Summary:

- The standard cut off period for the prices used for calculating market capitalization for the May semi-annual global indices review (SAIR) that is scheduled for May 11 are the last 10 business days of April, that is now. The effective date is May 28, 2021. May is expected to see major changes, which will affect certain stocks and the entire MSCI Russia.

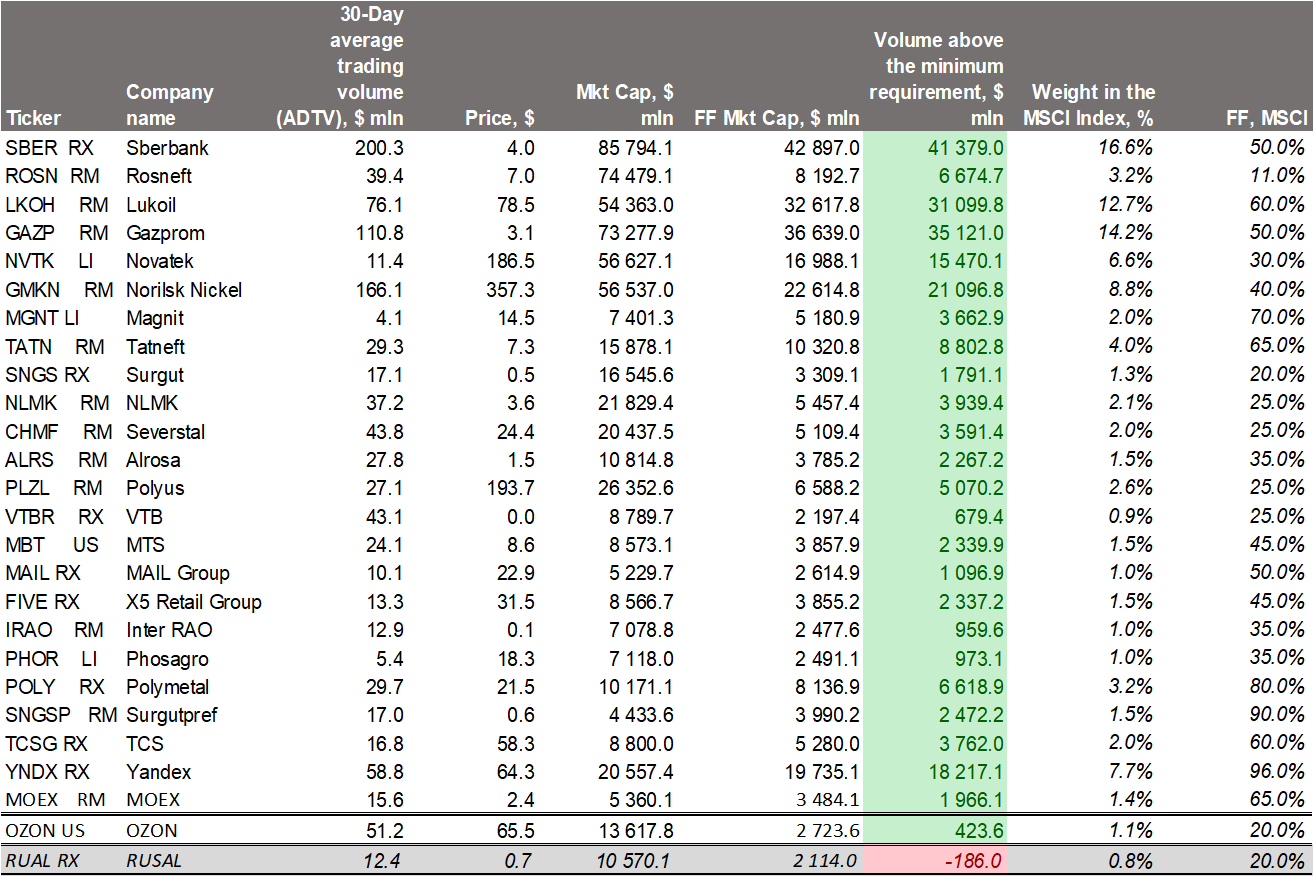

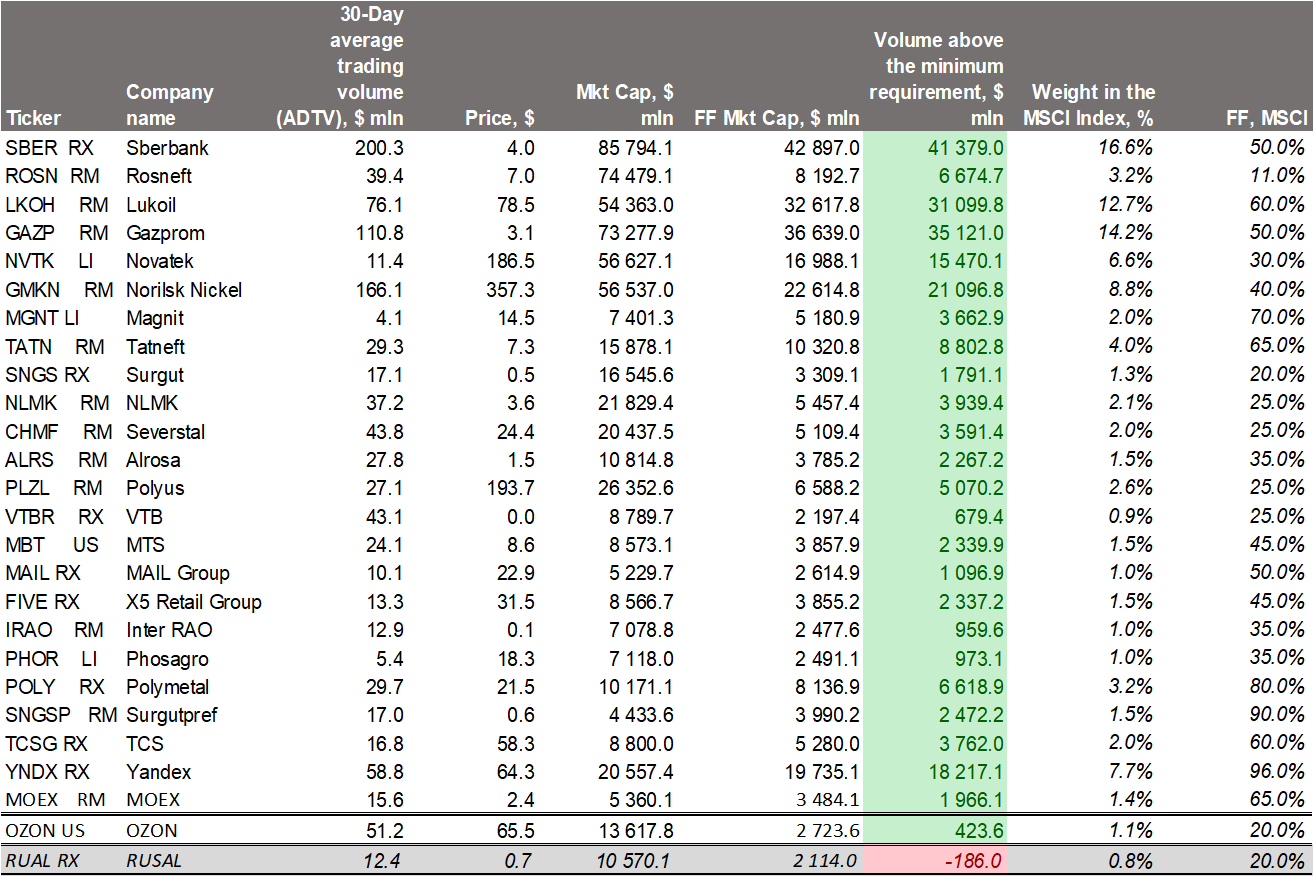

- We do not expect any exclusions from the MSCI Russia Index, as all companies in the index by far exceed the threshold, and we expect two inclusions, that will bring the number of companies in the index to 26!

- Ozon’s chances for inclusion are estimated at 100%, while Rusal’s at 50%. Polymetal and NLMK’s weight in the MSCI Russia Index is also expected to increase bringing new fresh flows.

Total inflow of funds will amount to $500 mln

- Ozon’s admission could drive a total inflow of $160 mln, including a passive investment inflow of $55 mln.

- Rusal’s admission could drive a total inflow of $123 mln, including a passive inflow of $40 mln.

- One should also take into account additional inflows from the ABB (Accelerated Book Building) and SPO (Secondary placement) of Polymetal and NLMK, which will increase the FIF (Free Float/Foreign Inclusion Factor) and drive additional inflow of funds.

- In Polymetal's case, this means an increase in the FIF from the current 50% to 80% and an increase in its weight in the MSCI Russia Index from 2% to 3.2%. This will result in a passive investment inflow of $57 mln and an active investment inflows of $110 mln.

- Total inflow in case of Polymetal will therefore amount to $170 mln, which is six times the average daily trading volume.

- In NLMK's case, this means an increase in the FIF from the current 20% to 25% and an increase in its weight in the MSCI Russia Index from 1.7% to 2.1%. This will result in a passive investment inflow of $20 mln and an active investment inflow of $40 mln.

- Total inflow in case of NLMK will therefore amount to $60 mln, which is six times the average daily trading volume.

Candidates for inclusion in May 2021: Ozon (100%) and Rusal (possibly)

1. Ozon is one of Russia's leading online retailers which held a successful IPO on November 25, 2020. The company is expected to join the index following the semi-annual review in May with a 1.1% weight. Ozon’s admission could drive a total inflow of $160 mln, including a passive investment inflow of $55 mln, which is roughly the 30-days average daily trading volume ADTV. The total inflow, including active funds, will be three times the average daily turnover.

2. Rusal fully meets the capitalization and liquidity thresholds, but may fall short of the free-float capitalization to be included in the MSCI Russia.

If the old minimum free float capitalization requirement ($1 600 mln) is used, the chances are high, but based on MSCI Russia capitalization as of February, the threshold should be higher, around $2300 mln, and therefore the chances are low. If the company is not admitted in May, it is very likely to be added in November.

If it is included, its weight in MSCI Russia will be 0.8%. Admission could drive a total inflow of $130+ mln including a passive investment inflow of $43 mln, which is 3.5 times the 30-days average daily trading turnover (Average daily trading volume, ADTV). The total inflow, including active funds, will therefore be nine times the average daily turnover.

Rusal’s free-float market cap, $ mln

Source: Bloomberg, ITI Capital, MSCI

Why won't MMK be added in May and possibly until November?

- MMK market cap soared 75% since exclusion following the November 2020 review, free-float has also partially increased, but overall the company is valued within the MSCI 20% range.

- Therefore, the company by far (20-25%) exceeds the MSCI Russia free-float criterion, which was the reason, alongside low liquidity, behind its exclusion from the index.

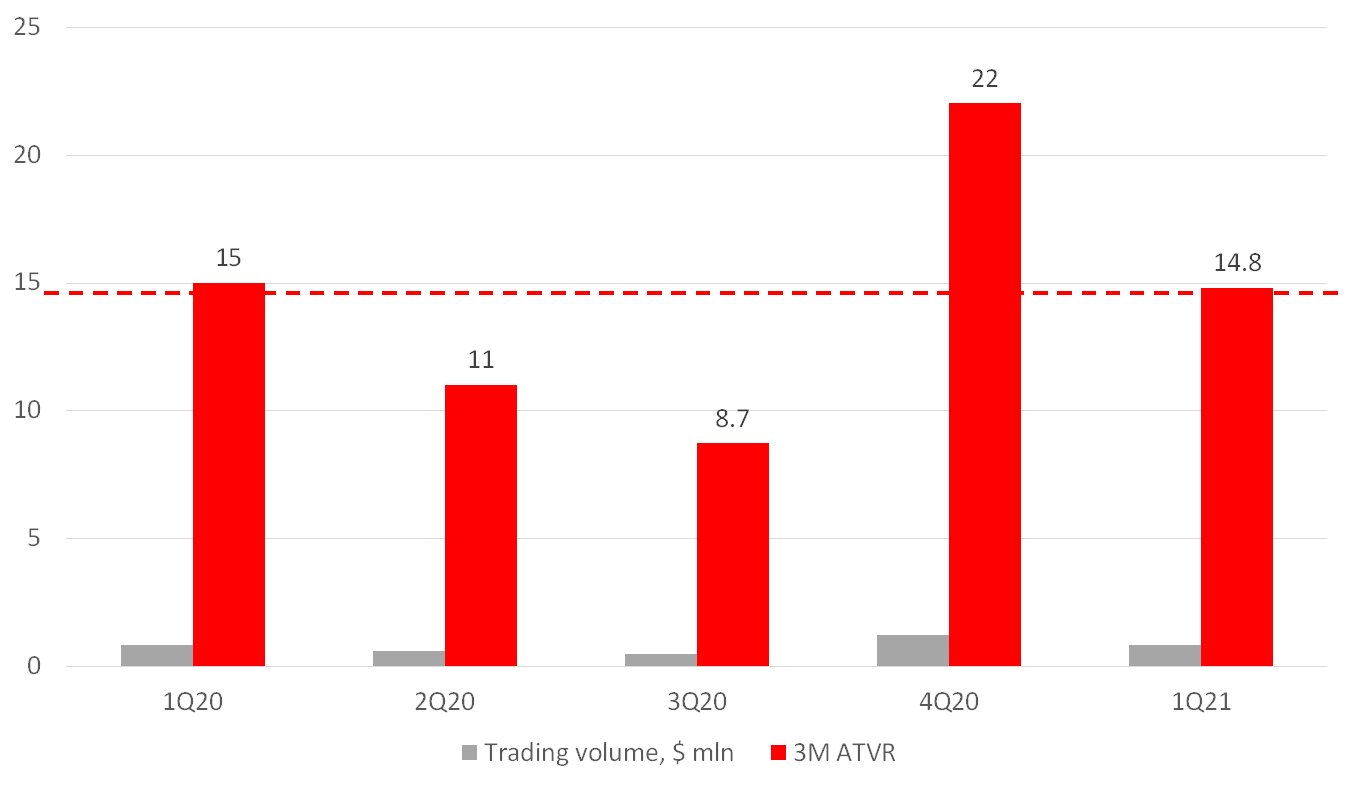

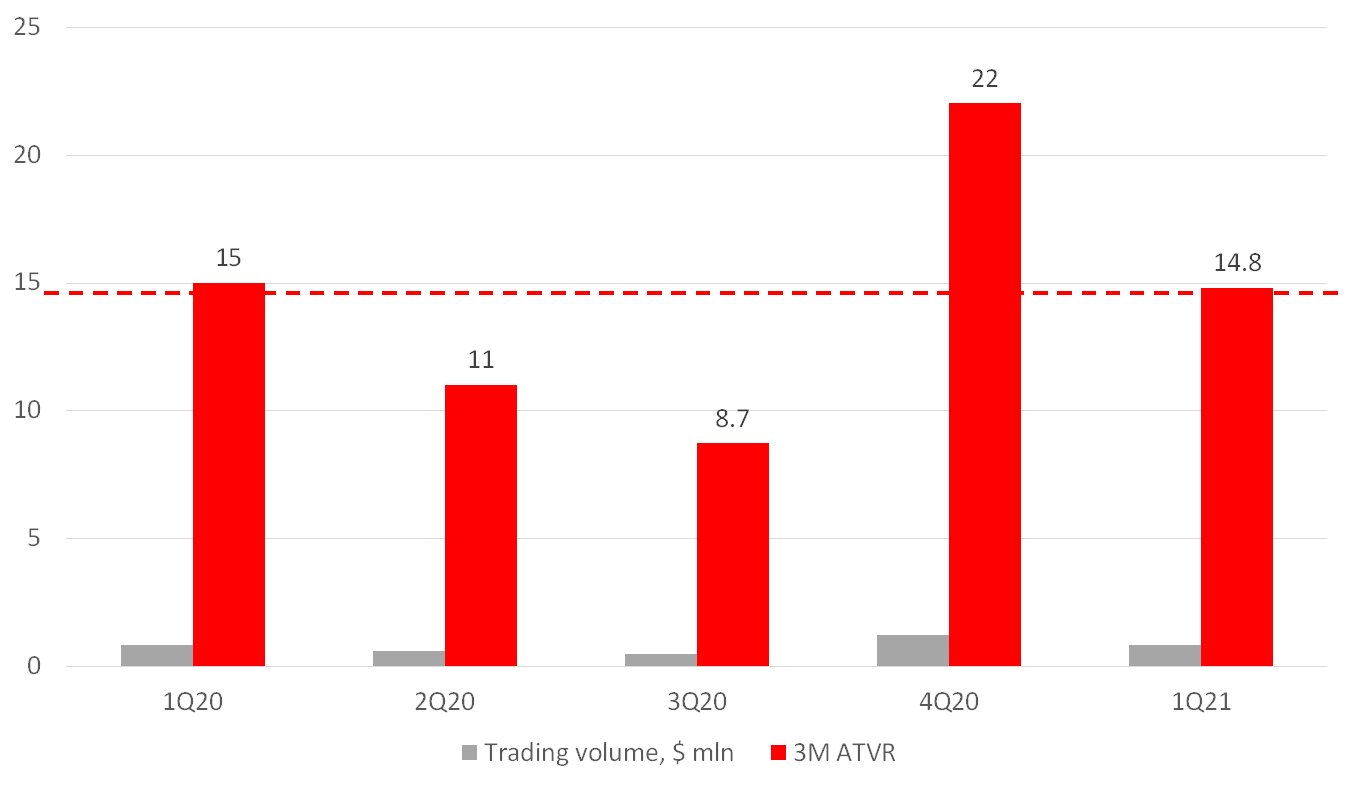

- The company has also significantly increased liquidity after the third quarter of 2020, but the first quarter of 2021 saw its decline and the company needs to meet the frequency of trading requirement over the last four consecutive quarters, or 12 months.

- Based on its current free float market cap and free-float of 20% MMK’s 90-days average daily trading volume should be at least $1.2 mln.

- The company would then meet MSCI Russia's minimum liquidity level, which is 15% of 3‐month ATVR (Annual Traded Value Ratio) and 80% of three‐month Frequency of Trading over the last four consecutive quarters, as well as 15% of 12‐month ATVR.

- Local and foreign listings with a maximum three-month ATVR are used, in the case of MMK it is the London listing of MMK LI.

- Hence, so far, the company’s chances for admission following the November semi-annual review are low.

Weighted average liquidity level of MMK, %

Source: ITI Capital, MSCI, Bloomberg

Current MSCI Russia components based on Polymetal and NLMK weight changes and candidates for inclusion

Source: ITI Capital, MSCI, Bloomberg