Company description

Credito Real is a leading specialty finance company in Mexico with a growing international presence (United States and Central America) with over 26 years of experience. It is highly recognized by its product offering, designed specifically for customers who are underserved by the traditional banking sector. Main products are payroll loans (53% of portfolio), non-revolving lines to fund working capital and investment activities, as well as leasing for SMEs, loans for used cars through strategic alliances with car dealers and internal salesforce and etc. Payroll lending revenues used to be nearly 80% of total revenues in the past with this declining to 43.2% in 4Q20, reflecting Credito Real’s acquisition of Instacredit and expansion into the SME segment. Personal loans are mainly granted to unionized state and federal public-sector employees, retirees and pensioners.

1. Our recommendations:

We believe Credito Real is a good choice in HY universe given its decent credit metrics and attractive bond’s yields.

2. Ownership:

The company has been trading on the Mexico stock exchange since 2012 with the current market cap of $204 mln. Founding members are founders of Mabe, a leading manufacturer in the Americas, who used to own BITAL bank, sold in the 1990’s to HSBC. Free-float makes up almost 70% of total stock.

3. Investment case (Yield curve, spread analysis):

-443.png)

Source: Bloomberg, ITI Capital

To the date Credito Real has 4 dollar-denominated issues outstanding (incl. perp) and one issue denominated in euro (CREAL 27, YTM 6%). We particularly like CREAL 2026 (YTM 7.77%) and CREAL 28 (YTM 8%) that trade with almost 5-7% upside to its 52-week high and look underpriced. CREAL 27 (EUR) also looks attractive when swapped into dollar yield.

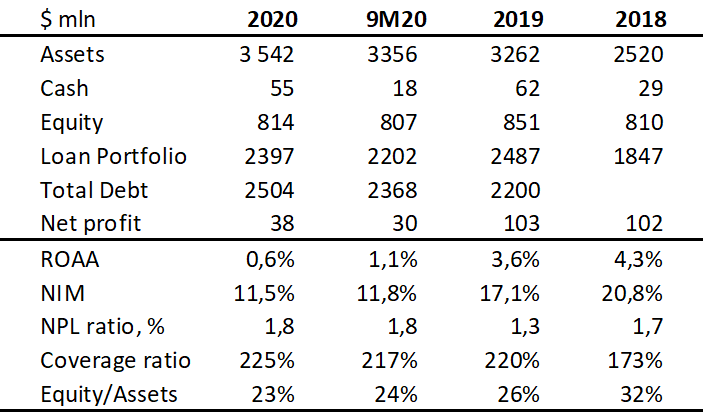

4. Financial overview:

Credito Real recently posted mixed FY2020 IFRS financials. Earnings, though gradually recovering, still look weaker compared to 2019. Although bank cut relief programmes amid weaker demand, they still comprise more than 5% of the total portfolio as of 4Q20 (8.6% in 1H20). On the positive side, despite implementation of stricter origination standards in 2020 (focusing on active clients with solid credit records, AAA credit profiles or salaried employees), the total portfolio recorded a 9% quarterly growth (on the annual basis it declined by almost 4%) mainly supported by performance in payroll and auto segments. The reported NPLs were stable q/q at 1.8%, yet provisioning increased to 4.3%.

Margins were still under pressure on the back of relief programmes, however it was partly offset by lower funding costs (cost of funds stood at 8.9% in 2020 vs 12.8% in 2019). Net income more than halved y-o-y due to provisions growth. Improved origination is likely to support margins going forward.

In January 2021, CREAL issued a $500 mln bond due 2028 with an 8% coupon to repay $177 mln of the CREAL 23 issue. The company also raised an $100 mln 7-yr ESG loan from DFC (International Development Finance Corporation), with proceeds to be used to promote women-led SME funding. CREAL guided a 10% total portfolio growth in 2021, with consolidated NPLs between 2% and 3%.

Selected IFRS financials of Credito Real group

Source: company data

5. Positive factors/opportunities:

- Stable asset quality despite tough environment

- Strong market positions and high brand awareness

- Diversified product mix

- Proved ability to roll over

6. Key risks:

- COVID-19 effect on asset quality still to materialize

- Further pressure on profitability because of costs inflation and provisions

- High demand for refinancing given that almost 30% of total indebtedness is ST

-443.png)