What is happening on Russian capital markets?!

False market movement

The Russian equity market stands on fragile footing subject to geopolitical risks. In fact, since resumption of equity trading on the Moscow Exchange on March 24, we have seen market making false movement based on unjustified expectations. After reaching a local peak on April 4 (+8% since March 24), the stock market has been declining and has already fell 18,5% to the levels of February 25, falling 9,3% short of the low of February 24 (start of the military conflict in Ukraine), or the local low of August 2018.

Since the trading resumed, key losers included the oil and gas sector and banks (the most liquid securities were sold, partly due to delisting), top gainers were retail (Magnit, Fix Price) and communications companies (VK).

The average volume of trading on the Moscow Exchange last week was ₽27 bln per day, compared with ₽50 bln per day immediately after the reopening. After systemically important credit institutions (SICI)/banks (following the Central Bank’s move to ease terms of fixing book value) bought shares worth ₽46 bln in March, household investors have been driving the bulk of trading. This is the reason behind a drop in trading and performance of shares, which are traded in the absence of clear market direction. According to the Moscow Exchange, the number of unique accounts has increased to 19 mln (26.3% of the active population and 13% of the total population of Russia). In the US, individuals directly invest in 40% of the equity market and through institutional funds in the remaining 60%. At the same time, local and international funds have traditionally accounted for the bulk of trading in the Russian market. Local funds, including managing companies and NPFs, have a negative view of the stock market.

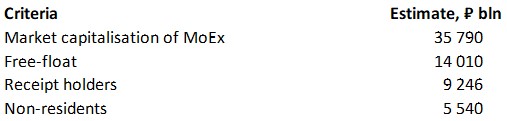

The main reason for the negative view of the equity market is the short planning period, the high risks of reduced operating flows of export-oriented companies, and the uncertainty with the rouble exchange rate, which significantly increases the risks of investing in companies with a focus on the local market. A potential equity overhang following GDR conversion into shares adds to the downside. The overhang from sales of Russian companies' receipts by residents after delisting and local shares by non-residents (should the ban be lifted) could exceed $60 bln (₽4,500 bln), or 14% of current market capitalisation.

Source: ITI Capital, Bloomberg

Meanwhile, the bond market is moving in an opposite direction following a sharp cut of the key rate (on April 8). The rouble is strengthening against the dollar, despite easing of capital flow restrictions due to low demand for the hard currency and its limited supply in the banking system.

Other important reasons behind the market decline

1. Delisting of Russian shares/equity sales by residents. Delisting legislation will come into force on April 27 - Russian companies have until 5 May 2022 to terminate the contracts under which they offered securities under foreign law and close the depositary receipt programmes. We estimate that, based on the equity share of the receipts, their value after conversion into local securities will amount to ₽9,245 bln, or 27% of the Moscow Exchange's capitalisation. We estimate that a third of these holders are residents and around 10% of them could sell their receipts for ₽920 bln. Selling such number of receipts in the market would require much time, as the trading volume now stands at ₽25-30 bln per day. After the February sanctions, the value of the Russian equity portfolio of foreign funds, including local securities and receipts, fell to $47 bln (₽3 666 bln). Before the sanctions, the share of non-residents was $200 bln, while the market capitalisation exceeded $800 bln. Based on the current market capitalisation, the share of non-residents, including individuals, could amount to ₽5,539 bln at best. ($71 bln). Non-residents will not be able to sell Russian securities until transactions between NSD and Euroclear are resumed.

2. Sanctions rhetoric intensifies. Europe is working on hey another package of sanctions against Russia, the sixth in less than two months. Over the past two weeks, the West has imposed sanctions on Russia's banking sector, including Sberbank and Alfa Bank, triggering a reallocation of bank assets and forced selloffs, including of local stocks and bonds.

The speculations about an embargo on oil and gas imports from Russia to Europe (which accounts for 70% of Russian energy exports) have intensified. For the time being there is a ban on coal imports to Europe from Russia (Russia accounted for 4% of Europe's coal imports in 2021). Energy supplies, including oil and gas, account for 59% of total Russian exports.

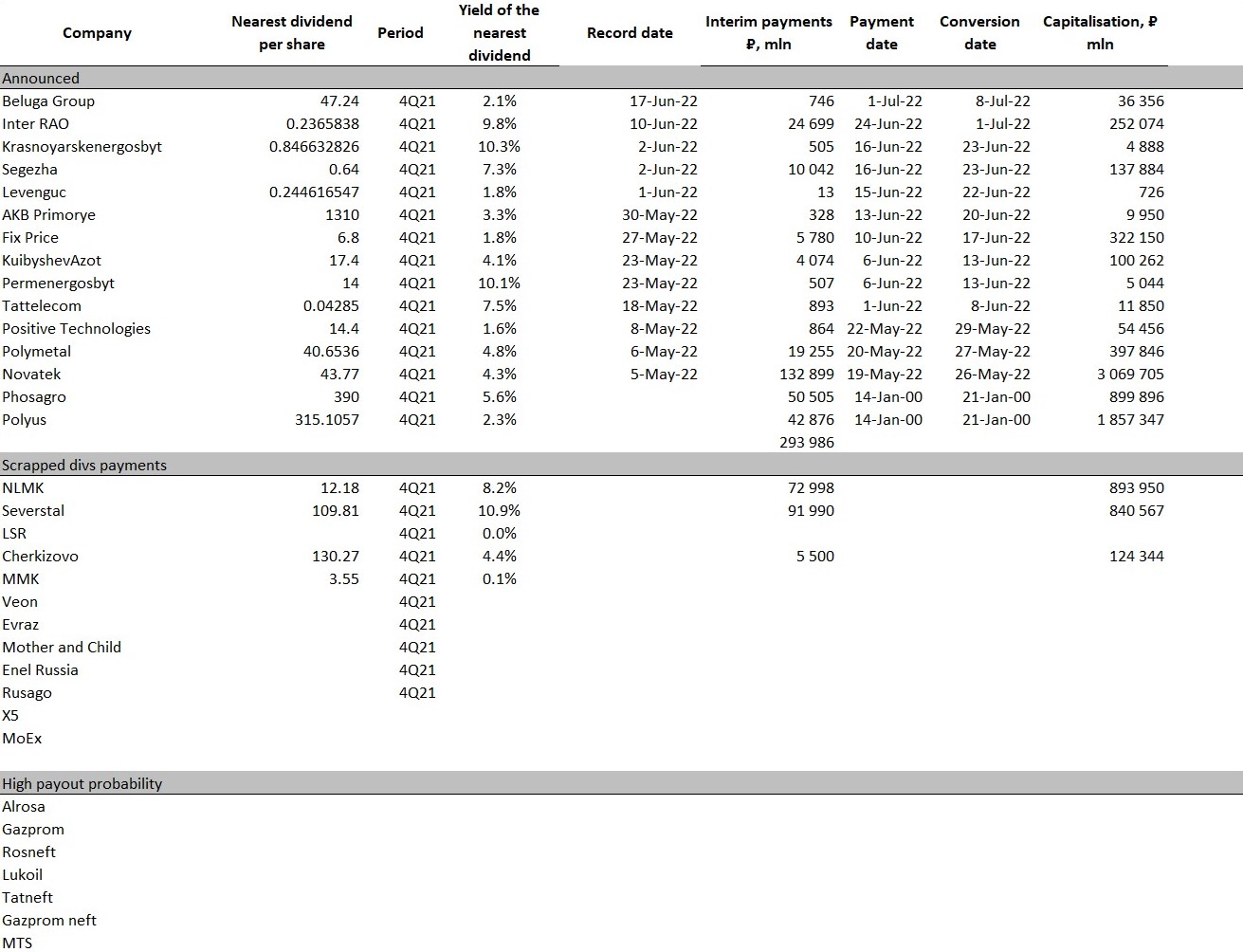

3. Lack of corporate motivation. Dividend payments have so far been suspended by steel companies (NLMK, Severstal, Evraz, MMK and others), retailers (X5, Cherkizovo and others), as well as LSR, Veon, the Moscow Exchange, Rusagro and Enel Russia. The state-owned exporting companies are highly likely to make dividend payments to increase federal budget revenues from government stakes in companies. So far, officially announced dividends have amounted to ₽293 bln, compared with an expected ₽ 4.7 trln for 2021 before the sanctions. Abandoning or suspending dividend payments and dropping plans to publish its financial results are a response to the operational sanctions imposed and the inability to pay dividends to their major shareholders. Some companies rule out dividend payments due to the low predictability of operating cash flows and limited options for attracting new funds. Moreover, The Russian central bank told lenders to consider postponing dividends.

4. Global volatility. The S&P 500 is down more than 5% since early April and the Nasdaq fell more than 9% after rebounding in March. We highlight three main risks which are not yet fully priced in. The first is the Fed's more hawkish monetary policy stance, the second is recession/geopolitical risks and the third is a lockdown in China due to the coronavirus.

5. Inevitable technical default. Six major companies (Russian Railways, Severstal, SUEK, Eurochem, Chelpipe and Nordgold) have faced technical default on their external debt, the grace period for these bonds has already expired, the grace period for the Russian sovereign bonds expires on May 4.

6. Not cheap enough. The capitalisation of Moscow Exchange has fallen by 45%, from an all-time high (October 2021) of ₽62 trln to ₽36 trln. Sberbank and VTB's losses on state programmes could exceed ₽600 bln for 2022, compared to a profit of ₽1.6 trln last year. The market share of exporters has grown to 78% and their future depends on the oil and gas embargo. Retailers are the most exposed to rising inflation, while the ability of IT companies to implement import substitution is highly questionable. In addition, growth stocks are under pressure from soaring foreign currency rates.

What is happening in the bond market?

The "dovish" statements of the regulator in recent days have strongly encouraged OFZ market participants. The yields of “classic” sovereign bond issues fell sharply against the backdrop of higher trading volumes; therefore, almost the entire curve is approaching the 10% yield (the only exceptions are securities maturing within the next year).

We should also highlight the sharply reduced negative slope of the sovereign curve, largely driven by investors' reassessment of interest rates in the medium term. Since the resumption of trading in the third decade of March, the government bond price index RGBI has recovered from its December 2014 low and has returned to 125.5 p.p. (+28% from its low).

We assume that yields on government bonds with a constant coupon have long since reached an equilibrium given our baseline forecast for the key rate by the end of the year. The current prices seem overbought, so we do not see much interest in taking long positions in “classic” OFZs now, unlike high-yield corporate bonds. Moreover, given expectations of higher annual inflation in the coming months, real yields will increasingly move into negative zone, thereby losing appeal for investors. Therefore, we continue to favour high-quality corporate rouble bonds of first- and second-tier borrowers. As far as the public sector is concerned, inflation-linked bonds might be of more interest, even if their prices have also materially increased in recent weeks.

What is happening on the currency market?

The rouble has been the best gainer of all Russian assets, after an April 8 to April 13 pause the Russian currency continued to pick up, gaining 35% from its peak on March 9. The growth was driven by currency sales by exporters on the background of an all-time high inflow of export revenues. Imports fell due to limited consumer demand amid the cap on currency cash withdrawal and reduction of its share in the banking system due to sanctions.

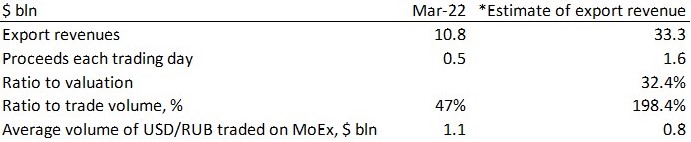

In March, exporters were only able to sell hard currency in the equivalent of ₽865 bln (i.e. $10 bln per month, or $0.5 bln per day), which does not exceed 33% of the actual hard currency revenues (we estimate that hard currency exports revenues amount to $500 bln per year, of which $400 bln are subject to mandatory conversion into roubles under the 80% sales rule, equivalent to $1.6 bln sold per trading day).

Hence, exporters actually sell 2.5 times less currency than the mandatory amount due to organically low trading volumes on the exchange market which dropped to $0.8-1 bln a day compared to $1.4 bln of export revenues per day of which 80% should have been sold on the exchange.

The latest measures by the authorities that imply extension of the term of mandatory conversion of exports revenues from 3 to 60 days and reduction in the share of export revenues sales from the current 80% will have little impact on the exchange rate.

We are likely to see the rouble strengthening to ₽70/$, given that April traditionally sees record quarterly tax payments.

Source: ITI Capital, Bloomberg

* Export sales based on estimated $500 bln a year in total revenues, of which $400 bln are subject to mandatory sales

What to expect next? / What to do?

The positive scenario assumes a 50% probability that there will be no embargo on oil, gas and metals and that the special operation will be over by mid-May. It implies lifting the "toughest" sanctions, in particular "unfreezing" of foreign currency reserves and resumption of transactions between Euroclear and NSD, a partial withdrawal of non-residents from Russian assets followed by ₽1 trln worth stock market interventions by the Central Bank and corporate buy-backs worth ₽650 bln, which would fuel a market recovery.

This positive scenario implies a high probability that non-residents will not sell all of the Russian assets they own. The other scenario is no changes in the current environment with no growth prospects and the threat of new sanctions. The base case scenario assumes further gradual sales and the market decline to the level of February 24, when the military conflict broke out in Ukraine.