Outlook for the Rouble: likely driven by geopolitics in the coming months

In late January, we predicted that the rouble will likely strengthen during Q1 2021, potentially to the level of 72.5/$, while highlighting the risks associated with new US sanctions. Indeed, the favourable conditions in global commodity markets and recovering risk appetite led to the appreciation of the rouble to 72.7 per USD during the trading session on 16 March. However, the publication later that day of the report by members of the US intelligence community about Russia's involvement in attempts to influence the outcome of the 2020 US elections alarmed investors, while Joe Biden's interview on 17 March containing some unexpectedly harsh personal attacks against Putin ensured the turnaround in the rouble’s dynamics. The deteriorating situation in Eastern Ukraine in recent days has increased the downward pressure on the rouble. Between 15 March – 12 April, the rouble fell 5.9% against the dollar (only the Turkish lira did worse, down 7.6%), despite the CBR’s much tighter than expected monetary policy and rhetoric.

In the coming weeks and months, geopolitical risks are likely to outweigh the fundamental (economic) factors of the rouble's performance. This is due to an unusually high concentration of external and internal political risks in the near future (US sanctions, conflict in Eastern Ukraine, situation with Navalny, elections to the State Duma in September). The new US sanctions introduced since the Biden Administration came to power (announced on 2 March) did not deal with the entire range of bilateral problems and are yet to be finalized, thus not resolving the uncertainty for investors (primarily, non-residents). The worsening of Navalny's condition and the sharp deterioration of the situation around Donbass added grounds for concern. In this situation, the fully justified tightening of policy and harsher rhetoric of the central bank in response to bad inflation data and the weakening of the rouble (including the growing likelihood of a larger hike in the key rate at the 23 April meeting) did not make investments in OFZs more attractive for non-residents and slowed down capital inflows into other sectors of the financial market (including the stock market). The reaction of the Russian authorities to the new challenges is complicated by the approaching elections in September, increasing the risk of narrowly-focused actions aimed primarily at Russia’s domestic audience.

Against the backdrop of persisting and new political challenges, the increasingly difficult task of accurately predicting capital flows would not allow investors to confidently model changes in Russia’s overall balance of payments, despite the early start of the monetary policy tightening cycle of the CBR and, in general, fairly constructive developments in the commodity markets. In these conditions, it is difficult to expect a quick return of foreign portfolio investors to the rouble-denominated government debt market. Based on these considerations, we are reducing our estimates of the potential for rouble appreciation from current levels until the end of Q2 2021 from 71.5/$ (7.5%) to 74.5 (3.7%). Under a not particularly likely scenario of US sanctions on the Russian sovereign debt, we would not expect the rouble exchange rate to move weaker than the lows set in its latest major drop (80.5, approximately 4.1% weaker than the current levels). It is more difficult to predict the behaviour of the rouble in a highly improbable scenario of an armed conflict on the territory of Ukraine, involving the risks of extremely harsh sanctions against the Russian Federation. However, even in this extreme scenario, we would not expect a much more significant depreciation of the exchange rate than in the previous scenario. The most likely rouble range at the end of Q2 2021 is 74.5-78.5.

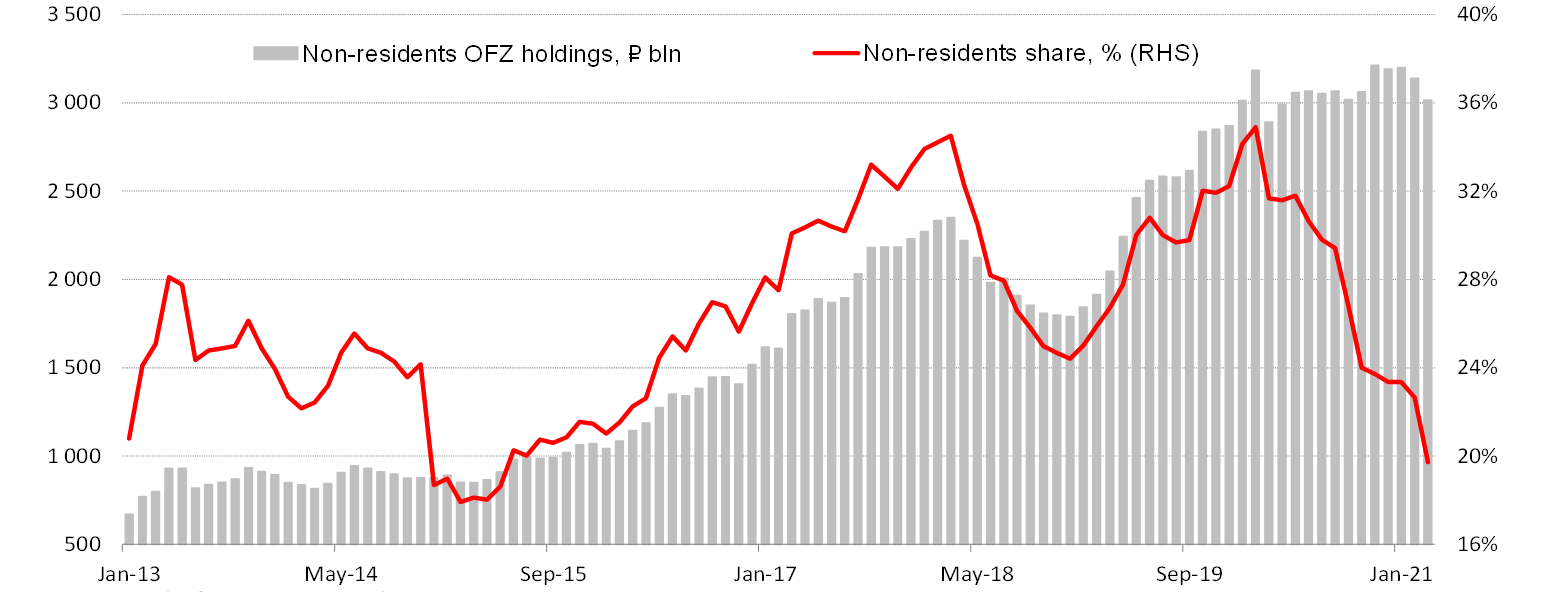

EXHIBIT 1: OFZ HOLDINGS BY NON-RESIDENT INVESTORS

Source: Bank of Russia, ITI Capital

Countdown to yet another round of sanctions

The White House spokeswoman announced at a press briefing on 7 April that a new round of US sanctions against Russia will be announced soon. (Similar predictions from CNN on 18 March did not materialize.) According to media reports, the new round of sanctions could include their extension to those officials who may have been involved in the attempted "interference" of Russia in the latest election campaign in the United States, individuals from the inner circle of Russian leaders, and companies participating in the completion of the construction of the Nord Stream 2 gas pipeline project. The impact of all such sanctions on Russia's sovereign assets will be very limited, in our opinion.

Paradoxically, the sharp increase in tensions in Eastern Ukraine reduces the likelihood of the US imposing extremely harsh sanctions against Russia - otherwise the White House would have no adequate further means of "containing" Russia’s actions in this and other regions. US measures against Nord Stream 2 remain the main trade and economic risk, as bilateral trade between the US and Russia is low (with the exception of increased purchases of Russian oil in recent years, which seem unlikely to be sanctioned in the near future) The impact of measures against Nord Stream 2 is really significant only for Gazprom (the main shareholder of the project) and its contractors.

Geopolitical risk premium is close to maximum

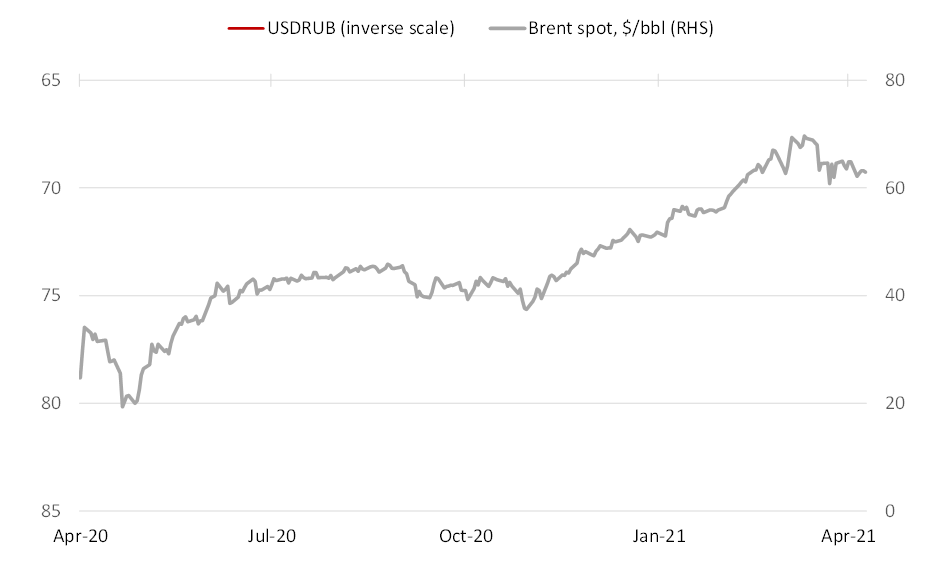

The weak performance of the rouble against the dollar in recent weeks (since mid-March) cannot be attributed merely to the oil price correction (by 9%): oil prices are still 68% higher than at the end of October (when the previous low for rouble was set). Compared to other liquid currencies of emerging economies, the rouble has a number of indisputable advantages: a highly professional team at the central bank which has seriously strengthened the regulator's reputation in recent years; persistent current account surpluses; extremely low level of public debt; a fairly successful start of the vaccination program and the rapid pace of the economy’s recovery to pre-crisis levels. The biggest challenge to macroeconomic stability remains the elevated inflation level, but the early start of the CBR tightening cycle and the expected further increases in interest rates should provide significant support for the rouble.

The geopolitical risk premium in OFZ yields also appears excessive. Even taking into account the deterioration of inflation forecasts and the prospects for further rate increases in the foreseeable future, as well as the volatility of the rouble exchange rate, the current OFZ prices clearly reflect the risk of severe sanctions, which, in theory, may involve a ban on purchases of new issues by US investors (which is not our base case scenario at this stage). In our opinion, even in the unlikely scenario of US sanctions against the domestic bond market, strong fundamentals of Russia's fiscal and monetary policy, as well as the “scarcity premium” in the price of “old” bond issues, will limit the potential for price reductions in currently outstanding OFZ bonds.

The faster pace of exit by non-resident investors from the OFZ market in recent weeks has been one of the main factors behind the downward pressure on the rouble. Outflows from non-residents’ accounts in March reached ₽123 bn, the highest since April 2020, while the share of foreign OFZ holdings dropped to 20%, the lowest in six years, according to the National Settlement Depository data. In April, further outflows were witnessed by the market (especially in recent days, over the escalation of tensions in Eastern Ukraine), pushing OFZ yields up by 25-30 bps. Against this backdrop, the 10-year benchmark yield (YTM 7.34%) climbed to the levels seen in late March 2020 when the market suffered the most serious shock from the COVID-19 pandemic. Local players, namely the largest state-owned banks, have helped avert a deeper slump in the rouble-denominated sovereign debt market. State-run banks have again become the main buyers of OFZ bonds, helping the finance ministry to implement its borrowing program. We believe that they will continue to support the market, keeping bond prices from further sharp declines even in the worst-case scenario (harsh sanctions). Meanwhile, the market is unlikely to be subject to additional pressure from the monetary policy in the near term. The short end of the OFZ curve has been pricing in much higher levels of the key rate (by 125-150 bps from the current level) than the latest scenario of the Bank of Russia (set to be updated following the 23 April meeting) envisaged.

As a result of this meeting, investors will be keenly awaiting the CBR's projections for policy rates (likely in the form of a range) and the current account balance. The latest current account estimates (for Q1 2021) were materially weaker than market consensus, including due to a sharper decline in value and volumes of hydrocarbon exports and a weaker investment account.

Rouble outlook for Q2 2021 worsened markedly

The combination of an unfavourable geopolitical backdrop, higher near-term risks for the oil market and a faster decline in the current account surplus point to a deterioration of the rouble’ outlook for this quarter. The main problem is the uncertainty regarding scope for improvement in the geopolitical situation around Eastern Ukraine. The recent statements by Russian officials suggest that tensions on the Russian-Ukrainian border are likely to persist in the coming weeks and months, at least until more certainty emerges about Ukraine's NATO membership prospects. So far, Ukraine's NATO membership prospects appeared both highly uncertain and distant, primarily because of Germany's lack of enthusiasm (this position was reiterated late last week). It is however difficult to be certain that this position will remain unchanged, especially in light of the forthcoming leadership change in Germany and the certain cooling in the German-Russian relations over the Navalny case. The situation may become even more complex in the near future if Russia recognizes the results of the 2014 “referendums” in the rebel-controlled parts of the Donetsk and Luhansk regions that expressed preference for self-rule and a union with Russia.

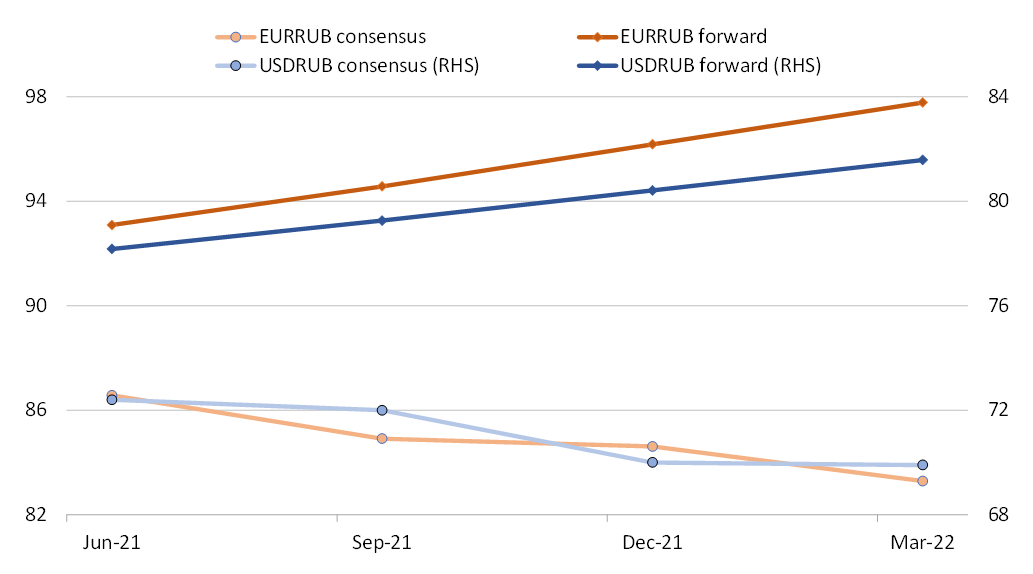

A comparison of market forecasts for the rouble against both the dollar and the euro (based on Bloomberg consensus forecasts) with corresponding forward rates shows that the consensus forecasts still do not fully reflect the higher geopolitical premium, including due to the situation in Eastern Ukraine. The forwards market is traditionally far less optimistic about the rouble. We currently see the scope for rouble appreciation until the end of the second quarter of 2021 to be much more modest than we assumed back in March (before geopolitical tensions escalated and the short-term outlook for oil prices deteriorated). The most likely range for the rouble exchange rate for mid-2021 looks now to be 74.5-78.5 (against EUR: 89.4-94.2, and against CNY: 11.46-12.07 respectively, based on the USDCNY consensus forecast of 6.5 for mid-year). That said, it is worth noting that the outlook for the USDCNY exchange rate in the coming months has become quite uncertain amid the growing signs of a possible slowdown in the Chinese economy.

EXHIBIT 2: USDRUB, EURRUB CONSENSUS FORECASTS AND FORWARDS

Source: Bloomberg

The rouble’s year-end projections against the main currencies will depend on a broad range of factors. Besides economic growth in Russia (which has been on a positive trend lately), in the USA, China and globally, the key impact will be made by oil prices, Russia's budget policy (including in respect of investment of some of the National Welfare Fund surpluses), as well as Bank of Russia’s reaction to these factors, including via further interest rate hikes, and the evolution of its macroeconomic forecasts. The President’s policy address to the Federal Assembly on 21 April and the CBR meeting on 23 April will be crucial in this respect (we are planning to issue updated forecasts for 2021 at the end of April). Besides this, we can predict even now that the rouble is still more likely to strengthen in H2 2021 than either remain at the current levels, or weaken.

EXHIBIT 3: USDRUB EXCHANGE RATE, SPOT OIL PRICE (BRENT)

Source: Bloomberg

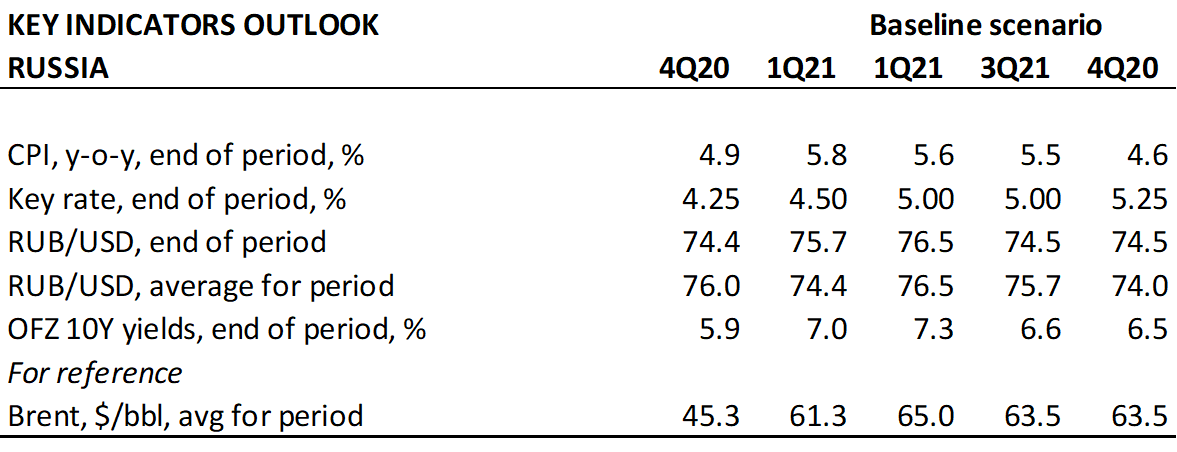

Source: Bloomberg, ITI Capital estimates