Trans-Oil (Aragvi Finance International): one of the top picks among high yield bonds

Рынок Акций

Рынок Облигаций и Валюта

Рынок Акций

Рынок Облигаций и Валюта

We outline Aragvi 24 among our top picks in EM high yield universe. Despite strong performance since placement in April 2019, notes still imply upside potential of 1,5% close to 108.5%. We believe that company’s credit profile will continue benefiting from ongoing growth momentum in the main segment of Origination & Marketing coupled with expected recovery in Crushing & Refining. Our view is justified by solid financials for the full fiscal year 2018/2019 ended 30 June 2019 released in mid October followed by strong trading update for 3M FY19/20.

Bond Summary

Issue/ISIN Aragvi 24/ XS1960552823

Country of risk Moldova

Maturity date 09.04.2024

YTM, % 10,0%

Credit ratings (M/S/F) -/B-/B

Target price, % 108.5%

-306.png)

Short company overview

- Trans-oil group of companies is the largest agro-industrial holding in Moldova with a wide range of activities including oilseeds crushing, grain handling and storage, international commodities trading, vegetable oil in bulk, bottled oil, farming and production of flour. The group has been the No.1 exporter of grains produced in Moldova over the last ten years, selling up to 57% of country’s grain export.

- The group comprises three major units: Origination and Marketing, Crushing and Refining as well as Infrastructure. The first segment is engaged in operations of buying and selling cereals, oilseeds, produced oil and meal. Trans-Oil has inland storage capacity of 750,000 MT spread among 14 elevators. Crushing and Refining division includes 3 crushing plants. The facilities with full refining and bottling capacities are located in Moldova and Romania. Moreover, the group owns export terminals in the International Free Port of Giurgiulesti (Moldova) and in Ukraine (throughput – 2.4 mln tonnes per year) that provide transshipment services, both internally and to the third parties (Infrastructure unit).

- Trans-oil is looking to ramp up its farming capacities. Currently group holds more than 60 000 hectares of farm land in long-term leases. The farms are located mainly in the North and South regions.

Recent corporate actions

- Oaktree Capital Management (OCM) has acquired a minority interest in Aragvi Holding International Ltd (the parent company of Trans-Oil Group) in June 2019. Oaktree Capital Management is a leading American global asset management firm specializing in alternative investment (including private equity) with over $120 bln of assets under management. This is the first corporate investment done by a major US global asset management firm in Moldova

- Black Sea Trade and Development Bank (BSTDB) became the "anchor investor" by purchasing 5yrs Eurobonds worth $22.25 mln

SWOT Analysis

| Strengths | Drawbacks |

|

|

| Opportunities | Risks |

|

|

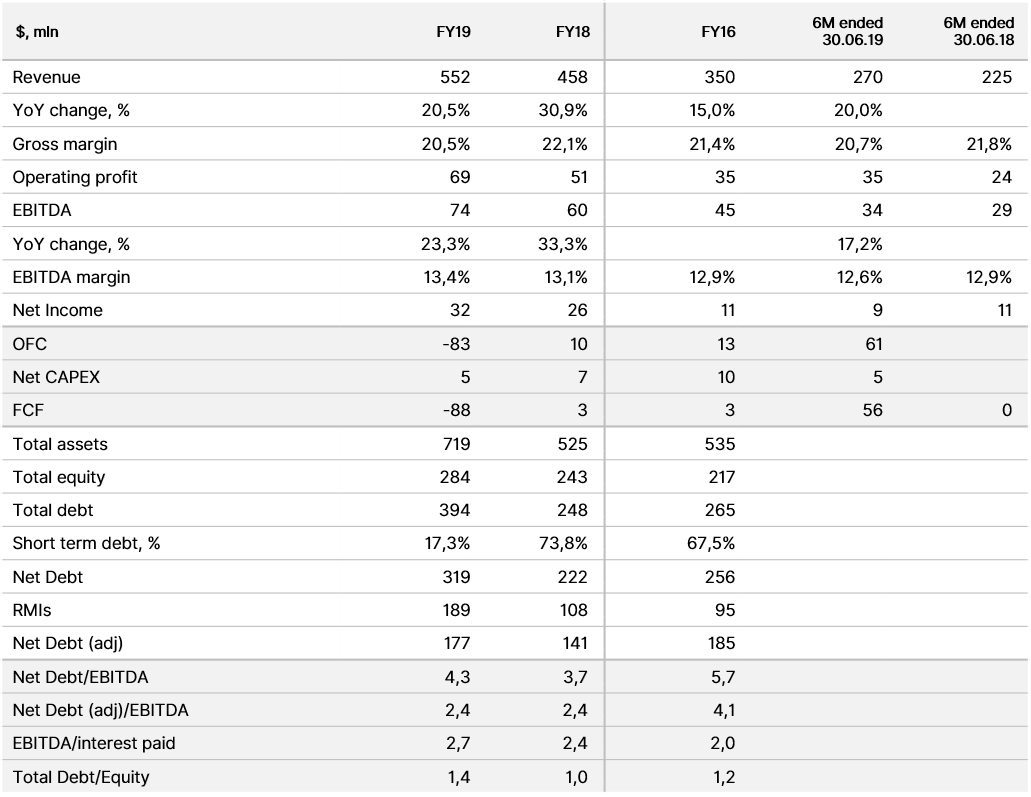

2019FY Financial highlights

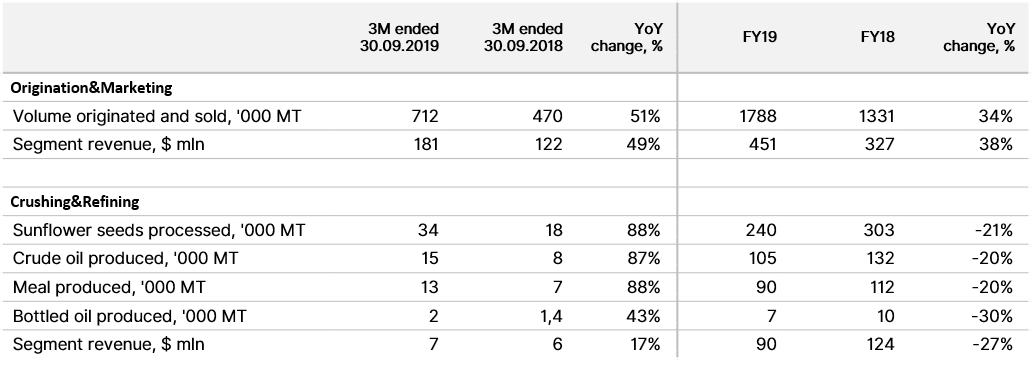

- The top line came out 21% higher YoY, reaching a historic high of $552 mln with the main growth coming from Origination and Marketing segment. The division’s trading volumes grew 34% YoY (up to 1.79 mln tonnes) thanks to improved liquidity as well as strong international marketing programme (export sales account for 97% of the group’s total revenue). At the same time, the segment’s turnover added 38% during the reported period (reaching $451 mln) on the back of increased grains and oilseeds yields. On the other hand, Crushing and Refining segment underperformed due to capacity upgrade and unfavourable price environment. That said sales contracted 27% YoY (made up $90 mln). The Infrastructure segment despite an insignificant contribution to total revenue, posted a 45% growth

- Better yields in key selling markets combined with cost control and slight local currency depreciation allowed for higher margins. EBITDA margin for FY2019 increased to 13.4% compared 13.1% in 2018

- Net income for 2019FY was $32 mln, a 23% increase YoY

- Debt profile has seen the most notable changes since previous reporting date. In early April 2019 Trans-Oil entered public debt market with debut $300 mln Eurobond issue. The deal significantly supported the company’s liquidity and improved financial flexibility by refinancing most of short-term debt. As of FY2019 the short-term portion of debt accounted only for 17% of total debt compared to 86% as of end-December 2018. $150 mln PXF facility acquired in October 2019 further mitigated refinancing risks

- As of 30 June 2019 all borrowings were denominated in hard currency (almost 95% in USD). Leverage calculated as Net Debt (adjusted for RMIs)/EBITDA stood at 2.4x, marginally unchanged YoY

- Free cash flow turned negative for the first time in the observed period as a result of additional investments in working capital the company has undertaken to secure greater trading volumes and higher profitability in the next season. On the other hand, these investments are about to support EBITDA expansion and deleveraging in 2020

- Going forward, we believe that further evolution of operating profile will translate into solid financial metrics and restrain debt burden. Major growth drivers will include expansion of sunflower seed crushing capacity through the recent acquisition of a plant in Romania and development of a new organic and high-oleic seeds crushing operation in Moldova. In October 2019, the group rented a 39’500 sq. m. plot of land on Prut river shoreline for 49 years as part of a land lease agreement with Danube Logistics – operator of Giurgiulesti port. The agreement is aimed at building the forth crushing facility and making the most out of sunflower seeds production potential in Moldova. The plant will have a crushing capacity of 750 MT of sunflower seeds per day and is scheduled to be commissioned in Q3FY2021

- Trans-Oil guides to sell at least 2 mln tonnes of grains and oilseeds (VS1,79 mt in 2019) and crush some 450 kt (compared to 240 kt in 2019) of sunflower seeds in FY2020. It is also expected that international sunflower oil prices will see slight recovery next year on the back of strengthening global demand. That said, we assume a decent growth in operating cash flow generation in the upcoming year

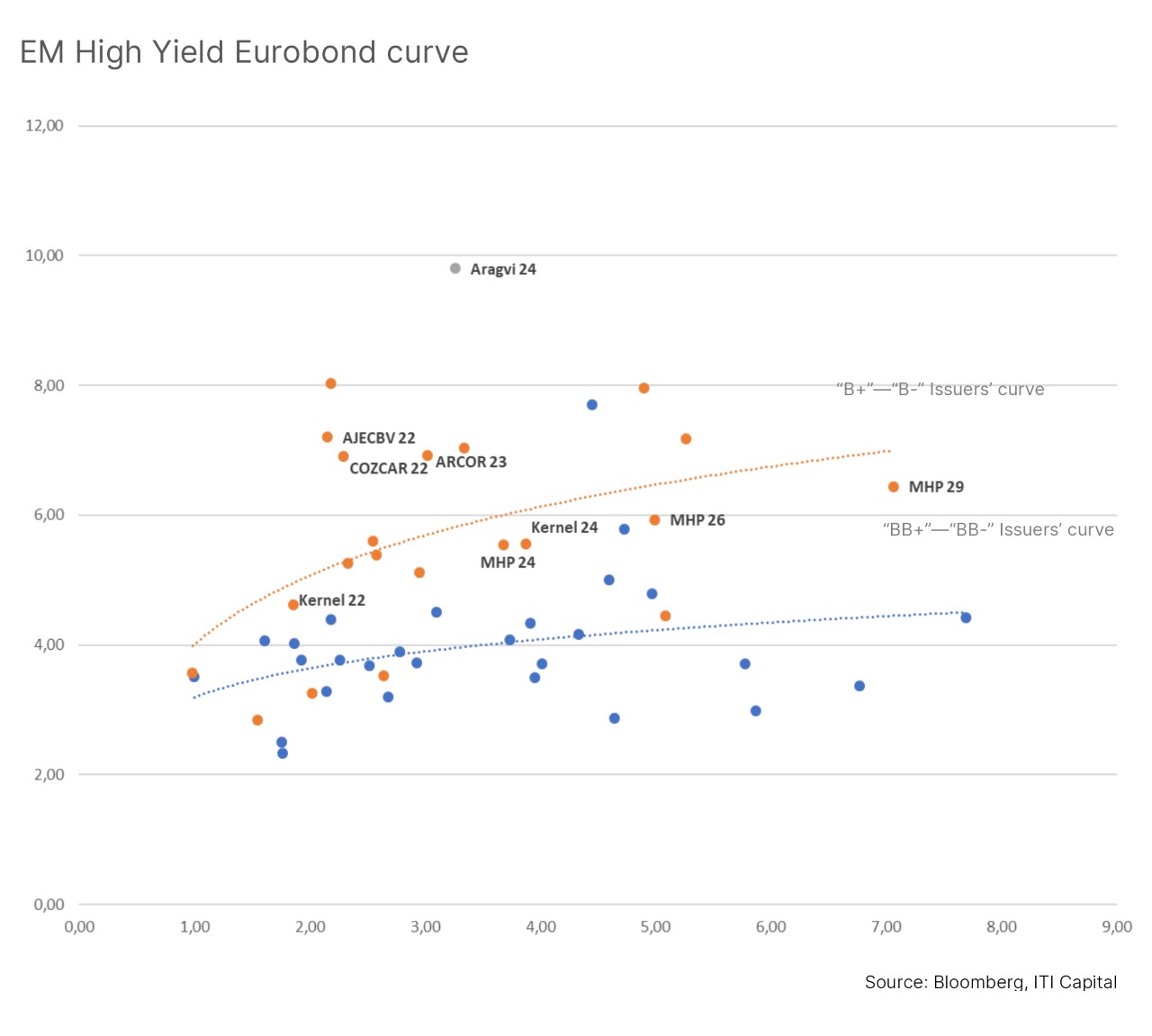

Eurobond comparative analysis and upside potential

- Since the placement date, the bond has well performed and is already up by over 7%. We estimate that Aragvi 24 (B-) still has an additional upside of 1,5% close to 108.5%. Moreover, the company’s bonds are an attractive investment target in HY segment on the back of moderate credit risks and ongoing business growth momentum

- Ukraine’s Kernel (B/B+) is of one of the closest competitors and peers, but it’s 4.5x higher in volumes though Trans-oil faces less competition at home. We evaluate that a fair spread between two issuers should not exceed 400 bps (compared to current 425 bps) given the differences in scale of economies and credit ratings