Opening date: 11.09.2019

GDR opening price: £0.10

GDR target price: £0.12 till year-end or +15%

Petropavlovsk 22’: + 5% price growth to 105% (6.2% yield to maturity growth from the current 8.3%) until the end of 2019.

We suggest Petropavlovsk shares and eurobonds as an investment idea in the medium term.

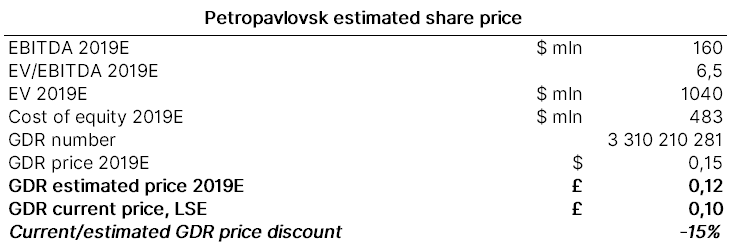

According to our estimates, Petropavlovsk GDR upside is about 15% by the end of 2019 to £0.12/GDR, based on 2019E EV/EBITDA of comparable companies with a discount of about 25%, and 2019E EBITDA of $160 mln.

Upside of Petropavlovsk 22' bonds with a coupon of 8.125% is 5%, to 105%, or 6.2% yield to maturity.

On September 10, the company posted strong 1H19 financial results. The company's management also held a presentation for investors and analysts in London for the first time in a long time, followed by the web cast for non-attorneys, which we find a very impressive.

We highlighted the following key value growth drivers:

- Majority shareholder change (Roman Trotsenko bought 22.4% of Petropavlovsk in July) and some of former managers comeback

- Improvements of corporate policy towards investors (highlighted by the management) and higher operations transparency

- Debt restructuring and reduction; Fitch and S&P credit rating upgrade

- Commissioning of new production and processing facilities, resulting in costs, capital investments optimization and higher operating performance

Financial and operational improvements

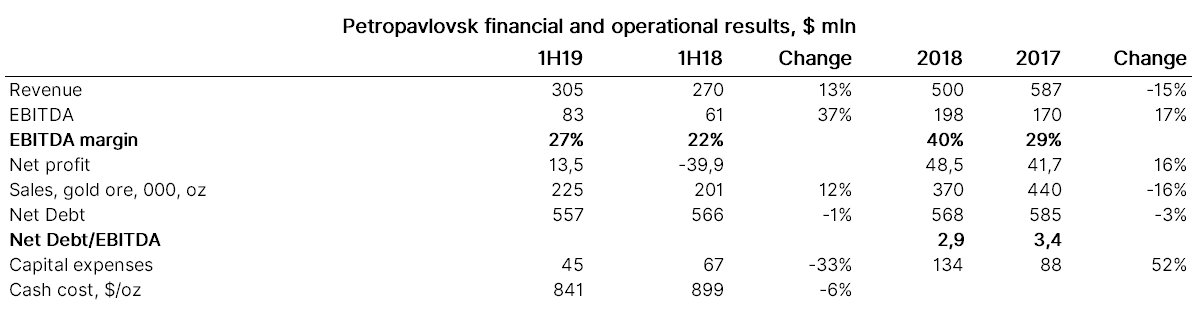

- Petropavlovsk 1H19 revenue grew 13% to $305 mln, EBITDA – 37%, to $83 mln (EBITDA margin - from 22% to 27%). Petropavlovsk earned a $13.5 mln net profit under IFRS in 1H19 against a loss of $39.9 mln yoy.

Sources: Company data, ITI Capital

- Commissioning of new facilities (Malomyr Flotation Plant, POX Hub, Pioneer Flotation Facilities) has already helped the company to optimize its production costs (from $899/oz to $841/oz in 1H19 compared to 1H18) and will contribute to their further reduction. In addition, commissioning of new facilities also accelerated capital expenditures reduction (-33% in 1H19 vs. 1H18) and improvement of operating indicators (gold sales increased by 12% in 1H19). The company plans to increase gold production and sales by 22–35% this year, to 450-500,000 ounces by launching a new autoclave to extract the metal from the concentrate

- Petropavlovsk benefits from rising gold prices (at a six-year high of $1500/oz), which should improve on its 2H19 financial results

Deleverage

- Leverage is 3x net debt/EBITDA. The ratio is expected to drop to 2x over the next two to three years, according to the management’s estimates.Fitch revised. Petropavlovsk's credit rating in August 2019 from CCC to B- and assigned a positive outlook. S&P outlook is expected to increase by the end of 2019 (currently it stands at B- with negative outlook)

- Further IRC's debt restructuring and potential sale of 31% of its shares to a strategic investor may contribute to Petropavlovsk's value growth. IRC 31% shares on the Hong Kong Stock Exchange is valued about $36 mln. Petropavlovsk is the guarantor of IRC's $160 mln debt, which accounts for 30% of Petropavlovsk's total net debt

Sources: Bloomberg, ITI Capital

Anna Kupriyanova, Senior investment strategist