Segezha Group: Pre-IPO View New Sector Champion

Long-Term Potential with Ongoing Support from Robust Inflation

IPO deal in a nutshell Segezha will hold its an IPO on the Moscow Exchange at a valuation of RUB122.5-152.4 bn (RUB7.75-10.25 RUB/share), according to Interfax. The placement would include a base offer of a new issue with raising at least 30 bn rubles and an additional placement option in the amount of up to 15% of the base transaction volume. From RUB30 bn to 39.7 bn IPO proceeds will be used for the company’s development and debt leverage cut. Top management agreed on a twelve-month grace period for selling their shares, while the grace period for the core shareholder Sistema is six months. BofA Securities, UBS, JPMorgan, Alfa Bank, Renaissance Capital, Gazprombank and VTB Capital are joint global coordinators and bookrunners.

Emerging international player from Russia Segezha operations are divided into the following segments: (1) paper and packaging, (2) forestry management and woodworking, (3) plywood and boards and Other (including glulam products). Segezha ranks first in Russia and second in Europe in the production of paper bags, fifth in the world in the production of large-format birch plywood and the first in Russia in sawn timber production. The company's product sales are also geographically diversified over 11 countries. Over 70% of the products are exported and roughly 60-70% of Segezha’s revenue is derived from the construction industry.

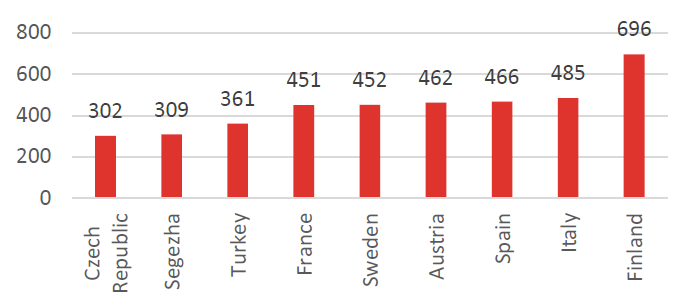

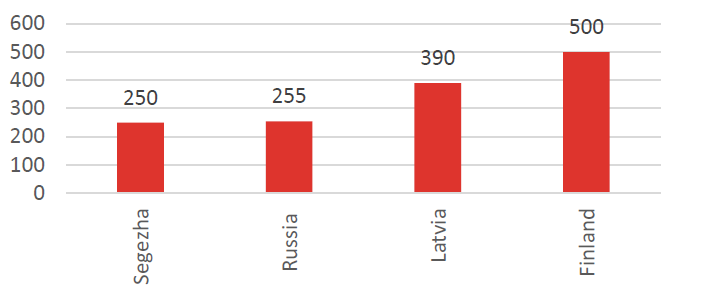

Segezha: large reserves, vertical integration, low costs Vertical integration is very important in this kind of business as it allows for a high level of raw material utilization, aiming to maximize the value of forestry resources to raise profitability and cut alternative (eco-related) expenses. Out of the total industrial wood consumed, 54% goes to pulp production and 46% is used for logs. The group is 80% self-sufficient in wood supply with long-term forest lease contracts for 49 years (33 years in average). The company has the largest forestry area with access to 8.1 million hectares (+an additional 1.1 million hectares potential). Segezha’s costs for sawn timber production amounts to $110 per cubic meter vs Canada ($195), Sweden ($226), Germany ($240) and Finland ($260).

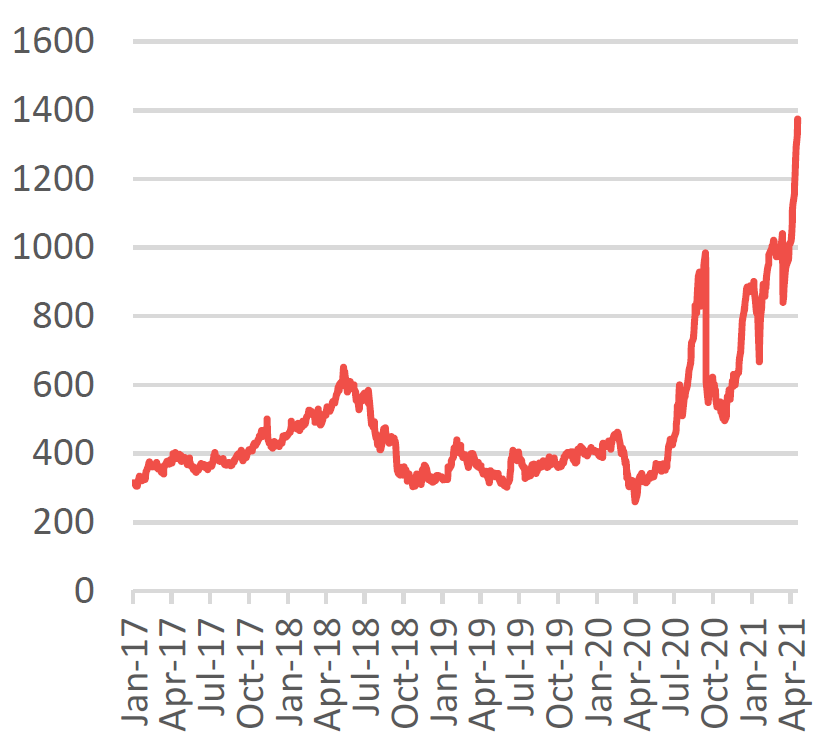

Ongoing global inflation in commodities, materials to unveil long-term potential earlier Governmental economic support via infrastructure development worldwide on the back quantitative easing measures have continued supporting inflation in core commodities, steel products and other materials. Over the past several months the forestry industry has seen unprecedented price dynamics, that we believe is most likely not fully priced-in. Most forestry product prices were affected by decreased demand during global economic slowdown due to COVID-19 in 2020 but started to rebound towards the end of the year and have been experiencing upward momentum in 2021. Prices were up across product lines in all Segezha’s operating segment as growing demand outpaced production capabilities in 1Q21. Sack paper prices in 1Q21 grew by 12% YoY (in EUR terms), plywood prices increased by 23% YoY (RUB), and sawn timber and glulam prices rose by 48% YoY and 13% YoY, respectively (in RUB).

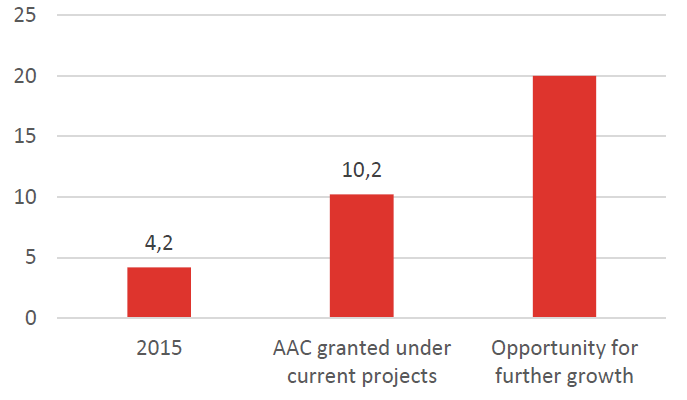

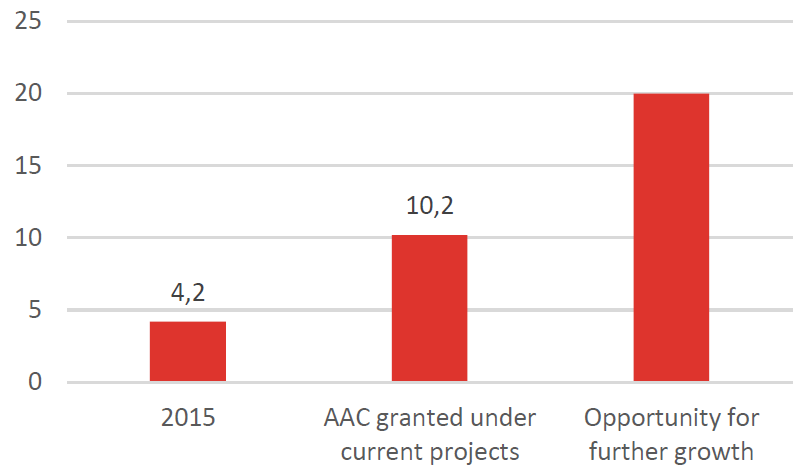

A chance to become a growth story on the most prospective Russian platform Russia controls 20% of the word’s forest area. Russia’s current output (annual allowable cut, AAC) is three times lower than annual allowable cut (AAC) vs 73% in Finland and 92% in Sweden. Thus, Russia could become a growth story via AAC increase. In addition, the market in Russia is fragmented. After the IPO, being well-funded Segezha could become the market’s consolidation center organically and via M&As.

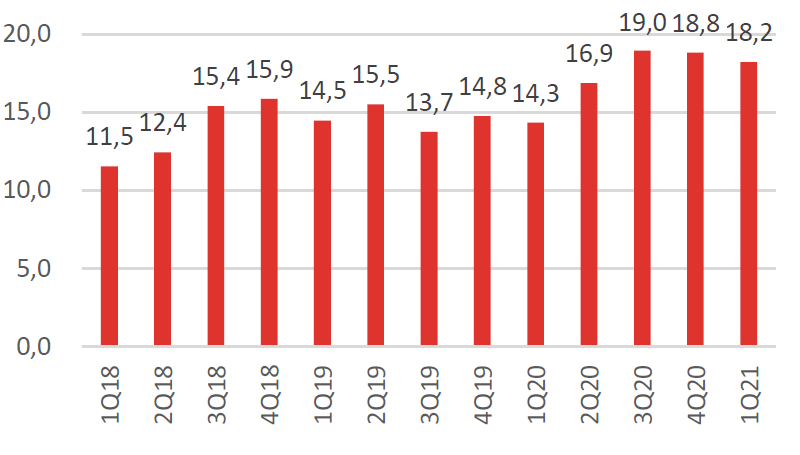

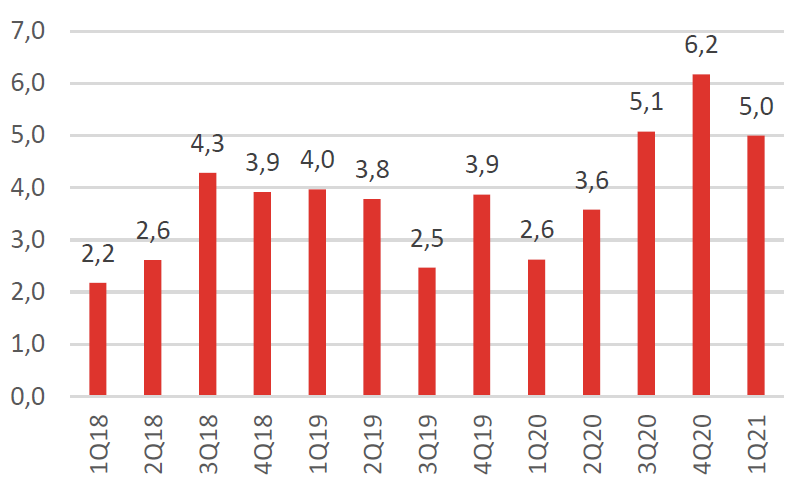

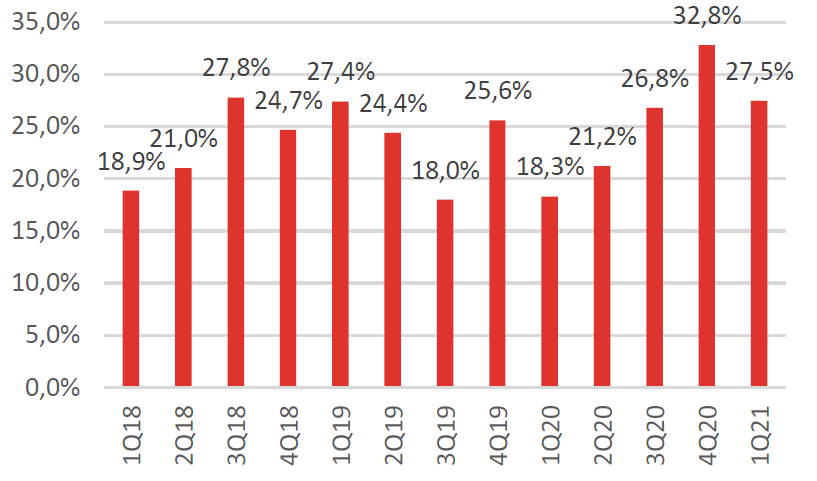

1Q21 Strong financial results Segezha reported 1Q21 financials: sales at 18.2 bn (+27.4% YoY; -3.2% QoQ; vs growth by 27.5% YoY in 4Q20). OIBDA to RUB 5.0 bn (+93.5% YoY; -19.0% QoQ; vs growth by 59.5% YoY in 4Q20). The company achieved an OIBDA margin of 27.6% (+9.2 p.p. YoY; -5.3 p.p. QoQ). Net debt grew to RUB 56.7 bn (+17.2% YoY from RUB48.4bn in 1Q20 and +15.5% QoQ from RUB 56.7 bn in 4Q20). Net profit amounted RUB 2.4 bn vs net loss of RUB -5.3 bn in 1Q20. Net debt/OIBDA was 3.8x that is lower than 3.9x in 1Q20 and higher then 2.2x in 4Q20. CAPEX amounted to RUB 7.1 bn (39% of sales) vs 18.2% in 1Q20 and 11.7% in 4Q20.

Dividends likely to be supported by Sistema Segezha recently updated its dividend policy, according to which the company intends to pay out 3 - 5 bn RUB as dividends annually from 2021 to 2023, that presumes a 3-4% dividend yield based on the pre-announced IPO range. From 2024, the dividend distribution is expected to be based on the amount of adjusted free cash flow. The dividend policy stipulates payments at the level of 75-100%.

Lumber futures price skyrocketed

Source: Bloomberg, ITI Capital

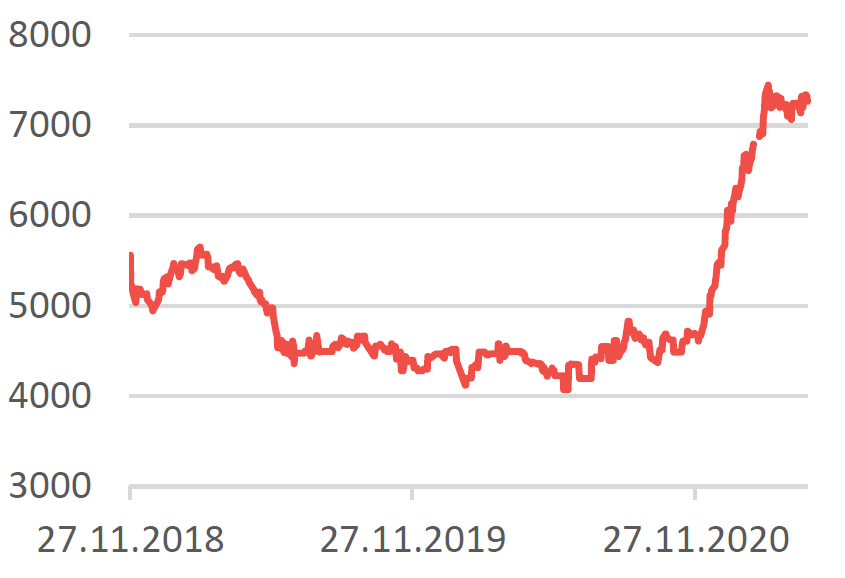

Softwood pulp futures

Source: Bloomberg, ITI Capital

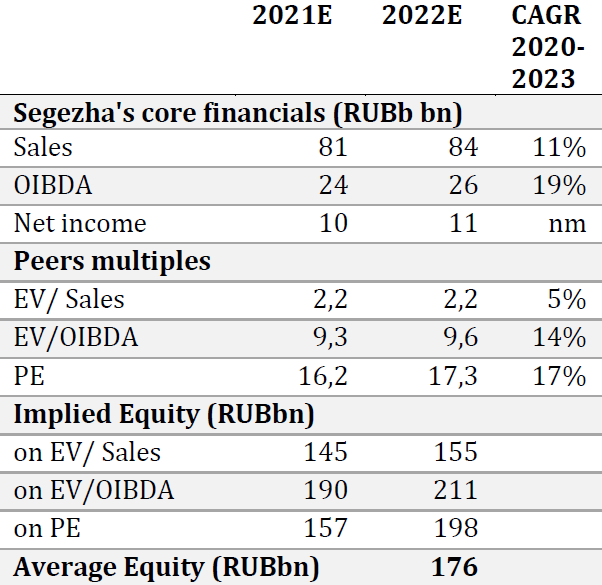

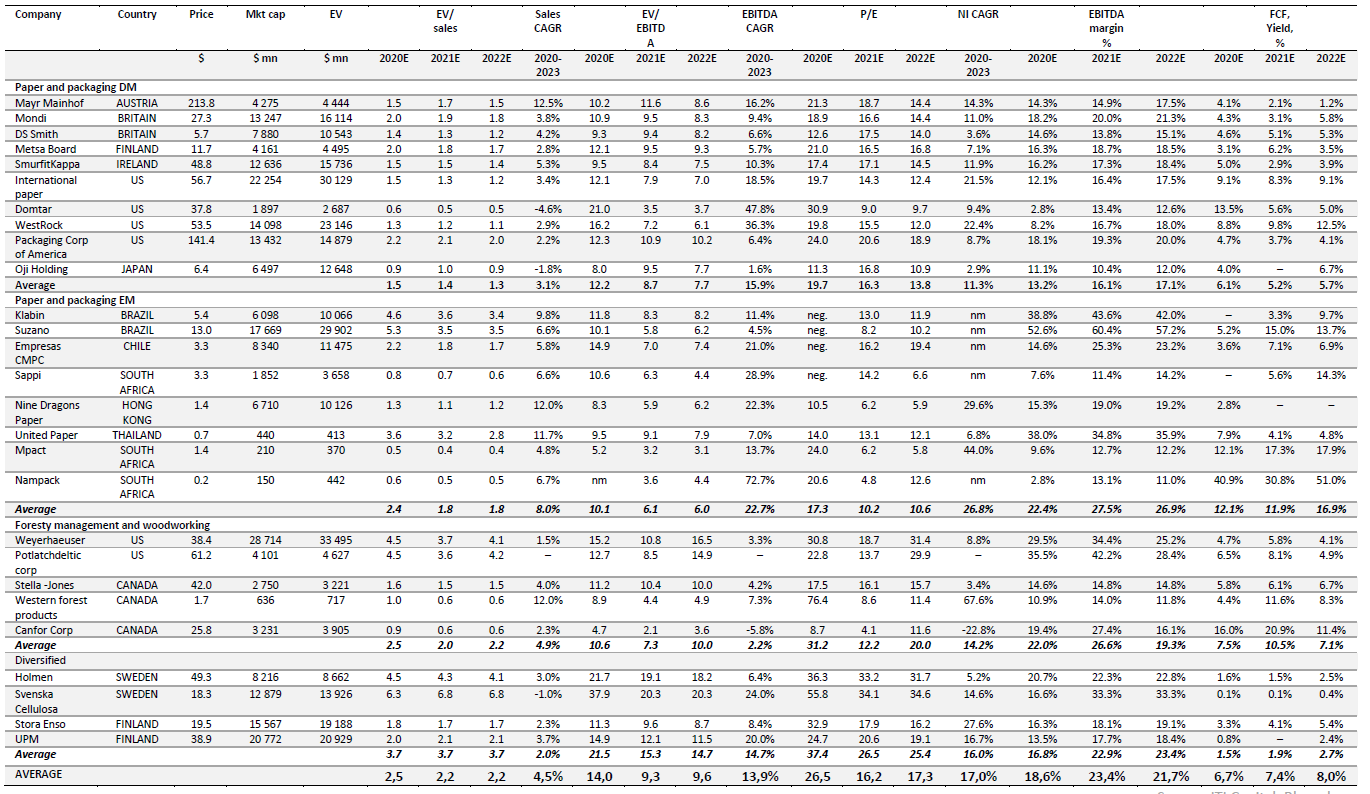

Segezha’s valuation on multiples

Source: ITI Capital

Higher growth and returns deserve higher valuation. We applied respective EV/Sales, EV/EBITDA and PE of international companies’ average for FY21E and FY22E and arrived at the equity valuation of ₽176 bln, which implies a respective 43% and 15% upside potential to the pre-announced price range. Although Segezha is a vertically integrated company we were reluctant to use multiples of the diversified peers’, as most of them are from Sweden and Finland, trading at high multiples. That said, we chose the average of both emerging and developed markets peers’ average, as we believe that Segezha deserves a premium to its emerging markets peers given the company’s superior growth and profitability profile. In addition, Segezha’s operational focus is closer to its European peers (comparative valuation table on page 15).

Boring sector? – not now, not for Segezha

Strong short-tern drivers and healthy long-term potential Among key factors affecting Segezha’s performance are demand patterns and product prices across the company’s key segments. The global forest products market holds high potential to expand in the coming years, which creates growth opportunities for Segezha and is an important condition for the company’s success in the long term. In the short to medium term the upward trend in prices for Segezha’s main products seen in the first quarter of 2021 should improve profitability as full vertical integration keeps raw material costs low, contributing to higher returns.

Segezha operates the following core segments:

- Forestry Management and Woodworking (xxx)

- Paper and Packaging

- Plywood and Boards and Other

- Glulam & CLT (cross laminated timber - construction values-added products)

According to Vision Hunters and Fisher International, the predicted CAGR for the group’s products from 2019-2025 globally;

- 2.5% for multiwall sack paper;

- 2.5% for paper sacks;

- 1.4% for birch plywood;

- 2% for sawn timber;

- 5% for consumer paper packaging in Russia.

The risk to these estimates in on the upside, given a mix of short-term inflation driven factors and long-term structural demand increase for the industry’s products.

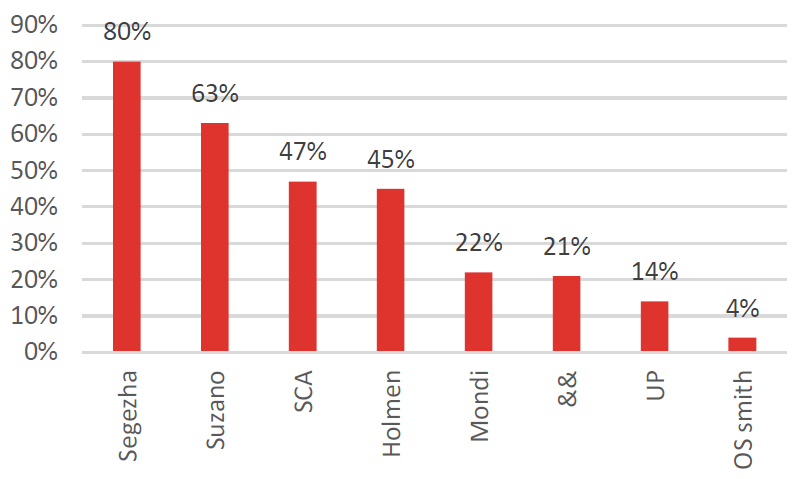

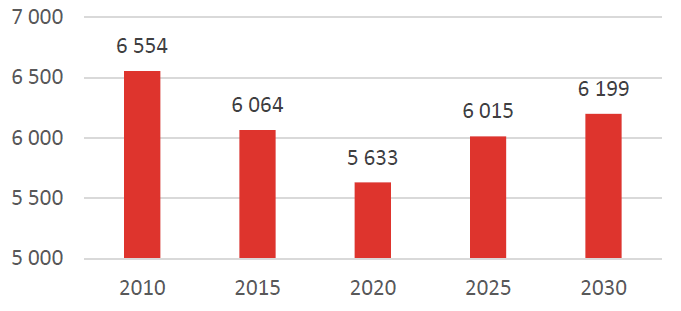

Usage ratio, % (harvesting of annual allowable cut)

-803.png)

Source: ITI Capital, Company data

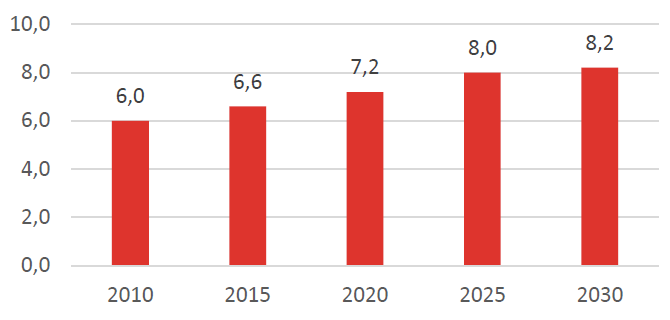

Segezha annual allowable cut expansion, m m3

Source: ITI Capital, Company data

Short-term growth drivers

Post-COVID construction boom The construction market typically constitutes between 60-70% of the demand for the Group’s products and, as such, growth in this market may be particularly advantageous for the demand outlook for products.

Adaption for new pricing reality in forestry Historically, lumber prices have been relatively stable. However, over the past few months lumber futures surged. In the short to medium term the upward trend in prices for Segezha’s main products seen in the first quarter of 2021 should improve profitability as full vertical integration keeps raw material costs low, contributing to higher returns.

Long-term growth drivers

Ecological factors should not be underestimated. Global change in products preferences Environmental awareness has led to sustainability trends such as substitution of plastic products, demand for biodegradable materials and a market preference for environmentally friendly producers. The regulations imposed across many countries will prohibit or limit single-use plastics products. In addition, regulations already limit the size of cement packaging, which has stimulated the consumption of paper sacks.

Plastic substitution – a stand-alone long-term driver Growing demand for the use of sustainable raw materials across products. Wood-based products are (i) recyclable and (ii) produced with significantly lower emissions – the C02 emitted in the production of a 25 kilogram paper cement sack is almost three times lower than the carbon emitted in the production of a 25 kilogram plastic cement sack.

eCommerce development Sack and kraft paper is primarily used for a variety of paper-based packaging – cement, dry-mix mortars, chemicals. That said, recently demand has been supported by food, as well as bags and carriers for retailers. The latter also means closer access to the end-user, that mitigates vulnerability of demand from the construction industry. The online food delivery market is expected to grow by a CAGR of 10.2% between 2019 and 2024 worldwide.

Despite the construction segment’s cyclical nature, it has long-term potential Population growth (CAGR of 0.8% to 9.8 billion in 2050) will drive increased construction activity, industrial production and retail activity. Thus, we will see an increased demand for construction products (sawn timber, birch plywood, glulam, home kits and CLT panels) and bags.

Segezha’s advantages

Vertical integration Vertical integration is very important in this kind of business as it allows for a high level of raw material utilization, aiming to maximize the value of forestry resources to raise profitability and cut alternative (eco-related) expenses. Out of the total industrial wood consumed, 54% goes to pulp production and 46% is used for logs. The company performs a full cycle of operations covering the whole range of the value-added chain.

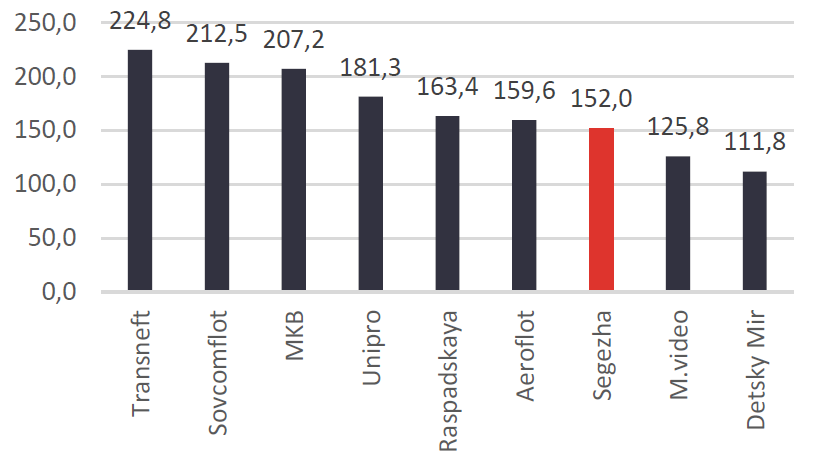

Segezha vs comparable rival in terms of market capitalization (₽ bn)

Source: Bloomberg, ITI Capital

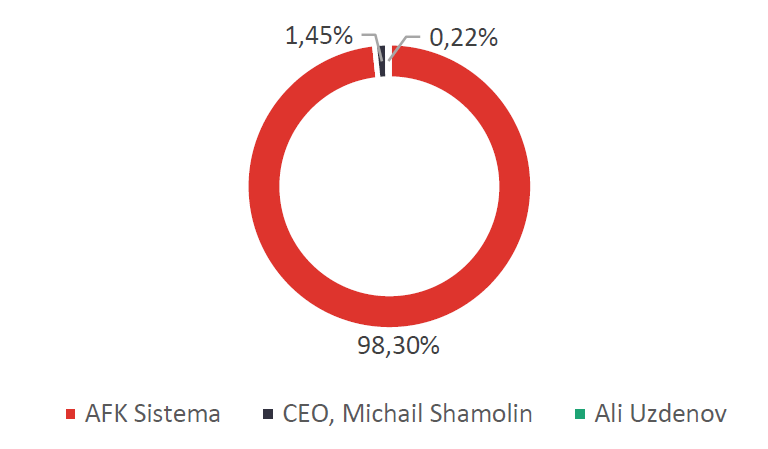

Segezha’s pre-IPO shareholder structure

Source: Company, Interfax, ITI Capital

Segezha’s strategy is to increase share of high-margin sack paper products, moving closer to the end-customers in the value chain targeting food packaging and frozen goods, eCommerce.

Large reserves The group is 80% self-sufficient in wood supply. It has long-term forest lease contracts for 49 years (33 years in average). The company has the largest forestry area with access to 8.1 million hectares (+an additional 1.1 million hectares potential).

Log prices are reflected in around 50-70% of overall costs of softwood sawn timber.

Low costs Segezha operationally one of the most efficient companies in the sectors in terms of costs. Lower cost is the results of Russian specifics (low leasing payments, labor costs) and vertically integrated model of the company. Russia, sawn timber producers enjoy higher margins on the back of abundant forestry resources and low cost of harvesting in Russia: sawn timber production costs of Segezha - $110 per cubic meter vs Canada ($195), Sweden ($226), Germany ($240) and Finland ($260).

Russia could become a growth story via AAC increase Russia’s current output (annual allowable cut, AAC) is three times lower than annual allowable cut (AAC) while vs 66% in USA, 73% in Finland and 92% in Sweden.

Russian market consolidation opportunities on the lucrative Russian market Russian forest area includes 20% of the word’s forest area. The market in Russia is fragmented. After the IPO, being well-funded Segezha could become the market’s consolidation center via M&As and organically via new operational capacities creation.

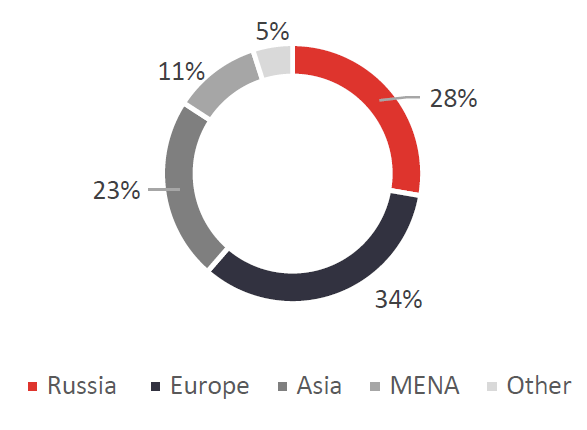

Export-oriented sales strategy The company derived 28% of revenue from domestic Russian sales and 72% of its revenue derived outside of Russia. With a predominantly ruble-based cost structure, this provides an advantage in case of the ruble weakness. Already now the company has good markets diversification and products. Sales geographic breakdown is the following:

- 31.6% from Europe,

- 23.6% from Asia,

- 9.9% from the Middle East and North Africa and

- 6.9% from other regions.

A chance to become a noticeable global player Segezha holds leading positions across a number of key segments by product capacity:

- #2 globally in multiwall sack paper by product capacity and

- #2 globally in industrial paper sacks by product capacity,

- #5 globally in plywood birch

- #1 in Russia in sawn timber by product capacity

Highest wood self-sufficiency among major pulp & paper players

Source: ITI Capital, Company data

Segezha annual allowable cut expansion, mn cu m

Source: ITI Capital, Company data

Risks

Significant exposure to the construction sector Implementing sales diversification initiatives could require some time.

Potential reshuffle in the legislative landscape. New import/ export duties introduction The segment could be subject to potential protectionism measures both in foreign markets and in Russia. The Russian government could potentially seek additional financial proceeds through increasing lease payments or introducing new ecological tariffs.

Large – scale investment projects The sector is capital-intensive (particularly pulp mill investments), which on the one hand increases the barrier to entry for potential new-comers, but on the other hand heightens operational leverage and risks.

Execution Establishment of a visible international player requires a decent strategic view and a strong capability for projects realization, that could be a risk.

Competition could intensify The sector could potentially become the next big thing in Russia, attracting new market players, that could threaten the economics of new investment projects’.

Forex risks More than 70% of the Group's revenue comes in USD/EURO. The company pursues a natural hedging policy for currency risks. About 44% of the company's 4Q20 debt was denominated in EURO.

Inflation has a negative impact on the costs of third-party raw materials and materials used in the production cycle. The growing importance of logistics and infrastructure could come at costs

Segezha’s revenues, bn ₽

Source: ITI Capital, Company data

Segezha’s sales by regions, %

Source: ITI Capital, Company data

Segezha’s OIBDA, bn ₽

Source: ITI Capital, Company data

Segezha’s OIBDA margin, bn ₽

Source: ITI Capital, Company data

Unprecedented Price Dynamics

Global inflation in commodities, materials remains strong amid ongoing recovery Expectations of a slowdown in China’s infrastructure spending’s recently were mitigated by President Biden’s $2,25 trillion infrastructure plan. We also doubt that economic support via infrastructure in China could be cut aggressively during vulnerable economic times. Additionally, quantitative easing is expected to continue support inflation in core commodities, steel products and other materials.

Over the past year the forestry industry has seen unprecedented price dynamics. Most forestry product prices were affected by decreased demand during global economic slowdown due to COVID-19 in 2020 but started to rebound towards the end of the year and have been experiencing upward momentum in 2021.

Adaption for new reality in forestry industry as well Historically, lumber prices have been relatively stable. However, over the past few months lumber futures surged to record highs driven largely by a supply gap on the markets due to strong demand from the construction market that was not matched by production due to COVID-19 related capacity and supply chain adjustments. Demand growth is expected to accelerate with robust post pandemic economic recovery, which should keep lumber prices elevated. Moreover, most analysts estimate strong commodity prices for the rest of the year driven by countries carrying out quantitative easing policies to bail out their economies and trillions of dollars being allocated for infrastructure projects that will be launched in the next few years.

Lumber futures price skyrocketed

-951.png)

Source: Bloomberg, ITI Capital

Softwood pulp futures

-331.png)

Source: Bloomberg, ITI Capital

Softwood pulp prices show similar dynamics to lumber futures since the first wave of COVID-19 lockdowns.

Prices for Segezha’s key products up in 1Q21 An export-oriented sales strategy means global market trends and international commodity prices are especially relevant for Segezha.

Prices were up across product lines in all Segezha’s operating segment as growing demand outpaced production capabilities in 1Q21. Sack paper prices in 1Q21 grew by 12% YoY (in EUR terms), plywood prices increased by 23% YoY (in RUB terms), and sawn timber and glulam prices rose by 48% YoY and 13% YoY, respectively (in RUB terms).

Boost in prices even ahead of historical seasonal peak The demand for industrial paper sacks follows the seasonality of the construction industry, with high demand seasons from mid-spring to mid-autumn, with demand slowing down in winter. The demand for the forestry management and woodworking segment also follows the seasonality of the construction industry. For example, about 70% of Segezha’s revenue in 2020 was derived from the construction industry, with peak demand in March and May. Pellet prices experience seasonality as well and have a strong correlation with energy demand.

The company published preliminary results in late April that demonstrated revenue and OIBDA growth across all segments of the business in 1Q21 on the back of price increases for their key products. In the paper and packaging segment, Segezha’s European assets were responsible for a significant share of the results, markets in Europe began to recover.

Segezha’s strong 1Q21 financial results Segezha reported 1Q21 financials: sales at 18.2 bn (+27.4% YoY; -3.2% QoQ; vs growth by 27.5% YoY in 4Q20). OIBDA to RUB 5.0 bn (+93.5% YoY; -19.0% QoQ; vs growth by 59.5% YoY in 4Q20). The company achieved an OIBDA margin of 27.6% (+9.2 p.p. YoY; -5.3 p.p. QoQ). Net debt grew to RUB 56.7 bn (+17.2% YoY from RUB48.4bn in 1Q20 and +15.5% QoQ from RUB 56.7 bn in 4Q20). Net profit amounted RUB 2.4 bn vs net loss of RUB -5.3 bn in 1Q20. Net debt/OIBDA was 3.8x that is less than 3.9x in 1Q20 and higher then 2.2x in 4Q20. CAPEX amounted RUB 7.1 bn (39% of sales) vs higher 18.2% in 1Q20 and 11.7% in 4Q20. That said, the 1Q21 financial results of the company do not fully reflect the new prices hike in our view, giving (i) some timing lag in export operations and (ii) the commissioning of new capacities launched in 1Q21.

Russia’s factor

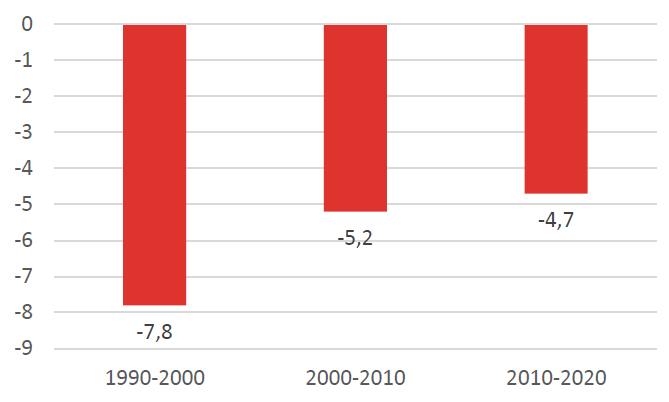

Russian forest area includes 20% of the word’s forest area. Only Caribbean region outstrip Russia, it’s forest area is equal 24% of the word’s one, and total South America – 20%.

Aside from Russia, the other major forest land holders are Brazil (12% of the world’s total forest land), Canada (9%), USA (8%), China (5%) and Australia (3%).

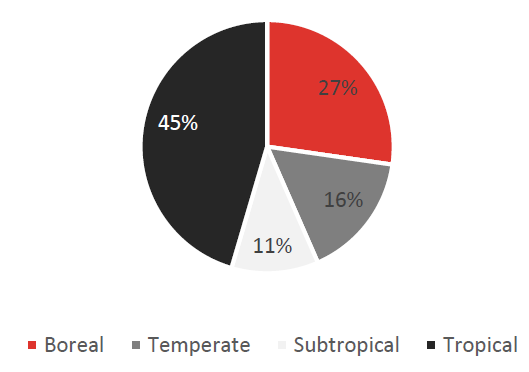

Softwood - Russia’s core specialization Russian forest is mostly softwood and the country accounts for 50% of boreal forests softwood resources. In other regions hardwood species prevail. Softwood species are preferred materials for sturdy products, such as sack kraft, industrial and consumer packaging. Approximately 65% of the world’s harvesting is attributable to hardwood.

Russia has superb harvesting potential as current output is three times lower than annual allowable cut (AAC) while in other countries harvesting opportunities are limited: 69% in Canada, 66% in USA, 73% in Finland and 92% in Sweden.

Forest area (1000 ha) by regions 1990–2020

by regions 1990–2020-433.png)

Source: ITI Capital, UN Food and Agriculture Organization

Sistema’s factor

Prior to the IPO, AFK Sistema and Segezha’s senior management have controlled 100% of the company’s shares of which a 98.3% stake was owned my core shareholder AFKS Sistema and the rest is held by Mikhail Shamolin (1.5%), currently the company’s CEO, President and Executive Board Chairman, and Ali Uzdenov (0.2%), the Board of Directors Chairman.

Sistema boards well with the public company’s philosophy Segezha’s majority shareholder AFK Sistema is a direct investment fund with a solid track record of creating, growing and monetizing its assets. The holding is considered to be a reputable private investor in the Russian economy, being involved into the active development of the following public market – MTS, Comstar, Sitronics, Bashneft, Detskiy Mir, Etalon, Ozon, as well as itself – AFK Sistema. The company is listed on the London Stock Exchange and MOEX. Over the past two years AFK Sistema has shown good results monetizing its assets, specifically Ozon’s IPO and selling Detskiy Mir. The investment fund is value-oriented targeting IPOs of its portfolio companies.

Sistema is to remain majority shareholder of Segezha post the IPO.

Segezha’s corporate governance system aligns the company’s interests with management interests and those of the company’s shareholders with a focus on increasing shareholder value. The Board of Directors consists of nine members, of which five are independent. The management team is headed by Mikhail Shamolin, currently the company’s CEO, President and Executive Board Chairman, and includes 13 management board members, who have an average of 19 years of experience. Segezha implements a management motivation program – the “Long-Term Incentive Plan”, which is aimed at achieving the company’s strategic growth goals and increasing shareholder value. The program aimed at incentivizing top management uses both cash payments and share-based compensation (so -called fantom shares), the latter promotes the alignment of management interests with those of minority shareholders.

Prior to be appointed CEO of Segezha, Mikhail Shamolin served as President and CEO of MTS (2008-2011) and Sistema (2011-2018).

Synergies from cooperation with other Sistema’s assets are possible Some synergies could be created between Segezha and some of Sistema’s other assets. For instance, with eCommerce sales being a major factor driving the packaging kraft paper market, there is a lot of potential in Segezha’s cooperation with Ozon – Russia’s leading eCommerce platform. Another possible partnership could involve the residential real estate developer and construction company Etalon Group. The primary end-market for multiwall sack paper is the construction industry, which is also responsible for a large share of other forestry product consumption.

Dividends likely to be supported by Sistema Segezha recently updated its dividend policy, according to which the company intends to pay out 3 - 5 bn RUB as dividends annually from 2021 to 2023, that assumes 3-4% dividend yield based on the pre-announced IPO range. From 2024, the dividend distribution is expected to be based on the amount of the adjusted free cash flow. The dividend policy stipulates payments at the level of 75-100%, an increase in the level of payments is also possible, provided a more stable market is provided, and there is a margin of safety for the debt load.

Company overview

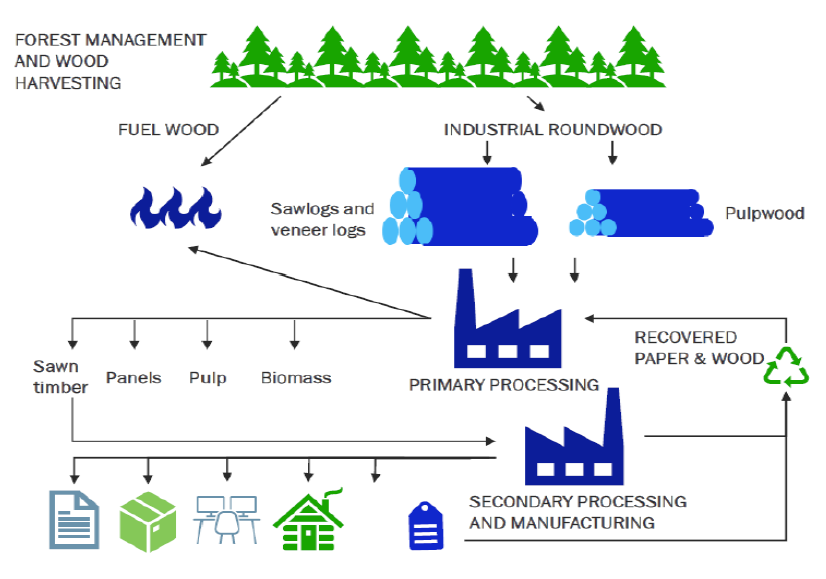

Vertical Integration is Key in the Sector

Wood harvesting is producing in 2 stages: 1 - felling, 2 - processing of trees.

Processing of trees includes top removal (topping), delimbing, crosscutting into logs (bucking), debarking, and sometimes chipping of undesirable trees or logging residues. Half of the wood harvested globally is used in industrial roundwood and another half is used as fuelwood. Out of the total industrial wood consumed, 54% is going to pulp production and 46% to logs. Logs are large diameter trunks of good quality suitable for industrial processing especially in production of sawn goods and veneer. Pulpwood is a small diameter trunk applicable in pulp production, wood-based panels, and sawn goods. Fuelwood is typically wood and pulp material obtained from the trunks, branches and other parts of trees and shrubs used as fuel for cooking, heating or electricity generation through wood burning in households and agriculture industry. After primary processing industrial roundwood is converted into panels, pulp and sawn timber, which is further processed into end-use products, like paper, paper sacks, glulam and plywood among others. For more details regarding the process of roundwood flow to industrial use, please refer to the scheme below.

Technological upgrade on march From 2015 to 2020, the Group’s production capacity for paper has grown by approximately 54%, from 265 thousand tons per year to 409 thousand tons per year and the Group’s production of plywood has doubled, from 95 thousand cubic meters 101 per year to 192 thousand cubic meters per year. In addition, the Group’s sawn timber production has tripled from 2015 to 2020, from 386 thousand cubic meters per year to 1,192 thousand cubic meters per year.

The process of roundwood flow to end use: everything in use

Source: Company data, ITI Capital

Company by segments

Sack paper and parchment

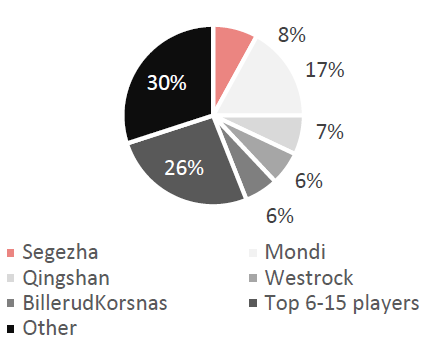

Segezha PPM and Sokolsk PPM specialize in producing sack paper and parchment. Total production capacity is 400 thousand tons per year, Segezha PPM’s production capacity is 375 thousand tons per year, they produce paper from pulpwood and technological chips. The plant is the world's largest production of unbleached sack paper and the only one in Russia manufacturer of highly porous craft paper with increased strength. Production of sack paper is a capital intensive business and requires material supply of quality pulp for operations – these two facts create significant barriers for new companies to enter this business and for the current players to expand their capacities. The market is relatively consolidated – top five players account for 44% of total sack paper production capacity, Segezha have got 8% of all sack paper capacity in the world.

Global industrial paper sacks market Global industrial paper sacks demand total up to 31 billion of packs in 2019. Europe, China, Asia, North America and Latin America are the main consumers in this market. European consumption of industrial sack paper was equal six billion of packs in 2019, its potential CAGR amounts 1% between 2019 and 2025 years. European consumption is focused mainly in construction industry (55% of total European demand), food and dehydrated milk (17%), fodder (9%) and chemicals and mineral products (10%). European industrial paper sacks production is divided between main players, such as Mondi, Segezha and Gascogne, these companies consolidate 66% of the market.

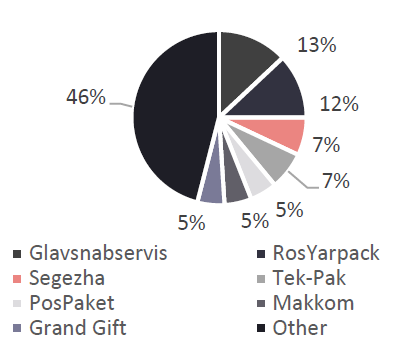

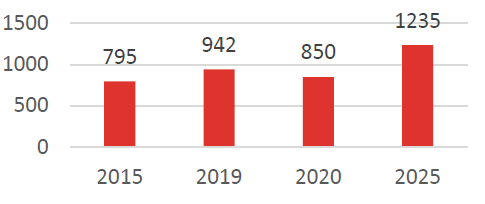

The Russian consumer paper sack market is very fragmented – 46% of this market is divided by the top seven companies, Segezha ranked third in terms of market share. Some players lack integration into paper production. The Russian consumer paper sack market amounted to 942 million packs in 2019, in 2020, demand on sack paper decreased by 9.8% to 850 million packs due to the COVID-19 pandemic crisis. In 2025, it is expected to account for 1,235 million packs, growing by a CAGR of 7.8 % between 2020 to 2025.

Sack paper capacity breakdown by producers, %

Source: ITI Capital, Fisher International

Paper packaging

Segezha Group produces paper packaging at factories in Russia and Europe. In Russia, Segezha Packaging plants with a total capacity of 883 million bags per year. The plants are located in the Republic of Karelia and the Rostov Region, in Europe the company produces paper packaging at seven Packaging plants with a total capacity of 800 million bags per year. Provision of own raw materials allows to restrain the growth of packaging production costs, reduces volatility and increases marginal income. About 36% of Segezha Group sack paper converts into paper packaging.

The kraft paper market is more fragmented than the sack paper one, it is due to lower entry barriers. The top five players globally account for only 16% of total 10.2 million tons of capacity as of 2020. Consumer packaging kraft papers do not require high strength properties and thus quality virgin pulp feed – products in this segment can partially or totally use recycled fiber. Segezha has some presence in virgin packaging kraft papers which is more prone to capacity additions segment due to raw material supply barriers.

Global packaging kraft paper demand is expected to grow by a CAGR of 4.2% between 2019 and 2025, expanding from 8.5 million tons in 2019 to 10.9 million tons in 2025. Over the same period, demand in China and other Asian countries is expected to grow with respective CAGRs of 5.8% and 5.5%, while demand in Europe and North America is expected to grow with respective CAGRs of 3.1% and 2.7%.

Russian consumer paper sacks market

Source: ITI Capital, Fisher International

Russian consumer paper sacks market, mln

Source: ITI Capital, Fisher International

Sawn timber The sawn timber is produced at four high-tech factories of Segezha, located in Siberia and in the northwest of Russia. For the production of lumber the Group uses high grade forest. Consistently high quality raw materials is provided by the Group's own logging, and a high level of diversification allows flexible redistribution of commodity flows depending on from current challenges and opportunities. Segezha Group produces high quality softwood edged lumber Due to its high content resin, softwood is different high strength and resistance to external damage. In addition, the Group's enterprises produce premium products from Siberian larch.

Plywood Segezha Group produces plywood at Vyatka Plywood Plant, the design capacity of which is 192 thousand cub meters per year. All products Vyatka Plywood Plant satisfy the requirements of international quality and safety standards. Vyatka plywood plant has wide production capabilities and modern equipment. The company specializes in producing: plywood with colored melamine, phenolic films of various applications, plywood with transparent melamine films and develops individual solutions according to customers' drawings.

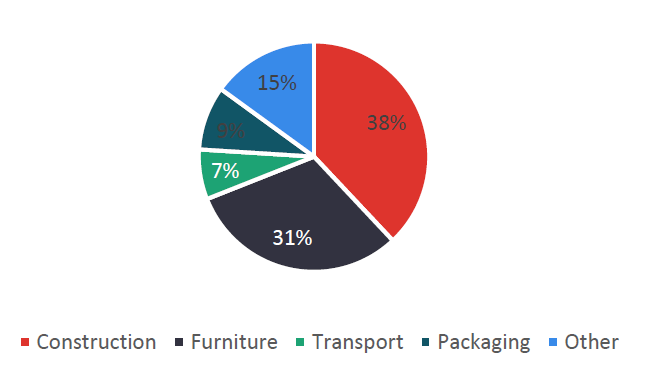

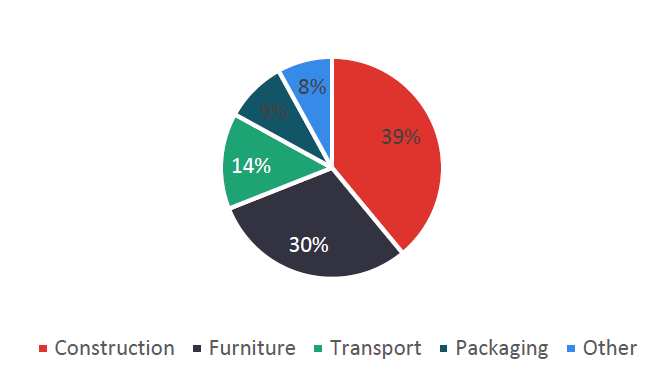

Global birch plywood demand, %

Source: ITI Capital, Vision Hunters

European birch plywood demand

Source: ITI Capital, Vision Hunters

Russia is the major global exporter of birch plywood and is the key driver of supply. Russian players have increased their presence significantly globally during the past 10 years and are expected to strengthen their positions and expand capacities further. European plywood production market is primarily represented by capacities in Russia, Finland and Baltic countries. European producers (UPM, Metsa and Latvijas Finieris) are primarily presented in high-end segments with customized solutions sold directly to end-users. Compared to Europe, Russian producers on average are currently more exposed to commodity-like plywood products, with major sales made through distributors.

Dry fibreboard and wet production Segezha Group produces dry fibreboard and wet production. Fibreboard of dry production method is a board produced by a dry continuous method based on the calender method from wood fibers using urea-formaldehyde resin as a binder. The formation of a woody carpet takes place in the air. Wet fiberboards are produced by hot pressing wood fibers using phenol-formaldehyde resin as a binder. Vyatka Plywood Mill produces dry fiberboard with a thickness of 3.2 to 7.0 mm, as well as RUF fuel briquettes. JSC Lesosibirskiy LDK No 1 is one of the largest wood processing complexes in Russia and includes several logging enterprises, a sawmill, production and finishing of wet fiberboards. The plant also produces its own heat energy. Segezha Group's diversified client base by industry avoids the seasonal prevalence of sales.

Glued wooden construction and house kits

Segezha Group produces glued wooden construction and house kits at Sokolsky woodworking. All manufacturing supply chain wood is certified according to the FSC standard. A key product manufactured Segezha Group, in the wooden segment is a glued structural beam, which is made from high-strength wood species, resistant to the effects of the external environment.

Segezha Group produces glued spruce beam, a pilot batch was also produced from Siberian larch, and in 2021 it is planned to use pine. High quality and unique properties glued structural beam allow to use it in the construction of not only wooden houses, but also various buildings and structures in combination with other materials.

The house building can be realized in every climatic zone and season. Low shrinkage of laminated veneer lumber house walls contributes to the high speed of construction and quick commissioning of objects into operation.

Markets in charts

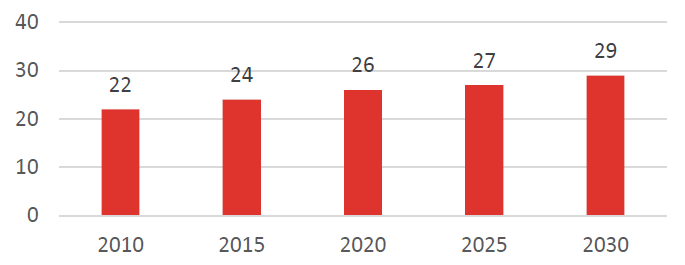

Global demand, sack paper, mn t

Source: ITI Capital, Company data

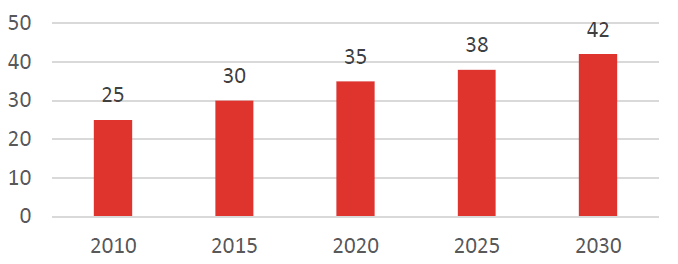

European demand, sack paper, mn sacks

Source: ITI Capital, Company data

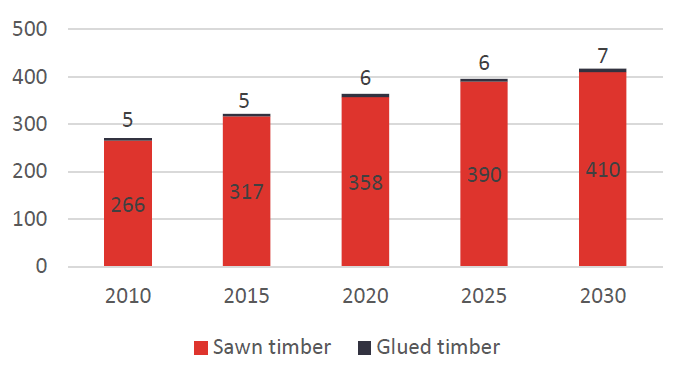

Global demand, timber, mn cubic meters

Source: ITI Capital, Company data

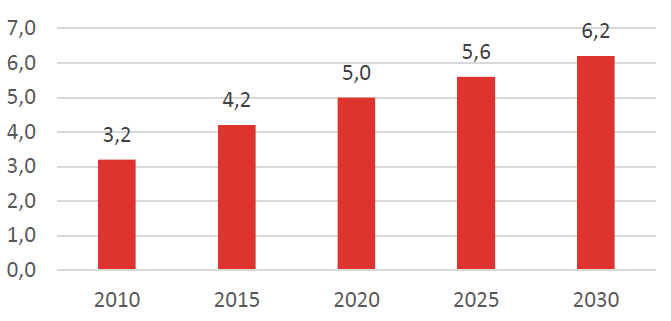

Global demand, birch plywood, mn cubic meters

Source: ITI Capital, Company data

Source: ITI Capital, Company data

Source: ITI Capital, Company data

Leadership in production costs (var.): unbleached sack paper, euro/t

Source: ITI Capital, Company data

Leadership in production costs (var.): birch plywood

Source: ITI Capital, Company data

Global distribution of forests showing the ten countries with the largest forest area, 2020 (million hectares)

-740.png)

Source: ITI Capital, Company data

Global distribution of forests showing the ten countries with the largest forest area, 2020 (% of world’s forests)

-57.png)

Source: ITI Capital, Company data

Global annual forest area net change, by decade, 1990–2020

Source: ITI Capital, Company data

Proportion of global forest area by climatic domain, 2020

Source: ITI Capital, Company data

Top five countries for forest area, 2020 (million ha)

-159.png)

Source: ITI Capital, Company data

Russian Forest area (1 000 ha)

-778.png)

Source: ITI Capital, Company data

Usage ratio, % (harvesting of annual allowable cut)

-653.png)

Source: ITI Capital, Company data

Segezha annual allowable cut expansion, m m3

-882.png)

Source: ITI Capital, Company data

Comparative valuation

Source: ITI Capital, Company data