Opening date: 17.01.2020

Purchase price: 93%

Target price: 100%

+7% through 1Q 20.

We suggest exploring the idea of buying eurobonds of the U.S. coal producer Alliance Resource Partners (B1/BB+/BBB-) with attractive risk/return ratio. ARLP 25 with maturity in May 2025 is traded with YTM 9.2% (760 bps z-spread) now. On top of the high coupon yield (7.5% coupon), we expect the notes to generate additional returns through revaluation. The bonds are traded below par value following a sell-off in autumn 2019 triggered by moderately weak 3Q19 results and revised forecasts for the entire 2019 due to unfavourable market conditions. However, we believe that the bond holders overreacted, and ARLP 25 may recover to par value, which implies a 7% price growth. 4Q19 operating results, scheduled for publication on 27.01.2020, will be one of the key growth drivers.

Alliance Resource Partners (ARLP) is a mid-size U.S. thermal coal producer founded in 1971. The company operates eight underground mining complexes in five states - Illinois, Indiana, Kentucky, Maryland and West Virginia and a coal-loading terminal. As of December 31, 2018, ARLP had approximately 1.7 bln tonnes of proven and probable coal reserves. The company’s key consumers include local and international utilities as well as industrial enterprises. In 2018, export supplies accounted for about 28% of total sales (up from 17% in 2017). ARPL has been a public company since 1999, free-float is estimated at 67%. ARPL market capitalization exceeds $1.4 bln.

Credit profile strengths:

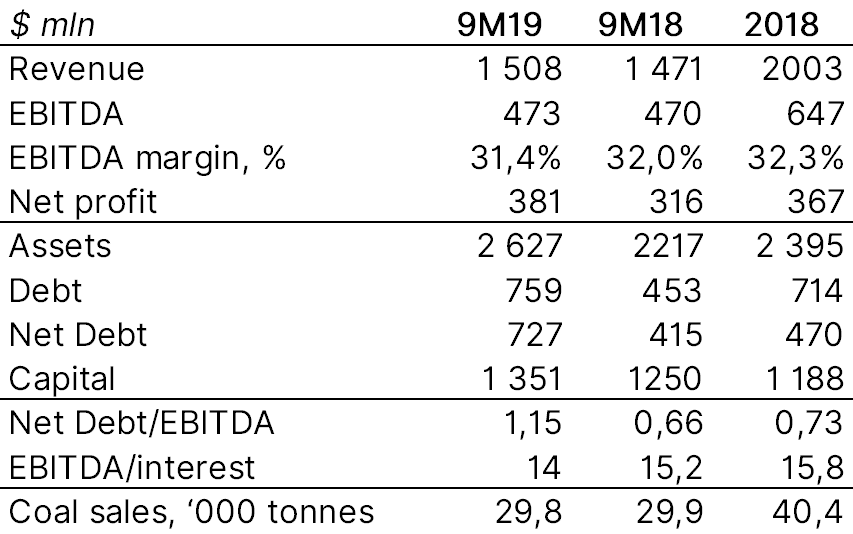

- Stable financial metrics, supported by high credit ratings. Conservative net debt/EBITDA ratio of 1.1x for 9M19. Free Cash Flow (FCF) has consistently been in the positive territory ($167 mln at the end of 3Q19)

- Most of contracts (mainly with local counterparties) are of long-term nature and provide for limited supplies. As of today, more than half of coal production volumes are booked for 2020. Moreover, the supplies have been partially agreed until 2023

- Lower production costs compared to competitors in the local market due to advantageous location in close proximity to the company’s consumers and optimization of transportation costs

- In 2018, ARPL decided to diversify its operating revenues by making several investments in U.S. oil and gas companies ($172 mln in 2018, $176 mln in 2019). The share of oil and gas in the company’s sales structure is expected to grow and will be comparable to the revenues from coal in eight years

Key drawbacks:

- High industry cyclicality. Over the past five years, coal demand in the U.S. has been weak due to cheaper shale oil, development of alternative energy sources, environmental concerns and emission cuts

- High customer base concentration. Some 30% of revenues account for sales to two largest customers: Tennessee Valley and Louisville Gas and Electric

- ARLP financial and operational performance

Olga Nikolaeva,

Senior Fixed Income Analyst