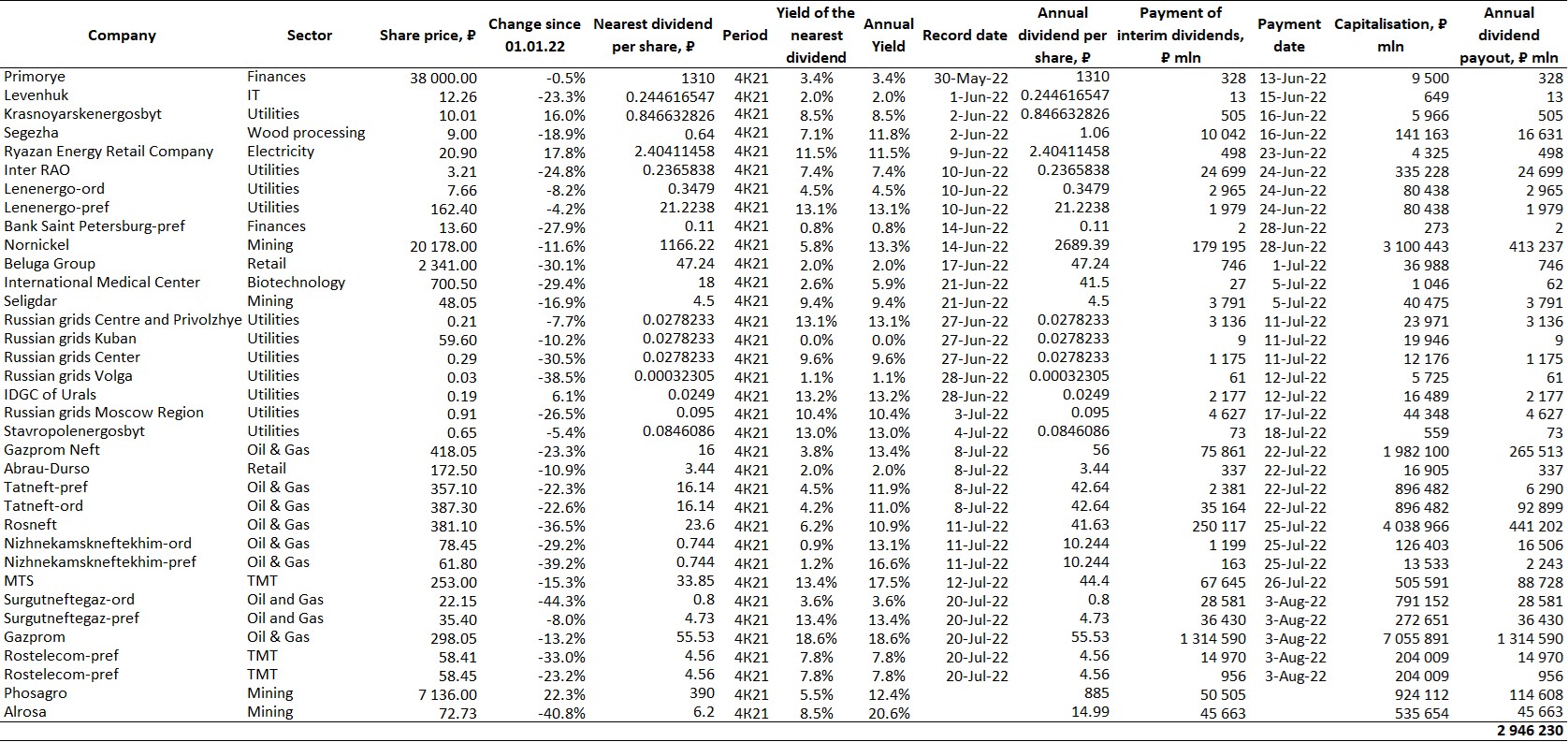

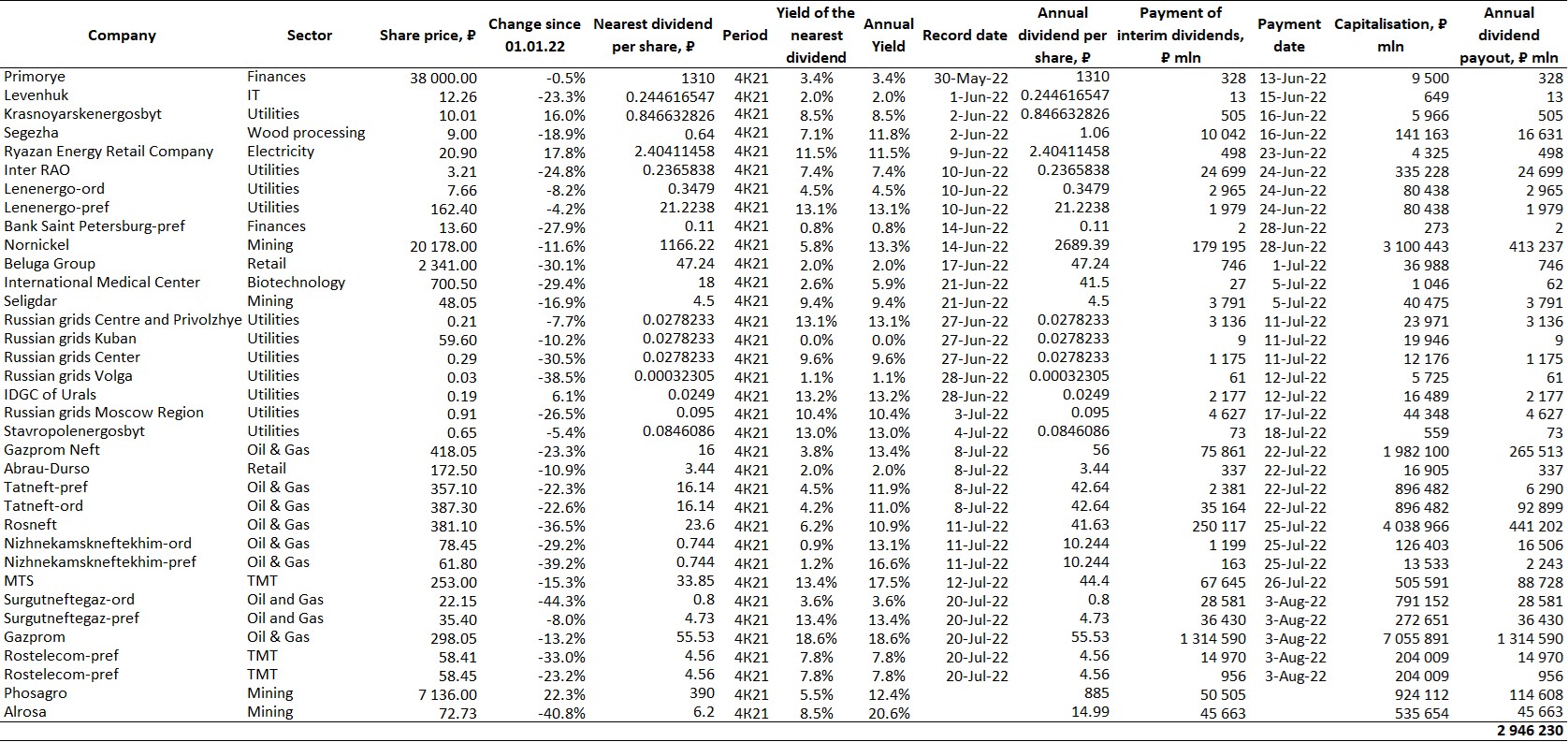

The dividends for 2021, despite the toughest sanctions against Russia in the country's history, look decent, but are certainly below what Russian companies and banks could have declared, given their huge dividends pay-out potential. Revenues of Russian companies for 2021 exceeded ₽30 trln. The record figure was 2.6 times higher than that in 2020 and twice as high as before the pandemic, according to Rosstat statistics service. In December, corporate earnings rose 3.2 times year-on-year to ₽4 trln. Consolidated profit of mining companies rose 2.5 times to ₽7 trln in 2021.

Record net profit of Russian companies in 2021

Source: Russia’s Federal Statistics Service, ITI Capital

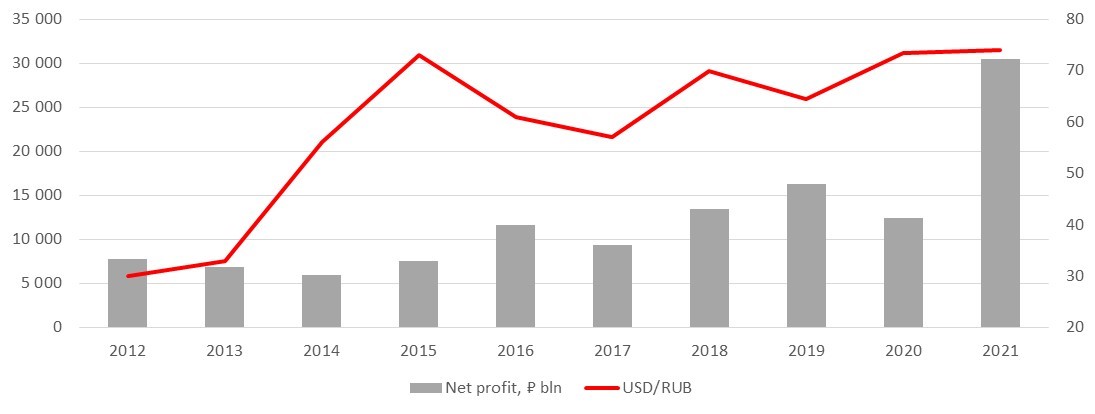

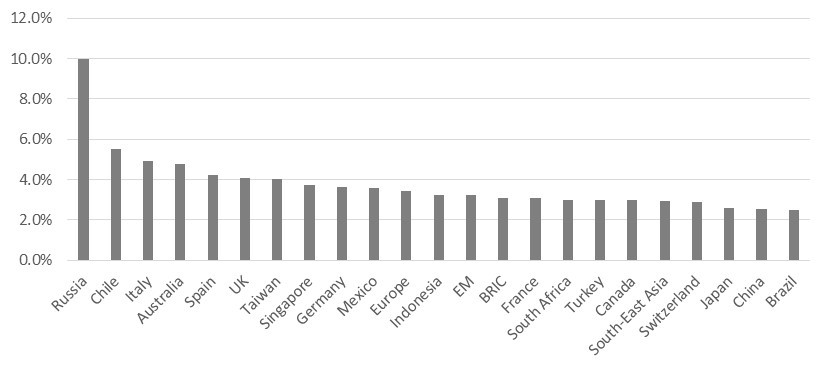

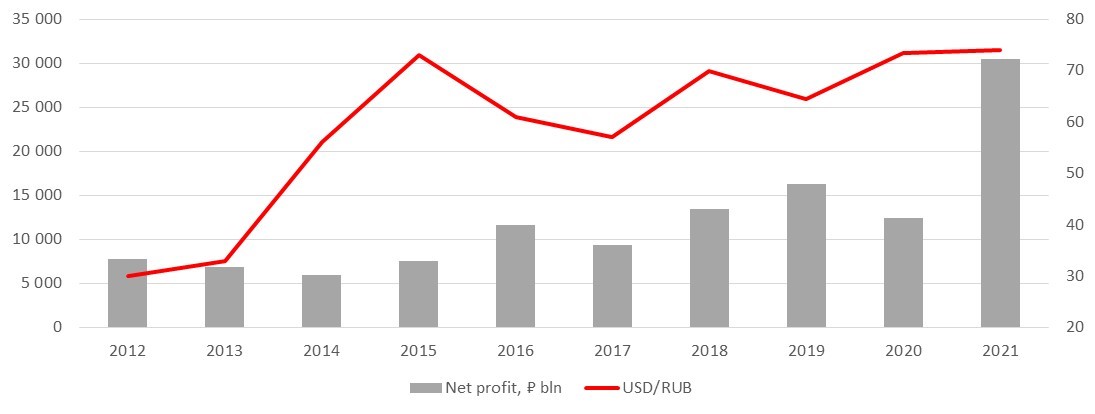

Unsurprisingly, prior to the conflict in Ukraine, we had assumed that total dividends for 2021 would exceed ₽5.1 trln, or $70 bln, compared to actual ₽2.9 trln now (almost half the potential), of which 44% are Gazprom’s ₽1.3 trln in dividends, certainly the all-time high. Exporters' share of total payments for 2021 was 94%, compared with the expected 80% and the 10-year average of 70-75%. In fact, only slightly more than a third (30) of over 80 most deep-pocketed companies will pay dividends for 2021. This is an all-time low, which is not even comparable with the pandemic-stricken 2020. Back then, more than 60 companies paid dividends on the back of a strong recovery in the commodity and capital markets.

If it weren’t for the conflict in Ukraine, dividend could have been a powerful growth driver for Russian companies and the market as a whole on the way to new records. See: Russia record dividends for 3Q21 and estimates for 2021 22.12.2021 (iticapital.ru)

Russian companies' dividends: could have been higher

*E - estimate as of 31.12.21, before the conflict in Ukraine

Source: Company data, ITI Capital

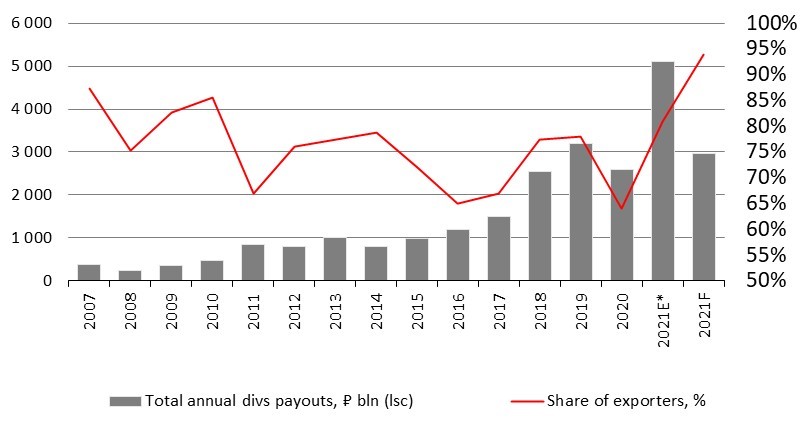

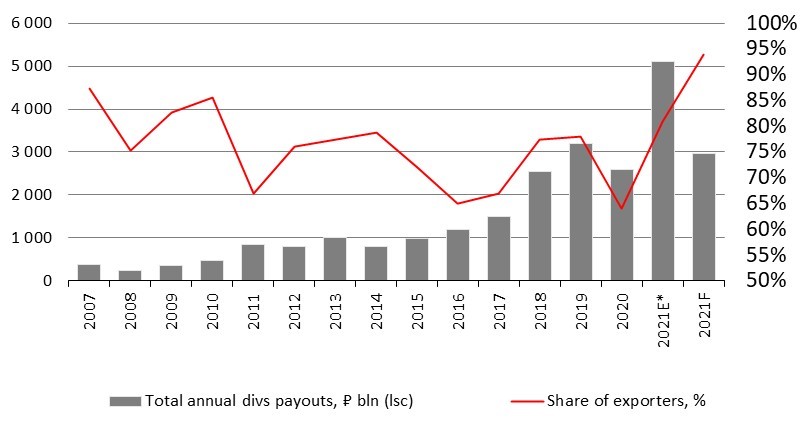

With Gazprom's large share in the Russian dividends payments and a high dividend yield of 19% for 2021, the weighted average yield for 2021 could be 15.2%, compared with an average yield of 9.6% (before the conflict), 6% for 2020 and 9% for the pre-pandemic 2019. Despite all these factors, dividend yields in the Russian market have remained high - thanks to the oil and gas sector in general and Gazprom in particular, Russia has ranked first in the world in this respect.

Average annual dividend yields globally, %

Source: Bloomberg, ITI Capital

Dividend season finally started

As the geopolitical situation worsened, many companies, including NLMK, Severstal, LSR, Cherkizovo, MMK, Veon, Evraz, Lukoil, MD Group, Enel Russia, Rusago, X5, Unipro and the Moscow Exchange decided to skip dividends. Meanwhile, according to the recent disclosures, Nornickel, MTS, Bank St. Petersburg, Beluga Group, Inter RAO, Lenenergo, Segezha, Phosagro, Gazprom, Gazprom Neft, Tatneft, Rosneft, Rostelecom and Surgutneftegaz intend to pay dividends. We also expect Alrosa to declare dividends.

Gazprom, Gazprom Neft, Rosneft, MTS, Surgutneftegaz and Rostelecom have already pleased investors by declaring dividends in May.

Gazprom The BoD recommends paying ₽52.53 per share for 2021, in line with its dividend policy. The dividend yield may reach 19%. The BoD has recommended to set the date in which the company determines holders eligible to receive dividends for July 20, 2022.

Gazprom Neft The BoD of Gazprom's oil arm has recommended a final ordinary stock dividend for 2021 of ₽16 per share (a 3.8% dividend yield). Given a ₽40/share dividend paid out for 9M21, the total dividend for 2021 will stand at ₽56/share. The date in which the company determines holders eligible to receive dividends is set for 8 July 2022.

Rosneft The BoD has recommended a final dividend of ₽23.63/share for 2021 in line with the company's dividend policy. The dividend yield may reach 6%.

Surgutneftegaz The BoD has recommended dividends for 2021 as follows: ₽0.8 per ordinary share (a 4% dividend yield) and ₽4.73 per preferred share (a 13% dividend yield).

MTS The BoD has recommended shareholders to approve the dividend for 2021 in the amount of ₽33.85 per share (dividend yield of 18% at ₽257 per share). The date in which the company determines holders eligible to receive dividends is set for July 12.

The dividends exceeded investors' expectations, since the major shareholder, Sistema, which positions itself as an investment fund, is willing to have funds to invest in other businesses that may be up for sale in the current geopolitical environment, according to our assessment.

MTS earlier set an interim dividend for 1H21 at ₽10.55/share, a full-year dividend was expected at ₽30/share, in our view.

Rostelecom The BoD has recommended an interim dividend of ₽4.56 per share for 2021, with a potential yield of 8%. Total pay-out may amount to ₽15.9 bln, or 50% of the company's net profit for 2021.

The date in which the company determines holders eligible to receive dividends is set for July 20, 2022.

Alrosa Although Alrosa has not yet declared dividends, we plan to add the stocks to our dividend portfolio, since we assume the company is highly likely to do so. According to the dividend policy, with the current net debt/EBITDA ratio the company returns 100% of free cash flow (FCF) to investors through dividends, which corresponds to a ₽5.6 per share yield. At the same time, the level of dividend payments should be at least 50% of IFRS net income for the year, which corresponds to a ₽6.2 per share yield. Therefore, according to our estimates, Alrosa's final dividend yield may reach 7.7-8.5%.

Most companies will keep DR listing. Dividends will accrue, but there are nuances

Most of the 19 Russian companies that applied to the government for depositary receipt programmes have received permission to keep them, the Finance Ministry said. Gazprom, MMK and Magnit were rejected. Investors willing to switch to local equities will be able to do so voluntarily, while the rest will be given time to exit the stocks, including by selling them on the OTC market.

Holders of depositary receipts are eligible to receive dividends if the programme is extended. Dividends are paid to depositary receipt holders who have a depositary receipt account. The currency control restrictions introduced in March of this year apply, namely that creditors from unfriendly states will be able to receive funds due to them under existing debt obligations from residents of Russia in special so-called “C-type” accounts opened with Russian credit institutions on application.

It cannot be ruled out that investors who are not willing to be subject to currency controls inside Russia would prefer to sell depositary receipts in the OTC market to residents.