What happened?

On June 3, the EU adopted the sixth package of sanctions against Russia. Key highlights: 1) sanctions against the National Settlement Depository (NSD); 2) cut-off of Sberbank, Credit Bank of Moscow, and the Russian Agricultural Bank (RusAg) from SWIFT. Only Gazprombank (GPB) is the only top-10 bank still connected to Swift, and it is unlikely to be cut off because of its role in settlements for Russian gas unless EU will impose partial sanctions on import of Russian gas. 3) a partial embargo on sea oil supplies from Russia.

Sanctions against NSD increase risk of non-resident assets’ confiscation

The sanctions against the NSD do not effectively change the circumstances resulting from the breakout of conflict in Ukraine, after Euroclear halted all financial transactions and settlements with the NSD. On 25 February, when settlements were shut down, Euroclear blocked ₽1.8 trln, or about $27 bln, in international assets held by Russian residents (mostly shares). Obviously this amount is less now given negative global market performance and forced selling due to margin calls and other financing needs.

Russian exposure in local equity and fixed income of non-residents stuck at the NSD exceed $85 bln before revaluation, of which $48 bln are equities and the rest are bonds, mainly OFZ worth $38 bln (2 700 bln roubles). So both type of investors are stuck within their assets for undefined time period. Holders of Russian Eurobonds is a different story for now given that its overseas holding of non-residents.

Our assumption is that most of the foreign asset holders at NSD are local banks, assets management companies (MC), private pension funds (PPF) and individuals. Lifting of sanctions is a very long process, and among individuals, holders of structured notes and international shares bought on the over the counter (OTC) market are primarily affected. The EU is also considering asset confiscation.

This week, following sanctions against the NSD, euro assets likely will not be used as collateral by local brokers, and after the US Treasury designates the NSD, which we expect to happen soon, dollar assets would be eligible as collateral.

What has changed for local holders of Russian Eurobonds?!

As for the restrictions on the Finance Ministry’s payments on Russian foreign debt, we think there are still loopholes that allow transactions through non-designated Russian banks. There is a high probability that payments to Eurobond holders at the NSD and Euroclear will be made in roubles, in line with the scheme previously outlined by the Ministry of Finance, and subsequently converted into hard currency. The Russian Finance Ministry may also decide that payments on external corporate debt will also be made exclusively in roubles, especially if the US Treasury will impose sanctions against NSD and the National Clearing Centre (NCC).

Another move to trigger Russia’s default?

In any case, the purpose of the latest EU sanctions will become clear as soon as/if the US decides to add the NSD to the SDN list.

The sanctions are widely considered as a means to trigger Russia’s default on its external debt.

The EU sanctions do not affect:

- local holders of Eurobonds at the NSD and rouble bondholders, as rouble payments are still received

- settlements in dollars on the Moscow Exchange

- dividends and coupon payments in hard currencies (were not received and will not be received by investors)

What next?

In the near future, the EURUSD trading will probably switch to an over-the-counter, unsecured mode. The same scheme is likely to be applied to settlement in dollars as soon as the US Treasury unveils further sanctions. In addition to the US sanctions against the NSD, it is highly likely that by the end of the month the EU will adopt its seventh package of sanctions against Russia, including a partial embargo on gas imports from Russia and s cut-off of GPB from SWIFT.

If the EU does not approve the confiscation of Russian assets at Euroclear by that time foreign assets stuck at the NSD may still be released, but everything will depend on how the conflict in Ukraine plays out.

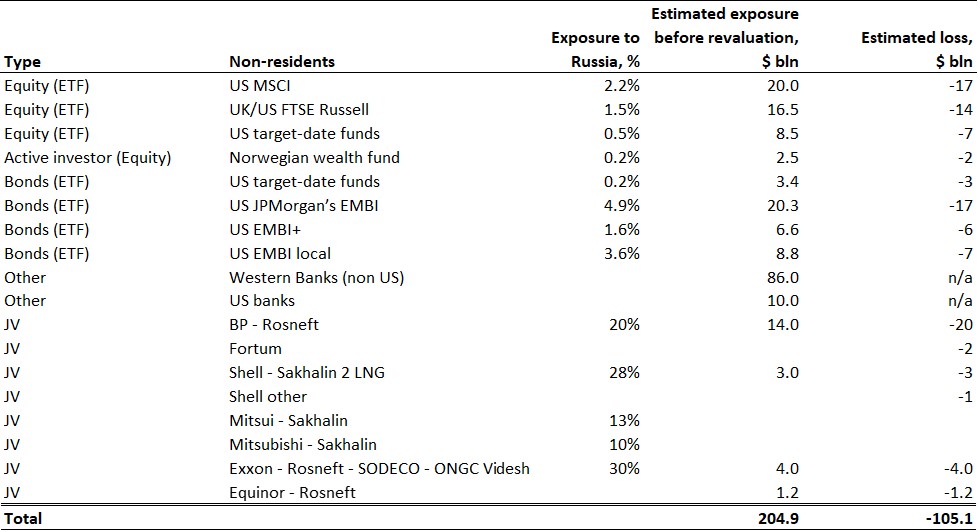

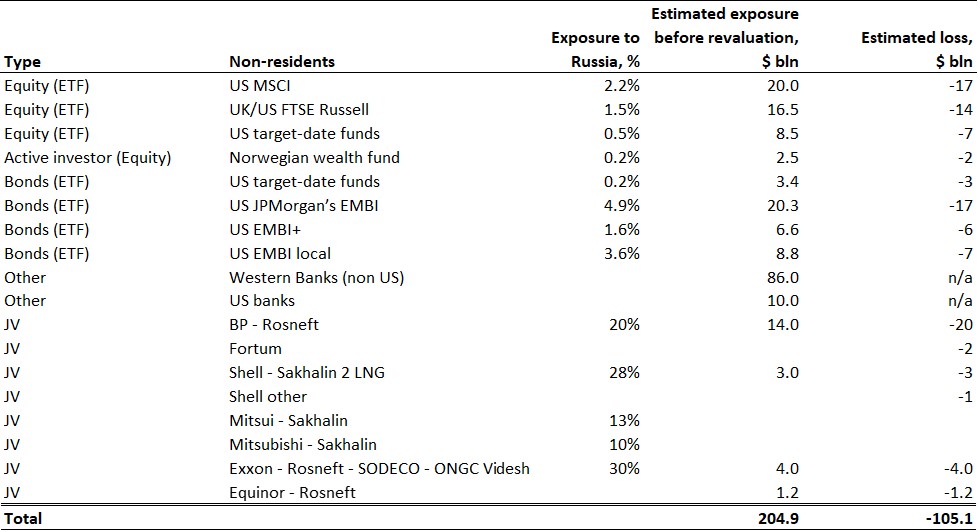

Non-residents' assets in Russia, or the cost of non-residents' “adventures” in Russia after sanctions

Source: ITI Capital, other