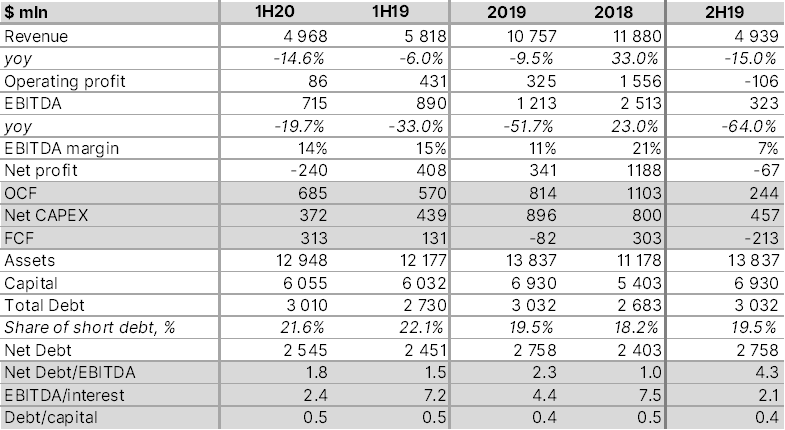

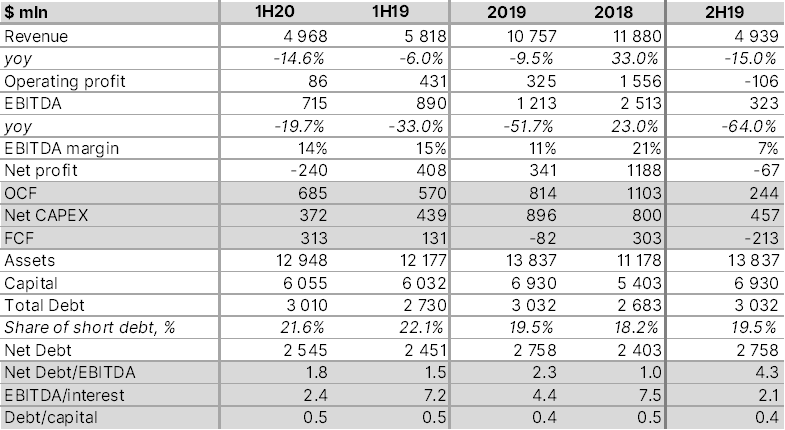

Ukrainian metals and mining holding Metinvest has published its consolidated IFRS accounts for the first six months of 2020. Naturally figures reflected the negative trend driven by the Covid-19 pandemic. However, we note some positive changes that add strength to the company's credit profile (especially against the 2H19), even despite the unprecedented operating environment. We summarized our comments below.

- In 1H 2020, Metinvest’s consolidated revenues decreased by 15% yoy to $4,968 mln. The decrease in the turnover was primarily driven by the negative price environment in several strategic markets and the 4% yoy appreciation of the hryvnia against the dollar. When compared to the 2H19 sales for January-June 2020 have even recorded moderate growth (on a half year basis), which however was offset by the national currency's depreciation (the hryvnia's average rate fell by almost 5%). Hard currency still accounts for the bulk of the company's revenue, 82% in 1H20.

- The consolidated revenues’s decline yoy was largely driven by a decrease in the Metallurgical segment’s sales (-18% yoy), while the Mining division’s sales were almost flat. In the latter case, supplies redirection to other markets played an important role. In particular, Metinvest benefited from the earlier (as compared to the EU) economic recovery in China, boosting sales in this region (46% of the division's 1H20 turnover, +32 pp year-on-year).

- Despite the drop in sales, Metinvest has maintained its operating margin almost at the same level. 1H20 EBITDA margin was 14%, slightly down yoy. The company recorded bigger changes in 1H20 earnings as compared to 2H19. 1H20 EBITDA was more than twice than in 2H19. It should be noted that the metallurgical segment's efficiency improved significantly, primarily due to cost savings. The Mining Division’s contribution to consolidated EBITDA decreased due to greater share in low-margin products in the sales breakdown against the backdrop of the pandemic.

- The group's net profit for the reporting period was negative (-$240 mln), the second time the company posts the negative figure. Losses from FX-operations have contributed to the poor performance.

- Free cash flow turned positive ($313 mln) due to a working capital release and a decrease in capital expenditures. This allowed Metinvest to improve its liquidity, the cash balance almost doubled since January 2020.

- Total debt of Metinvest in 1H20 was $3.01 bln, almost unchanged since the beginning of the year. Net debt decreased by almost 8% due to cash balance growth. Loans repayment schedule still looks very comfortable - over 80% of the portfolio should be refinanced in 2023 or later.

- The group's net leverage, calculated as the net debt to annualised EBITDA ratio, grew to 1.8x (1.5x a year earlier), which is a more comfortable level for the company.

- Metinvest public debt consists of four issues of USD-denominated bonds and one Euro-denominated bond issue. After a strong slump in March, the bonds have gradually recovered to their previous levels, their dollar yields stand at 6.3-8% depending on duration. The news about good financial results have contributed to the price growth. Meanwhile, we expect spreads to narrow further and recommend that risk-tolerant investors should pay attention to the bonds.

Metinvest’s key financial results, IFRS

Sources: Metinvest, ITI Capital estimates