External debt of Russian issuers: Navigating a sanctions minefield

On 17 March, Russia’s Finance Ministry reported payment of $117 mn in interest on two dollar-denominated sovereign Eurobonds. This was an important indication that Russia is still in a position to service its hard-currency debt, despite the harsh sanctions and negative expectations from the market and rating agencies, at least until the expiration of a corresponding licence from the US Treasury on 25 May. Further on 22 March, Finance Ministry confirmed another sovereign coupon payment, for $66 mn. Media reports that the funds have been reaching bondholders’ accounts have yet to be verified, with domestic holders of securities still reportedly unable to access the funds through the local depository.

The collapse in prices for Russian sovereign debt reflected the most dramatic scenarios, including the borrower’s potential refusal to pay and low recovery values in case of a restructuring. The threat of outright default now seems to have declined but risks for investors remain high including as a result of enhanced compliance procedures at all interim stages of payments processing which could lead to delays or even suspension of transfers between depositories, as currently is the case with corporate FX debt payments to Russia-based investors.

For some Russian corporate borrowers, a freeze of most of the government's liquid reserves and tight capital restrictions hamper the task of meeting their external debt obligations on original terms (which in worst-case scenarios may lead to defaults and debt restructuring). However, most major exporters can still be seen as safe havens, thanks to their holdings of foreign currency assets outside Russia and the ability to generate sizeable export revenues sufficient for continuation of servicing FX debt, even upon mandatory sale of 80% of their hard currency proceeds.

In our view, issuers with sufficiently large external assets and foreign currency revenues to cover their primary technological needs and payments on external debt will seek to avoid defaults. As for the ability of Russia’s companies and whole sectors to continue servicing external debt, this will depend on their specific circumstances, including preservation of access to export markets, the impact of sanctions imposed by Western countries against Russian entities and individuals from among their controlling shareholders, and the situation with trading counterparties.

We expect that in the absence of a sharp escalation of the conflict and assuming a truce is agreed over the next several weeks, leading exporters of hydrocarbons (Gazprom, Lukoil), base metals (Norilsk Nickel) and ferrous metals (NLMK) are likely to avoid defaults on external debt. However, a prolonged conflict would sharply increase the risk of a trade embargo, further barriers to foreign exchange inflows and restrictions on the operations of many Russian borrowers.

Russian sovereign debt payments in foreign currency, March-June 2022

Bond details include currency of issue, coupon amount and the year of maturity.

Source: Finance Ministry of Russia, Bloomberg

Russia makes coupon payments, investors look for confirmation

The armed conflict in Ukraine has brought on Russia unprecedented sanctions against state-owned financial institutions, severe capital controls, downgrades of its sovereign credit ratings to near-default levels and steep falls in prices for its FX debt.

The decision by Western governments to freeze the bulk of the Bank of Russia's foreign exchange reserves (of approximately $300 bn, according to Finance Minister Siluanov) overnight transformed the Russian government from a reliable investment-grade borrower into a debt market pariah from the category of states like Iran or Venezuela. While Russia's external debt stock remains very low (about $40 bn, with only about half of it held by non-residents), the lack of access to foreign reserves (except for assets in China’s currency and physical gold), a total loss of access to Western capital markets, the steady tightening of restrictions on Russian exports to the West and a de-facto boycott of Russian commodities by some market participants have resulted in extreme FX cash-flow challenges, unlikely to be fully resolved in the near term even with the help of exorbitant commodity prices. Furthermore, since the start of the conflict there have been some concerns about the willingness of the Russian government to repay non-resident investors in “unfriendly” jurisdictions (i.e. pretty much anywhere in the West) in view of the decisions of their governments to freeze holdings of Russia’s sovereign assets.

Nevertheless, Russia made timely steps in order to make coupons payments on the dollar-denominated bonds falling due on 16 March (of $117.2 mn in total). Early on 17 March, Russia’s Finance Ministry reported that its payment instruction in this amount was executed. JP Morgan Chase, the correspondent bank Russia used to channel the payment, processed the funds, according to a Bloomberg report. The paying agent (Citibank, N.A., London Branch) subsequently - after a delay, reportedly in order to clarify the status of the payment with US regulators - distributed the funds to depositories. This was an important indication that Russia is still in a position to service its hard-currency debt, despite the harsh sanctions and negative expectations from the market and rating agencies. Further on 22 March, the Finance Ministry confirmed another sovereign coupon payment, for $66mn. Media reports that the funds have been reaching bondholders’ accounts have yet to be confirmed.

Russia had earlier warned investors that it would have to make payments to bondholders in Western jurisdictions in roubles in the event it is unable to make payments in US dollars. The Licence No 9A issued by the US Treasury's Office of Foreign Assets Control (OFAC) authorises U.S. persons to engage in servicing Russian sovereign debt (at least through 25 May 2022 when the licence expires). However, the execution of payment orders by an agent bank from the frozen foreign currency reserves in dollars is prohibited without additional approval from OFAC, and a payment in any other currency (including roubles or even renminbi) would be considered a technical default. All major rating agencies have previously said that a default on Russian sovereign debt is imminent or extremely likely. In the end, OFAC approved the use of Russia’s sovereign funds held by US financial institutions for the purposes of scheduled coupon payments.

This was a critically important development for the prospects of timely redemption of $2.1 bn falling due on 4 April 2022 (Russia-2022). As of now, we expect Russia to retain access to sufficient FX liquidity to make all foreign currency payments on sovereign debt at least until the OFAC license expires on 25 May 2022. Russia’s ability to service its FX debt without access to frozen funds will depend on its ability to escape imposition of a comprehensive trade embargo by Western powers and access to the remaining part of liquid reserves (including in gold).

It is unclear at this stage whether this OFAC licence gets extended, but it will almost certainly be a political decision rather than merely a technical step by US Treasury officials. US Secretary of State Blinken recently said that US sanctions against Russia could be lifted following Russia’s “irreversible” withdrawal from Ukraine and provision of security guarantees.

The collapse in prices for Russian sovereign debt reflected the most dramatic scenarios, including the borrower’s potential refusal to pay and low recovery values in case of a restructuring. The threat of outright default now seems to have declined but risks for investors remain high, including as a result of enhanced compliance procedures at all interim stages of payments processing which could lead to delays or even suspension of transfers between depositories, as currently is the case with corporate FX debt payments to Russia-based investors.

Currently, prices for Russia’s sovereign Eurobonds still imply a high risk of default, even after a rebound in recent trading sessions. These concerns primarily reflect the perception of Russia’s extremely limited access to its stock of external reserves, even though their notional amount (adjusted for the share of “frozen” assets) remains much higher than the total stock of sovereign external debt (around $40 bn).

Should the military conflict in Ukraine prove lasting, risks for holders of the Russian sovereign bonds would climb, in view of the threat of further sanctions and a growing range of individual and corporate claims that Russian government could face (potentially including from Western corporate shareholders whose assets in Russia might be nationalised). Prospects of such claims would largely depend on details of legislation and its enforcement practices in specific jurisdictions, but their existence under scenarios of a debt restructuring would delay payments to Eurobond holders (and diminish the stock of assets that can be used for repayment of such claims). Even with extremely high risks facing Russian sovereign debt holders, timing of the cessation of the conflict will be critical: if it gets prolonged, let alone escalates, prospects of Russia's balance of payments will deteriorate and the amount of claims against the Russian state will rise.

A lasting conflict would significantly increase the risk of a comprehensive trade embargo against Russia by the European Union (Russia's largest trading partner). Under such a scenario, even a further spike in fuel and energy prices would not be enough for Russia’s foreign trade surplus to significantly exceed total external debt payments by all Russian entities (including short-term debt). In this situation, even with a drop in outflows on services and income, the balance of payments surplus would fall sharply, undermining both the build-up of reserves and a recovery in sovereign Eurobond prices.

Leading exporters retain their creditworthiness, for now

At end-2021, the total outstanding amount of Russian corporate Eurobonds was close to $100 bn, of which just over $20 bn was held by foreign investors. For many corporate borrowers, a freeze of most of the government's liquid reserves and tight capital restrictions hamper the task of meeting their external debt obligations on original terms (which in worst-case scenarios may lead to defaults and debt restructuring). However, most major exporters can still be seen as safe havens, thanks to their holdings of foreign currency assets outside Russia and the ability to generate sizeable export revenues sufficient for continuation of servicing FX debt, even upon mandatory sale of 80% of their hard currency proceeds.

Earlier this month, the country's two largest energy companies (Rosneft and Gazprom) made sizeable repayments on their FX debt, totalling $2 bn and $1.3 bn respectively, despite the government’s decree allowing Russia’s entities to repay foreign creditors from “unfriendly’ jurisdictions in roubles. One of the reasons these payments were made in dollars may have been their initialisation before the government decree took effect. A more plausible explanation is that major corporate borrowers in the energy sector still retain access to certain foreign currency savings and are willing to use them to avoid early delinquencies and to prove themselves as reliable borrowers. This approach arguably reflects their expectations that the conflict in Ukraine may be coming to an end soon and anticipation that at least some Western sanctions, and Russian countermeasures, will be subsequently eased.

For now, we can assume that those Russian exporters that have significate foreign assets and generate sufficient hard-currency revenue to cover their primary technological needs and make payments on external debt, will seek to avoid default. For companies under state control, such decisions in future may get complicated by the Russian government’s decisions. We assume that maintaining solvency of major exporters, especially in strategic sectors, as well as averting the risk of seizing their assets or products, will remain to be in the best interest of the Russian state.

As for the ability of Russia’s companies and whole sectors to continue servicing external debt, this will depend on their specific circumstances, including preservation of access to export markets, the impact of sanctions imposed by Western countries against Russian entities and individuals from among their controlling shareholders, and the situation with trading counterparties.

We expect that in absence of a sharp escalation of the military conflict and with a truce agreed in the coming weeks, leading exporters of oil and gas (Gazprom, Lukoil), base metals (Norilsk Nickel), ferrous metals (NLMK), precious stones (Alrosa), fertilisers (Uralkali, Phosagro) are likely to avoid defaults on external debt. However, prolongation of the conflict would dramatically increase the risk of a trade embargo and other biting sanctions.

A number of leading Russian exporters have not been able to execute coupon payments on their Eurobonds over the past several days, due to restrictions by Western banks in view of the sanctions imposed by EU authorities on shareholders of such companies, including Severstal and Evraz. The latter borrower’s payment eventually came through on 22 March.

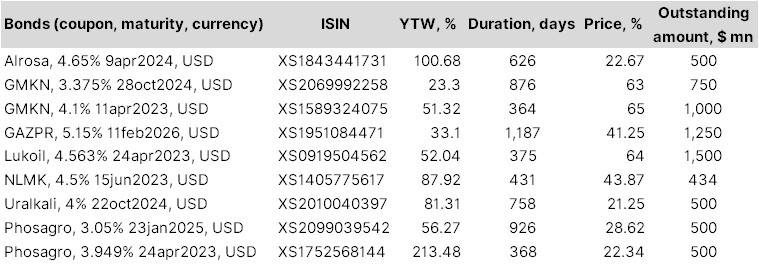

Below we provide a list of Eurobonds of leading Russian exporters with relatively short duration that look appealing from the risk/return perspective, in the wake of large-scale price declines following the recent events. For certain categories of investors, these bonds may represent an attractive investment opportunity. However, limitations on accessing these securities (and in some instances even coupon payments made by their issuers) are an important drawback, including to prospects of a near-term recovery in prices.

A selection of attractively priced Eurobond issues by Russian exporters

Source: Bloomberg, ITI Capital

Disclaimer

This report is issued for the information of professional investors and institutions only. The report is not intended to provide the basis for any evaluation of an investment decision. Your attention is drawn to the date of issue of the report and of the opinions expressed therein. Any opinions are subject to change without notice. The report is based on information obtained from sources believed to be reliable, which have not been independently verified and are not guaranteed as being accurate, complete or up-to-date. The report is not and should not be construed as or forming a part of any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any investments, nor should it or any part of it form the basis of, or be relied upon in any connection with any contract or commitment whatsoever.

ITI Capital Limited is, unless otherwise stated, the owner of copyright over the report. Except for personal use only (including saving to an individual storage medium and printing such extracts from the report as are necessary for such use) or as permitted by the Copyright Designs and Patents Act 1988, no part of the report may be published, distributed, extracted, reutilised, or reproduced in any material form (including photocopying or storing it in any medium by electronic means and whether or not transiently or incidentally to some other use of this publication). ITI Capital Limited reserves the right at any time at its discretion to withdraw or modify the licenses set out above. The above permissions do not apply to any content supplied by third parties. For permitted use of third party content apply to the relevant content owner. The securities and other financial instruments (and any related investments) and investment services described in the report may not be suitable for all people. Before entering into an agreement in respect of any such investments, you should consult your own investment advisers as to their suitability for you and should understand that statements regarding future prospects may not be realised.

This document may contain statements about expected or anticipated future events and financial results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, new legislation and regulatory actions, competitive and general economic factors and conditions and the occurrence of unexpected events.

The report is made available without responsibility on the part of ITI Capital Limited who neither assumes nor accepts any responsibility or liability (including for negligence) in relation thereto. No action should be taken or omitted to be taken in reliance upon information, data or materials in the Research. Advice from a suitably qualified professional should always be sought in relation to any particular matter or circumstances. Nothing in this Dis-claimer excludes or restricts any duty or liability to a customer which ITI Capital Ltd has under the Financial Services & Markets Act 2000, ITI under the Rules of the FCA, or to the extent liability cannot be excluded or restricted under applicable law, rule or regulation.