Russia’s interim dividends: perfect New Year’s gifts

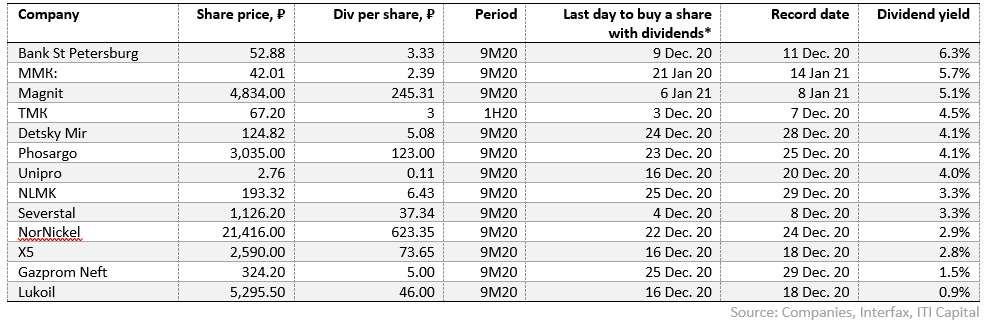

The most attractive dividend ideas with cut-off dates in December traditionally include steel and mining stocks (NLMK, Severstal, MMK, TMK, Phosagro and Norilsk Nickel), to which were added retail stocks (X5, Magnit and Detsky Mir). The average yield stand at 4%. We may also expect positive surprises from Rushydro (8%) and Sovkomflot (7%) in 2020.

Based on our dividend payments’ expectations, our year-end forecast for the USDRUB is ₽73/$ and forecast for Brent if $50/bbl. The risk premium for the rouble at current oil prices is 10-11%, which is also reflected in the Russian stocks. We therefore assume that sanctions risks are unlikely to materialize this year. Out year-end targets for RTS and MoEx are 1,400 pt and 3,370 pt respectively.

Attractive interim dividend yield of 3-5% Interim dividend payments for 9M20 may exceed ₽350 bln, or $4.8 bln. The bulk of payments are scheduled for January with most of the register closing dates set for the last week of December. The average yield stands at 4%. Most, or 76%, of the payments, account for exporters, mainly metal and mining companies.

Year-End: targets for RTS and MOEX indices are 1415 pt and 3370 pt respectively. Against the backdrop of massive layoffs and dividend cuts around the world, the Russian market which is seen fundamentally undervalued remains highly attractive in terms of offered dividends. In contrast to 2019, Russia is one of the most oversold stock markets with a growth potential of 8-10% for the rest of the year, target for RTS is 1,400 pt and 3,370 pt on the Moex index.

Positive impact on the rouble and a year-end target If we take into account all payments made and to be made to shareholders this year (according to the record date), including as interim payments for 2019, annual and interim payments for 2020, they will total a record of ₽3.5 trln ($50 bln), including ₽3.15 trln of suspended annual, interim payments for 2019 and late payments from Sberbank and Transneft. As part of the interim payments for 2020, we anticipate massive FX-sales, which are estimated to reach $1.2 bln for dividend payments in roubles, as is traditionally the case with tax and dividend payments. FX-buying is expected to be made as part of the rouble-to-dollar conversion for payments to foreign funds and receipts holders, which could reach $0.8 bln. In contrast to the interim and annual payments for 2019, the overall impact on the rouble could be positive and provide further support amid demand for risk until the end of the year, particularly in terms of export currencies and undervalued commodity companies.

Year-end rouble outlook

Our year-end forecast for the USDRUB is ₽73/$, our forecast for Brent is $50/bbl. Regression analysis suggests a significant short-term gap between the rouble and the oil, and, unlike the bonds, this is reflected in the performance of the Russian stocks in both local and hard currencies. Although all assets face sanctions risks, they are unlikely to materialize this year.

The interbank rates suggest that the FX-liquidity conditions are extremely favourable, and traditional pressure from external debt payments will be limited, since these payments will amount to just over $1 bln based of net repayments of actual corporate debt, since intra-group loans could reach a record of 60% in December, according to the Central Bank's data published on its website.

This is the highest level of monthly loans since year-to-date. Payments from the banking sector could be just over $0.5 bln, total payments could reach $1.6 bln.

If intra-group payments are excluded, net payments in the fourth quarter of 2020 could reach $21.6 bln, of which 60% are due in December (a 31% growth yoy) and $11.8 bln are due in the first quarter of 2021 (a 3% growth yoy). Russia's external debt has fallen by $30.3 bln this year, mainly due to lower debt of government agencies and other sectors following a currency revaluation, according to the Central Bank’s data.

Short-term growth drivers

Metal and mining

Growth drivers for all three metal producers Higher demand for steel products in Q3 was driven by a recovery after business restrictions were lifted in the previous quarter. NLMK, Severstal and MMK’s strong 3Q financial results were driven by higher steel prices. Implementation of infrastructure projects in China approved in 2020 will increase steel consumption by 23 mln tonnes, which should drive up steel prices in Q420 and 2021. Russian steel producers could also benefit from an attractive external climate due to lower production costs amid weaker rouble. Accumulated demand from the construction industry and state stimulus package contribute to a favourable environment and should accelerate sales of NLMK, Severstal and the MMK Group in Q4.

Severstal

Severstal’s BOD recommended a dividend of ₽37.34/share for 3Q20 (₽15.44/share for 2Q20). The record date to receive dividends is December 8, 2020.

NLMK

NLMK's BOD recommended a dividend of ₽6.43/share for 3Q20 (vs. ₽4.75/share for 2Q20). The record date is December 19, 2020.

ММК:

MMK's BOD recommended a dividend of ₽2.4/share for 9M20 (vs. ₽0.6/share for 2Q20). The record date is January 14, 2021

It should be noted that the exclusion of a stock from MSCI Russia is due on 30 November, which could lead to an outflow of investors' funds. However, the company plans to return to the MSCI index. MSCI will conduct a Q&A session with investors and analysts on December 9. Traditionally, such events create a positive background.

Norilsk Nickel

Norilsk Nickel’s BOD recommended a dividend of ₽623.35/share for 9M20. The record date is December 24, 2020.

Recent comments made by the regulators on the causes of the accidental spill may speed up the court hearings over the company's appeal against a ₽148 bln fine. The first hearing is due in the third decade of November. We believe the fines have already been price in and reflected in expected dividend payments. From this point of view, the risk from legal proceedings is rather positive.

The company will hold an Investor Day on December 1. Traditionally, such events create a positive background.

ТМК

TMK’s BOD recommended an interim dividend of ₽3/share. The record date to receive dividends is December 3.

The company expects that a seasonal recovery in demand for OCTG pipes from the Russian oil and gas companies in 4Q20 will drive up total supplies of the Russian Division after the traditionally weak 3Q. Industrial pipe consumption in the European market is expected to recover further gradually, provided that the current market situation does not deteriorate.

On the negative side, the stock’s liquidity dropped sharply following the buyback.

Phosargo

Phosagro’s BOD recommended a dividend of ₽123/share for 3Q20 (+3.7 times growth qoq, +2.6 times growth yoy). The last day of purchase of securities for receiving dividends is 23 December 2020. The dividend amount may be more than 100% of the company's adjusted net profit for 3K20 according to Interfax consensus and more than 100% of FCF.

Higher price for phosphate fertilisers in the US following a decision to ban Russian and Moroccan phosphate fertilizers producers from the US market. The U.S. Commerce Department is investigating whether phosphate fertilizers from Morocco and Russia are receiving unfair government subsidies. US farmers unhappy with the situation may push the watchdog to revise the decision. If the ban is lifted, Phosagro will be able to maintain its positions in new destinations to which it has managed to redirect its supplies and benefit from trading in the US market. The company also forecasts strong 4Q20 results.

Overall, as prices for agricultural products rise in Russia and globally, Russia’s agricultural producers are planning to ramp up production and purchase fertilisers at higher prices. Wheat prices in Russia have hit record highs exceeding ₽17,700 per tonne, a year ago they were 1.5 times lower.

Sunflower prices have also risen sharply due to poor harvest. Moreover, sunflower oil prices rose by $15, to $985 per tonne (FOB) in the global market, driven by higher prices for soybean and palm oil, which also led to higher sunflower prices.

Gazprom Neft

Gazprom Neft’s BOD recommended a dividend of ₽5/share for 9M20. The record date is December 29, 2020 (T-2 - 25 December). Total payments may reach ₽23.7 bln (65% of net profit for 9M20).

The company has been paying record dividends in recent years. Dividends for 2019 amounted to ₽37,96/ord (including dividends paid for the six months of 2019 in the amount of ₽18,14/ord). The total amount of dividends paid for 2019 was ₽179.979 bln, which corresponds to 45% of IFRS net profit.

Oil and gas sector stocks may benefit from a recovery in oil prices due to positive results of coronavirus vaccine tests.

Lukoil

Lukoil’s BOD recommended a dividend of ₽46/share for 9M20. The record date is December 18, 2020. (T-2 - 16 December).

A total of ₽31.9 bln (100% of the adjusted cash flow) will be used to pay interim dividends, in line with Lukoil's new dividend policy, which says that at least 100% of the adjusted free cash flow under IFRS for the six-month period be used for dividends payout.

Retail

Detsky Mir

Detsky Mir’s BOD recommended a dividends of ₽5.08/share for 9M20, which corresponds to a 4.2% yield. The record date is December 28, 2020

Detsky Mir traditionally pays high dividends. Detsky Mir’s management will recommend to use all net profit under RAS for 2020 interim dividends payout, therefore total payments for the year may increase to ₽7.8 bln. (₽10.6/share, 8.8% yield).

We believe that the company's stocks are attractive due to its business flexibility in terms of the pandemic-linked restrictions, a strong strategy involving aggressive regional expansion and squeezing out competitors, a marketplace development, and discounts on retail space rental rates for the rest of 2020.

Magnit

Magnit's BOD recommended a dividend of 245.31/share for 9M20, which corresponds to a 5% yield. The record date is January 8, 2021

The dividend was significantly higher than the recommendation for 9M19 when the company paid ₽147.19/share, which is more than an annual dividend of ₽157/share for 2019.

X5

X5 management is committed to increasing dividends for 2020, payouts may grow by 50% yoy, i.e. to ₽45 bln or ₽165.7/GDR, which corresponds to a 6% yield. X5's net profit for 9M20 advanced by 45.3% yoy, to ₽36.4 bln, which suggests that the company is implementing its plans amid a traditionally a high 4Q season.

The Supervisory Board of X5 Retail Group recommended a dividend of ₽73.645/GDR for 9M20. The record date is December 19, 2020.

The company is the most prominent representative of the food retail sector (sees as a safe harbour), which is most relevant amid uncertainty due to pandemic-linked restrictions.

The company is focused on a new strategy, which involves retaining leadership positions in the market, upgrading old-style Pyaterochka stores, transformation of the Karusel chain into Perekrestok, online sales, opening a Chizhik discounter, which is the most well-thought-out decision amid declining real incomes of the population.

Other sectors

Unipro

Unipro’s BOD recommended a dividend of ₽0.11/share for 9M20. The record date is December 20, 2020

Potential drivers for the stock include:

- Planned launch of Unit 3 of Berezovskaya state district power station in 1H21;

- Strategy update in March 2021 and

- Extension of the current dividend policy, which implies a payout of ₽20 bln per year;

- Therefore, dividend payout may total ₽20 bln, or ₽0.317/share for 2021, implying a 11.6% dividend yield.

Bank Saint Petersburg

The Supervisory Board of Bank St. Petersburg recommended a dividend of ₽3.33/ord (7.4% yield) and ₽0.11 /pref for 9M20. The record date is December 11, 2020.

The driver for the company’s stock is strengthening of the rouble amid higher oil prices after positive news about vaccines again COVID-19.

Possible surprises by the end of 2020

Sovcomflot

Sovcomflot retains its plans to pay $225 mln in dividends for 2020 (up from $97 mln for 2019), which corresponds to a 9% yield. To date, the BOD has not issued a dividend recommendation.

Rushydro

Rushydro plans to pay at least ₽25 bln in dividends annually in the medium term. Therefore, the dividends for 2020 (due in 2021) may amount to ₽0,057/share(a 60% growth yoy), which corresponds to a 7% yield.

The new dividend policy adopted in 2019 implies payments of 50% of IFRS net profit for the year, but not less than the average for the previous three years, which is ₽14.3 bln (₽0.032/share), according to our calculations.