The Russian equity market capitalisation has fallen by more than $570 bln since this year, down 85% from pre-crisis levels, the Russian (offshore) equity market is frozen and lost its value. The expected net profit of most Russian companies in 2021 is more than 10 times their capitalisation (the world average is 40-50%). The country is on the verge of its first-ever default on hard currency sovereign bonds pushing Russia to CCC- status from BBB. Total payments in foreign currency are estimated at $45 bln over the next 18 months. The lion share of the CBR’s reserves (75%) are blocked and there are sanctions imposed on exports, logistics and transport as part of global response to Russia’s invasion of Ukraine which resulted in a massive spike in commodities, inflation and supply bottlenecks for all major economies.

But there are two pieces of news for investors in the Russian equity and bond market - bad news and good news.

Let's traditionally start with the bad news - as soon as the Russian market reopens, non-residents will actively sell/close positions in equity index funds, in particular in MSCI Russia, FTSE Russell and others (which have already announced exclusion of Russian equities from global indices from 7 March 2022). The outflow of funds will exceed $40 bln, according to our estimates. The outflow from the bond market is anticipated to reach $33 bln, due to exclusion of equities from such benchmarks as JPM EMBI, although Russia’s weight in the index does not exceed 3%.

However according to the Russian Presidential decree its prohibited for non-residents to sell and buy local equities and other securities via local brokers inside Russia.

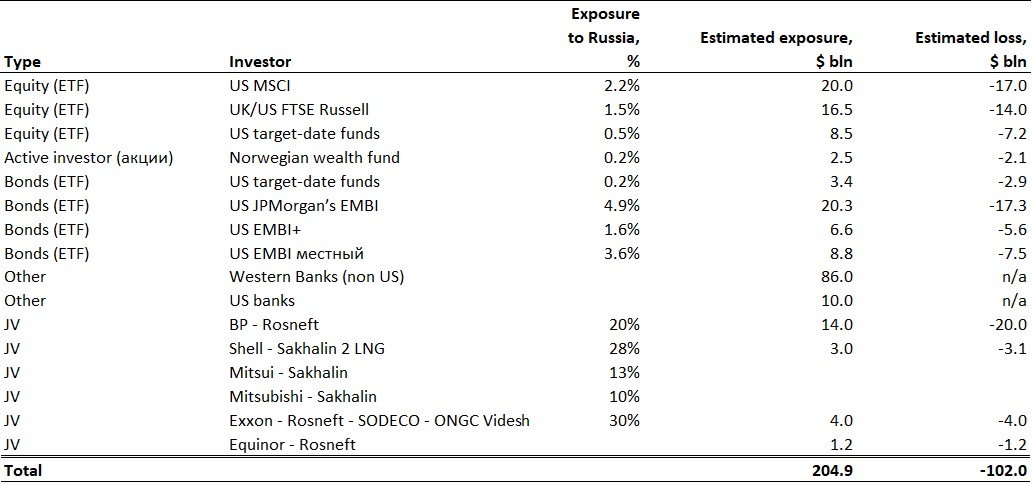

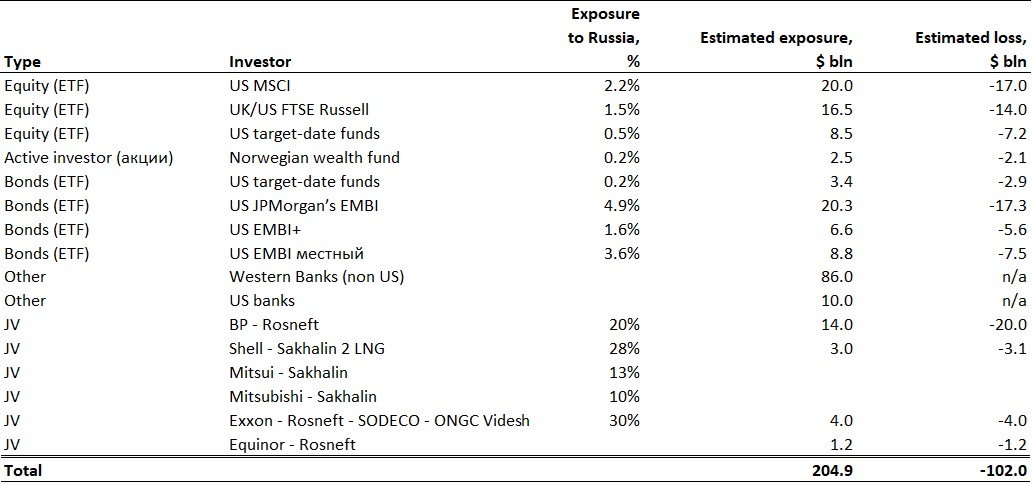

Non-residents exposure to Russia before revaluation made by international funds, banks and JVs exceeds $200 bln, while potential losses exceed $100 bln.

Early losses and the market rout will be driven by liquidation of "long positions" in equities and bonds, which will wipe off 30-40% of the Russian market capitalisation.

The good news is that after the foreigner investors leave the local market (if they are allowed), and they have already disposed of Russian depositary receipts, VEB will spend ₽1 trln to buy shares and bonds of Russian companies, which will be enough to revalue the market. One can benefit from this "buying wave" by entering the market and buying securities at very attractive prices, and get a record return on investments in a short period of time. All major risks and the toughest sanctions will already be priced in.

After that, we expect the market to get support from de-escalation and the toughest sanctions removal. Investors will therefore be able to "ride the price tsunami" in a bull market. ITI Capital is ready to help you benefit from this challenging, but possibly the most profitable buying opportunity for local investors in the history of the Russian stock market.