Yandex and Mail.ru: A bet on business development

On Friday, October 11, Yandex shares tumbled 19% on the Moscow Stock Exchange and 16% on Nasdaq (losing $1.5 bln of cap) against the background of discussed bill suggesting limiting foreign ownership of significant resources of the Russian information infrastructure to 20%. Since Friday, Yandex stock have only partially paired losses. Mail.ru shares declined 3% on the LSE last Friday (October 11).

We thus set our recommendation as Buy for both IT-operators and consider a 20–34% discount to peers to be excessively high, as we expect business integrity to remain intact. However, we do not rule out increased volatility, primarily of Yandex shares in the near term, and we recommend a one-year investment horizon for IT stocks.

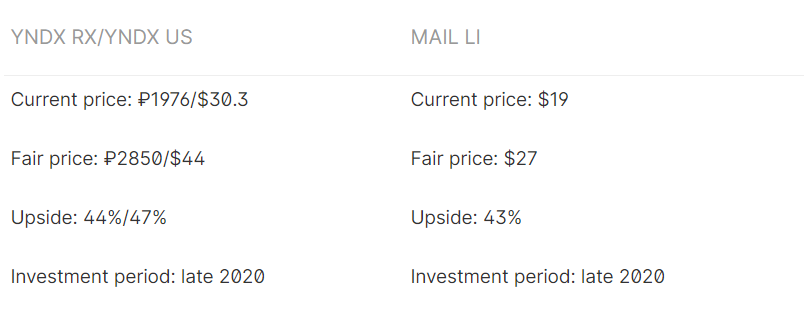

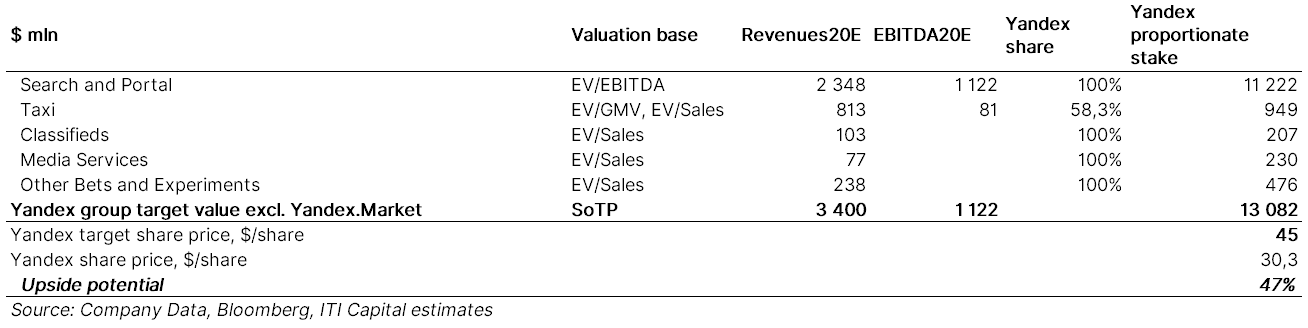

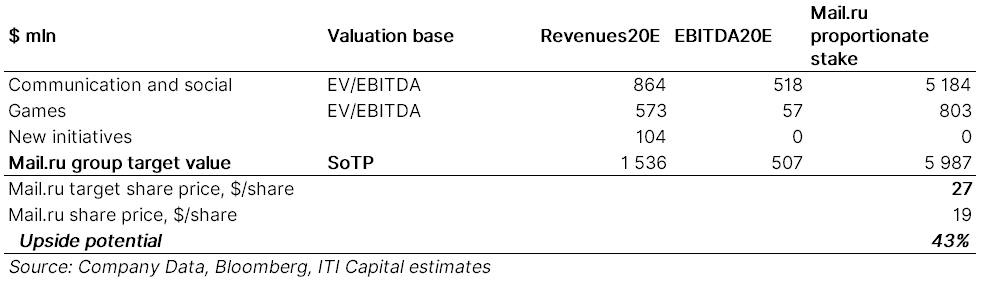

Our estimate assumes a 44% upside for Yandex by the end of 2020, up to 2850 roubles per share ($45/ADR), and 43% — for Mail.ru, up to $27/GDR. Our assumption is more conservative as compared to consensus, which is justified given the upcoming legislative changes in the sector.

- We assume the bill’s adoption to be inevitable and be merely a matter of time. The next discussion of the draft is scheduled for November, Vedomosti reports

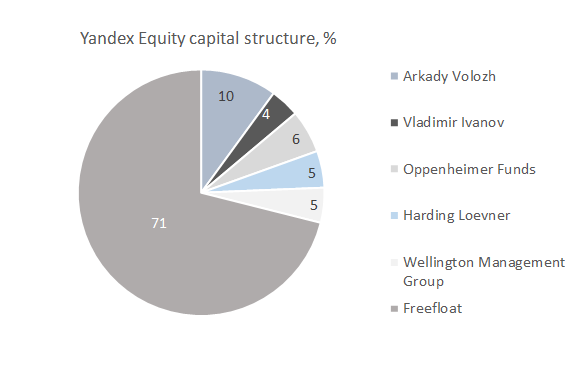

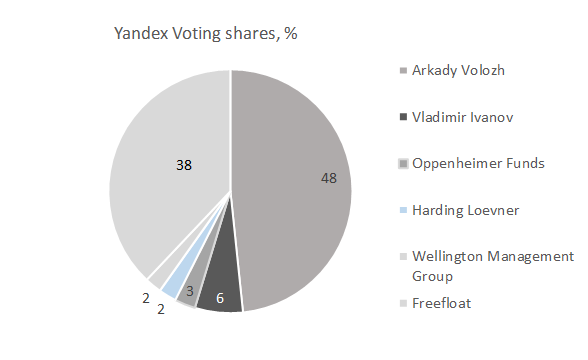

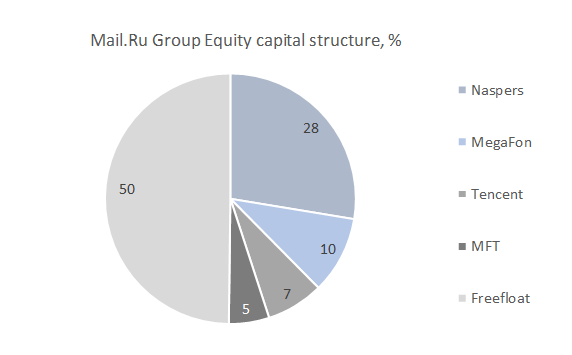

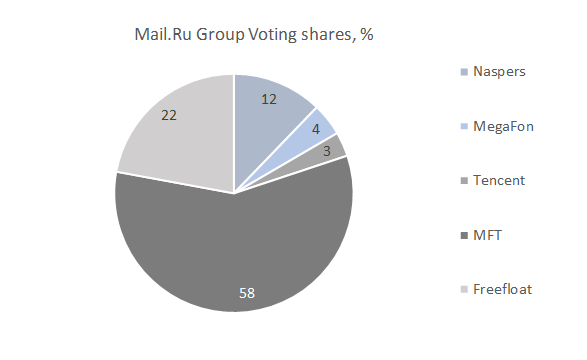

- The law is seen to change the structure of Yandex equity capital in the first place. Mail.ru is unlikely to face any significant changes in terms of equity capital, given a string of JVs set up recently with state-owned entities

- While it is difficult to predict name of a new shareholder, most likely this would be state company and/or bank; the number of potential bidders is significant

- Ownership changes with subsequent amendments to the strategy and value erosion are the main risks for Yandex. However, we expect Yandex' business to survive ownership changes and to maintain its integrity and attractiveness in the long run. Mail.ru may even considerably benefit if a new shareholder (if any) come in

Online services market in Russia

Our integration into virtual space is growing rapidly. Information search, navigation, music and video content, dating, games, TV and news, reading books, storing information, and finally communication. It’s increasingly hard to imagine a real life without online services: hailing a taxi, ordering food, shopping, making payments, making a doctor’s appointment, renting a car — online are increasing their presence in our everyday life. The day is not far off when a voice assistant will be help us to unlock front door, pay bills, shop, carry out timely medical diagnostics and medication monitoring, make to-do lists, respond to messages, and much, much more.

There is no need to collect data and study analysts' forecasts to realize that online services will play an important role in our life, they grow rapidly; and those companies that will take a lead in this race, will benefit the most.

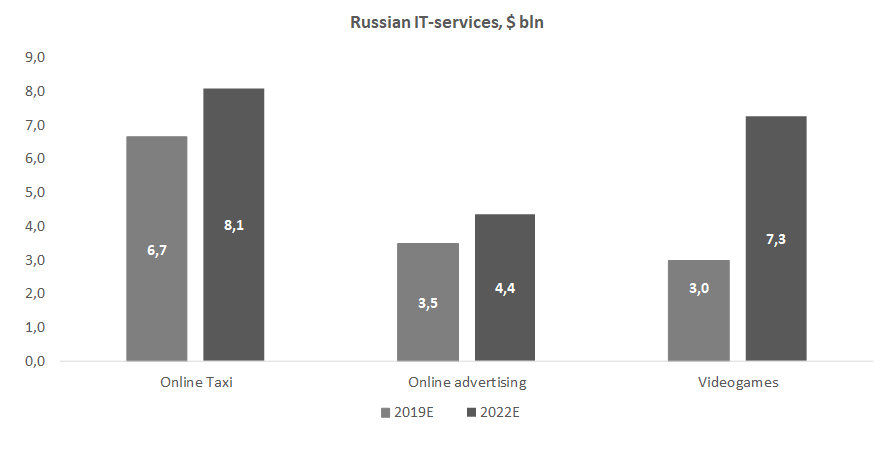

Mobile Internet penetration in Russia will reach 85% over the next five years, according to PwC (it was 61% back in 2018, according to GfK estimates). At the same time, Russia is lagging behind online services penetration in developed countries, even in such «advanced» segments as online advertising and e-commerce. The Russian online advertising market growth rate will average 12% in 2018-2023, from the current $3 bln a year, according to PwC. E-commerce market in Russia in 2018 amounted to $27 bln, according to Yandex (+59% yoy) and in 2019 may grow up to $34 bln (+31% yoy). At the same time, the level of e-commerce penetration in Russia does not exceed 5% against 10%+ in more developed countries. This segment may double in value in the next three years, according to Data Insight.

In Russia, (1) Internet companies (Yandex, Mail.ru), (2) banks (Sberbank, Tinkoff, VTB), (3) mobile operators (MTS, Beeline, MegaFon), (4) financial and investment groups (Sistema with its Ozon e-commerce project, for example) are seeking to become an ecosystem (a company providing all kinds of interrelated Internet services). At the same time, as this market is just emerging, it is hard to predict its structure five years from now.

State’s involvement in the industry economy is just a matter of time...

The growing impact of online services on people's lives and worldviews, as well as the amount of data coming through Internet resources, are inviting more participants, including state-owned companies, and attracting increasing attention from security and state agencies.

Recently, a number of legislative initiatives emerged that are likely to result in an IT services sector restructuring.

- Some of these initiatives target ownership structure. Namely, the State Duma is considering a draft law capping foreign ownership of «significant information resources» in Russia with at 20%. First of all, that is about Internet companies and Yandex. The State Duma will consider the bill in the coming weeks.

- Other proposals focus on transport aggregators and electronic payments providers, which can lead to lower profitability of these online services segments.

Source: Company data

What it means for the companies?

- Most likely, it means selling their shares to a new investor (probably, to a state-controlled entity, and, most likely, that is about Yandex)

- The worst case assumes a delisting from foreign exchange (Yandex is listed on Nasdaq, Mail.ru — on LSE; the latter is not traded on Russian exchanges)

...but it doesn't pose major risks to the industry.

We tend to think that changes to the ownership structure may prompt the government to withdraw its claims against IT-companies, while direct restrictions on the development of certain business segments of high-tech companies are unlikely to be imposed. Moreover, we assume the state control of the online services sector is inevitable and is just a matter of time.

Thus, the main risks are related to the condition of a deal and potential changes in the balance of power in the industry. However, we do not see any significant long-term risks for either Yandex or Mail.ru here.

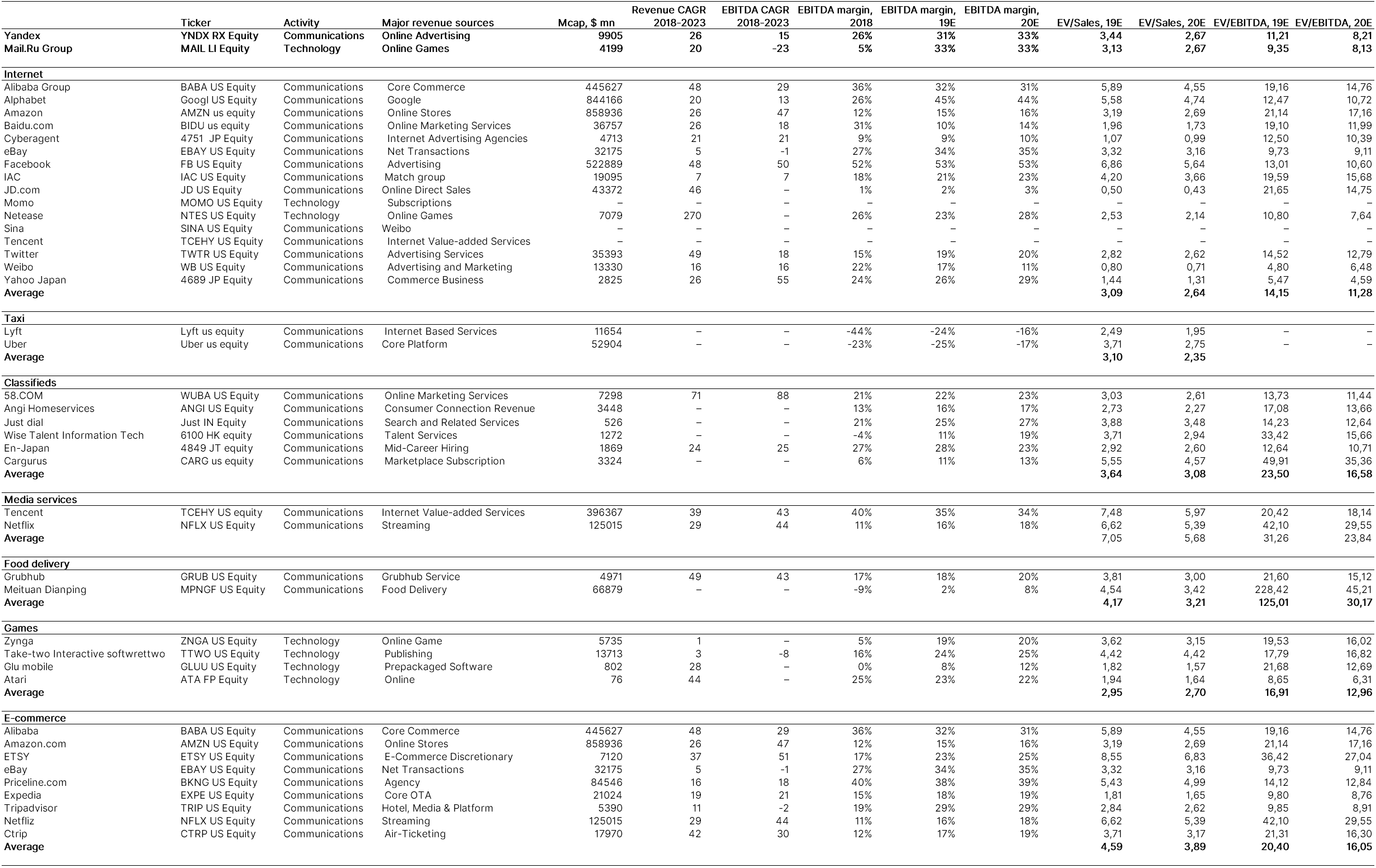

- Firstly, the current market valuation of Yandex and Mail.ru, which are unjustifiably low even considering current risks, suggests a 20–34% discount to peers at the projected EV/EBITDA19 11x and 9x, respectively, and a 43–44% discount to fair value at the end of 2020, according to our estimates

- Second, sale related valuation of the companies will have only a short-term effect on their share price, while the future enterprise values will primarily depend on operating and financial results

- Mail.ru has created a number of joint ventures (JV) with state companies, spinning off new promising business units; therefore, major changes in its ownership structure are unlikely. Anyway, any new shareholder, especially a state-owned company, is more likely to benefit Mail.ru, as it may potentially improve the company's strategy and market position

- For Yandex, changes in the equity capital structure involve moderate risks, since it is unlikely to change the integrity of the company. Higher risks assume ceding assets to different owners, which would undermine the integrity of the business and profit consolidation centre. However, this would be unreasonable, as the value of the company is the synergy of its services and promotion of a single ecosystem, so we believe that it is more likely that the group's asset integrity will not be changed, and its business will remain intact. Potential competition increase will only contribute to development of Yandex, which has obvious competitive advantages

Growth drivers and valuation

We’re making a bet on Internet companies as the most promising and fastest-growing segment economy sector, which is increasingly penetrating into our lives. We like both Russia’s IT companies — Yandex and Mail.ru. Yandex strengths are successful business model and highly qualified team, Mail.ru’s — a new stage of development, offsetting past failures, and lower risks in light of the bill aimed at limiting foreign ownership of «significant information resources.»

Yandex

Yandex is currently the leader and the fastest growing company in the Russian online services sector. Yandex — key growth triggers:

1) The market of traditional search services accounts for 80% of Yandex revenue (income from online advertising); Yandex expects it to grow by 20%+ per annum in 2019–2020, with Yandex' share in this market standing at 57% and growing, according to the company's data

2) Yandex. Taxi is a division that achieved positive EBITDA margin in Q219; the Russian taxi market grew by 8.6% in 2018, and, according to the data of the analytical centre under the Russian government, it will grow by 4–6% per annum in the next few years, with Yandex.Taxi accounting for 27% of all rides in Russia (they will increase to 40% if Vezet is consolidated; however, the deal is subject to the Federal Antimonopoly Service approval, there are some chances that the deal would not go through); the main trigger is the company’s potential IPO (Yandex.Taxi’s peers, Lyft and Uber, have recently quite successfully sold their shares in the market); our estimate of this Yandex’ subsidiary stands at $2 bln, or about 10% of the group’s current market capitalization, taking into account 58% stake, which is a much more conservative estimate compared to the $5–7 bln circulated in the media

3) The company's other services and projects are growing fast — total revenue from Classifieds, Media and new projects quadrupled in the second half of 2019; and despite the fact that they do not generate positive operating income yet, the things may turn around in the future, as it was the case with Yandex.Taxi

4) The company obviously benefits from the synergy of different divisions and promotion of its unified product in different areas

5) Highly-qualified management and talented team (Yandex is a dream employer for most graduates of elite programming departments in Russia)

6) Net negative debt

Our subsidiaries- and multiples-based valuation of Yandex assumes a 44% premium to the market price and a fair price of 2850 roubles per share ($45/ADR), below Bloomberg's consensus (3088 roubles per share and $47.7/ADR, respectively). Our more modest estimate, however, to some extent takes into account the risks associated with changes in the ownership structure. In addition, it does not include the company's share in the JV with Sberbank (Yandex.Market, Beru).

Mail.ru

In recent years, Mail.ru has been less successful in business development than Yandex, which affected the value of its shares (down 47% since February 2018). However, the company is seeking to catch up and has taken a number of successful steps in this direction over the past year. We see the following value growth triggers for Mail.ru:

1) Mail.ru may benefit from a potential change in Yandex ownership structure, with some weakening of the latter's position and strengthening of the former

2) Stable growth of the core business, including search, e-mail service and Vkontakte social network; they cumulatively generate about 60% of the company's total revenue and 90% of consolidated EBITDA; growing at a 12% annual rate (with Vkontakte remaining the main driver of growth with its 30%+ annual growth rate of revenue); it is this unit with its current user base that should become the centre of the Mail ecosystem development; management has set aggressive targets to double VKontakte's revenue over the next three to four years

3) The group's second most important Games segment generates almost 40% of its revenue; its revenue growth was 32% in the first half of 2019; positive EBITDA was $17 bln; we expect this trend to continue in the near future; video games market in 2018 amounted to $3 bln roubles and will grow by 6% in the next five years, according to PwC's estimates

4) Exclusion of new subsidiaries from the group's consolidated financial results through setting up various joint ventures (Delivery club food delivery project and Citymobil taxi aggregator with Sberbank; Pandao e-commerce project with Alibaba, Mail.ru Group, Megafon and RDIF); using this approach, Mail.ru may expect for a positive synergy effect with these businesses, which is important for developing an ecosystem, while its financial performance will benefit from their exclusion from consolidated reporting, and the burden of financial investments into new projects will be shared by partners; however, the potential disadvantage of this approach is that Mail.ru and partners may diverge in views on business development and profit sharing going forward, especially given Mail.ru’s minority stakes in both projects; time will show which of the two models (Yandex or Mail.ru) in respect of new business lines is more viable; however, in the near future the financial performance of Mail.ru will improve as a result of these steps; a seasonally strong Q419 may send financial results higher

5) the group’s negative net debt

Our subsidiaries- and multiples-based valuation of Mail.ru assumes a 43% discount of the current market price to the fair value of $27/GDR ($31/GDR, according to consensus).

Source: Bloomberg, ITI estimates