CBR policy rate on hold as inflation accelerated

Our baseline forecast - no change in December

On 18 December, the Bank of Russia will hold its final monetary policy meeting in 2020. The balance of factors determining the regulator's decision has undergone some changes since the previous meeting (on 23 October), our baseline forecast now assumes that the key rate will be left unchanged. The market consensus indicates that such a decision is highly likely, so for the third meeting in a row the key rate will stay at 4.25%, even though the picture was much more nuanced only a month ago. The main argument in favour of this forecast is the sharp spike in inflationary pressures since the beginning of November. Rising inflation expectations of the households (to 10.1% year-on-year in November 2021), which may further affect consumer behaviour, are also notable. Meanwhile, the CBR officials’ comments made over the past weeks suggest that they do not rule out a 25bps cut in December.

Reasons in favour of keeping rates on hold

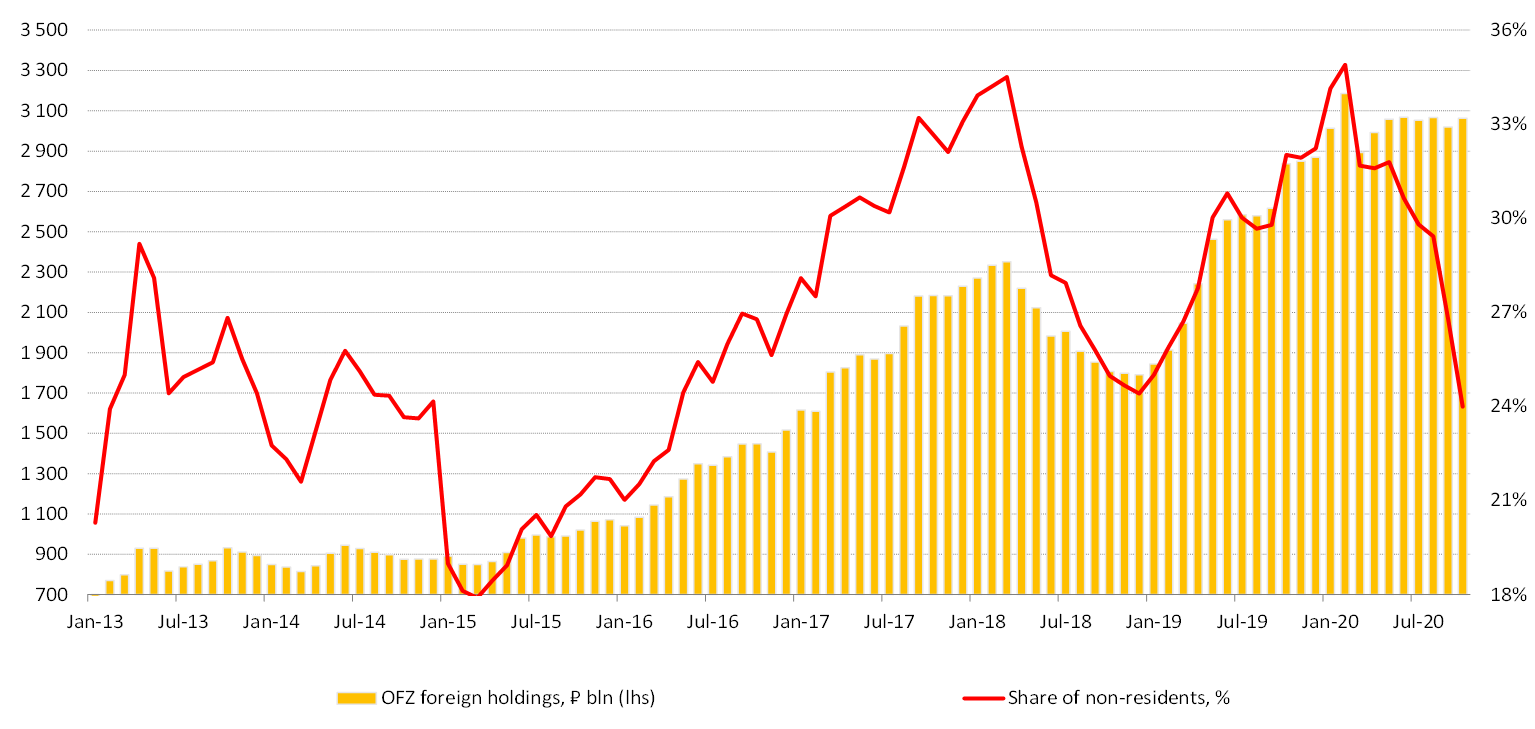

- Inflationary pressures have surged since November. Over the past five weeks, minimal price increases (of less than 0.2% per week) were recorded only once, according to weekly inflation estimates. Headline inflation in Russia advanced to nearly 4.6% yoy as of 7 December from 4.4% at the end of November, according to the statistics office data. If this trend continues until the end of the year, 2020 CPI could be as high as 4.9-5.0%, much higher than the Central Bank's earlier estimates. The Economy Ministry's latest forecast (4.6-4.8%) seems more realistic to us. At the same time, the real rate (taking into account accumulated inflation) in Russia has already entered the negative territory, for the first time in four years. Previously, Central Bank officials warned against negative real rates (typically estimated on the basis of projected inflation).

Real interest rates by country (adjusted for accumulated inflation), as of 1 December 2020

Source: Bloomberg, ITI Capital estimate

- As was the case in the spring, food prices are again responsible for accelerating the pace of inflation. In most cases (except for imports), food prices growth was not visibly affected by the pass through effect from the weaker rouble. This can partly (for commodities produced from exported raw materials) reflect a global trend. The government has already taken note of the food prices spike and is considering measures to stabilise prices of key products, including via introduction of export duties and setting caps for wholesale prices.

- The CBR governor expects 2020 inflation to reach 4.5% yoy (the initial estimate was 3.9-4.2%). CPI is projected to peak at 5% (or less) in February 2021, driven by base effects, and decline towards target levels thereafter.

- CBR officials have expressed concern about a possible bubble in the real estate market. Demand from households surged this year driven by increased availability of mortgages, as prices decreased due to both the stimulus programme and the monetary policy easing amid declining lending rates.

- Most of emerging markets’ central banks have already reached the trough of the current monetary easing cycles and are no longer cutting rates. Thus, the central banks of Brazil, India, Ukraine and Uzbekistan kept interest rates unchanged at their latest policy meetings.

- Global uncertainty and the resulting volatility still persist, which is taken into account by the monetary authorities. In a recent interview, Elvira Nabiullina noted that the regulator, when deciding on the key rate, was customarily mindful of increased geopolitical risks, primarily associated with the change of the U.S. administration.

What may still prompt the Central Bank to unexpectedly cut the key rate?

- The regulator still sees no risk of a rapid acceleration of inflation in the foreseeable future. Disinflationary risks are expected to prevail in early 2021 primarily driven by weak consumer demand, so inflation is likely to fall below the 4% target again. At the same time, the Bank of Russia said on many occasions that it takes into account projected, rather than accumulated, inflation when deciding how to adjust monetary policy.

- Stabilization of the rouble. Since the beginning of December, the rouble has strengthened against the dollar by 4.6%, which will also help contain inflation in the longer term.

- Sustained weakness of the economy driven by restrictions introduced during the first wave of the pandemic and expectations of negative effects from the second wave. The CBR expects the Russian economy to recover to pre-crisis levels by the first half of 2022 at the earliest.

- The balance of external risks looks stable for now, in absence of rising geopolitical tensions.

OFZ market

Since the latest CBR’s meeting on 23 October, the OFZ market has seen mixed dynamics but eventually edged higher. As global demand for risk recovered following the US presidential election, investors have become increasingly interested in higher-yielding assets. The Russian rouble-denominated government bonds were not an exception. Against this backdrop, prices for longer-dated issues rebounded by 3.5-4% from their local lows. The short end of the curve lagged, staying at the levels seen at the end of October, which resulted in a flatter curve.

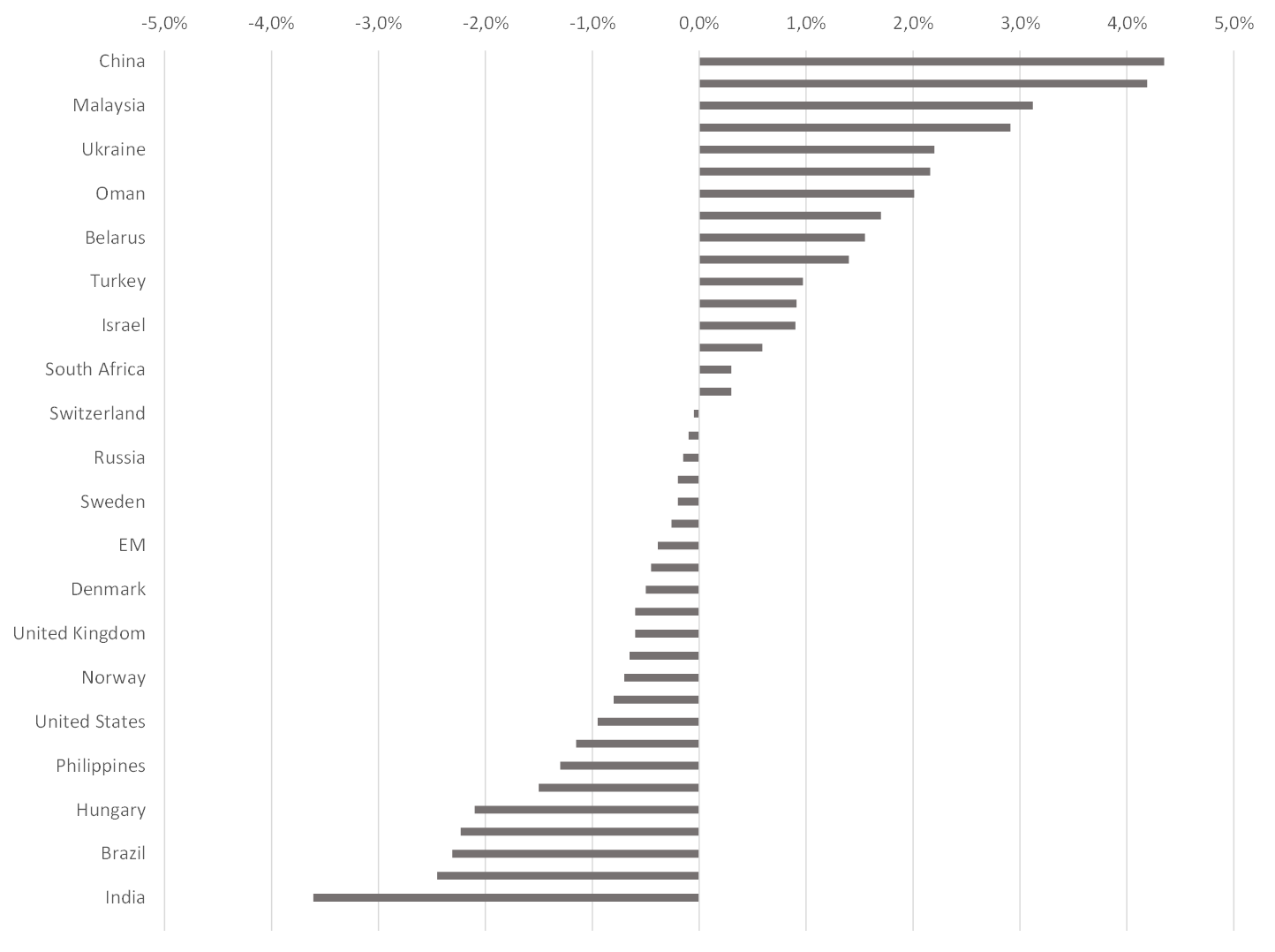

In November, amid the favourable external backdrop the Finance Ministry successfully placed two issues of sovereign Eurobonds for €0.75 bn and €1.25 bn with 7- and 12-years maturity, respectively. The ministry also fulfilled its annual OFZ borrowing plan ahead of schedule, placing ₽814.6 bln in November alone. The country’s internal debt stock rose by ₽2.3 trn in just two months in Q420. OFZ-PKs (Variable Coupon Federal Bonds) accounted for the bulk of the placements (88.6%), with state banks being the major buyers. Non-residents’ share in the OFZ market has declined by 0.7% to 22.6% since the end of October.

Non-resident OFZ holdings

Source: Bank of Russia

Since the beginning of December, OFZ prices have been fluctuating within a narrow range, effectively ignoring the rouble’s strengthening. Growing inflation as well as projected excessive supply of "classical" OFZs in the primary market starting from 2021 has already influenced investors’ demand. Furthermore, investors are aware that the room for further monetary policy easing is very limited. Against this backdrop, price upside for OFZ looks limited, and this is unlikely to change until the year-end. We think that even in the unlikely event of a rate cut to 4% this week the balance of fundamentals in this market would change.

FX-market and outlook

The rouble has advanced 4.6% against the dollar since the beginning of December, behind only Brazil (6%) and Colombia (4.7%). This appreciation was driven by higher oil prices buoyed by the new OPEC+ agreement, positive sentiment in major markets ahead of a new stimulus package in the US, and the approvals of various vaccines.

The stronger rouble might indeed support the anti-inflationary efforts of the Russian authorities, but only marginally and with a certain lag. CBR experts estimate the pass through effect of rouble depreciation on inflation within 10% (we believe the mirror impact on inflation of a stronger rouble would be even weaker). The CBR will find it difficult to rely on the rouble’s appreciation as an effective anti-inflationary tool due to further contraction of the imported goods’ share (especially for food products) in the consumer basket amid the weaker rouble, as well as due to seasonal factors – retail chains will likely try to avoid material prices cuts at the end of the year, during the high consumption season.

The rouble’s exchange rate in December-January is also subject to seasonal changes in the rouble liquidity, primarily driven by uneven budget spending at the end of the year, as well as the long New Year holidays. The weakening of the rouble typical for the last ten days of December may this time be offset by a further inflow of non-residents' funds and a drop in FX-purchases by households for foreign trips. Given the seasonal factors, we believe that the risk of some weakening of the rouble in the second half of December is somewhat higher than the prospects of its strengthening.

The last ten days of January typically see a sustained strengthening of the rouble, driven by stronger current account surplus. This time around, the impact of the capital account on the rouble may be far greater than that of the current account, since investors are likely to focus on the first steps of the new US administration, including its policy toward Russia. If fears of a significant increase in US sanctions pressure on Russia do not materialise (in line with our own expectations), the rouble performance in the first half of next year will largely reflect progress toward lower inflation and the associated interest rates reduction, as well as increased non-resident interest in the Russian assets.

The key domestic political factor driving the rouble's exchange rate in the third quarter of 2021 is likely to be the preparation and conduct of parliamentary elections in Russia in September 2021. Measures to improve the welfare of the population traditionally taken ahead of elections may well coincide with the Kremlin’s harder foreign policy tone, which could result in renewed confrontation between Russia and the West, especially the US. In that case, the usual weakening of the rouble in Q3 could start earlier or be more substantial. In any case, our year-end rouble forecast in the baseline scenario (₽72/$) remains more upbeat than the current market consensus.