Overview. On March 21, the OFZ market reopened after nearly a three-week break. At first Russia's government bonds traded in a discrete mode from 10:00 a.m. till 11:00 a.m. Contrary to expectations, the trading resulted on a mildly positive note.

Prices of the “classic” bonds fell in line with projections, returning to a balance in the wake of the recent changes in the monetary policy. The RGBI state bond price index hit the lowest since December 2014, falling to 98.21 pt. Sales were low, with “bids” (purchase orders) dominating an order book, including, apparently, put by the Bank of Russia.

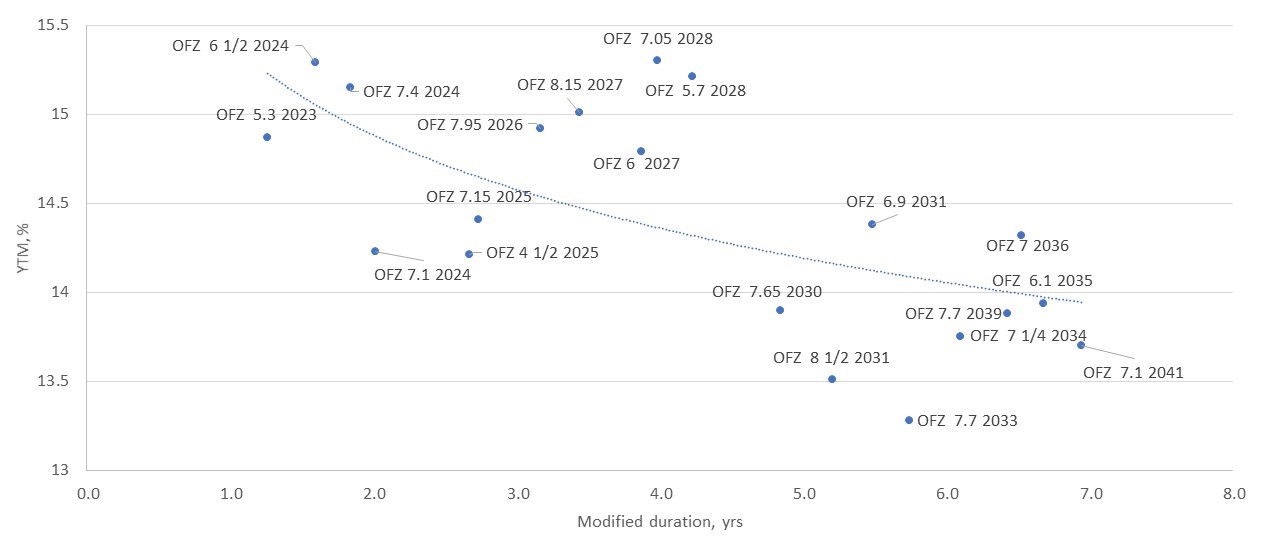

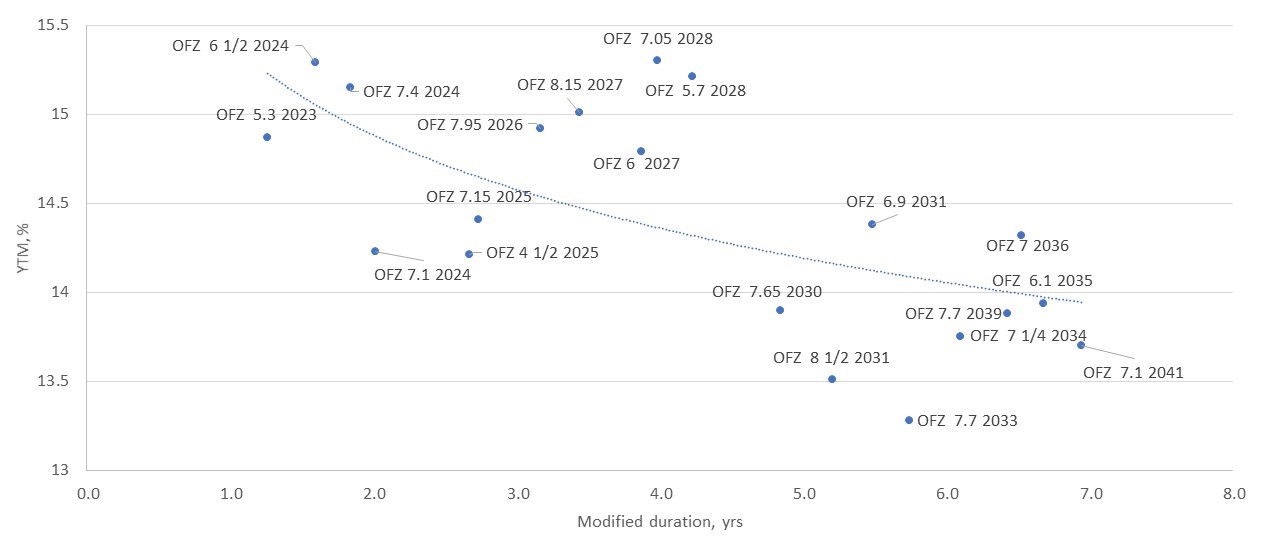

As a result, the curve on the short end came very close to the key rate level, 19-20%, the belly segment reached 16-18%, and the yield on the longest securities – 14-15%. Later on, it turned out that these yields were the bottom of intraday trading, as securities pared some of the early losses in the main trading (RGBI climbed back to 102.45 bps), while OFZs with floating coupons even managed to appreciate. Yield of the "classic" bonds grew to 16-13% p.a., which is way lower than the current key rate. Trading volume was less than ₽14 bln, which is almost half of the pre-crisis average.

Key takeaway We may outline the following factors that shaped the “seller's market” and averted massive sell-offs anticipated by some investors:

— First of all, it is the promised support from the Bank of Russia. During a press conference on March 18, the governor said the bank would begin buying the entire range of OFZ bonds hoping to maintain price stability. Later on, the CBR will gradually divest its OFZ holdings to offset the impact of these purchases on the monetary policy. The volume of planned purchases was not disclosed, except that it will be big enough to prevent risks to financial stability.

At the end of the first trading day, the Central Bank put purchase orders for a number of liquid lots totalling ₽3 trln at prices close to the minimum possible. Despite the fact that there were almost no real transactions at such prices (and one should hardly expect many going forward), the “stable bid” factor provided psychological support to the market;

— a ban on sales of OFZs by non-residents (except for closing margin positions), who predominantly hold medium- and long-dated securities worth just under ₽3 trln;

— a ban on short selling.

We are certainly pleased to state that the rouble-denominated government bond market has managed to avoid the most pessimistic implications after a long period of uncertainty, and a new benchmark has emerged in the debt market. However, given that the entire OFZ curve is currently below the key rate and the geopolitical crisis is still far from being resolved, we will refrain from recommending massive, long positions in OFZs for the time being.

Short “classic” bonds could become an alternative to a bank deposit for conservative investors, seeking to lock in a double-digit yield for a longer period than three to six months. However, given that year-end inflation is likely to run above 20%, the real rate of return on such investments will be negative. The rationale for buying riskier long OFZs in anticipation of an imminent reversal of the monetary cycle is controversial yet (at least not until the foreign capital flight issue becomes clearer). Moreover, at this point, it is difficult for us to say definitively that the key rate has reached its peak.

OFZ yield curve

Source: ITI Capital, Bloomberg

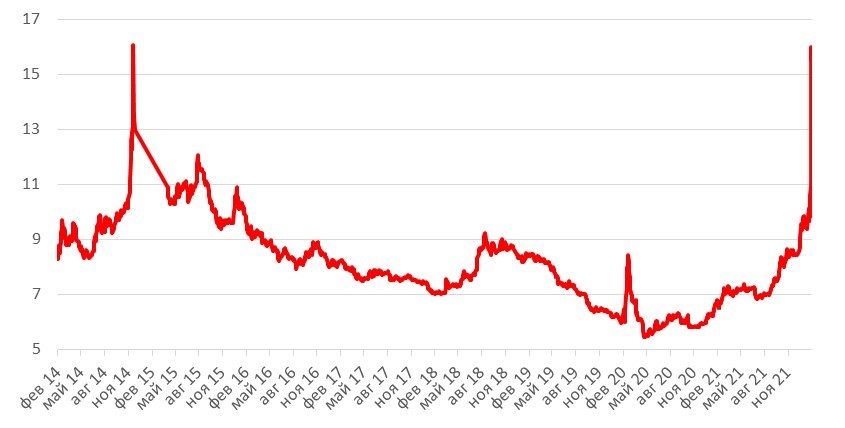

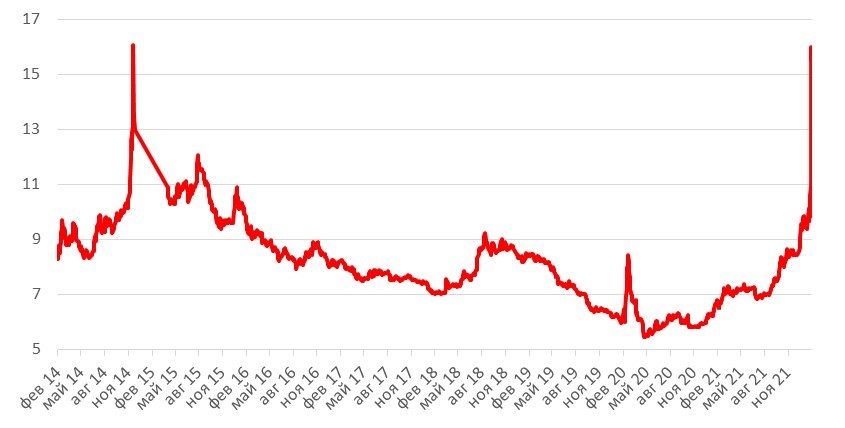

OFZ 10Y yield, %

Source: Bloomberg, ITI Capital