Key takeaway: New reason to buy Russian Eurobonds

We expect Russia’s Finance Ministry to roll out a single scheme for foreign corporate Eurobond payments that would involve rouble settlements through the National Settlement Depositary (NSD). As soon as it is launched, the spread gap between offshore Russian Eurobonds via Euroclear and those via NSD will narrow significantly (most bonds at NSD are traded at par now). Thus, bonds at Euroclear which still trade at a significant discount look like an attractive investment target for buyers from Russia and “friendly” countries.

We still assume that the risk of a cross default on Russia's external debt is low, given that the largest dedicated US and European funds sold most of their holdings at the early this year, so there wouldn’t be enough creditors left short to declare a default (required quorum or the threshold is usually holders of 25% of the outstanding bonds).

What happened? On June 3, the EU adopted the sixth package of sanctions against Russia. The National Settlement Depository (NSD), among others, was designated for its essential role in the functioning of Russia’s financial system, thus directly and indirectly enabling the Russian Government in its activities.

As we have pointed out before, the latest sanctions are not a game-changer. They only provide a legal pretext for blocking depository payments to Euroclear (already suspended since late February). However, the ban may have positive implications. It could bring investors in Russian Eurobonds closer to an understanding of how Russian external debt is to be paid out.

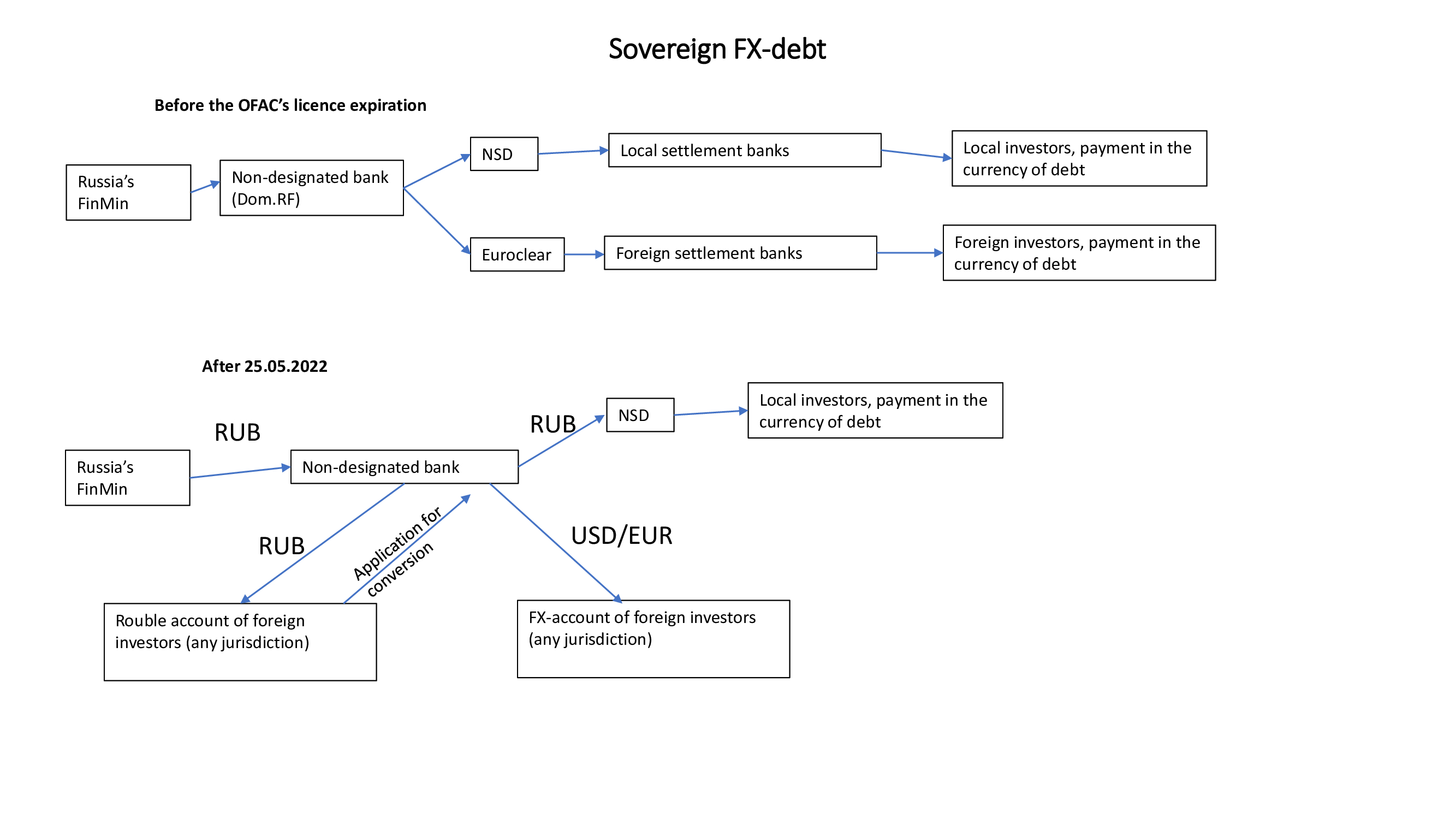

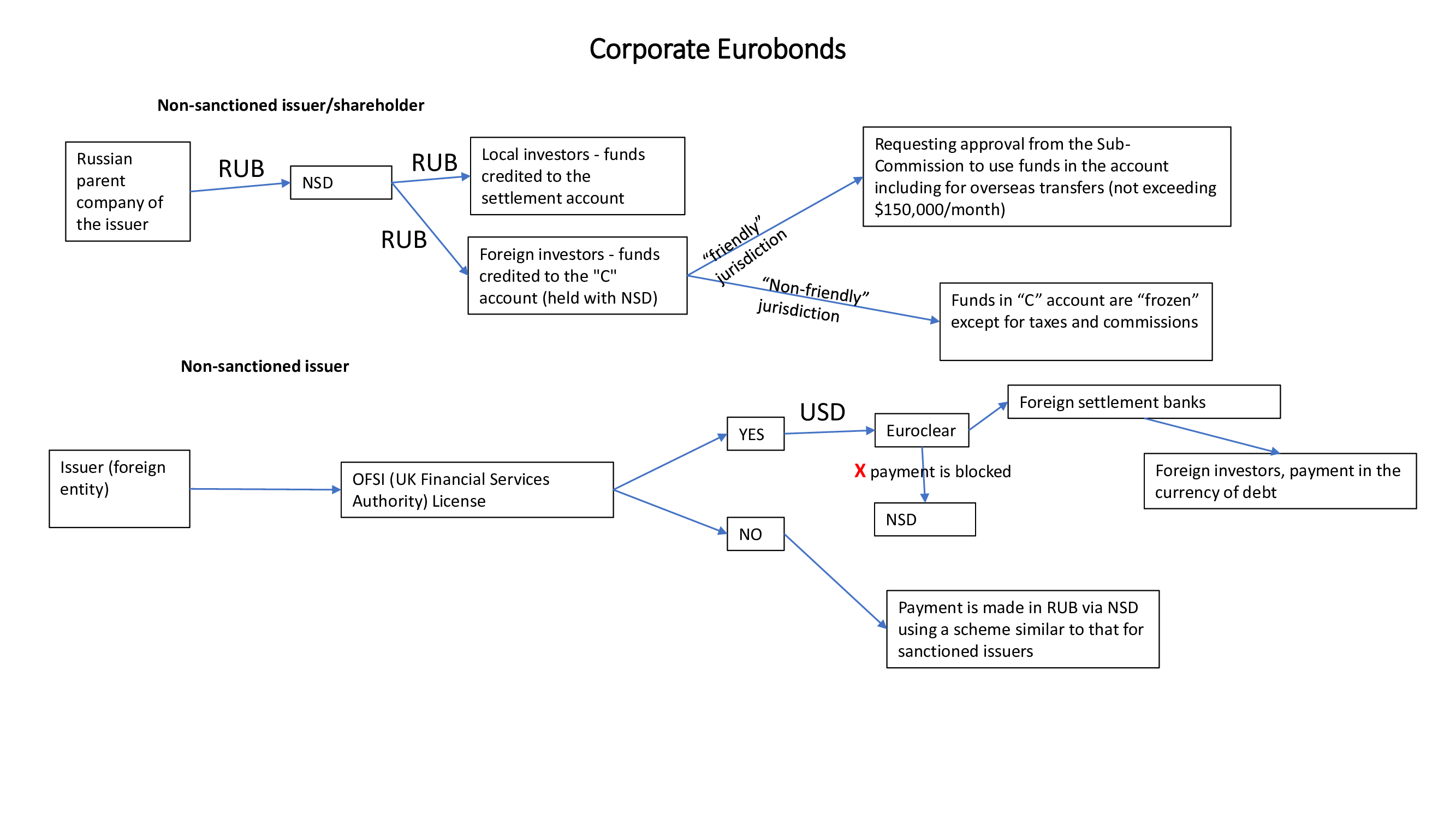

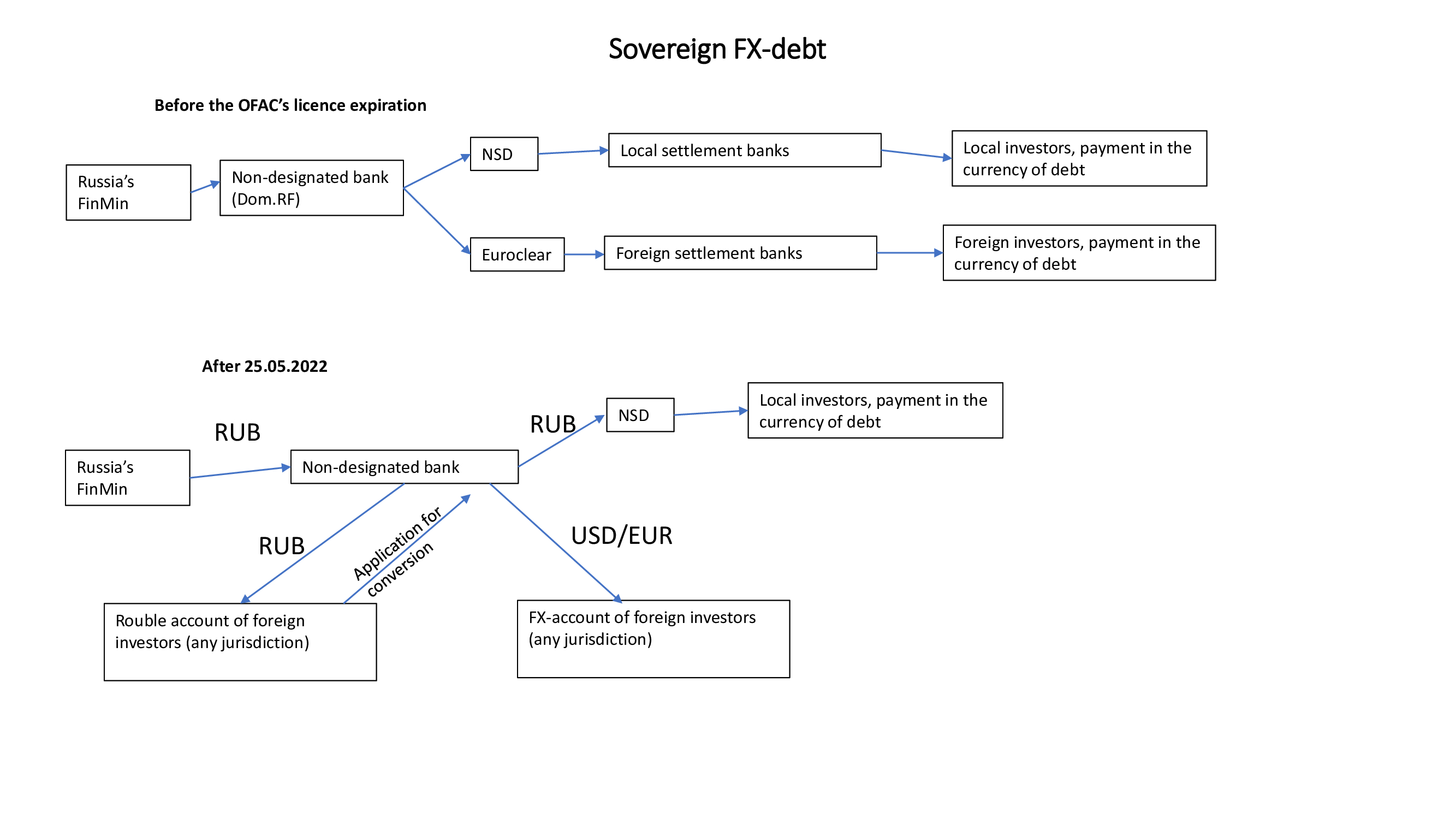

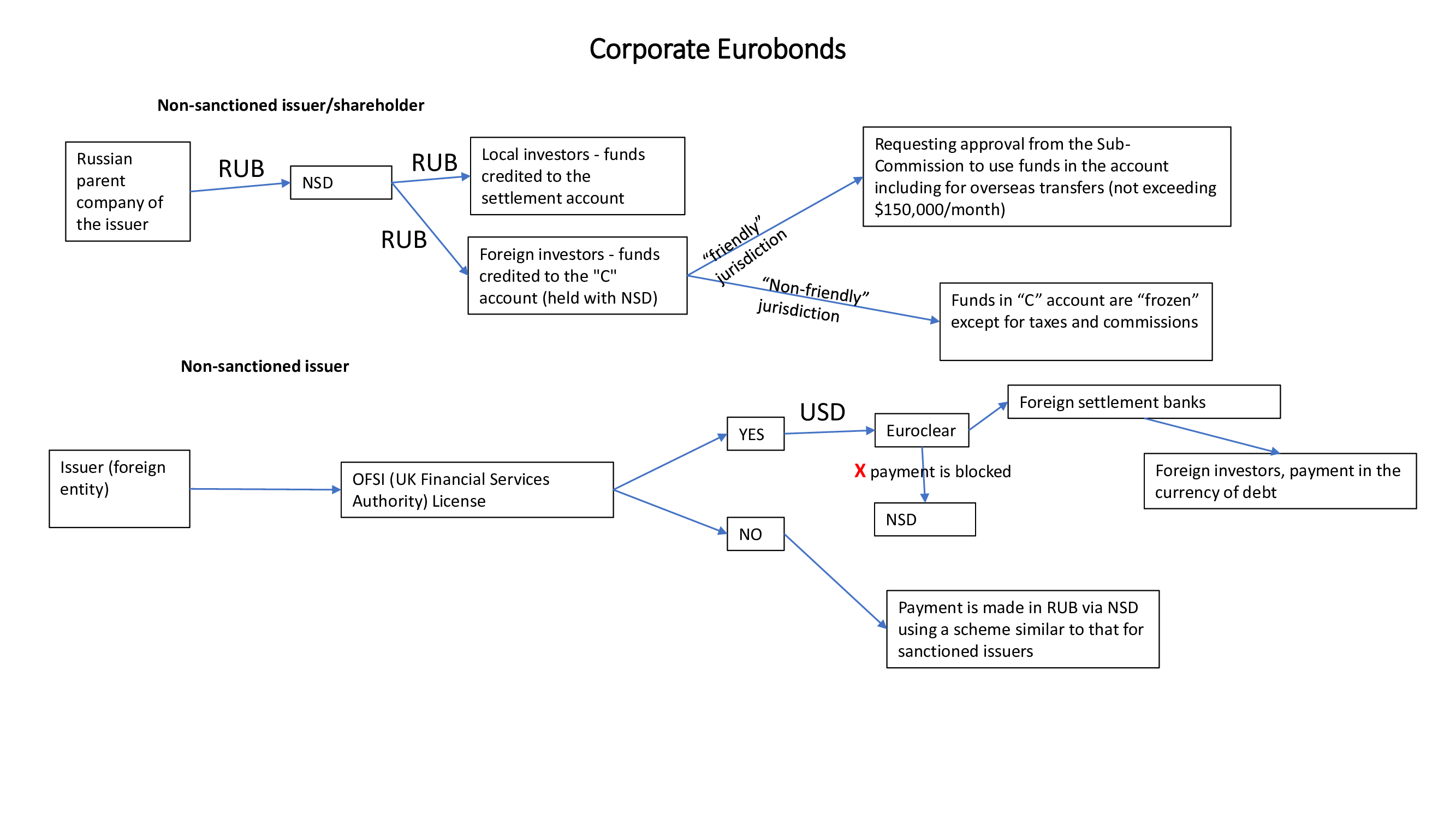

Our take There’s no single Eurobond repayment template available for Russian corporate borrowers as of now. Depending on the issuer (designated or not), funds are sent either to Euroclear, as before, or to NSD in the rouble equivalent. The detailed payment scheme is shown below.

Russian corporate Eurobonds payment scheme

Source: Finance Ministry, ITI Capital

In view of the recent sanctions, we believe the Russian government is highly likely to present a single payment mechanism for corporate borrowers soon that would involve rouble settlements through local payment infrastructure.

A single settlement channel is now being developed, as soon as it is launched the bonds at NSD, which so far trade almost at par, will see their premium over offshore bonds decline! Since the EU’s sanctions against NSD have dashed away all hopes of restoring the Euroclear-NSD settlement channel, Russia will have to launch its own internal settlement channel closing the price gap between offshore and onshore bonds.

In March, the Russian President signed a decree №95 that sets out a temporary procedure for Russian residents' transactions with persons from “unfriendly” states Until now, however, non-sanctioned issuers have typically sought a special approval from a sub-committee of the Russian Finance Ministry to make payments in the currency of the debt.

Issuers have opted for this scheme to the detriment of local investors (the funds do not reach them since the Euroclear-NRD settlements are blocked) in order to prevent a breach of the terms of the issue, i.e. a default that could be declared by foreign holders.

Now, as Russia is increasingly being pushed towards sovereign default (we do not rule out the NSD's designation by the US in the short run), we expect that the Finance Ministry will soon stop granting such approvals to companies and banks. Various schemes are reported to be worked out for further transactions with investors.

Rublization of external debt

In addition to rouble settlement scheme involving the NSD, the Ministry of Economic development is looking to issue “substitute” bonds in roubles under Russian legal scheme to repay Eurobonds. This instrument is proposed to be issued under a simplified scheme for redemption of outstanding Eurobonds (a scheme similar to that used with depositary receipts). Sovcombank was one of the first lenders to suggest that exchange of existing Eurobonds for a an equivalent new issue of local bonds but in roubles under Russian law.

Whatever option is chosen, we expect a single settlement channel for all corporate borrowers to be presented soon. As soon as it is launched, the premium of local over the offshore bonds should hit a new low (most bonds at NSD are priced at par now). Thus, bonds at Euroclear which still trade at a significant discount look like an attractive investment target for buyers from Russia and “friendly” countries.