The bottom line: buy dollars now but not higher than 75 roubles per dollar

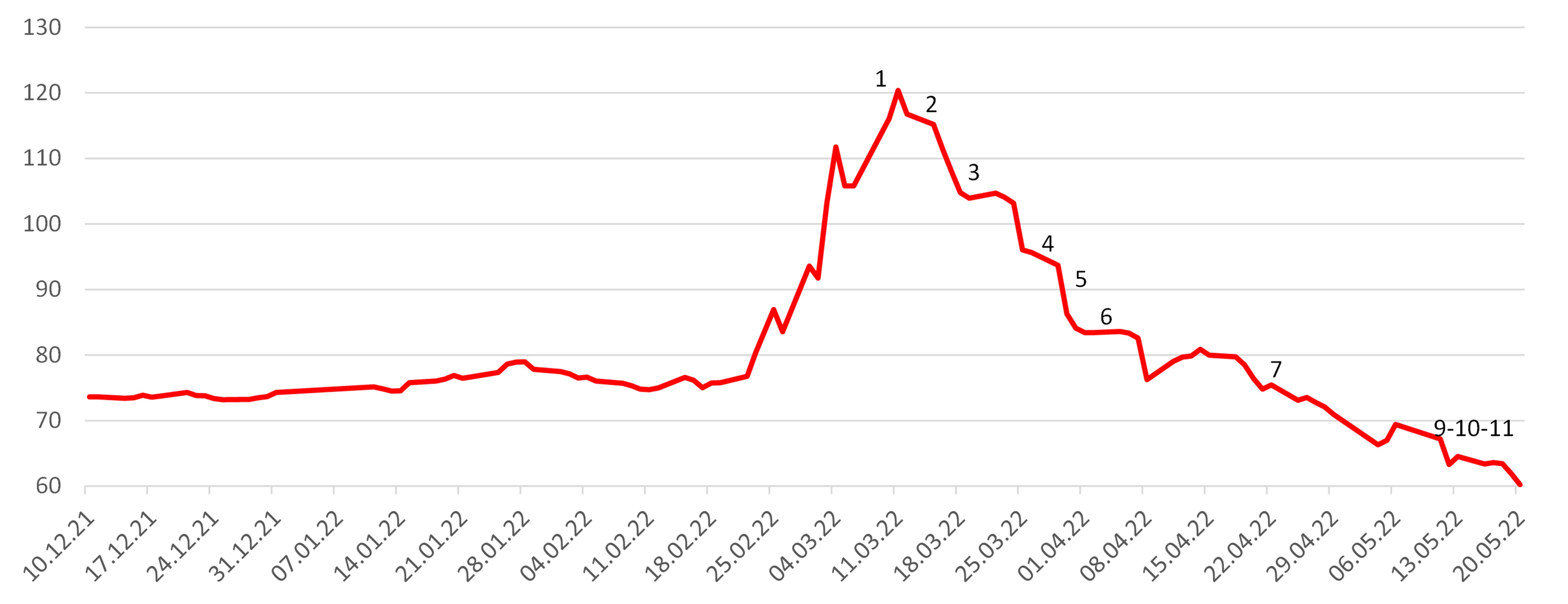

- Since the breakout of the conflict in Ukraine on February 24, the rouble has advanced against the dollar by over 53%, hitting levels of February 28, 2018, at an average volatility of 56% over three months against an average volatility of 15% for G-20 currencies. Over this period, the dollar rallied against all major currencies, with the DXY index rising 7.5%, to a peak seen in late 2002, as the US Treasuries’ yields picked up by 100 bps, to 3%, and inflation increased by 2-3% in the US and Europe, to a 40-year high, triggering a new global cycle of monetary tightening, i.e., rate growth.

Friday's margin call and record volumes

- Last Friday, May 20, 2022, was the most volatile trading day since early April 2022. That same day saw the highest daily trading volume in three months, above $3 bln. Since February 24, the average daily trading volume was $1.1 bln, as most of the key players - European and US institutional funds/banks and local players (non-state pension funds + asset management company) - left the Russian market. We believe that the main reason behind Friday's elevated volatility of the rouble dollar pair was the margin call by major players, who held long positions on the dollar against the rouble, as few expected the dollar would drop below ₽60/$.

Further appreciation of the rouble poses major threat to Russia's new budget structure

- We believe that there’s no room for further rouble strengthening rate because of the adverse implications for the Russian budget - in April, oil and gas revenues accounted for a record 63% of the budget’s proceeds compared with 33% a year ago. In April the budget situation deteriorated. The budget deficit widened to a record ₽262 bln year-to-date (compared to a surplus of ₽1 151 bln in March), as VAT collection declined sharply (halving y/y) amid a drop-in business activity and reduced revenue from import VAT and import duties.

- VAT and MET are the two key sources of tax revenues for the Russian budget. The situation will deteriorate further amid sectoral sanctions and shrinking non-energy revenues, while budget spending has been rising strongly since February and in April grew one and a half times from the first quarter average, with social policy and national defence accounting for a material share of the spending mix.

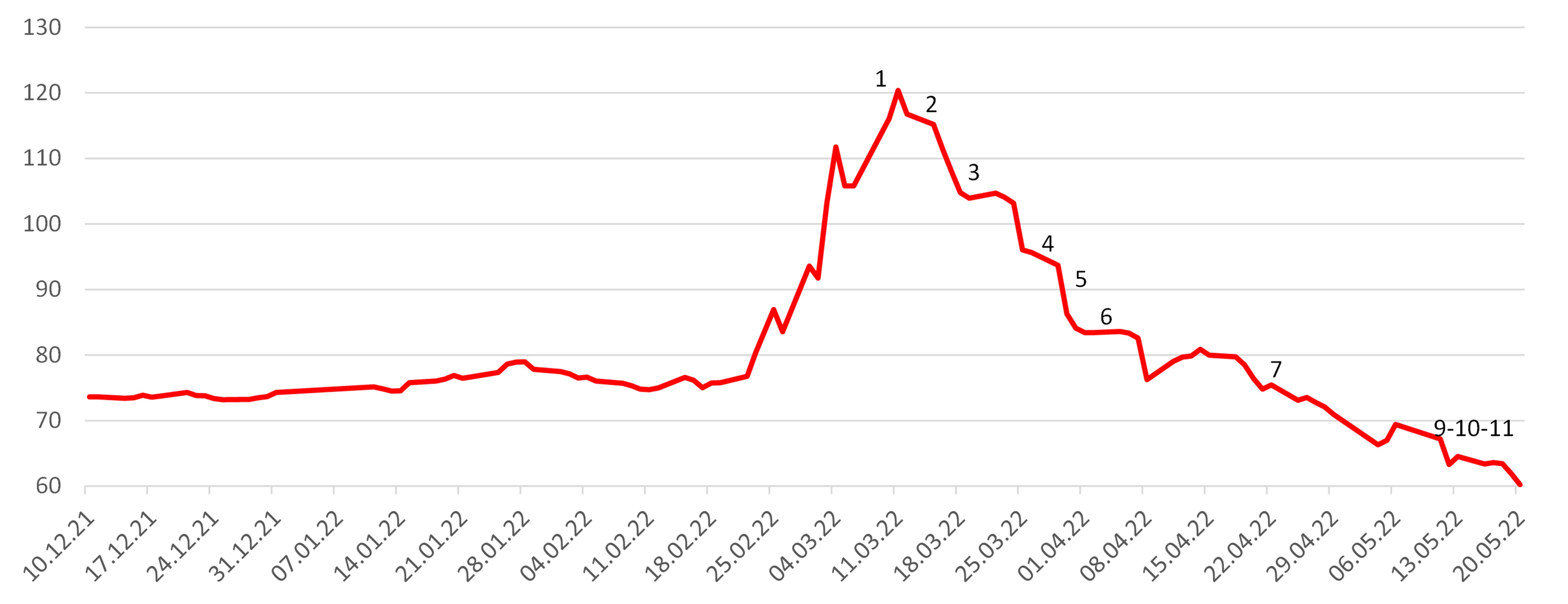

Overview of steps taken by the Central Bank to curb the rouble weakening against the dollar

- Russian budget is facing major risks, since with high dependency on oil and gas revenues, the government must also address major risks of EU’s embargo on Russian oil and gas.

- The rouble’s rally on Friday drew negative reaction from the Bank of Russia. The regulator has twice intervened since then to ease capital controls, First, it allowed banks to sell foreign currency in cash to individuals without restrictions, with the exception of euros and dollars. In addition, the Central Bank lifted a ban on short sales and leveraged currency purchases from June 1.

- The regulator also introduced a special trading regime for non-residents, allowing them to use roubles to sell and buy Russian securities. Also on May 23, Vedomosti reported that the Central Bank was considering resuming currency purchases as part of the budget rule. The Central Bank later denied the report.

- In any case, we consider this measure to be ineffective (although it generates artificial demand) since the currency to be purchased by non-sanctioned Russian banks, such as Gazprombank, Dom.RF and others, will be deposited in transit accounts.

- The Ministry of Finance and the Central Bank are also considering lowering the mandatory FX-sales ratio for exporters to 50% from the current 80%, but as we pointed out earlier, exporters actually sell no more than 50% of export revenues due to low liquidity on the FX-market. Therefore, in the current environment, the Central Bank is struggling to work out measures to stir up demand for hard currency due to restrictions on FX-purchases by individuals and falling imports.

- We believe that the rouble will enter the ₽60-65/$ range in the short run and ₽65-75/$ range by the third quarter.

Seasonality and 2015 scenario?!

- In the first half of 2015, amid comparable volatility, "long" government bonds were able to offset about half of their losses, rising from lows of 50-55% to 85% of par, in line with strengthening of the rouble from ₽70/$ to ₽49/$, or by 28%, from February to May 18, 2015, the rouble then weakened against the dollar by more than 40% in the three months to mid-August 2018.

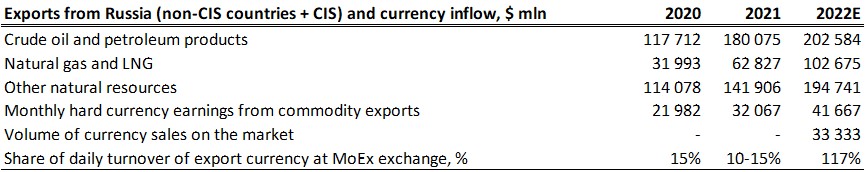

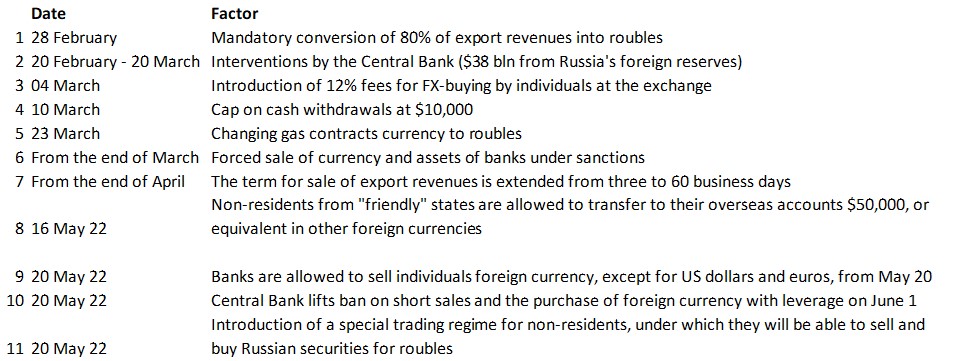

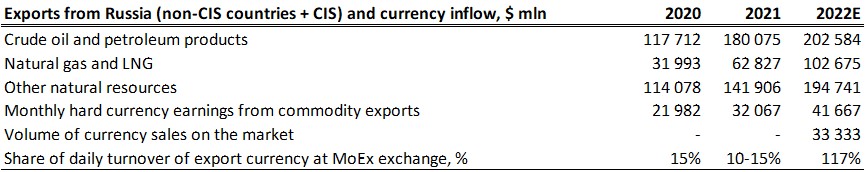

- Almost every July and August in the past eight years have seen the biggest weakening of the rouble against the dollar (by an average of 2.5-3% in each of those months), while in February-May the rouble traditionally strengthened due to increased inflows from oil and gas export revenues. June usually marks the start of a sharp seasonal weakening of the rouble as exports fall and production and consumption of fuel increase (the summer driving season in the US accounts for 66% of demand for petroleum products, mainly gasoline). The seasonality factor also remains relevant under sanctions, given the latest export data. Oil exports averaged 7.2m b/d in April, just 0.4m b/d below the average of 7.58m b/d in February, before the conflict in Ukraine broke out. Russian oil exports averaged 156,000 bpd exceeding the exports before the conflict, while petroleum product exports fell by 652,000 bpd, according to data of ocean tankers oil loading at export terminals.

- Despite the May 16 EU ban on crude oil and oil products imports from Rosneft, Gazprom Neft and Transneft, and Western traders' shunning Russian srude oil, supplies remain strong, thanks in part to companies from Greece, which accounts for 20% of the world's trade fleet deadweight and 30% of the world's tanker fleet deadweight. Moreover, importers benefit a great deal from buying Russian oil at 35-40% discount.

- According to the Central Bank, Russia's current account surplus increased to $96 bln in January - April while in January - March it was $58.2 bln. Thus, in April the increase amounted to $38 bln. At these growth rates, the current account surplus could exceed $200 bln in 2022, with $500 bln in exports from Russia. Gas exports alone could bring Russia $100 bln ($270 mln per day) by the end of the year, even taking into account the restrictions imposed, and oil and oil product exports - $200 bln ($560 mln per day).

- The sharp fall in imports and the record share of oil and gas revenues are the reasons behind the rouble’s strengthening, as we pointed out many times.

Source: Bloomberg, ITI Capital

Excessive amount of dollars in the banking system

- Apart from the strengthening of the rouble, another important indicator of a currency surplus is swap rates. Since the start of the month the dollar overnight basis (difference between the overnight dollar swap rate and RUONIA) has exceeded 100 bps. The banks are therefore prepared to offer a 100-bps premium in foreign currency funding. A crisis, on the contrary, is usually marked by a shortage of foreign currency liquidity and a negative basis.

Negative factors

- The key negative factor for rouble is restrictions on oil and gas imports from Russia, which will come into effect as soon as it is agreed. In any case, a 30-40% drop in exports at the end of the year cannot be avoided. Right now, for example, exports declined by 15% from the February highs. Notably, the second negative factor for the rouble is the improved geopolitical situation and the lifting the toughest sanctions against Russia, which will bring non-residents back and provide for a more market-based and less volatile rouble rate compared with what we have now.

USDRUB rate, %

Source: Bloomberg, ITI Capital

Source: Bloomberg, ITI Capital