Addressing the risk of higher core rates: a defensive strategy does not preclude high-yielding bond exposure

Ahead of the key end-of-summer event for global financial markets — the Federal Reserve symposium in Jackson Hole — we have summed up our expectations for market trends in the coming months, alongside strategy ideas in the bond market.

In August, development of the global economy was generally disappointing. The accelerated spread of the Delta strain of Covid-19 in the US and Asia has led to slower recovery in demand and manufacturing activity. US GDP growth in the 3rd quarter will be significantly lower than its level recorded in Q2 (6.6% QoQ). Notably, a slowdown in global growth is likely to be accompanied by a decline in the inflow of monetary liquidity into the US economy, in view of the forthcoming reduction in asset purchases by the US Fed (tapering).

The expectations that Fed's leadership will continue to be cautious in their actions and market communications have led to an increase in risk appetite in recent days, a sharp rise in commodity prices and, ultimately, higher rates on US and Eurozone government bonds. As a result of the approaching start of tapering, we expect the 10-year rates in the US to rise to the levels seen in early summer (1.6%) by year-end and pick up further in Q1 2022.

On these assumptions, a defensive strategy in bond portfolios looks appropriate, including short positions in US Treasuries, neutral positions in most EM fixed income asset categories and selective long positions in those assets that reflect either high credit quality alongside attractive yields (e. g. Russian sovereign debt, including domestic), offer higher returns together with certain macroeconomic stability (such as Egypt) or offer acceptable credit quality for HY corporate borrowers (including in Russia).

The OFZ market in particular looks interesting to us now, thanks to the proactive actions of the Bank of Russia to combat inflation, and the attractive yields. We expect the positive mood in the OFZ market to persist and recommend positioning in the so-called «classic» issues of long- and medium-term duration. The new issues of rouble government bonds, in circulation since 14 June (when the additional set of US sanctions came into force) may also be of interest to at least some categories of investors.

In the sector of rouble-denominated securities of Russian corporate borrowers, investors can still find attractive options in terms of risk-reward ratio. It is worth following the calendar of primary market placements closely, as issuers are compelled to offer more attractive coupons following the increases in the central bank’s key rate.

Global slowdown may coincide with slower USD liquidity growth

In August 2021, the development of the global economy was generally disappointing. The accelerated spread of the Delta strain in the US and Asia has led to slower recovery in both demand and output. Besides the continued slowdown of the Chinese economy and the renewed practice of quarantining large cities and entire regions, investors also became concerned about China’s new regulatory initiatives limiting profitability in technological and socially important sectors. Oil prices reacted to the deterioration in demand expectations with a 15% slide to 3-month lows, followed by a positive bounce in recent days, in anticipation of only cautious policy steps by the US Fed. The decline in iron ore prices in August reached levels some 35% below the end of June, giving way to positive dynamics over the past week.

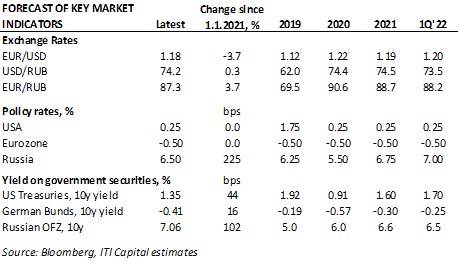

US, China, Eurozone Markit PMI indices

Source: Bloomberg

Importantly, outside China and several other large economies of the Asia-Pacific region (such as Japan, Australia and New Zealand), new curbs on economic activity triggered by coronavirus mutations and the spread of the Delta strain have yet to be introduced. Furthermore, deterioration in investor sentiment was caused primarily by survey indicators (including the University of Michigan US consumer confidence index and Germany’s ZEW economic growth expectations index) rather than actual real-sector data. For example, the labour market indicators in the US for July again showed a sharp increase in the number of people employed outside of agriculture, and the latest statistics indicate a further decline in the number of new claims for unemployment benefits. The forthcoming expiration of the various jobless subsidy programs (in September) should support further growth in US employment levels.

Forecasts for the world economy in the coming months continue to be closely linked to the development of the situation with the coronavirus and require regular updates. It is already clear that the rate of recovery of US economic growth in the 3rd quarter will be significantly lower than that in Q2 (6.6% QoQ), and that such high pace of growth is very unlikely to be achieved for the year as a whole. This year’s US growth will still be the fastest since 1984 but taking into account the extremely low base of 2020 and the very strong recovery in H1, it will certainly fall short of most forecasts produced as recently as early summer.

The deceleration of the global economy in the second half of the year will most likely be accompanied by a slower liquidity inflow into the world's largest economy, the United States. This is due to the expected start of the reduction in purchases of government bonds by the Federal Reserve System, indicated clearly in the minutes of the July FOMC meeting (published on 18 August). The exact timing of the announcement of the start of tapering is still a matter for debate (some clarity may be provided by tomorrow's speech by Chair Powell), but the market is clearly expecting this to happen not later than the November FOMC (a September announcement cannot be ruled out at this stage). These expectations may in theory fail to materialise in case of a sharp deterioration in the situation with COVID-19 in the coming weeks and months, but the risk of this remains low in our view. The most likely schedule for tapering is a $15bn reduction in purchases per each FOMC meeting, until the total amount of asset purchases (of $120bn per month) is cut to zero. In the event such a reduction begins in December 2021 and follows this schedule precisely, the tapering process could end in October 2022, which would create preconditions for the start of US interest rates lift-off later that year.

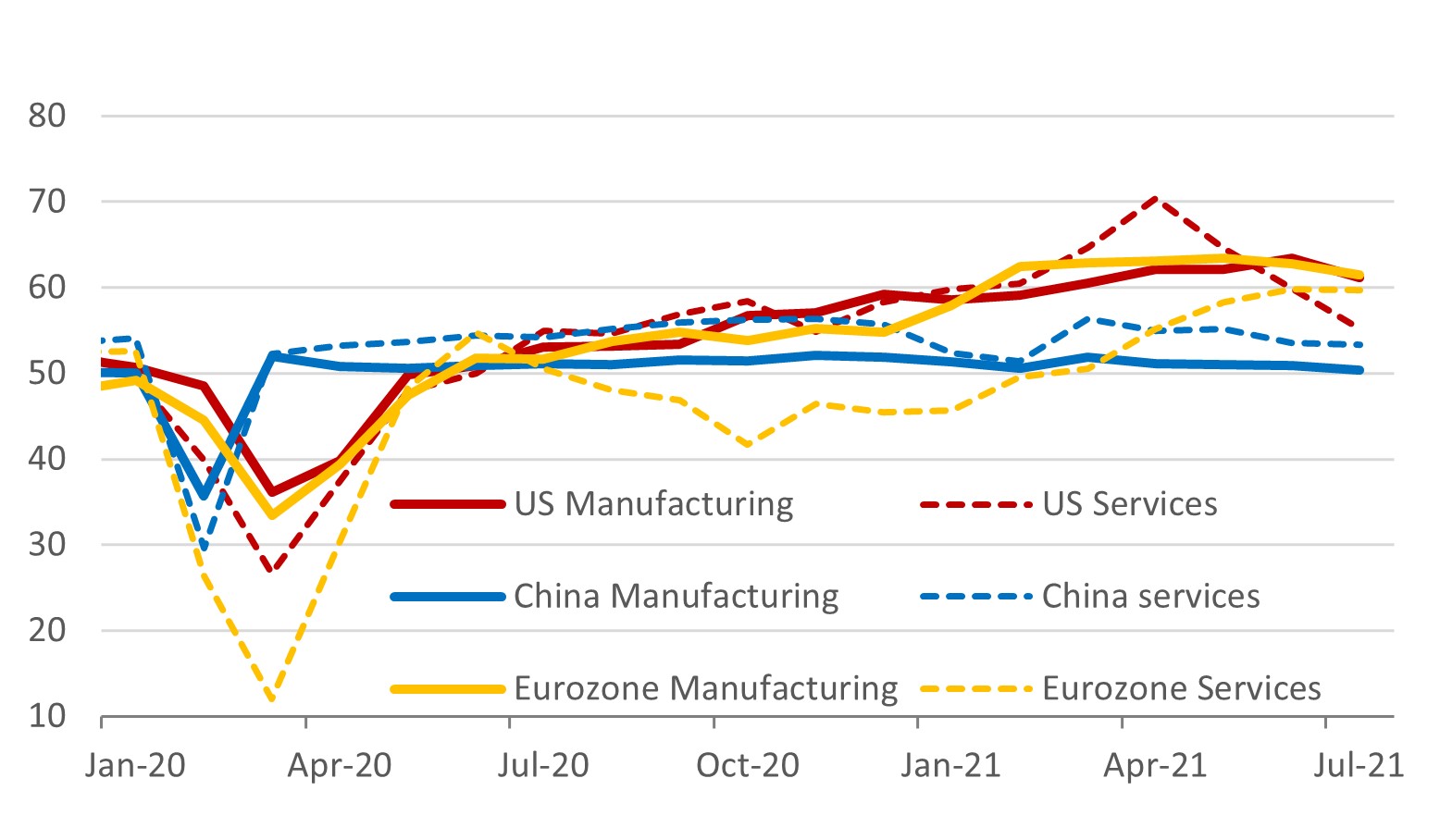

The approaching start of tapering, and with it the moment of rates lift-off, should find a reflection in the UST yield curve. Yields on 10-year Treasuries reached a high of 1.74% at the end of March and then were on a gradually declining path until the beginning of August. We, like most investors, expect UST yields to rise by the end of this year. It is not easy to predict the scale of yield pick-up (substantial foreign demand for US government securities and continued purchases by the Fed should hold rates back). We expect the 10-year rates to rise to 1.6% by the end of the year (from 1.35% currently). Should such a projection materialise, this would allow investors to benefit from a short position in these securities. In our opinion, it is worth taking such a position through exchange-traded funds (ETFs):

TBX US Equity (US74348A6082) — ProShares Short 7-10 Year Treasury

TBT US Equity (US74347B2016) — ProShares UltraShort 20+ Year Treasury

10y and 30y UST yields, TBТ US ETF

Source: Bloomberg

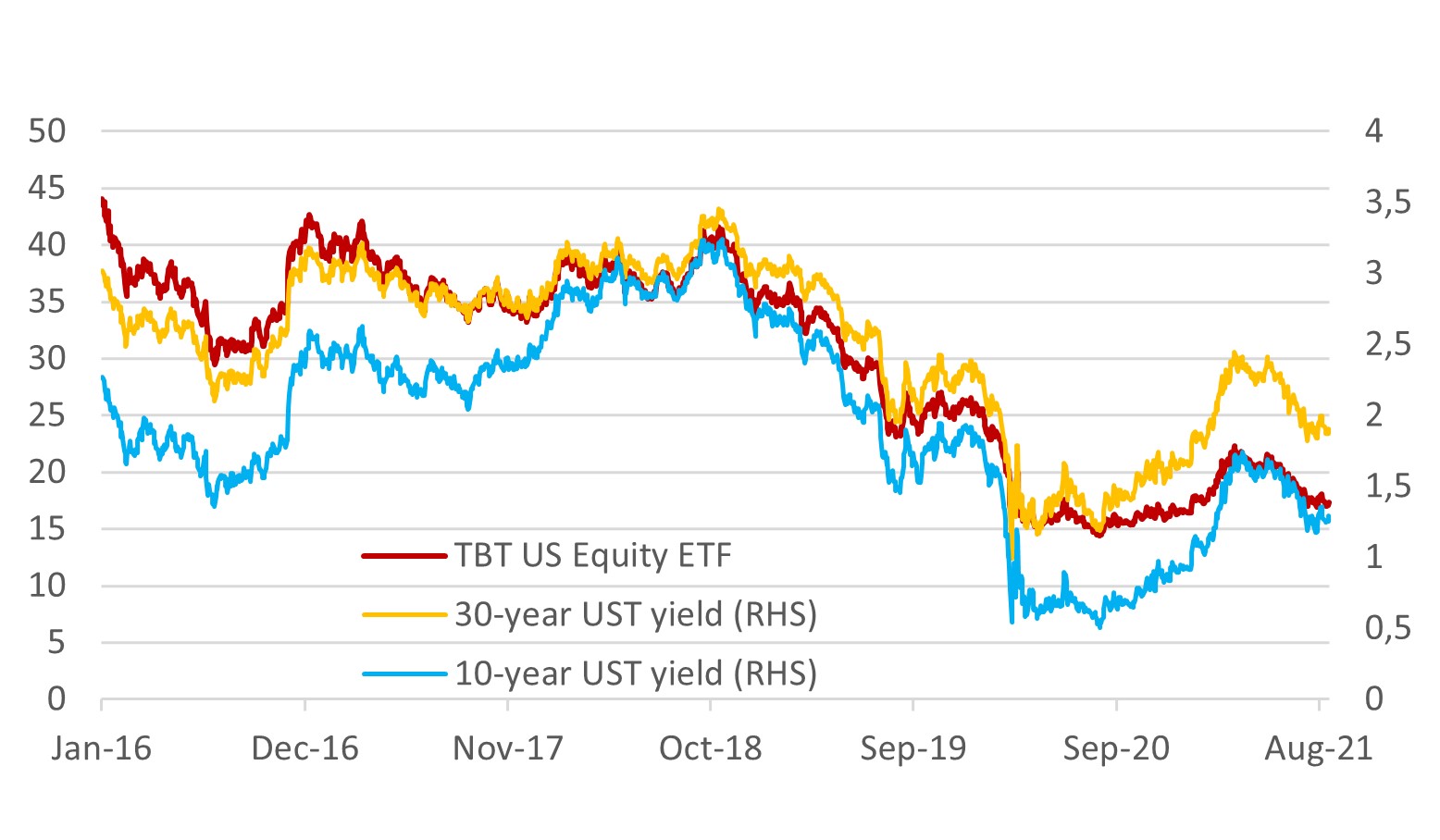

In the developed credit markets, the risk of an increase in risk-free yields due to the upcoming reduction in the volume of asset purchases (tapering) was especially noticeable in the US high-yield bonds area where normalized spreads to Treasury yields have been widening over the past seven weeks. This was the longest such period since 2013. Obviously, in addition to concerns about the pick-up in UST rates, this can also be attributed to the signs of a slowdown in the US economy (which will result in lower profits and could be especially painful for weakest borrowers). This difficult period for the High Yield sector was interrupted earlier this week (spreads narrowed by some 15 bps). It is however too early to recommend going long HY bonds, in our view: since the trough in spreads in the second week of July, spreads widened by an average of 45 bps, to 340 bps (or by about 15%) but are still below pre-pandemic levels recorded in February 2020. Compared to the spreads performance in the 3-year period prior to the spring 2020 Covid-19 related selloff (390 bps on average), the current level is 50 bps (13%) lower.

US High Yield corporate bond spread, bps

Source: Bloomberg

For investors in emerging markets assets, the main consequences of an earlier start of tapering compared to the initial forecasts are the risk of further strengthening of the dollar against major currencies, as well as an early pick-up in US Treasury yields (which would particularly affect prices of fixed-income assets with lowest spreads to US government securities).

The dollar's positions against the currencies of most developing economies appear fairly solid, notwithstanding the strengthening of these currencies in recent days: in the case of continuation of fairly fast — even if somewhat slower than recently — growth of the US economy in the remainder of the year, chances of tapering will be very high, while in the scenario of intensifying signs of crisis trends in the US demand for dollar as a defensive asset should stay strong.

Under the current conditions (the expected announcement of tapering in the foreseeable future and the associated significant probability of an increase in the yields of US government securities and the dollar index), a defensive strategy appear appropriate for investors in fixed-income assets, including short positions in US treasuries, neutral positioning in most assets of emerging economies and selective purchases (long positions) in those assets that reflect either high credit quality of a particular economy along with attractive yields (e. g. Russia, including domestic government debt), or elevated yields (staying attractive even in the environment of higher core rates) against the background of a certain degree of macroeconomic stability (such as in the case of Egypt).

Russia: investors in the OFZ market regain their optimism...

Taking into account the positive developments in Russia’s domestic government debt market recently and the attractive yields, we believe it is appropriate to renew focus on the OFZ market. In this regard, price drawdowns could offer opportunities for initiating long positions.

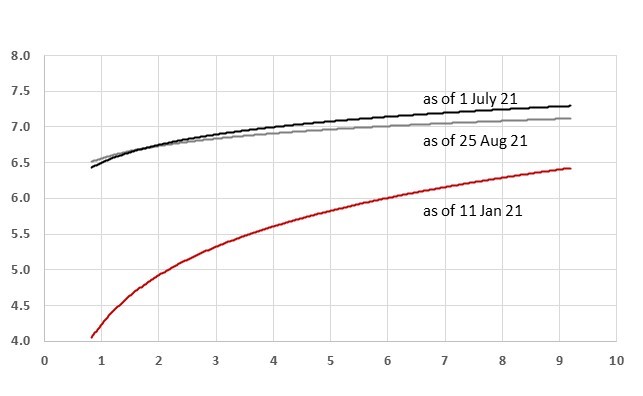

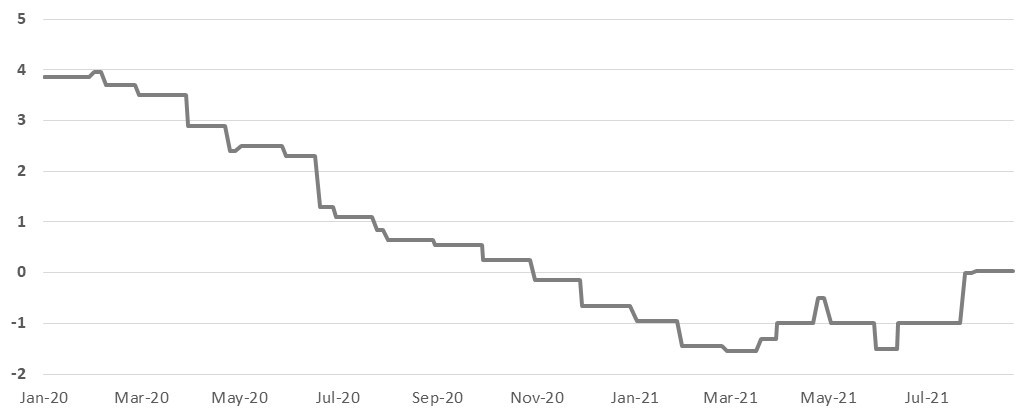

Last month, the OFZ market finally broke the prolonged declining trend that had been observed since late 2020. The trend reversal in the sector of rouble-denominated government debt occurred in mid-July, shortly before the announcement of the results of the core CBR policy meeting (accompanied by publication of an updated set of macro forecasts). Since the highs of May 2020, when the market was supported by the government’s stimulus measures, longer-dated «classic» issues have fallen almost 20% in price terms. The main reason for the return of investor interest was the expectation of imminent completion of the current tightening cycle. At the same time, the proactive/hawkish actions by the central bank which chose to hike the key rate by 100 bp (to 6.5%) at the meeting on 23 July failed to deter investors and actually helped to reinforce the positive momentum. A significant factor in this situation was the return of demand from non-resident investors who finally concluded that the CBR’s resolve should succeed in curbing inflation.

According to CBR data, the volume of non-resident funds on the accounts with the depository rose by RUB 172bn in July. As a result, the share of non-residents in the OFZ market increased to 20.6% as of 1 August, from 19.7% a month earlier. It is important to note that the long-awaited halt to increases in inflation (on the basis of weekly observations) has been observed since mid-July (with the exception in the week of 17-23 August, when a pick-up of 0.1% was recorded). In July, inflation on the monthly basis moderated to 0.31% compared to 0.69% a month earlier, coming out below consensus expectations. This trend was highlighted by the CBR in its latest monthly report that indicated certain signs of weakening price pressures. In addition to constructive inflation data, the improvement in investor sentiment was facilitated by the establishment of effective communication between the regulator and the market, allowing investors additional confidence in interpreting the CBR’s policy actions and their implications. As a result, yields of rouble-denominated government bonds declined to levels last seen in March. Specifically, yield on the 10-year OFZ issue declined towards the level of 7% p. a.

OFZ curve evolution (% p. a. / maturity, years)

Source: Bloomberg

... which we think may persist over the next half-year

We expect the favourable market conditions for rouble-denominated government securities to persist over the next half-year. For this to happen, further deceleration of the pace of inflation will be needed, which, among other factors, should support interest of non-residents thanks to further increases in real yields. At the same time, the CBR’s near-term monetary policy actions are unlikely to have a decisive impact on the direction of the price trend in the OFZ market. According to the statements accompanying the results of the July policy meeting, further increases in policy rates are no longer predetermined and will depend on actual data. In other words, it is not entirely inconceivable that the July rate increase may prove the last one in the current cycle of monetary policy normalization. Should the CBR decide to hike the policy rate again before year-end (which looks quite possible to ourselves, given the official forecast for the average level of the key rate in 2H’21 of 6.5-7.1%), on the 12-month horizon, the most likely scenario would still be that of a start of monetary easing. This would be fully consistent with the CBR’s base-case forecast for the average level of the key rate next year, of 6-7%.

Until the end of 2021, the CBR calendar includes three more meetings (the nearest one is scheduled for 10 September). Taking into account the uncertain inflation picture at the moment, we are keeping our latest forecasts for the range of key rate outcomes for year-end, of 6.75-7.00%. As the final part of the year is likely to witness a slowdown in the rate of trailing 12-month inflation, the likelihood of further rate hikes is the highest in the near term (i. e., in September). As for the first policy meeting next year, expected to be scheduled for February 2022, in absence of fresh inflation shocks, monetary policy parameters will likely be kept at the end-2021 levels. The risk of further (modest) increases in the key rate after the September meeting is related to the recently announced additional social spending (expected to take place towards the end of this year) and the implication of this decision for rouble liquidity and inflation. In our opinion, the probability of this at the moment isn’t high.

Taking into account these considerations, we expect further constructive dynamics in the OFZ market and recommend positioning in the «classic» issues of long- and medium-term duration. We are inclined to treat possible price drawdowns as short-term developments and would recommend viewing those as attractive entry points. The «new» issues of bonds (series 26237-26240), the placement of which began after 14 June (when the additional package of US financial sanctions came into force) could be particularly attractive for eligible investors. Due to technical factors, they have been placed with a considerable premium (10-20 bps) to the curve of «legacy» securities. As the liquidity situation improves, this premium should shrink in our view. Against the backdrop of rising attractiveness of carry trade operations (as the gap between actual inflation and its target level declines, real interest rates should rise), we expect a continuation of non-resident inflows into these instruments. As for shorter maturity issues, they may well outperform at some point as the inflection point in the current monetary policy cycle (likely to occur in 1H 21) draws closer.

Beyond the next half-year, predicting the dynamics of the market is getting more challenging. Demand for OFZs depends on a number of variables, both domestic and global. Progress in containing the pandemic will be essential; its pace will determine growth and interest rate trajectories in the leading economies. Actions of Russian authorities will also remain important.

For instance, recently CBR Governor Nabiullina referred to possibility of lowering the inflation target from the current 4%; a decision could be made by mid-2022. It is obvious that targeting lower inflation (e. g., 2-3%) would require tighter monetary conditions compared to those that the CBR associates with a neutral policy rate (recently seen by the CBR to be in the 5-6% range, due to be reviewed later this year). The Ministry of Finance, in turn, would need to be cautious in expanding the stock of domestic public debt, in line with adopted conservative budget policy guidelines. In recent auctions, however, Finance Ministry clearly decided to take advantage of the favourable market conditions and maximize the size of placements, despite the recent declarations about a sharp reduction in financing needs this year (by RUB 850 bn, or $11.5 bn) compared to the original budget plan, thanks to additional oil revenues and faster growth. The recent statement from the political leadership (about allocation of RUB 500bn, or 0.4% of GDP, of additional budget revenues towards subsidies to pensioners and other categories of the electorate by the end of 2021) has brought some clarity to the issue of using this year's windfall revenues (of at least 1% of GDP). The need for conservative public debt management strategy will remain an important prerequisite for positive dynamics of Russia's sovereign credit quality.

Real1 key CBR rate,% p. a.

1 Adjusted for trailing YoY inflation rate | Source: Bank of Russia, ITI Capital.

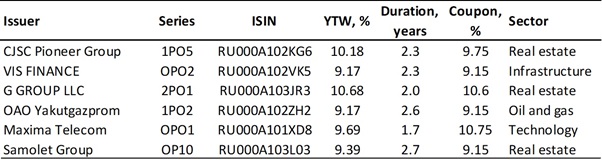

In the rouble-denominated corporate bonds sector, investors can still find attractive names from the point of view of risk/reward. It is worth monitoring the calendar of placements in the primary market, where issuers have been forced to offer more attractive coupon yields following the increases in the key CBR rate.

Against the background of a sharp increase in OFZ yields observed in 1H’21 (especially with duration of up to 5 years, where almost the entire corporate part of the RUB debt market is concentrated), attractiveness of bonds of high-quality corporate borrowers has become less obvious due to the traditional time lag necessary for normalizing spreads, as well as rising inflation. The sector of high-yield debt instruments, as a rule, is more sensitive to volatility, effectively repeating the dynamics of the underlying asset. Below we provide a sample list of securities that may be of interest to investors in terms of yield. The issuers selected by us have acceptable credit quality within their specific rating category. We also prefer positioning in low-duration securities (maturities up to 3 years), which looks feasible in view of the uncertainty about the current stage of monetary policy cycle. In this respect, we recommend paying attention to the primary market, where activity among borrowers of the second and third tiers picked up recently. Due to the shifts in the Russian sovereign curve and the increased policy rate, issuers have been forced to place new paper with more attractive coupons.

Source: Moscow Exchange, ITI Capital

Egypt: tourism recovery, yield cushion support sovereign debt

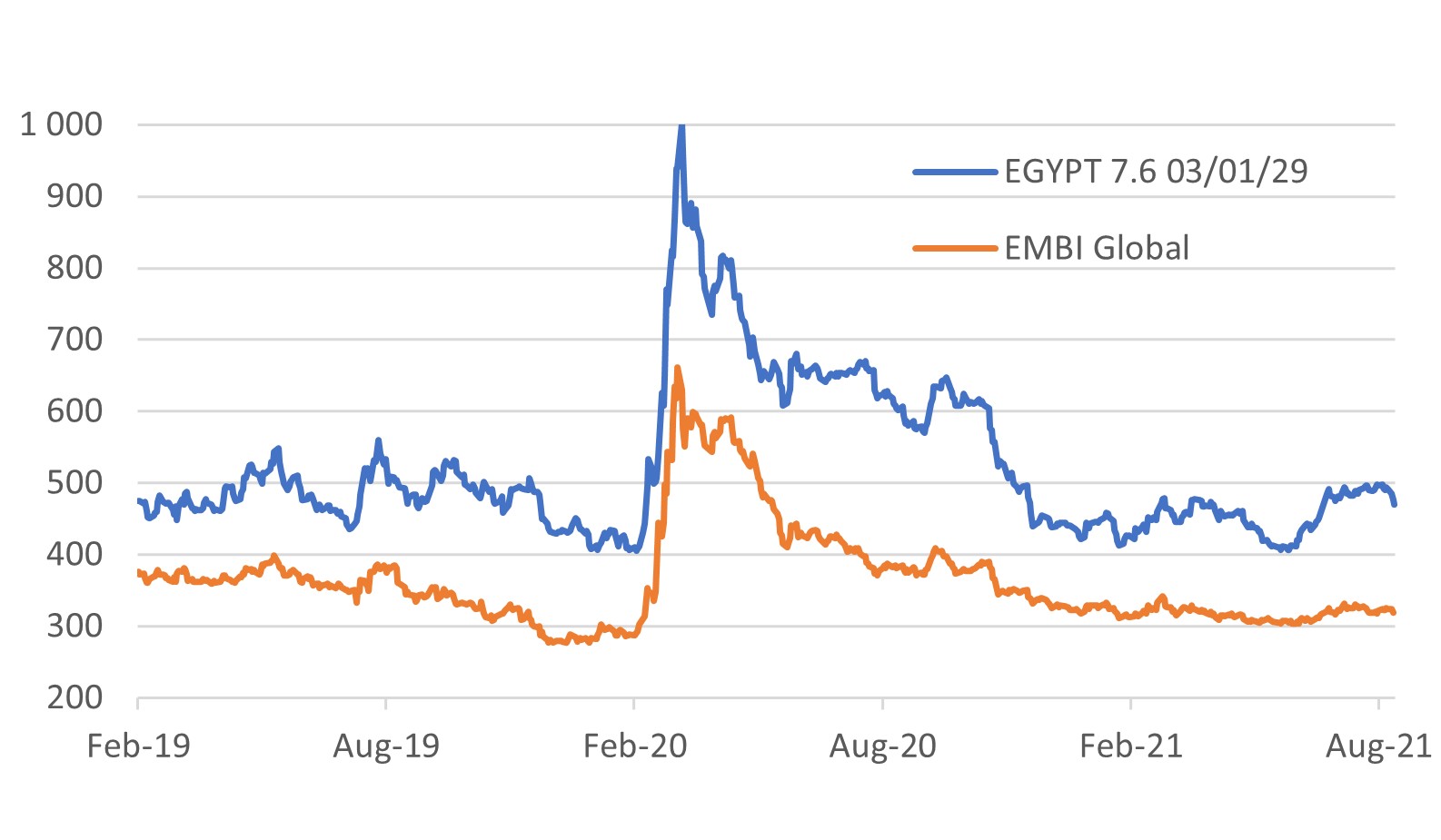

Within the EM high-yield sovereign debt category, we recommend buying Egypt sovereign bonds (B Stab/B2 Stab, B+ Stab) of 7—10-year maturity.

Egypt's sovereign credit quality remains stable, and restoration of a more normal way of life has supported both GDP growth and external current account receipts (mainly from the exports of goods and services, including tourism and transportation fees). Losses in domestic output and consumption from the pandemic were lower than expected, thanks to the relatively successful implementation of quarantine measures. The gradual opening of Egyptian resorts for foreign tourists (including from Russia, most recently, after a long pause) has become an important positive factor recently. Earlier this summer, the attitude of investors to Egypt’s risk worsened primarily due to the spread of new virus strains globally and the close dependence of the country's foreign exchange and budget revenues on tourism prospects. The main problem in this regard in the near future is the lack of clear goals for vaccination. Accumulation of foreign exchange reserves (and the slow appreciation of the exchange rate) have resumed indicating the return of the overall balance of payments to a small surplus while the current account deficit has likely peaked, at less than 4% of GDP.

In the longer term, the main problem for Egypt's creditworthiness is the high debt burden. To reduce the high stock of debt (which, according to the IMF estimates, should have peaked at the level of 92% of GDP in the 2020/21 fiscal year), a rapid recovery in the pace of economic growth is necessary. Egypt managed to avoid a recession in 2020/21, thanks to the stability of domestic demand (real GDP growth in the current fiscal year is expected to pick up to 5.2% from 2.8% previously). The primary budget surplus should begin to recover from 2021/2022 financial year and reach the target of 2% of GDP in 2022/23.

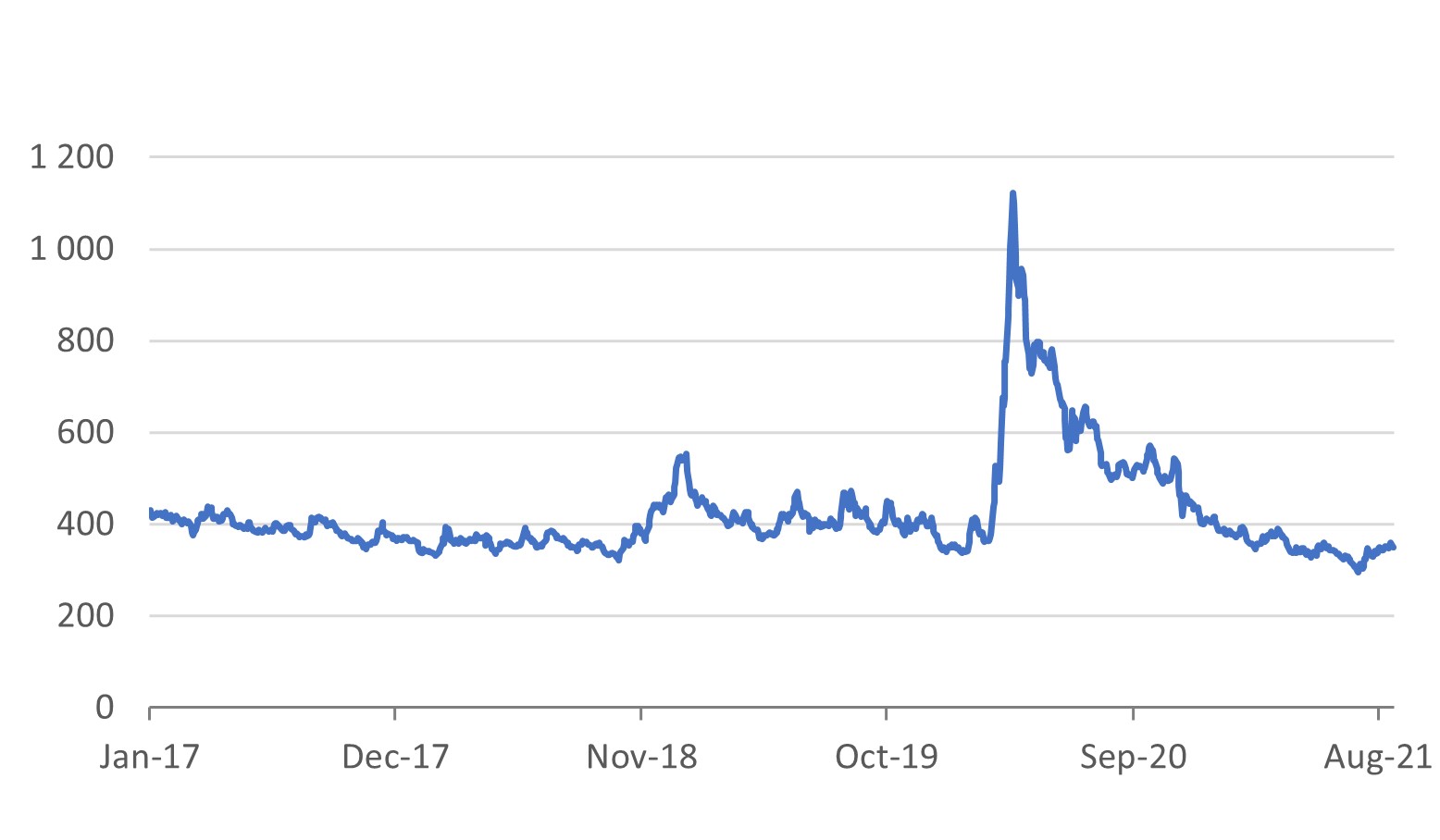

The improvement in the prospects of the tourism sector has led to an increase in prices of Egyptian sovereign Eurobonds in recent weeks. Since mid-August, spreads on bonds maturing in 2029 have narrowed by almost 30 bp (or 6%). For comparison, the spreads of the EMBI Global index narrowed by only 5 points (1.5%) during this period. We expect positive dynamics of prices for Egypt’s sovereign debt even in the environment of lower additional dollar liquidity globally, thanks to the cushion of high yields and the country’s positive creditworthiness factors.

Egypt 2029 7.6% bond, EMBI Global spreads, bps

Source: Bloomberg