The Russian market: Wild Wild East. Next, the “Iranian model”?

As events continue to unfold in Ukraine at a rapid pace, it is hard to tell what will happen as soon as the Russian equity market reopens, what prices we’re going to see in early trading and how long it will take to discover a new equilibrium. Current financial forecasts no longer matter, Russia's credit rating is downgraded to junk, the institutional landscape of the stock market has been reshaped and the popular imaginings are full of apocalyptic scenarios. Isolation of Russia’s economy and stock market comparable to what Iran has faced for decades is broadly discussed.

Nevertheless, the Russian market collapse could be followed by exponential growth, turning it into a Klondike with fortunes made overnight, at least in the short term. The stock market is still closed and following the first rule in a crisis situation, "don't panic," one can try to single out the key factors of new reality, build risk tolerance and divide stocks into classes depending on possible scenarios. The market is likely to be dominated by the following factors:

Technical: (1) lifting a ban on settlements between brokers and the future of the depositary receipt market; (2) pullback of foreign investors from blocked assets; (3) the impact of channeling money from the National Wealth Fund to buy shares in Russian companies, Russian corporates’ buyback programmes, the stakeholders’ willingness and ability to buy back cheap shares. As soon as technical issues are addressed we will see who will be admitted to early trading and which stocks will get a boost. Fundamental: (4) Risks of Russia's isolation from the Western economy, chances for keeping Russia’s export operations going; (5) the rouble exchange rate. Strategic: (6) Russia's trade flow shifting towards China is imminent, and the prospects of economic alliances of emerging economies against developed ones.

The last point is only partly related to "economic futurology". It defines the resilience of the Russian economy that drives a long-term equity growth. The first six points are tactical, they allow to build a portfolio depending on what we will see at the market reopening.

Most commodities are trading at all-time highs, a full embargo on Russia’s exports hasn’t been imposed. Isolating Russia completely would have serious consequences many economies. However, with sanctions and limited government measures to support the economy, growing commodity prices are unlikely to curb devaluation. In current circumstances selecting an Export-oriented portfolio seems appropriate. At the outset, managing risks looks more important than maximising returns. Companies with significant shares in global production – Rusal, Norilsk Nickel, Alrosa and Gazprom could be selected as defensive stocks. Polyus and Polymetal could be included in response to increased demand for gold. The portfolio can be diversified by adding Phosagro, Novatek, Rosneft, Lukoil, Segezha Group, Softline and locally oriented Sberbank. We picked Sberbank since it’s too big to fail and is loved by Russian investors. The latter may be the key factor since Russian private investors and Russian funds may be the main players and beneficiaries in the Russian stock market when it first reopens. This is not to say that foreigner investors will only be able to observe the trading on the MOEX. But the overhang of foreign-owned shares for sale may be regulated, at least when the trading first resumes. There could be additional demand from investors from "friendly" countries. The situation is constantly changing as new Central Bank regulations are issued. While the "letter of the law" has not yet been formalized, it can be suggested that in its "spirit" the regulator may try to prevent defaults on international debts. However, it is not certain that currency exchange controls will be relaxed. Theoretically, liberalization of the restrictions on debt, could also have an impact on the equity segment. The regulator may be interested in returning shares "to Russian jurisdiction" followed by the gradual recovery in stock prices.

Technical factors

Who will be the main players on the Russian market when it opens?

Although the bulk of Russian equity trading has migrated from Western exchanges to the Moscow Exchange over the past decade, the role of foreign investment has remained strong.

Foreign exchange controls The logic behind transactions executed by foreign investors must take into account forex restrictions designed to block the withdrawal of foreign currencies from the country. These measures make selling Russian shares on the domestic market less convenient. At the moment (the situation is changing quickly), it is possible to convert Rubles into foreign currencies, but it is difficult to take it out of the country. At the same time, the currency control ban does not yet look totally prohibitive. It allows for transfers that can be made with an individual permit issued by the Russian stater Commission for the Control of Foreign Investment. Therefore, selling Russian shares on the local market seems pointless following the move.

Technical restrictions for foreigners on the local stock market. As we understand the situation, the new legislation divides investors into two categories - those from "unfriendly countries" and everyone else. Investors from "unfriendly countries" cannot buy or sell securities (both Russian and foreign, including, therefore, depositary receipts); however, exceptions are possible for certain legal forms. Restrictions should not affect forced closing of clients' margin (uncovered) positions, repo transactions. Debt payments will be made in Rubles and a new type of account will be introduced for non-residents from "unfriendly" countries and relevant beneficiaries.

Foreigners from "friendly countries" can buy and theoretically sell securities, which relaxes the restrictions somewhat. However, it is unclear how active the channel between "friendly" and "unfriendly " investors will be when trading begins. That said, the ability to use this channel will be limited due to the forex restriction.

The restrictions were imposed hastily, require an explanation from the regulator, are constantly changing, and apparently the full legal framework will be clear when trading the MOEX opens. For example, over the weekend the Central Bank mentioned an injunction prohibiting writing off securities issued by Russian entities from personal (depo) accounts. As we understand it, once the Russian market opens, most foreigner investors will only be able to observe the trading for technical reasons.

It is worth bearing in mind that significant foreign funds were invested in depositary receipts the bulk of foreign investments are "blocked" due to the inability of Euroclear - National Settlement Depository (NSD) to make payments.

Thus, the overhang of foreign-owned shares for sale may be limited at least when trading first resumes. There is likely to be additional buying demand from investors from "friendly" countries in the market.

The equity overhang may therefore be limited at least in the beginning. It is clear that foreign funds could have been actively removing Russian stocks from equity index funds, such as MSCI Russia and FTSE Russell. Therefore, the market might still see non-residents’ sales, though not immediately but after restrictions are lifted.

Not all Russian institutional investors will be willing and able to sell We believe that some institutional Russian investors, including banks and pension funds, will also hold off from selling stocks to keep their balance sheets healthy. For reporting purposes, the Central Bank allowed to report prices as of 18 February. Banks are thought to be more exposed to debt securities.

Lifting a ban on transactions between local brokers is another issue that needs to be addressed before the market reopens. The issue could be resolved before the Euroclear-NSD problem is removed.

Thus, foreign investors, will continue to be present on the market, but Russian private investors and funds may be the main players and beneficiaries in the Russian stock market as soon as it reopens.

The situation is constantly changing as new Central Bank regulations are issued. While the "letter of the law" has not yet been formalized, it can be suggested that in its "spirit" the regulator may try to prevent defaults on international debts. However, it is not certain that currency exchange controls will be relaxed. Theoretically, liberalization of the restrictions on debt, could also have an impact on the equity segment. At the same time, special type-C accounts are being introduced and the softening of foreign exchange restrictions remains in question.

The regulator could theoretically be interested in returning the shares the "to Russian jurisdiction" followed by the gradual recovery in stock prices.

GDR segment frozen

Russian securities in the US, trading of almost all ADRs is suspended in the London Stock Exchange (LSE) on 3 March.

The Euroclear-NSD channel has ceased to operate, we understand, on the initiative of the Central Bank. The move is meant to curb FX-ouflow. It also prevents investors from scooping major stakes at a bargain price. We assume the measure is made in response to limitations imposed on the Central Bank’s international reserves.

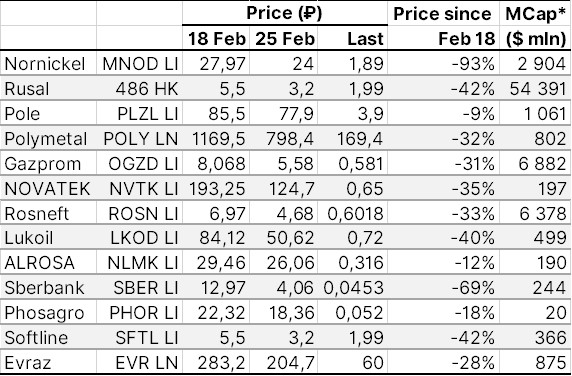

Emergency measures taken by Russia’s government and Central Bank to stabilize the exchange rate and Western sanctions have split the Russian market into offshore (depositary receipts) and onshore (local securities). Non-residents could only sell their receipts to each other. Residents are banned from making FX-transfers outside of Russia and buy ADRs, while non-residents could no longer buy Russian assets without the green light from the Russian regulator. Conversion from ADRs to local shares is blocked since the Euroclear account at NSD is frozen, a move which prevents changes in ownership. On top of regulatory restrictions, foreign investors vowed to shun Russian assets, which became toxic overnight, no matter whether there is any real value behind them or not. Massive selloff and positions liquidation triggered the receipts market rout.

Therefore, effectively zero prices of depositary receipts cannot serve as a market valuation indicator for the local market. It can therefore be assumed that there is a chance to avert an 80% market slide.

A ceasefire between Ukraine and Russia could result in partial lifting of sanctions and resumption of receipts trading. The West is likely to ease the curbs, given that the stock market is an important part of the financial system – the core of the Western infrastructure meant to impact global economies. The NRD is likely to reactivate Euroclear’s frozen account as soon as the Central Bank's reserves are released. if any. "A CB asset freeze is an extraordinary measure, so it cannot be completely ruled out that it could be reversed. The unprecedented curbs hypothetically could be lifted following Russia’s withdrawal from Ukraine.

Obviously, foreign funds could actively continue to close positions in equity index funds, in particular in MSCI Russia, FTSE Russell. In this regard, we could still see foreigners selling securities, but not immediately, but after the restrictions have been lifted. BlackRock and Fidelity said they will stop all investments in Russia. Fidelity is examining its exposure to Russia and will consider cutting it where possible and appropriate. Such wording reflects a reluctance to sell at any price, which could also delay sales.

Some Russian companies might eventually move their ADRs and shares to Hong Kong and Russia exchanges.

The Central Bank's clarification of 5 March, according to which the conversion of depositary receipts into shares does not require permission from the authorities, looks interesting in this regard.

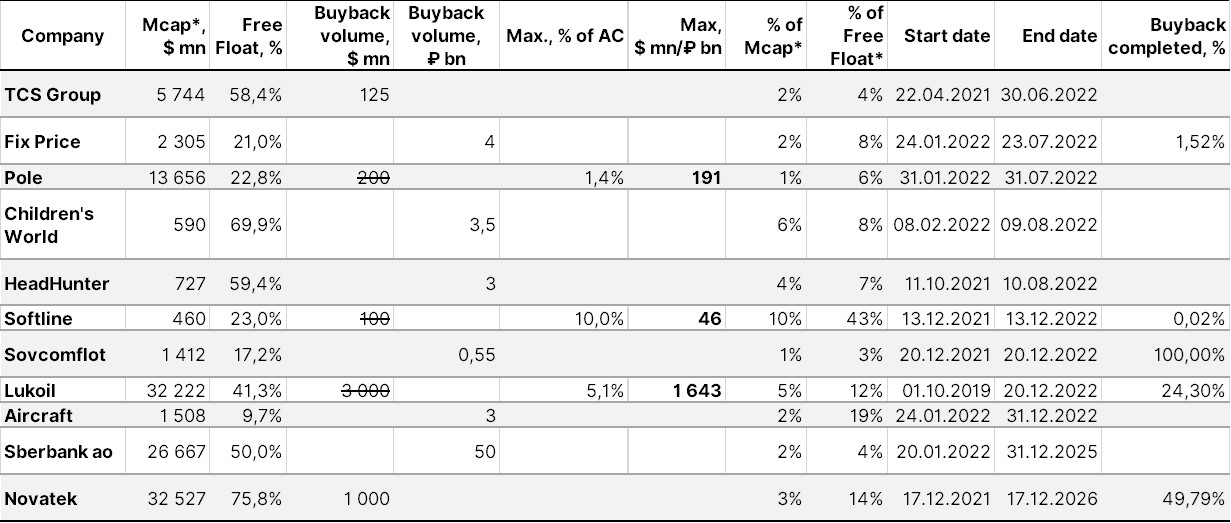

Share buybacks

State Buyback...

Funds from the National Wealth Fund (NWF) in the amount of RUB 1 trillion have been allocated to support the stock market. VEB and "specialised financial organisations" will be involved in the buybacks.

In the past, during the 2008 global crisis and market crash, VEB similarly received NWF funds in order to support Russian stocks. At that time, VEB spent ₽175 billion on shares of Gazprom, Rosneft, Lukoil, Sberbank and VTB.

...and corporate

It cannot be ruled out that not all the share buybacks programs that were announced at the start of the crisis will be completed due to the constantly changing conditions. Modifications are most likely in industries heavily dependent on import (non-food retail) affected by export restrictions.

However, the opposite trend is also possible. Capital intended for planned dividend payments could be reproposed to fund a share buyback.

The practice of buybacks is quite common and concerns not only large industries such as Oil & Gas (Lukoil, Rosneft) but also, for example, IT (one of the largest buyback programs announced was Softline). TMK took advantage of the market downturn in the spring of 2020 to buyback a significant stake and leave the London Stock Exchange.

Core business owners, majority shareholders may also be interested in purchasing shares at such low prices. This could affect not only the Metals & Mining sector, known for having dominant shareholders, but also the retail and IT segments.

Latest share buyback programmes on the Russian stock market

Source: ITI Capital, Bloomberg

*prices as of 1 March 2022, as the ratio of buyback volume to capitalisation has lost relevance due to further declines in the stock

Gazprom's management previously considered the possibility of buying back shares from the market. MTS and Sistema have turned to share buybacks on multiple occasions.

Another example is Novatek, the company resumed its buy-back program, with a sharp increase in volumes, repurchasing 5,118,046 shares, including GDRs between the 21st and 25th of February spending as much as ₽6.3bn. Prior to this, the company executed its buyback program at the end of January.

Fundamental factors

Since there’s little sense in providing an outlook on the Russian economy, the Ruble or transport constraints facing the local business at this stage, it might be appropriate to highlight the fundamental factors of the current situation.

(A) Russia’s exports flow to continue - for now On March 12, the EU barred 7 Russian banks, including VTB, from SWIFT. Sberbank was subject to other measures but was spared from the ban. The US and EU leaders moved to keep the main channels of payment for Russia’s exports open to prevent a blow to the Western economy. Shunning Russia’s export supplies is likely to take years, if not decades.

(B) The Ruble in free fall so far A ban on foreign exchange loans and transfers to outside of Russia and an order to Russian exporters to convert 80% of their foreign exchange revenues into Rubles are now the key tools to support the local currency, since the Central Bank’s ability to use interventions has decreased due to sanctions blocking more than half of its reserves. Therefore, the Ruble may fall further, as local companies are expected to face pressure amid a lack of forex revenues.

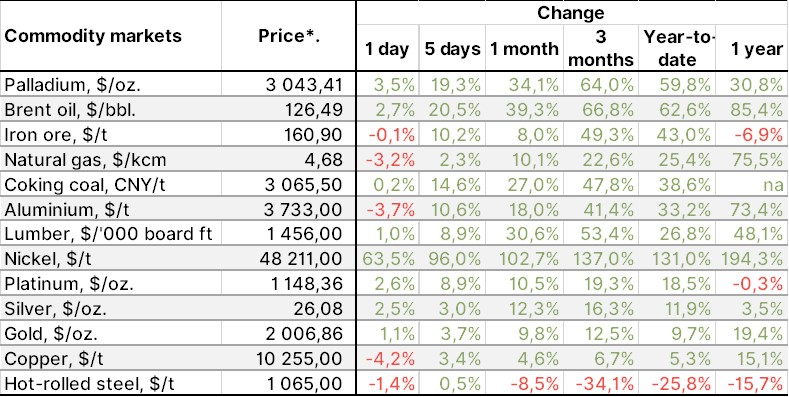

(C) Spike in commodity prices The Ukrainian crisis is driving commodity prices.

Raw material prices have been rising vigorously since the beginning of the year

Source: ITI Capital, Bloomberg

*on 8 March 2022

(D) Decline in confrontation and potential for economic alliances exists Decline in economic confrontation with the West and the 'unfreezing' of the Central Bank’s reserves is needed to stabilize the situation. And growing commodity prices challenge the isolating sanctions. At the same time, it is worth bearing in mind that a high oil price justifies the shale gas economy in the US and improves investment rates for green energy projects, which are strongly encouraged developed countries.

The reorientation of Russia's economy towards China and the creation of economic alliances amongst developing countries 'against' developed countries seem inevitable. The latter is relevant due to the lack of precedent when it comes to the sanctions against Russia.

The last point has only partly to do with "economic futurology". It determines the viability of the Russian economy, allowing the formation of a long-term growth trend for equities. The other factors are tactical, allowing the portfolio to be modeled depending on the development of current events.

The League of Arab States (LAS) maintains neutrality in the Russia-Ukraine conflict. The LAS includes 22 states, including Qatar, the UAE and Saudi Arabia. Traditionally, Oman has adhered to neutrality. Beijing is clearly not supporting sanctions against Russia. At the same time, cooperation could reach a new level in the context of the creation of an alternative international financial system.

The gradual transformation of the "West vs Russia" confrontation into a "Mature Countries" vs "Developing Countries" form of world economies would significantly reduce the isolation and risks Russia’s economy would be exposed to on its own. In the developing world, the strong emphasis on ESG, the shift to 'green energy' by Western countries is seen as an attempt to reshape the institutional landscape of the global economy, all the while depriving developing countries of some of the profits and accelerate investments in technology that are currently held mainly by developed countries.

(i) The "export survives" portfolio

Given political turmoil, limited state capacities to support the economy, growing commodity export prices may not be enough to curb further devaluation of the Ruble. With all these factors in mind, an export-oriented portfolio is seen as the best option.

Export-oriented portfolio

Criteria for stocks selection: (i) export-oriented; (ii) significant share in global production, difficult to substitute;

Dividing the companies traded on the Russian stock market into groups, we identify export-oriented companies, with Group (A) comprising of companies that would be difficult to replace in global supply even in the medium term. We also include gold mining companies in this category, despite the fact that they are only quasi-export-oriented, given the Central Bank's "freeze" on foreign exchange reserves. Tighter regulation of the gold market could affect profitability, but it’s the lesser of the risks assosiated with russian stocks nowadays. The second group of companies (B) are heavily export-oriented but not dominant in the global context, subject to the risks of being replaced by other companies.

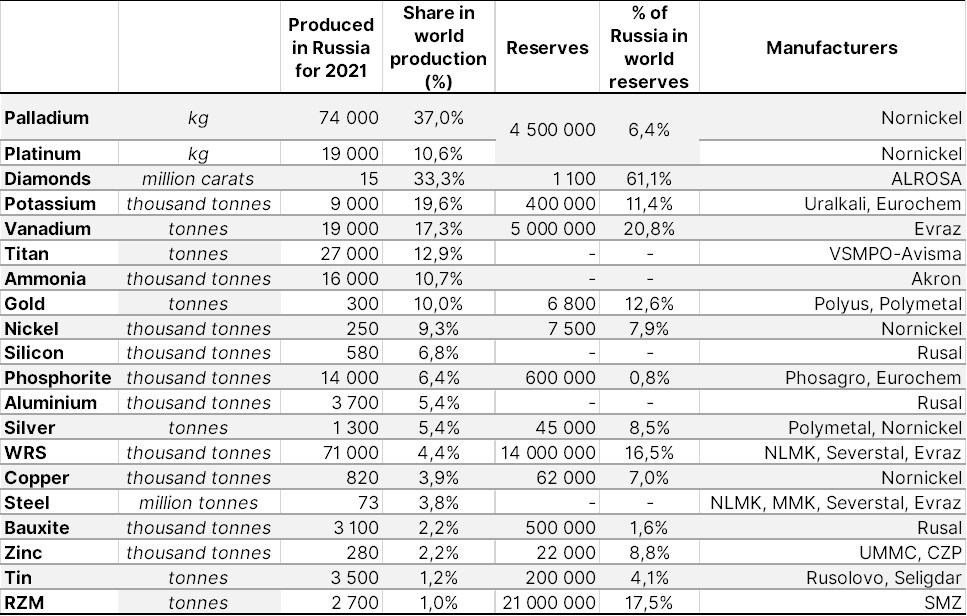

(A) Significant contributors to global supply

Export-oriented and responsible for significant share in global commodity production, as imposing sanctions on these companies would be painful for the Western World.

Aluminium. Rusal: Back on the 24th of February Bloomberg reported that the Biden administration will hold off on sanctions against Russian aluminum. Rusal accounts for about 5.4% of global aluminum production.

Nornickel accounts for over 40% of global palladium production, 11% of platinum production and 9% of global nickel production (about 22% of high-grade nickel).

Diamonds. Alrosa is the world's leading diamond miner (33% of global production).

Gazprom's share in European gas consumption is around 35%. As a result of higher prices, its financial result (in rubles) in 2022 will probably be even better than in 2021 (which implies a dividend of ₽48/share). In February Qatari officials declared that it would not be possible to replace Gazprom's supply in Europe soon. It’s worth mentioning that Russia is one of the few countries that supported Qatar during the economic and food blockade by Saudi Arabia a few years ago.

The suspended Nord Stream 2 project becomes secondary. At the same time, the significance of launching this project is decreasing for Gazprom as well, given the prospect of pumping through Ukrainian pipelines. The gas flows through the Ukrainian transit pipeline have been near full capacity since the start of hostilities in Ukraine. European buyers are booking more Gazprom pipeline capacity after gas prices in Europe soared.

The benchmark gas prices on ICE Futures set a new record on 2 March, exceeding $2200/kcm. The April futures price on the TTF hub in the Netherlands jumped 34% to $2260/kcm. Since then the rally accelerated, gas prices in Europe soared to $3700/kcm as early as March 7 and continue to rise.

Gold Western sanctions against the Central Bank and its self-imposed currency restrictions will not affect the ability to pay bills in roubles in the domestic market. Seizure of the Central Bank's foreign reserves will lead to higher demand for gold both in inside the country, including from individuals, and outside Russia, from other central banks in the emerging markets.

Cancelling a 20% VAT on precious metals on gold investments by individuals looks like an alternative to FX-buying and is described in these terms by the prime minister and the finance minister.

Russia accounts for a significant share of global commodity production

Source: ITI Capital, Bloomberg, US Geological Survey

(B) Export-oriented companies

This group primarily includes companies with a significant share of export revenues in operations, but with higher risks of being replaced by other suppliers. Revenues may fall, if not overnight, then gradually, due to lower sales and discounts for products from Russia to global prices.

The oil industry

This segment includes Russian oil companies, which account for 10% of global oil supplies. OPEC+ is still behind schedule in increasing supplies, but the process could accelerate with production growth in the Middle East. The region’s countries have so far taken a neutral stance on the crisis in Ukraine.

At the same time, a ban on imports of equipment could seriously affect the development of LNG projects and refining capacities.

Canada is the first Western country to impose a ban in oil imports from Russia. It was joined by the US and the UK. However, they are not the main consumers. China accounts for about a third of Russian oil exports.

Brent is rising strongly, above $130/bbl on March 7, while Urals has not been advancing and the discount between the grades has exceeded $20.

Buyers of Russian oil are facing payment and logistics challenges. Russia's Surgutneftegaz failed to award its spot tender for 880,000 tonnes of Urals oil loading from Russian ports in March as buyers shunned the volumes, according to media reports.

As for LNG, is the policymakers decide to divert LNG supplies to Europe from Asia, the latter would traditionally wage a price war, that is thought to also benefit Novatek.

However, in any case the country will lose export revenues due to lower sales.

Ferrous metals, fertilisers, wheat

Evraz, NLMK may face higher tariffs from the target markets. However, higher price for almost all products globally will act as a deterrent. To illustrate, two years ago, duties imposed on Phosagro products by the US were lifted soon after under pressure from, among others, the US agricultural lobby.

Russia’s trade and industry ministry has recommended the country’s fertiliser producers temporarily halt exports citing logistics problems, but the recommendation is not mandatory and may be lifted soon, as Russian farmers' needs for mineral fertilizers are now met. At the same time, disruptions in the fertilizers supply may result in crop failures and food shortages in Europe, Latin America and Asia, the ministry said.

We should not forget that Ukraine, like Russia, is an important player in the iron and steel and wheat markets. Lower production capacity in Ukraine will also affect global prices. ArcelorMittal Kryvyi Rih (AMKR) has idled operations following reducing them to a technical minimum.

Evraz's share of global vanadium production stands at around 16%.

Severstal has stopped exporting steel products to the EU following sanctions against Alexei Mordashov, its main owner. In 2021, 47% of Severstal's revenue came from exports, including 30% from exports to Europe.

IT

Belarus-based EPAM has long been an international company with an army of engineers working not only in Belarus and Ukraine. The company is integrated into the developed economies. Softline has no clients in developed countries, but holds strong consolidating positions in the IT market of developing countries, where Western vendors that need Softline's intermediary services have been active. If the current rouble exchange rate is used to assess the revenue structure, Russia's share would fall below the 50% typical for 2020-2021. The situation with Microsoft products should be further assessed, but looks manageable for the company.

However, it is worth noting that Western regulators can easily impose sanctions on any company, such as Aeroflot and VTB.

Selection of securities for the portfolio

We include securities from groups (A) and (B) in the portfolio. For investors willing to lower their risks, we may limit the portfolio to group (A). We provide a detailed description of the companies in this group in Appendix 1. We do not think current dividend payout forecasts are relevant now and we do not look at dividends as an important criterion a for stock selection.

On top of these equities, we picked Sberbank since it’s too big to fail and is loved by Russian investors. The latter may be the key factor since Russian private investors and Russian funds may be the main players and beneficiaries in the Russian stock market as soon as it reopens.

Possible composition of a local stocks portfolio

Possible composition of a GDR/ADR portfolio

*Exception for Rusal (in HKD)

(ii) Isolation portfolio

Criteria for the securities selection in this case could include: (i) relatively low exposure to currency fluctuations; (ii) a focus on the domestic market.

A market in its own juice

In this political context, it is risky to look at companies that are oriented only to the Russian economy. We are not inclined to look in detail at a portfolio composed just from such stocks as of today. However, "a ban on exports" and switching to an isolated "Iranian" model cannot be ruled out. The stock market rout would continue, but then it eventually stabilise and function the way it did over the past decades in Iran.

Stocks with a particular focus on the Russian domestic market could be of interest after the resolution of the conflict with two polar results:

1) normalisation of the exchange rate situation (releasing the Central Bank’s assets), a ceasefire and lifting of some sanctions. So far, this scenario does not look realistic.

2) an embargo on exports from Russia, further massive decline of the rouble and a stock market collapse.

Telecoms (dollar capex can be delayed, eventually switching to Chinese vendors of Huawei) and food retailers (70% of sales are Russian products) are seen as a strong hedge, but the risk of further rouble declines makes them unattractive.

The EU will cut seven Russian banks, including VTB, from SWIFT. Sberbank has evaded the ban. It is worth noting that the Central Bank will always support the banks in a challenging situation.

It would make sense to take a closer look at companies in the agricultural and energy sectors. A surplus of energy resources on the domestic market could leave domestic gas and fuel oil prices under pressure.

For such a portfolio, the dividend payout could be an important stock selection criterion, given the likely limited liquidity in the stocks.

Appendix

A description of the export-oriented companies with the strongest hedge.

Rusal

Rusal is one of the world's largest aluminium producers and the largest producer of aluminium with a low carbon footprint. The company's main products are primary aluminium, aluminium alloys, foil and alumina. The company's assets include the entire range of facilities involved in the end product chain, from mining facilities to aluminium smelters and foil mills.

Stock growth drivers:

- Biden's administration held back from imposing sanctions against aluminium from Russia.

- Rusal's positive 4Q21 operating results, released on 9 February, on the back of exceptionally favourable pricing environment in the aluminium market, which will support a strong 2H21 and 1H22 financial performance.

- Aluminium has been trading at historic highs since February. Its prices are not likely to be driven by short-term factors (COVID outbreak in China's Baise) but rather by a sustained medium-term trend. Soaring electricity prices (aluminium producer's most important cost item) together with rising energy costs and decommissioning of "environmentally dirty" capacities reduce the chances of a rapid trend reversal. Moreover, the energy asset could come under long-term pressure due to the global ESG agenda. Meanwhile, a strong global economic recovery with a focus on green technologies is generating increased demand for aluminium. The aluminium deficit seen in 2H21 is likely to become a trend in 2022 as well. Against this background, sanctions on Rusal would infict pain for the whole market.

- Rusal's shareholders, Sual Partners (25.7%), are likely to review dividend issues at the end of the 2021.

- Rusal's major shareholders embraced spinning off the higher-carbon business from the aluminium company announced by Rusal in May 2021. The spin-off was blocked by Sual Partners, which owns 25.72% of Rusal. En+ expects that the spin-off can be completed in 2H21, allowing Rusal to meet EU environmental requirements.

Alrosa

Alrosa is the world's largest diamond producer (with a 26% share) and has the world's largest diamond ore reserves. Diamonds’ prices continue to rise.

Stock growth drivers:

- Sanctions relating to fundraising are not likely to affect Alrosa's capital expenditure funding.

- In January, diamond prices rose by an average of 8-10% m/m in US dollar terms. Moreover, by the end of 2021, global diamond prices have jumped by 30% y/y.

- The diamond market has seen a strong recovery in 2021, with mining companies' inventories falling to historic lows. Market majors Alrosa and De Beers may raise prices further against this background.

- Alrosa may continue to pay high dividends in 2H21 on the back of strong financial results. For example, in 1H21 the dividend amounted to ₽8.79 (a 8.8% dividend yield).

Nornickel

Nornickel is the world's largest producer of palladium (37%) and nickel (9.3%) and one of the largest producers of platinum (9.3%) and copper. The company also mines, refines and markets silver, gold, cobalt and other metals. Nornickel is the world's largest producer of high grade nickel (22%), which is used in the production of batteries for electric vehicles. The company is likely to benefit from the development of this industry.

Stock growth drivers:

- The prices of the company's main metals rose to multi-year highs. The price of palladium has risen by a third since the beginning of 2022, nickel by a quarter and growth continues.

- Nornickel is the world's largest producer of high grade nickel, which is used in the production of batteries for electric cars. The company is expected to benefit from the development of this industry. Sales of electric cars and hybrids are expected to grow significantly globally (sales are projected to reach 25 mln units by 2025).

- The company consistently pays high dividends. In accordance with the Shareholders' Agreement that expires at the end of 2022, Nornickel spends at least 60% of the annual EBITDA on dividends. Therefore, taking into account Nornickel's $3.2 bln paid for 9M21, the BoD might recommend spending at least $3.1 bln (or ₽1511/share) on the final dividends for 2021, but under the shareholders' agreement, the final dividend for the year may not be lower than interim (₽1523.17/share for 9M21). Consequently, we expect that the final dividend for 2021, Nornickel may pay around ₽1530/share.

- The company’s unique position in the nickel, palladium and platinum market reduces the producer's exposure to short-term fluctuations.

- A hedge stock due to the price movements of platinum, gold.

Polymetal

One of the leading precious metals miners in Russia and Kazakhstan. One of the top 10 gold producers in the world. Polymetal's shares are traded on the LSE, Moscow Exchange and the Astana International Exchange (Kazakhstan). The company owns nine operating gold and silver deposits, as well as a high-quality portfolio of development projects.

Stock growth drivers:

- Polymetal is not directly affected by sanctions now. Moreover, Polymetal is not linked to the Russian government and has no shareholders with large stakes, so it may be spared from the penalties.

- The sanctions against the Central Bank will not affect the ability to pay bills because transactions in the domestic market are made in roubles.

- The company presented IFRS results for 2021 on March 2 in line with expectations: revenues +1% YoY, but net income fell by 15% YoY due to higher costs. The board proposes to pay a final dividend of $0.52/share for 2021, although the payment may be deferred or cancelled.

- Despite the current geopolitical situation, the top management maintained the production forecast for 2022: +1.4% y/y, forecast for 2023 is withdrawn.

- Polymetal previously reported a 7% increase in ore reserves at its mines to 30 million ounces of gold equivalent.

- Polymetal currently generates 40% of its revenues in foreign currency and about 43% of its EBITDA comes from Kazakhstan.

- In early March 2022 BlackRock increased its stake in Polymetal from 5.07% to 10.08%.

Polyus

Polyus is the world's largest gold producer by reserves and the fourth largest by production, and the lowest-cost producer among major global producers. Polyus is Russia's largest gold mining company with full-cycle production - from exploration and mining to processing and sales of the final product.

The company's main production facilities are located in Siberia and the Far East: in the Krasnoyarsk Region, Irkutsk and Magadan Regions, and the Republic of Sakha (Yakutia).

Stock growth drivers:

- The US sanctions imposed on Suleiman Kerimov date back to April 2018 and do not apply to Polyus. Since 2014, his son, Said Kerimov, has been the sole beneficial owner of a controlling stake in Polyus.

- The escalating geopolitical conflict has spurred demand for the precious metal.

- Polus' 2021 net profit rose 38% YoY to $2.278 bln; adjusted EBITDA declined 5% YoY to $3.518 bln.

- In recent years, exports of gold mined in Russia have declined, primarily due to bullion purchases by the Bank of Russia.

- The geopolitical turbulence will contribute to higher demand for gold in the domestic market, including from individuals.

Gazprom

The largest gas producer in the world. Gas prices in Europe jumped in 4Q21 and have relatively stabilised at high levels in early 2022. A decline in Gazprom's share price amid political turbulence has increased the dividend yield for 2021.

Stock growth drivers:

- Europe will probably not be able to shun Russian gas supplies sooner than 2030, even under the most ambitious substitution plans.

- The price of Russian gas exports to non-CIS countries in 4Q21 exceeded $580/kcm, according to the Federal Customs Service. To illustrate, the average price for 3Q21 was $448/kcm and $313/kcm, according to Gazprom. In March 2022, the price on the European spot market was super-high at more than $3,700/kcm.

- Rising gas prices will have a positive effect on the 4Q21 financial results.

- The dividend for 2021 could reach ₽48/share.

- Management has not ruled out buying back shares in the market.

- Against the backdrop of high gas prices in 2022, Gazprom's export volumes to non-CIS countries fell in January 2022: -41.3% YoY, to 11.4 bcm. The situation has improved since February.

- As for squeezing Russian gas out of the European market, the Qatari energy minister said that 30-40% of Europe's gas supply comes from Russia, and it will be 'almost impossible' to quickly replace these exports to Europe by LNG shipments.

- Gas is 'green energy', and Gazprom stands out against other oil companies in terms of ESG thanks to its hydrogen energy projects.

- The European Commission plans to allow new investments in gas-fired TPPs approved until 2030-2035. The current European crisis therefore increases the chances that Gazprom will remain a key supplier to Europe for decades to come.

- Gradual geographical diversification of supplies, start of development of the Power of Siberia-2 project (Mongolia, China).

Phosagro

A leader in the global production of high-quality phosphate raw materials and in European production of phosphate-based fertilizers.

The company produces fertilizers, high-grade phosphate rock - apatite concentrate, feed phosphates and ammonia. It manages a full cycle of operations, from phosphate rock mining and fertilizer production to the production of finished products.

Stock growth drivers:

- Although sanctions have not yet affected Phosagro's operations, the company has already faced was squeezed from the US market in July 2020 and has managed to divert supplies to other markets.

- A favourable market environment for fertilizer producers. In 2021 and 2022, the fertilizer market is supported by low stocks of key fertilizer importers and high agricultural commodity prices.

- The company's production improved, revenue for 2021 grew by 66% YoY to ₽420.5bn; EBITDA: +124% YoY to ₽191.8bn; net profit: +7.6 times YoY to ₽129.7bn; FCF: +83% YoY to ₽77.9bn. The company's output was up 3% YoY.

- Greening in agriculture and food production has become a powerful global trend in recent years. Phosagro fertilizers are environmentally friendly and meet the most stringent environmental criteria.

Phosagro offers a high dividend yield compared to international peers. The company's BOD has recommended the final dividend for 2021 in the amount of ₽390/share, or (₽130/GDR) from undistributed net profit at end-2021. The payment will total ₽50.5 bln. The recommendation was way above analyst expectations, ₽172.6 to ₽274/share.