Preview of the CBR policy meeting: Steady rates ascent to continue

Our baseline forecast: 25-bps key rate hikes in October and December

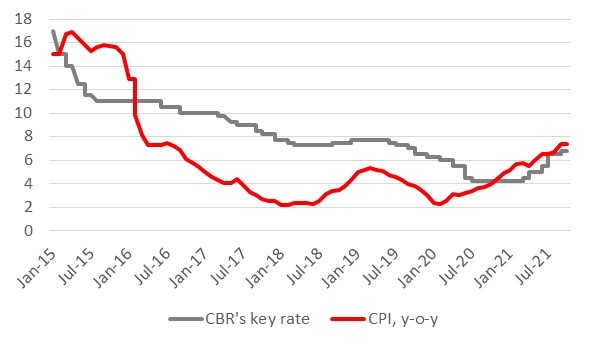

On 22 October, the Bank of Russia will hold its final core meeting of the year and will announce its key rate decision. It will also update the medium-term macroeconomic outlook, which is especially important in light of the sharply increased economic uncertainty. Every single CBR decision since the spring of this year resulted in 25-100-bps hikes reflecting further inflation increases. Almost at every such meeting Bank of Russia had to shift to a later date its expectations for the return of inflation to the target resulting in significant adjustments to the macroeconomic forecast. At its latest meeting in September, the Central Bank did not ease its rhetoric, making it even more "hawkish" and signalling further rate hikes in the coming months.

Since then, the inflation picture has deteriorated considerably. For several weeks in a row, Rosstat recorded unusually strong spikes in consumer prices for this time of year (by between 0.22-0.29%per week), which brought the annual inflation rate to a new post-2016 peak of 7.63% as of 11 October. The government's updated macro forecast assumes year-end inflation at 7.4% and it is now hard to expect a significantly lower inflation projection from the Central Bank.

Statements by CBR officials ahead of this month’s “quiet period” stressed the regulator's commitment to previously set priorities and the willingness to actively use monetary policy instruments to curb inflation. In this context, it is for certain that the policy rate will be raised this week. Market participants fully share this assumption, with a majority expecting a sharper 50-bps hike.

Our baseline forecast assumes a more cautious (tactical) action, in the form of a 25-bps rate hike to 7.00% at the forthcoming meeting. This forecast takes into account recent clarifications by central bank officials about the importance of moving to fine-tuning of monetary policy in the current situation. Since it is rather difficult to accurately forecast the inflation peak now, sharp tightening moves appear too risky. Moreover, the latest spike in inflation was mostly driven by food prices (especially for vegetables) against the backdrop of an early onset of cold weather. At the same time, the much more important structural component - non-food inflation - is gradually slowing down.

According to the recent monthly bulletin published by the central bank, the effects of monetary policy changes are only beginning to translate into inflation expectations and have not yet had a significant impact on inflation. Therefore, it is reasonable to assume that the regulator will continue to raise the rate gradually in standard-size hikes, keeping hawkish guidance regarding its future moves. Such moves would provide space for future policy action and assessing effectiveness of the steps taken. Accordingly, we expect the central bank to raise the key rate by a further 25 bps to 7.25% at the December monetary policy meeting. It remains unclear whether this will be the peak in the current monetary policy cycle. The first meeting in 2022 is scheduled for as late as 11 February, and during this fairly long period a lot of developments from both domestic and global agenda may (or may not) materialise.

CPI year-on-year and key rate, %

Source: Bank of Russia, ITI Capital

Recent trends in the local debt market

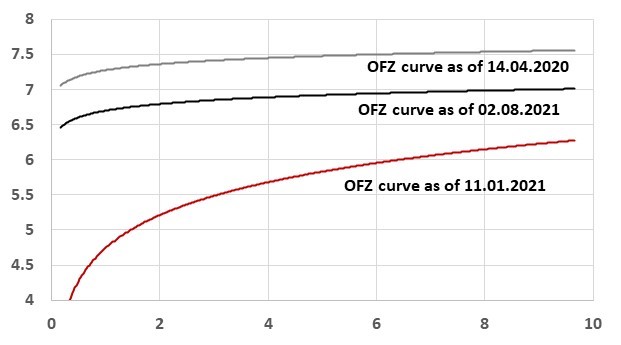

Since the beginning of August, the upward price trend in the OFZ market that started in July, has reversed again. Lower risk appetite globally due to expectations of earlier-than-expected scaling down of monetary policy stimulus in the US and rising US treasury yields has had a material impact on the market.

By the end of August, domestic factors also added to selling pressures - consumer prices in Russia unexpectedly returned to growth rather than displayed the traditional seasonal deflation pattern. Headline inflation began to pick up again and exceeded June highs earlier expected by the central bank to be the peak levels. The market began to adjust its projections for future trajectory of the key rate, and expectations of an imminent turnaround in Russia’s monetary policy began to wane.

OFZ prices continued to slide, with biggest yield increases naturally occurring in the shorter segment of the curve. The belly of the curve and longer maturities performed much better including thanks to support from non-resident investors who continued to increase positions in the rouble sovereign bonds after a massive hike of the key rate in July (in September the share of their holdings rose to 21%). In the second half of September, inflation spiked higher triggering a new wave of OFZ selloffs and further increases in yields in the short end of the sovereign curve. All in all, the under-10 year section of the curve has become practically flat, and the overall yield pick-up along the curve hit the lowest for the year.

OFZ curve

Source: MOEX, ITI Capital

OFZ: is there upside price potential in the near term?

OFZ yields have increased significantly over the past couple of months, reaching the peak pandemics levels of late March 2020, widespread lockdowns and a spike in volatility globally. Thus, short-term yields rose by 60-70 bps while medium-term and long-term bonds’ yields rose by around 50 bps.

It is reasonable to assume that some investors may find these prices to be attractive for beefing up long positions. We believe that time to buy government bonds has yet to come.

In late summer, we, like most market players, were expecting an early reversal of the monetary policy cycle, which, combined with slowing inflation and stability of the national currency, made "classic" OFZ of long- and medium-term duration an attractive investment target.

In reality, the situation turned out to be fundamentally different. Expectations of an inflation slowdown (not just in Russia, but also elsewhere) have not yet materialized. Conversely, in Russia we are witnessing another spike in consumer price inflation. At the same time, it is difficult to imagine that the recent explosive growth in commodity prices (particularly for gas, coal and oil) will not have some lagged inflationary impact on prices of a wide range of goods and services around the world. Consequently, Bank of Russia's plans to bring inflation back to the 4-4.5% range next year may require more time and possibly even further key rate increases (above the 7.25% we forecast for the end of 2021). Apart from other factors it is worth bearing in mind the remaining geopolitical risks, namely potential prohibition on participating in secondary market for Russian government debt for US investors.

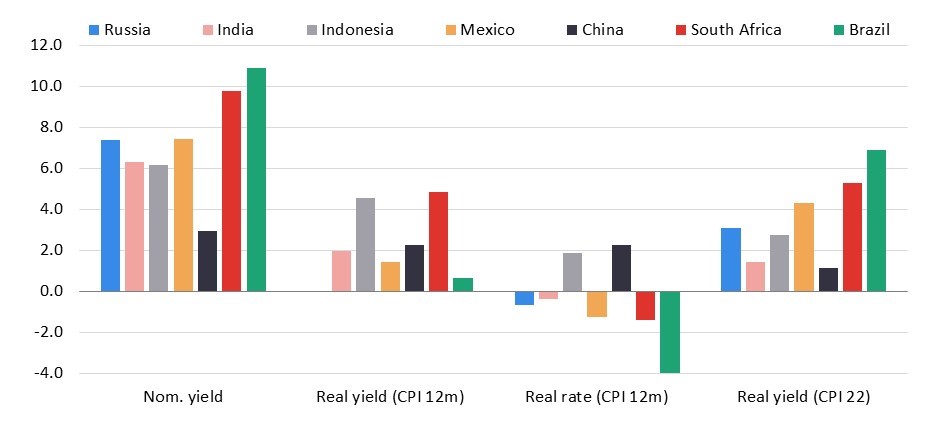

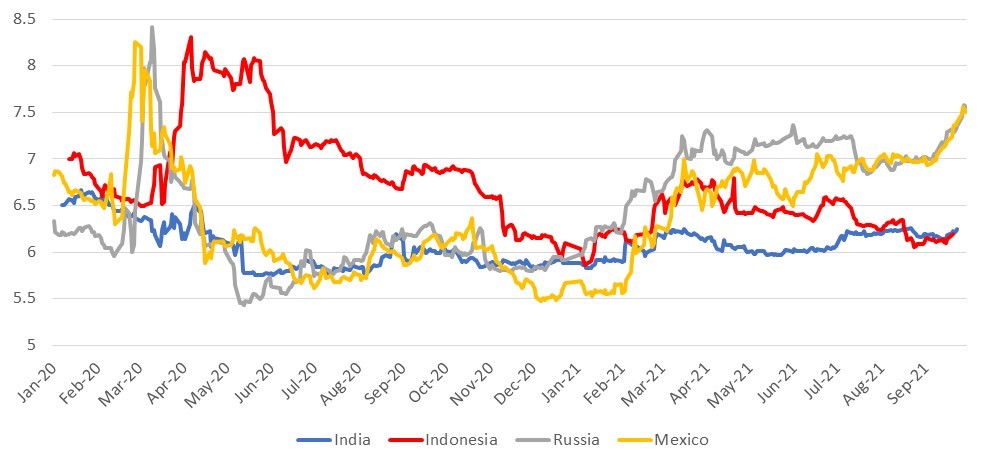

So far, despite the Central Bank’s steps to curb inflation and transition to a moderately tight monetary policy, the real policy rate in Russia (based on 12-months trailing inflation) has been negative since the beginning of 2021. Furthermore, the real yield of 10-year OFZs has also turned negative over the past month. In absolute terms, the yield of the 10-year issue has now become comparable with that on local government bonds in Mexico, although earlier in the year OFZ traded with a 30-60bps yield premium, due to sanctions risks.At the same time, the actual inflation rate in Mexico, even given the upward trend, stands at 6%. Local currency debt in India, Indonesia and especially South Africa looks even more attractive in terms of current monetary parameters, even though absolute yields in the former two markets are lower than in Russia. If we take into account inflation projections for the end of 2022 (based on IMF data as of October 2021), Russia's real yields screen higher than those of India and Indonesia, but lower than those of Mexico, South Africa and Brazil. The attractiveness of rouble-denominated government debt to non-residents is supported by the prospects of a stronger rouble (at least in the short term), provided that the CBR succeeds in regaining control over inflation fairly quickly.

Yields on 10-year government bonds, interest rates including trailing and projected inflation for end-2022, %

Source: Bloomberg, IMF, ITI Capital

Yields on 10Y local currency government bonds, %

Source: Bloomberg, ITI Capital

We therefore recommend adopting a cautious stance on Russian local currency government bonds at the moment. Investors should consider actively buying “classic” OFZs as soon as signs of a sustained slowdown in inflation appear and timing of the end of monetary policy normalisation gets clearer. At the moment, investors willing to take OFZ positions may consider securities with floating coupons, e.g. inflation linkers.