Company description

Petrobras is a state-owned Brazilian petroleum corporation, the largest publicly traded on Brazil SE Bovespa and the largest taxpayer in Brazil, founded in 1953.

Petrobras is the largest petroleum company in Latin America (LATAM) and the world’s seventh-largest by production (2 mbpd). Petrobras made it to the top-20 by total revenue for 2020. Petrobras is one of the most influential companies in the oil and gas industry, ranking as the 70th-largest in the 2020 Global Fortune 500.

Petrobras controls significant oil and energy assets in 16 countries in Africa, North America, South America, Europe, and Asia. It is known worldwide for its ultra-deep water oil exploration technology.

Petrobras had its best operating performance in 2020, overcoming considerable challenges from the pandemic, contraction in global demand for fuels and low prices. The company reached annual production records of 2.28 mbpd of oil and LNG and 2.84 mboed of total production. Previous production records had been reached in 2015, of 2.23 mboed and 2.79 mboed, respectively.

1. Our recommendations:

We believe Petrobras bonds will outperform in the near future recovering from the recent sell-off caused by surprising management changes. We have a BUY recommendation on notes with medium duration.

2. Ownership:

The Brazilian government directly owns 54% of Petrobras' common shares with voting rights, while the Brazilian Development Bank and Brazil's Sovereign Wealth Fund (Fundo Soberano) each controls 5%, bringing the state's direct and indirect ownership to 64%. Petrobras’s free-float is 25%.

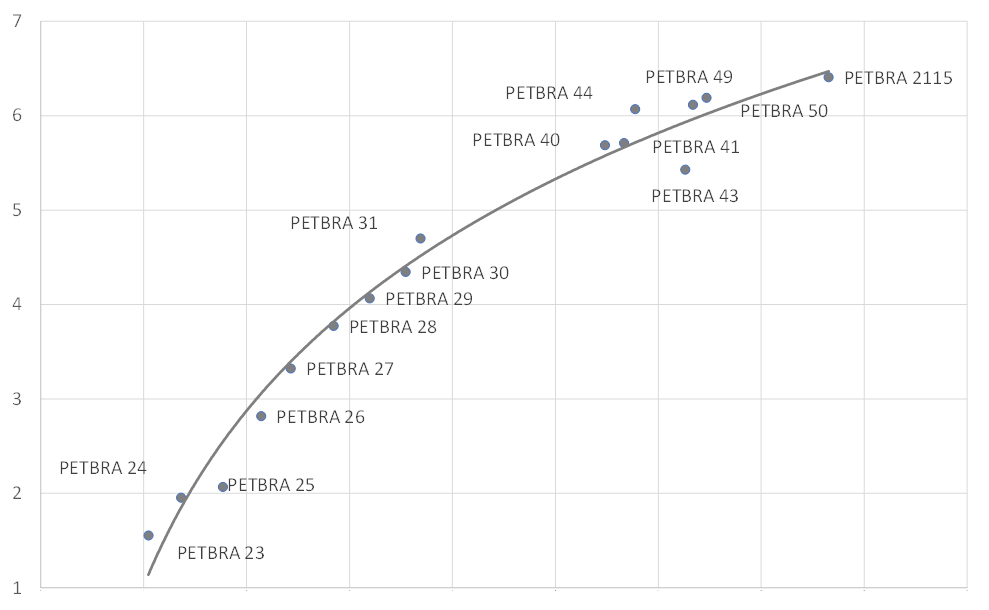

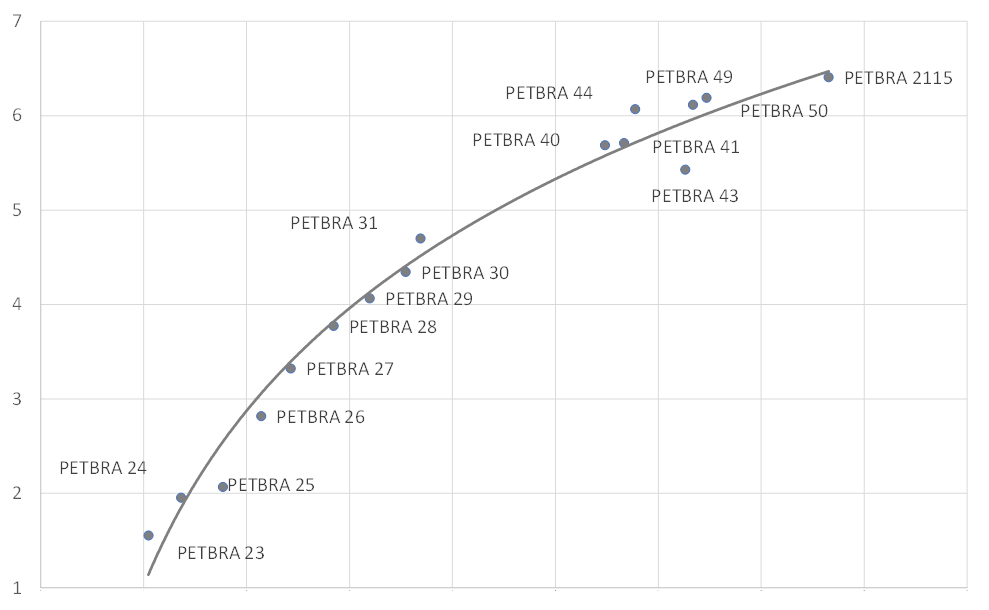

3. Investment case (yield curve, spread analysis):

Source: Bloomberg, ITI Capital

Price upside: Petrobras belly bond spreads to Pemex $ similar maturity issues are 100 bps off their historical average. We believe belly and longer end issues are the most attractive amongst Brazil $ issues with medium-term price upside of up to 10%.

Petrobras has many multi-currency issues trading with the total amount exceeding $30 bln. During the past weeks, the bond was subject to material pressure due to the corporate conflict (substitution of CEO) and lagged behind despite favourable oil market conditions. We assume current price levels are undervalued and expect their recovery in the near term. Out of majority dollar-denominated notes we prefer PETBRA 31 as the best pick in terms of spread and liquidity.

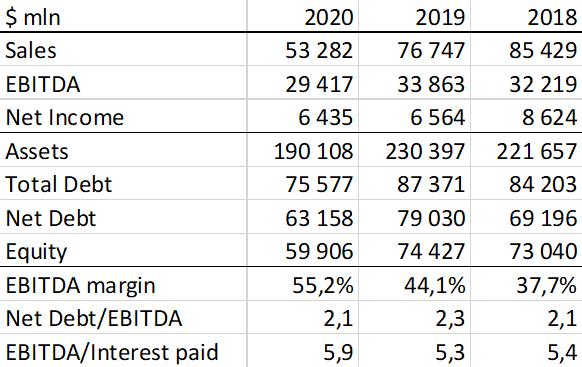

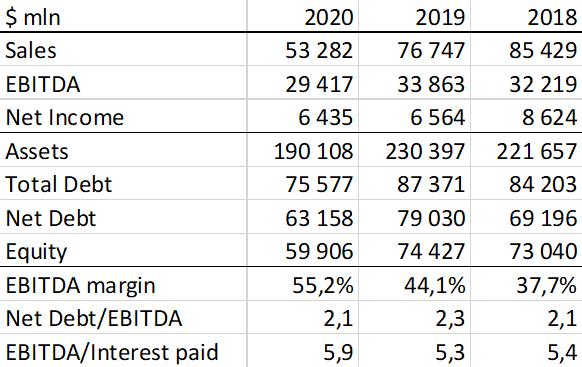

4. Financial overview:

In late February 2021 Petrobras posted superb financial results for 2020 despite a severe environment. Although total sales declined by almost 30% due to oil price drop, the company managed to post notable margins growth. EBITDA margin reached 55% vs 44% in 2019 thanks to efficient cost control. The bottom line came out almost the same as a year earlier.

Oil and oil & gas production reached all-time highs at 2.28 mbpd and 2.84 mboed, respectively, while most of global competitors reported output drop. Oil and fuel oil exports also reached all-time highs. Crude oil sales increased 33%.

Whereas oil prices plunged 35%, operational cash flow (CFFO) went up 13% and free cash flow (FCF) advanced 20%. The strong cash flow allowed the company to continue to deleverage the balance sheet. Total debt was reduced by $11.6 mln to $75.5 bln, from $87.1 bln as of December 31, 2019. Debt reduction and lower costs of debt contributed to a substantial decline in interest burden. (net debt/EBITDA in 2020 stood at 2,1x). The interest paid to the barrel of oil produced ratio was $3.8 in 2020 against $7.8 in 2015 – a 51% drop – and the average of $7.7 for 2015-2019.

The company is taking steps to optimize inventory management. The inventory was reduced, reaching the lowest level since 2011, and the inventory of oil declined by 8 million barrels in a move to eliminate inefficiency and to reallocate capital to better uses.

Selected IFRS financials of Petrobras group

Source: company data

5. Positive factors/opportunities:

- Strong oil prices support operating cash flow and form a liquidity cushion

- Strong market positions. The company enjoys a monopoly on refining importation of refined products in Brazil

- Proven state support in risk scenario

- Certain access to refinancing sources, decent financial metrics

- Comfortable breakeven levels (about $27 Brent) compared to global peers

- Despite the second wave of growth in the number of COVID-19 cases in Brazil, the company manages to keep operation and maintenance activities

- Temporary federal tax cuts on diesel

6. Key risks:

- Recent government interference in fuel pricing policies and other non-market friendly corporate policies

- Higher financial and lifting costs from lower oil products prices

- Government export pricing policy regularly has a negative effect on Petrobras

- Involvement in corruption scandals in earlier years