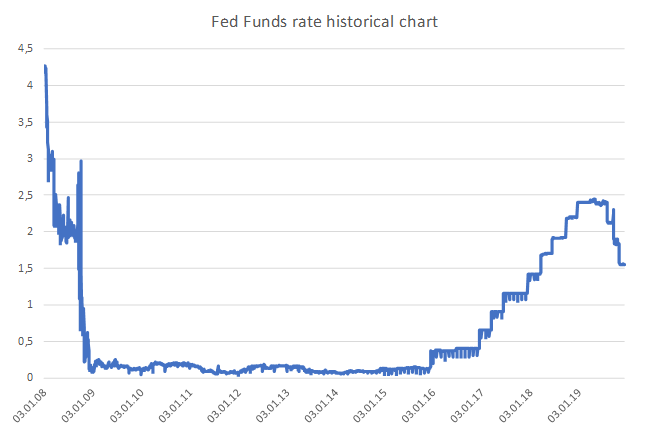

The Federal Open Market Committee held the target range of the federal funds rate steady at 1.5% to 1.75% in line with market expectations. However, the regulator adopted a more hawkish tone than the market anticipated. Wednesday's vote was the first unanimous decision since May. Looking ahead, the Fed’s dot-plot of interest rates forecasts by officials showed no changes next year. Only four of 17 officials think rates might rise in 2020.

The markets welcomed the decision. It suggests a sustainable economic growth and stable bank funding costs. In terms of further monetary policy adjustments, the Fed will look at the growth rate and consumption, as well as geopolitical factors rather than inflation that remains low.

Impact on high-yielding bonds

We believe that a pause in the dollar rate cutting cycle may curb demand for high-yielding Eurobonds that has been strengthening since early 2019. The premium of high-yielding Eurobonds to the UST has already dropped sharply, limiting further growth of the UST prices under the current Fed policy.

At the same time, the strong prospects of currency rates remaining on hold over the next 12 months may prompt issuers with a lower than investment grade rating to offer an additional premium to the risk compared to the current levels.

Other important point is that as global recession risks are falling considerably which is a reflection of US hawkish stance there are growing chances of rate increase next year especially if USA and China will complete phase one deal agreement at better terms, the latest agreement is that USA will not scale back previous tariffs but will cancel upcoming ones on December 15.

What to BUY?

We recommend taking a look at the Ukrainian issuers such as DTEK (-/-/B-), Metinvest (-/B/BB-), Kernel (-/B/BB-). We also like securities of financial institutions, such as Unifin Financiera (-/BB/BB), Credito Real (-/BB+/BB+), Uzbek Industrial and Construction Bank (-/BB-/BB-).