Home Credit Bank: perpetual Eurobonds sell-off not justified

Home Credit and Finance Bank's (-/-/ВВ-/ruА) has placed $200 mln of HCFBRU perp eurobonds in early November 2019. Recently, the securities declined, down nearly 2% from price highs. We believe that the trend is unjustified and we see the potential for recovery to at least 101.5%.

- The decision of a parent company, Home Credit N.V., to scrap an IPO on the Hong Kong Stock Exchange was among the corporate actions that could have weighed on the bank’s bonds. However, we believe that the bond holders overreacted, as the decision to cancel the deal will not have a negative impact on the credit quality (in particular, on capital adequacy) of Home Credit and Finance Bank Russia. First of all, it was Home Credit N.V., the parent company, that sought an IPO. But even without additional capital the shareholder has enough resources to support its subsidiaries if needed. Home Credit N.V. was looking to raise up to $1.5 bln, as its assets portfolio exceeds $51 bln. Moreover, Petr Kellner, the key beneficiary of the group, is the richest man in the Czech Republic (his wealth is estimated at $12.5 bln). In mid-November, when Home Credit and Finance Bank (ruA) was assigned a credit rating by ACRA rating agency, the positive effect of potential support from the shareholder was estimated at one notch (it raises the estimate of creditworthiness)

- The current unrest in Hong Kong, which has been going on for a long time now, is likely to have had a negative impact on risk appetite and valuation of the financial institution. At the same time, the unwillingness of the issuer to launch an IPO "at any cost" indirectly indicates that the company is not facing liquidity problems.

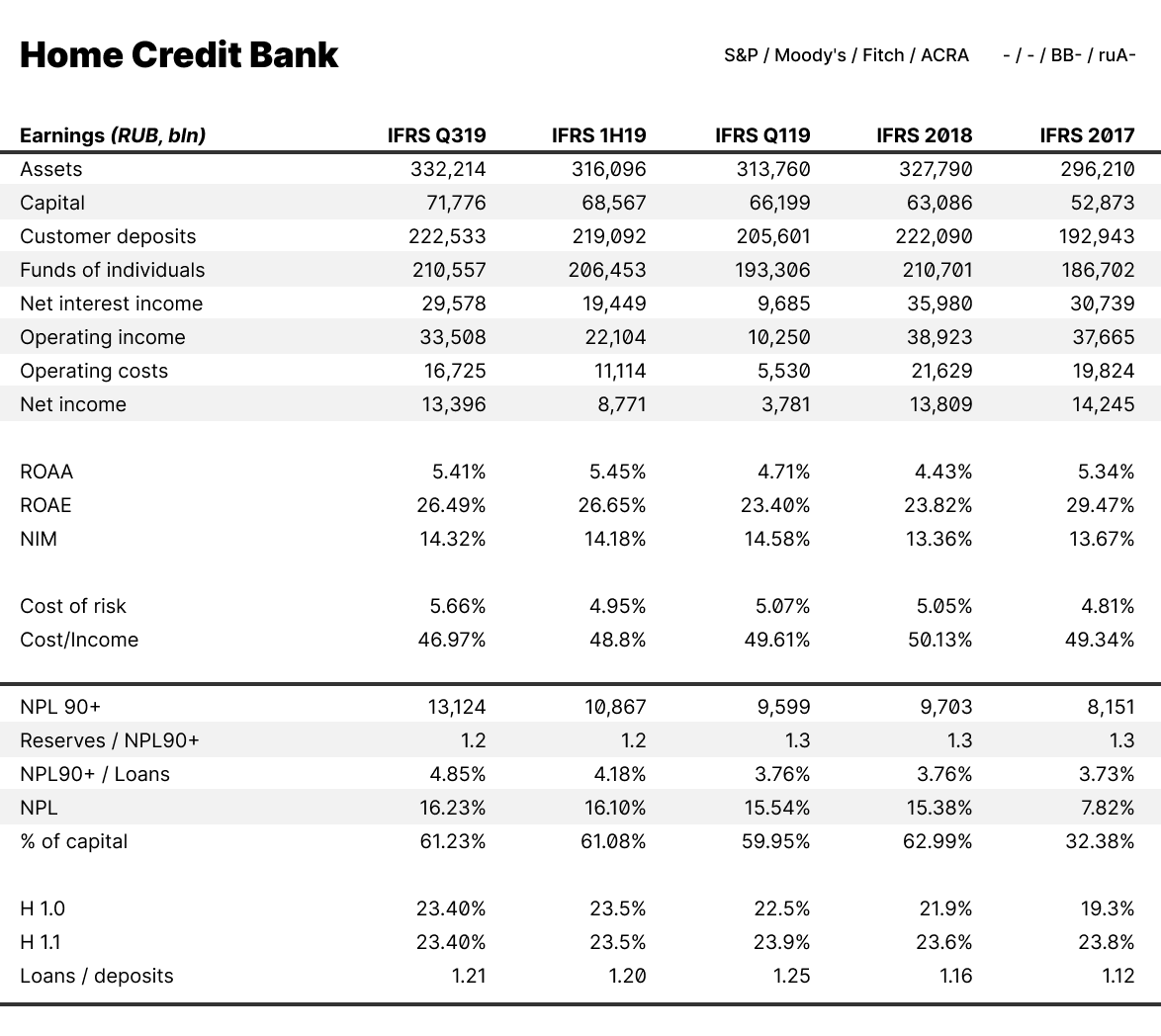

- At the end of November, Home Credit and Finance Bank presented its January-September 2019 IFRS financial results. The report suggests continued growth of assets (the loan portfolio for Q319 increased 4%), while their quality remains high (the share of NPL 90+ is estimated at 4.8%). The bank also confirmed its strong capitalisation figures. As of the end of September 2019, the capital adequacy ratio (Tier-1), calculated in line with the Basel standards, was 23.4%. The bank's capital adequacy ratio under RAS (N1.2), in turn, was 11%. Such a substantial safety margin give confidence to the holders of perpetual subordinated bonds. Publicly traded bonds of Home Credit and Finance Bank were unchanged following the release

- We believe that the issue of HCFBRU perp (YTC 8.89%) retains upside bias. Subordinated Eurobonds of Sovcombank - Sovcom 30 (YTC 6.95%) may be used as a reference for our projections. The securities of the latter issuer should obviously be traded at a discount due to better credit ratings and other terms of bond issues. We estimate this spread at about 160-170 bps. Currently, the yield gap between the two financial institutions is about 200 bps. Thus, the fair value of HCFBRU perp issue is not less than 101.5% (upside over 1%)

Olga Nikolaeva, Senior Fixed Income Analyst