Softline: 4Q21 results, 1Q22 outlook

Softline (SFTL)

Recommendation: BUY

Softline has released its financial results for 4Q21 (ended 31 March 2022). As expected, the Russian market environment had a negative impact on profitability. For us it was more important to see that the Russian IT market ( which accounts for half of the company's turnover) remains viable as reflected in the company’s positive outlook for 1Q22 (15% group-wide growth, positive EBITDA, including Russia). Withdrawal of competitors such as Crayon and SoftwareONE from the Russian market will boost Softline's market share and offset the likely decline of the IT market in 2022.

In our view, the truly international company with Russian roots has avoided sanctions risks. Further implementation of the strategy looks justified.

As of 31 March 2022, the group had $335 mln in cash, or $398 mln including the Crayon stake. The company is thought to proceed with its M&A strategy and use its large cash cushion to ensure sustainable funding of development projects ahead of competitors. The revenues of Indian companies alone, which Softline considers as potential acquisition targets, exceed $350 mln.

As expected, geopolitical turmoil affected performance in 4Q21:

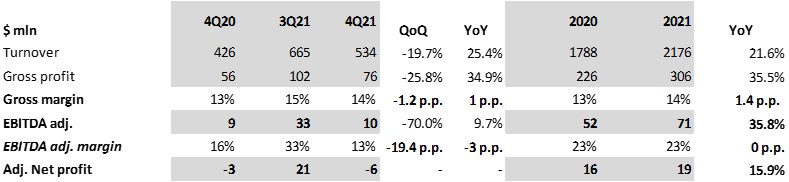

- Turnover was up 25% YoY (vs +13.3% YoY in 3Q21), -20% q/q to $534 mln, the drop q/q resulted from the seasonality of the IT market: for example, turnover in 4Q20 was down 24% q/q. Even turnover in the struggling Russian market posted 11% growth YoY in 4Q21.

- Gross profit: +34.9% YoY, -25.8% QoQ to $76 mln. Gross margin grew by 1.4 pt YoY to 14.1%.

- Adjusted EBITDA increased by 10% YoY, -70% QoQ to $10 mln. Given that the Russian business was a major driver of profitability, the negative impact of seasonal factors QoQ increased.

Adj. net profit: -$6 mln vs. -$2.5 mln in 4Q20.

Softline's 4Q21 and 2021 results

Gross margin, % of turnover

Adj. EBITDA margin, % of gross profit

Source: Softline, ITI Capital

In FY21

- Turnover was up 21.6% YoY, to $2,716 mln.

- Gross profit increased by 35.5% YoY to $306 mln. Gross margin grew by 1.4 pt yoy to 14.1%.

- Adjusted EBITDA for 2021 picked up by 35.8% YoY to $71 mln, while EBITDA margin remained flat at 23.1%.

- Net adjusted profit increased by 16% YoY to $19 mln.

Growth of IT staff is the key to success The company stands to benefit from the current situation in the Russian IT labour market. The company had 8,400 employees in 4Q21 compared to 6,400 in 3Q21 and 5,500 in 4Q20. Half of the staff are developers and engineers.

Services, International Segment: No Slowdown

IT Services - a driver of profitability and growth

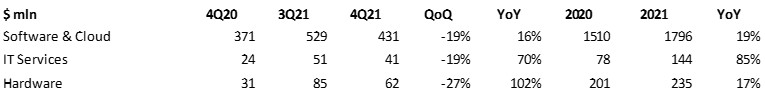

Turnover of IT services, the most profitable business segment (78% ROI), grew by 85% YoY in 2021, as compared to 70% YoY growth in 4Q21.

Turnover by business area

Source: Softline, ITI Capital

International business is growing

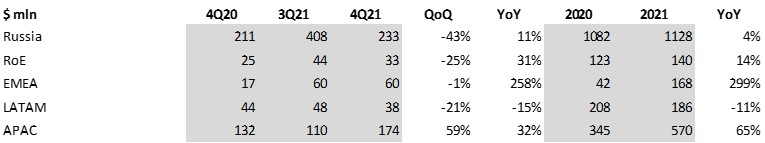

Turnover in Russia: -11% YoY, -43% QoQ (negative seasonality) to $233 mln. Therefore, Russia's share in total turnover dropped to 44% in 4Q22 from 61% in 3Q21 and 49% in 4Q20.

At the same time, the international business posted growth even QoQ: +16% QoQ and +41% YoY (vs +40% YoY in 3Q21), to $304 mln, which is extremely positive, in our view, and wiped away fears of the company's inability to pursue active expansion in international markets in turbulent environment.

Turnover breakdown by regions

Source: Softline, ITI Capital

Forecast for 1Q22 looks good

In the face of uncertainty, Softline has switched to quarterly forecasts and expects that in 1Q22

- turnover will grow by at least 15%, while

- turnover in markets outside Russia will grow 30%:

- turnover in Russia will drop by at least 10%, with IDC forecasting a 25% contraction in the Russian IT market.

- gross profit in 1Q22 will increase by at least 25%, particularly due to the growing share of higher-margin IT services in the revenue mix

- a positive adjusted EBITDA in 1Q22, including Russia. Since the Russian market accounted for almost half of the company's revenue last year and massive shocks it has suffered due to the likely withdrawal/operations

suspension of foreign vendors and the uncertainty in the entire economy, Softline's outlook looks positive, in our view.

The Russian market is alive As for the Russian market, the withdrawal of such competitors as Crayon and SoftwareONE from Russia will help Softline build up its market share, while a huge shift to domestic software will drive growth of the IT services segment in the coming years.

During the May 24 earnings call, the management confirmed that the Russian IT market is generally operationally efficient, despite hardware and foreign software substitution problems. With foreign vendors leaving the Russian market, Softline has a chance to replace the departing vendors with others, given Softline's strong portfolio (more than 6,000 vendors and over 1 mln items for sale). One should remember that the company is building its expertise in software development and developing its own cloud segment, which is in high demand in Russia now. The introduction of new products can drive demand for IT services.

M&A: Cash is King

As of mid-May, we can already state that the truly international company with Russian roots has avoided major sanctions risks. Softline still cooperates with key vendors and is listed on the LSE. The company, naturally enough, is expected to proceed with its strategy.

A large cash cushion...

As of 31 March 2022, the group had $335 mln in cash, or $398 mln including the Crayon stake. As of March 31, net debt was -$247 mln.

Softline has negative working capital of $12.9 mln. Meanwhile, a seasonal release of inventory is expected.

Crayon investment monetized in time in 1Q21 Management confirmed that the company recently monetized most of its investment in Crayon. The sale of the Crayon stake, in our view, was driven by favourable timing and availability of more attractive investment targets.

Softline held about 7.5%, or 3.3 mln shares, in Crayon at the end of 4Q21. The total value of Crayon stocks sold in the second quarter might have been $40-50 mln, according to our estimates and media reports.

Buy-back is over Softline also reported it bought back 1.1 mln of GDRs worth $7.8 mln, followed by 4.42 mln of GDRs of an offer valid from 14 April to 18 May. The deals were meant to optimize the company’s capital structure.

...will help fund M&A

Softline has made five acquisitions this year in line with its growth strategy. The pause in M&A activity, which has dragged on since February, resulted from by uncertainty over the company's ongoing cooperation with major Western vendors. There is reason to believe that the company will proceed with its M&A strategy and use its large cash cushion to ensure sustainable funding of development projects ahead of competitors, who have often funded acquisitions through share swaps. Given declining multiples and general volatility in global equity markets, the demand for this type of acquisition funding could fall.

New acquisitions in India are possible Interestingly, many of Softline’s target markets including India and Latin America, are relatively tolerant of Russian sanctions risks.

The revenues of Indian companies alone, which Softline considers as acquisition targets, exceed $350 mln, according to the company’s presentation. Softline's turnover in India in FY21 grew by 45% YoY to $486 mln.