The highest oil and fuel prices since 2008, due to the military conflict in Ukraine, have led to record inflows of speculators' funds into commodity assets and stocks of major commodity companies. In our view, this trend is approaching peak levels, going against the generally accepted practice of investing in ESG companies aimed at reaching "zero emissions" by 2050 and pulling out from commodity stocks.

Since the start of the geopolitical confrontation between the US/NATO and Russia, gas prices have soared by 400% and oil prices by 55%, which will drive up prices along the entire production chains and squeeze global economy.

These risks that may hurt every consumer provide further reasons for investing in alternative and clean energy providers. Such companies are well-positioned to quickly deploy such technologies, soaring conventional energy prices have made renewable energy providers even more competitive.

Thus, since the conflict in Ukraine broke out on February 23-24, the two largest renewables-focused ETFs, Invesco Solar ETF and First Trust Global Wind Energy (TAN US and FAN US, solar and wind power, respectively) have gained 28,5% and 12.8%, while global index MSCI World have advanced 6,9%.

At the peak of oil's rise on March 7 amid general sell-offs, when the S&P 500 lost 3%, solar energy providers, including Sunnova (+13%), Sunrun (+10%) and others, outperformed the market. Even oil and gas stocks fell 3%, despite higher oil prices. This trend will continue due to high volatility in global markets.

Stocks of alternative energy providers as an undervalued hedge against higher volatility in commodity prices.

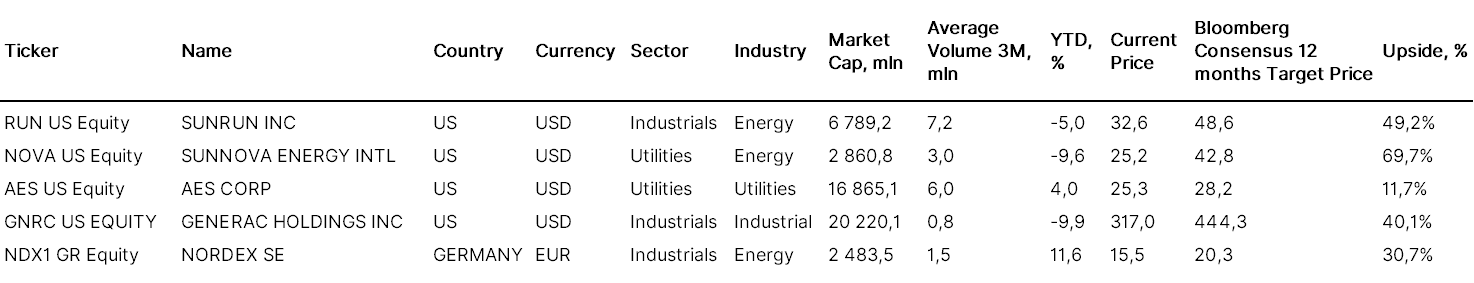

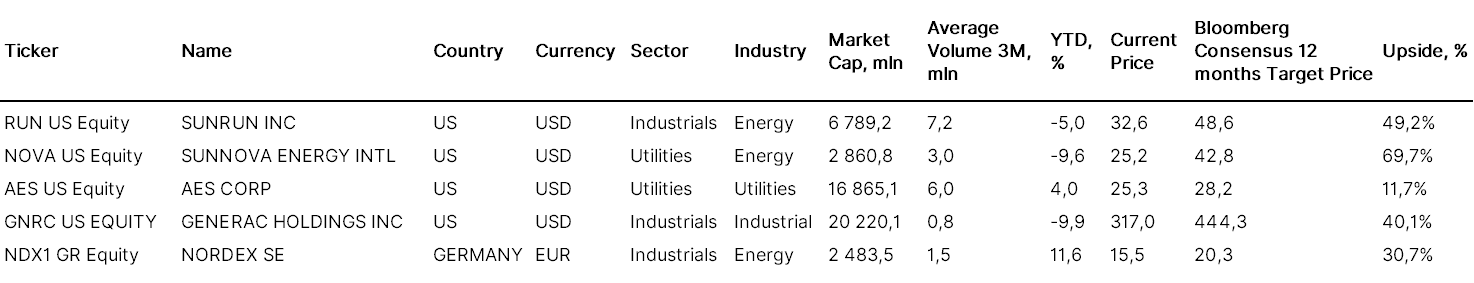

We have picked five alternative energy stocks with the highest upside. We consider these stocks an undervalued hedge against higher volatile commodity prices, both in the short and long run.

1. Sunrun is a leading home solar, battery storage, and energy services company, it is engaged in the development, installation, sale, ownership, and maintenance of residential solar energy systems in the United States. It is headquartered in San Francisco, California.

- Sunrun is technically oversold due to the California Public Utilities Commission’s proposal to impose higher utility fees on people who install solar panels on their homes.

- Most analysts believe that the introduction of solar energy storage technology and rising prices of other energy sources will offset higher utility fees, and the market has overreacted to the commission's initiative.

- The California regulator is delaying a vote on a controversial proposal to slash incentives for home solar systems, which is good because of the issue is important, but the break contributes to stock volatility.

- However, the worst fears are already priced in, the stock’s potential upside stands at 49.2%.

2. Sunnova Energy International is one of the leading providers of solar and residential energy storage throughout the US. It is headquartered in Houston, Texas.

- The company expects to double the number of customers, double services per customer and triple EBITDA by the end of 2023.

- Utility rates are expected to rise further in line with inflation. Therefore, consumer demand for solar installations and batteries is projected to increase, the prospects of delinquent payments from customer will decrease and the company will have room to raise rates.

- Sunnova is the favourite stock of major investment banks, its growth potential stands at 69.7% on a 12-month horizon.

3. The AES Corp. is a Fortune 500 global energy company that owns and operates regional utilities and develops renewable energy projects, including clean energy production and distribution.

- It owns one of the largest renewable energy portfolios in the world.

- The AES Corp. is now technically oversold and trades at a ~30% discount on major financial multiples to its peers.

- The company continues to reduce its global business risks. Currently, more than 80% of the company's cash flow is denominated in dollars and about 85% of its cash flow is contracted with an average term of 13 years.

- The AES Corp. has 11 "buy" recommendations from the world's major investment banks and just one "hold" recommendation, its average upside over a 12-month horizon stands at 11.7%

4. Generac Holdings is one of the leading energy technology companies that develops advanced software solutions for power grids, standby and main power systems for residential and industrial facilities, conventional and solar energy storage solutions, virtual power plant platforms, and engine- and battery-powered tools and equipment.

- The company accounts for 80% of the residential standby generator market in North America. Generac has recently invested in a solar back-up storage business, which is growing rapidly, and is also successfully developing a large commercial and industrial business that accounts for around 40% of the company's sales.

- Generac accounts for the largest market share in the US, it has long-term growth opportunities in its backup housing segment. The company has successfully pursued a clean energy strategy and continues to benefit from extreme weather, increasing use of renewable energy and consumers’ willingness to perceive their homes as shelters in a world exposed to pandemics, hurricanes and wildfires.

- Sunnova is the favourite stock of major investment banks, its growth potential on a 12-month horizon stands at 40.1%.

5. Nordex is one of the world's largest developers, manufacturers and sellers of wind turbines. It is headquartered in Rostock, Germany, with management based in Hamburg.

- Germany aims to increase its wind power capacity to 10 gigawatts per year by 2027, up from around 2 gigawatts now, and maintain that level until 2035. The rationale is to avert an energy crisis.

- For example, Russian gas accounts for about half of Germany's gas consumption. An increase in renewables capacity would accelerate electrification of the economy and reduce its dependence on gas as the main energy source.

- Nordex will be one of the key beneficiaries of this programme.

- The company's stock has 30.7% upside potential over the 12-month horizon, according to a forecast by analysts polled by Bloomberg.

Source: Bloomberg, ITI Capital

*Prices are as of the close of trading on March 30