higher y-o-y, reaching $464 mln. Such strong sales performance was in line with estimates after the announcement of trading update in the end of January. On the back of better crops in Moldova as well as strong marketing programme implementation group managed to sell 1 717 mt of commodities of all types, showing an upside of 73% (y-o-y). The bulk of consolidated turnover (83% as at 1H20 VS 78% FY19) traditionally came from Origination and Marketing segment (commodities trading unit)

- On the negative side, Aragvi faced moderate margin decrease – consolidated EBITDA margin fell to 12.5% compared to 14.8% in the 2H19 due to costs inflation in the largest (in terms of sales and assets) Origination and Marketing segment. Gross margin in this division slipped down from 20.2% as at FY19 (ended 30.06.2019) to 17.4% for 1H20

- Net income for 1H2020 was $24 mln, a 4% increase y-o-y

- Free cash flow (FCF) returned to the negative zone (- $97 mln) despite insignificant CAPEX. This was due to high demand for working capital although operating cash flow managed to gain almost 50% y-o-y. Constant increase of scales of business and sales volumes requires the company to build up inventories. Thus, as of 31 December 2019 RMIs made up $325 mln, +15% y-o-y (72% growth since the previous reporting date)

- Debt profile has seen some mixed changes since last reported for FY19. On one hand Aragvi’s total debt added around 21% (due to short-term bank loans growth) to $477 mln. All borrowings were denominated in hard currency (almost 94% in USD). At the same time leverage ratio improved thanks to higher RMIs and EBITDA. Namely Net Debt (adjusted for RMIs)/EBITDA stood at 1.5x compared to 2.2x as at FY19. We view the current debt burden of the group as conservative, which is especially important for HY category issuers during global turmoil

- Aragvi guides that during FY2020 it will manage to originate and sell around 2 500 mt of grains & oilseeds while crushing volumes are about to exceed 400,000 mt (i.e. no downward revision of forecasts)

- Now it is difficult to predict the scale of negative impact of the situation with the coronavirus on the company’s operating profile. Management does not expect a serious deterioration in financial performance, as the demand for production will remain high and resistant even during the crisis period. At the same time, certain output disruptions are possible. Production facilities in Romania are currently not functioning due quarantine requirements

- Aragvi is rated the same level as the sovereign (“B-” cumulative level). We assume that the risk of issuer’s credit rating downgrade is limited in the near future due to its stable financial profile when compared to this kind of rating category. If the sovereign rating is revised downwards, the risk of similar actions with respect to Aragvi is also not high given that export sales account for almost 97% of the Group’s total revenue

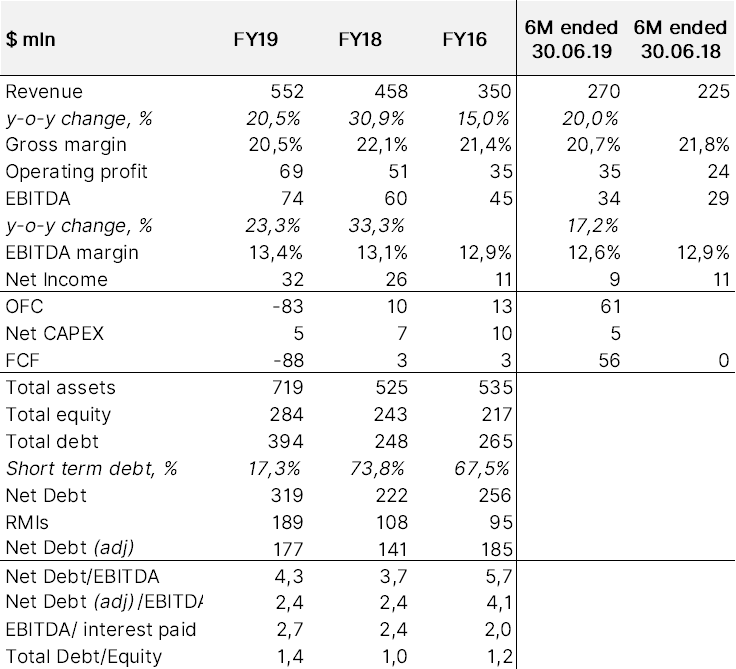

Key financial data, IFRS

Source: Company data, ITI Capital estimates

Aragvi 24 price performance

Source: Bloomberg, ITI Capital