Our take: The new presidential order of 22 June 2022 that establishes temporary procedures aimed at fulfilling Russia's foreign debt obligations marks the start of the first ever “roublization” of payments to resident and non-resident holders of Russia’s offshore bonds and thereby further deoffshorization of the Russian debt market. We believe that this measure lowers uncertainty of holding Eurobonds purchased primarily through Euroclear and should lead to a material drop in the two-fold premium of NSD-services bonds over bonds serviced by Euroclear, especially if they are held by residents of “friendly” jurisdictions. Russian companies and banks are likely to use a similar template to service external debts, as we previously anticipated. We rule out a formal sovereign default since there wouldn’t be enough creditors from “unfriendly” countries left short to declare a default in case of non-payments (required threshold is usually holders of 25% of the outstanding bonds).

What happened?

On the eve of the next coupon payment date on sovereign Eurobonds (Russia 27 and Russia 47 are to be paid on June 23), the Russian president “The Executive Order On the Temporary Procedure for Meeting State Debt Obligations in the Form of Government Securities with Nominal Value Denominated in Foreign Currency to Residents and Foreign Lenders by the Russian Federation”. The document is fully in line with the government's previously announced plans, namely that payments on sovereign debt will be made in roubles at the exchange rate to accounts at the National Settlement Depository (NSD).

What does this mean for holders of Russia's external debt?

Local investors will receive payments through their custody accounts. Holders serviced by foreign entities (Euroclear) will be entitled to reach out to the NSD to open an “I” account , which will also be credited with Russian roubles. The Bank of Russia will set the mode of operation of “I” accounts.

Unlike “C” accounts (for payments by companies), the funds received can be used without restrictions. The funds are expected to be sent to a non-designated bank and converted into required currency - such funds may be sent abroad without restrictions (other transactions are capped at $150,000 per month). Vladimir Putin also instructed the monetary authorities to pick banks for a new scheme within 10 days.

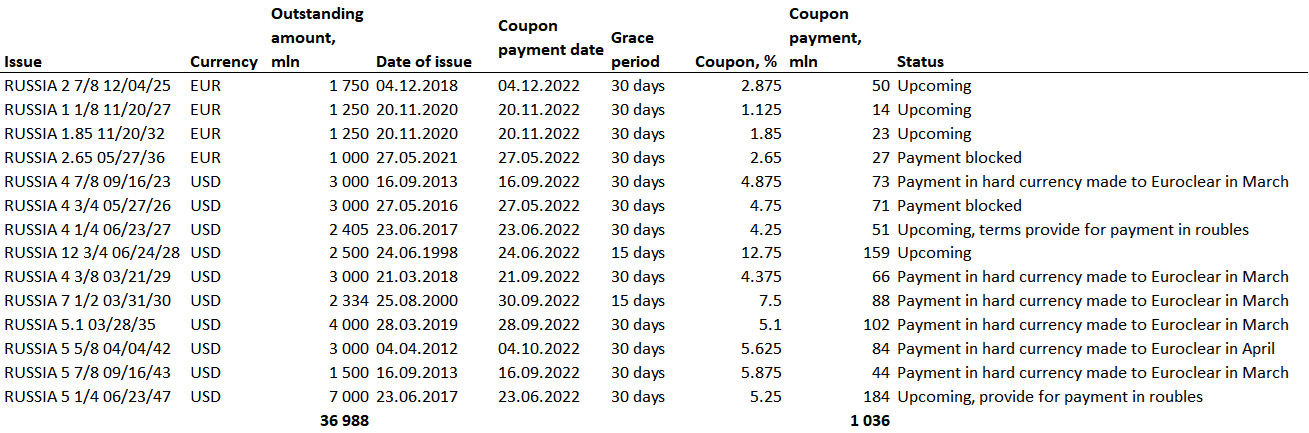

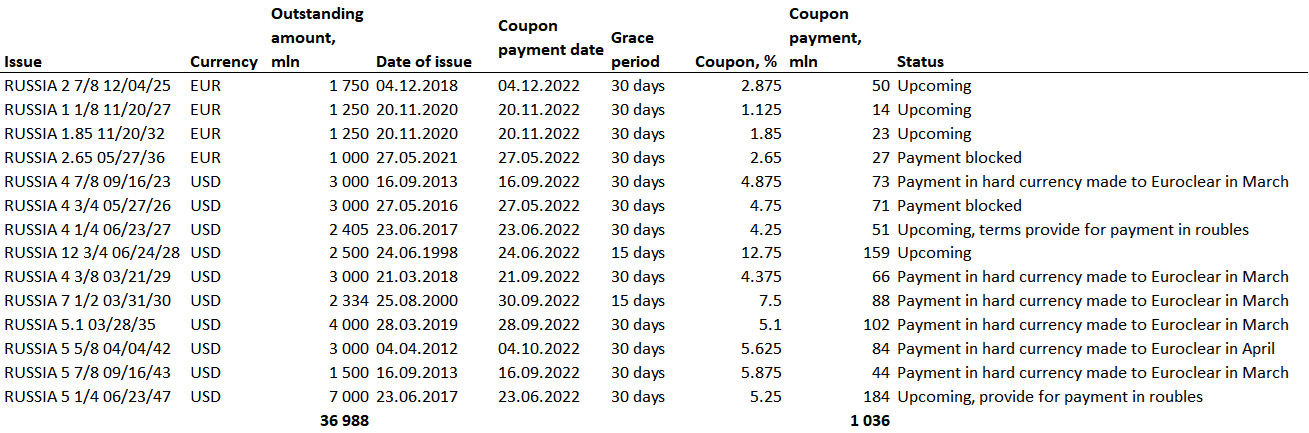

Payments on Russia's external sovereign bonds

Source: ITI Capital