On July 5, Russia’s president signed an Executive Order on repatriation by residents participating in foreign economic activity of foreign currency and Russian currency. The decree also allows Russian companies with outstanding Eurobond issues to replace these securities by issuing new bonds. The Russian companies therefore were given the green light to issue new securities to meet obligations under outstanding Eurobonds.

If outstanding Eurobond issues are replaced with new securities the obligations to the holders of Eurobonds will be deemed to be “duly discharged” under Russian law. The new securities are to be issued with the same conditions (yield, terms of payments, maturity date, par value).

This is good news for holders of hard currency bonds issued by sanctioned companies.

Russian legal entities have also been ordered to fulfill obligations to holders of Eurobonds, whose rights are recorded in the Russian depositories, by transferring funds in the manner specified by the Board of Directors of the Bank of Russia (details will follow later), or by issuing new bonds.

This news is positive for local investors, who will finally get their due income from Eurobonds in line with the payment schedule. Newly issued securities will trade in a secondary market, and are supposed to be in demand by many Russian investors willing to invest in non-ruble assets without the risk of getting seized.

The new securities will be most in demand among sanctioned issuers who have cut off from foreign payment infrastructure and are still in negotiations with NSD (e.g. Severstal, MMC, State Transport Leasing Company), etc.

Will non-sanctioned companies pay twice?

However, it is not yet clear how the order will apply to non-sanctioned issuers who have been meeting their obligations in line with bond prospectus (i.e. by sending funds in foreign currency to Euroclear accounts). For them, new bonds will be nothing but a bigger debt burden, provided they do not breach the original bond payment terms.

Upcoming payments by the end of July

Sanctioned issuers who are due to make foreign currency payments by the end of July include Sovcomflot ($5.1 mln), Alfa Bank and Promsvyazbank. Sibur, one of the issuers who previously paid in line with the bonds' prospectus, is due to pay a coupon on July 8.

Negative news for the rouble?

Since sanctioned companies will issue new hard currency bonds on the local exchange, additional demand for currency could weaken the rouble. According to our estimates, the outstanding bonds of sanctioned companies total $25 bln.

Nearly 50% of this amount may be purchased through NSD, that is $12.5 bln.

If non-sanctioned companies, particularly Gazprom, Phosagro, MTS and others, will have to issue bonds on a local exchange in exchange for those traded abroad, then the total amount of bonds (issued by Russian companies and banks) will increase to $70 bln, implying a 50/50 split between the NSD and Euroclear.

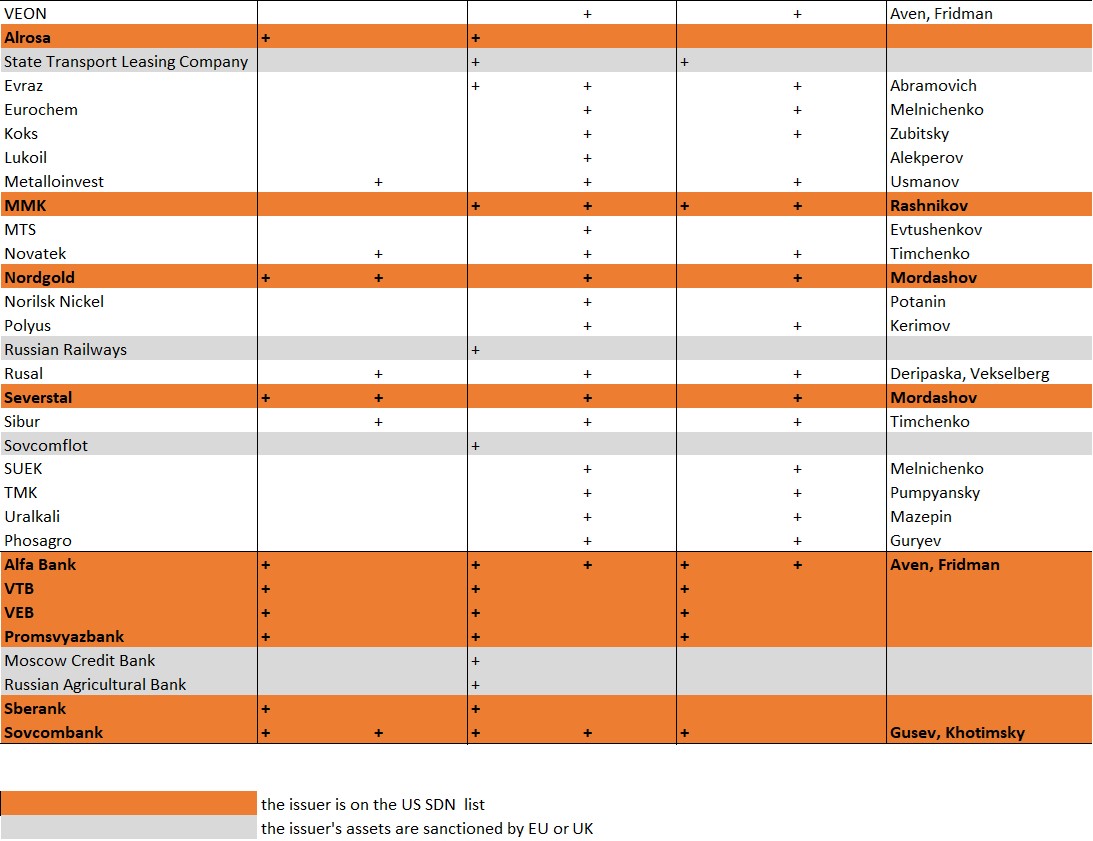

List of sanctioned entities

Source: ITI Capital, U.S., U.K. and EU regulators

Upcoming payments on foreign bonds

-203.jpg)

Source: ITI Capital, Bloomberg

-203.jpg)