Rouble on the swings of geopolitics: hold on tight

A long-awaited rouble recovery, anticipated to occur in the second half of August, after large-scale conversions of dividend payments into FX, did not materialise. Moreover, the rouble even weakened to nearly ₽76/$, the level last seen in the third week of April, during the peak of the pandemic (when the Russian oil prices approached their lowest levels this century, below $17/bbl). The rouble’s poor streak in August (almost a tradition now) was due to geopolitical turbulence: a spike in domestic political tensions in neighbouring Belarus was followed by the Russian president’s statement indicating Moscow’s readiness to intervene on behalf of the current authorities in Minsk. The tragic incident with Alexey Navalny on his return flight to Moscow from a campaign trip in Siberia, weighed on investor sentiment, especially after the German experts concluded that Navalny was likely poisoned with a weapons grade chemical nerve agent. These events were accompanied by harsh statements from European and U.S. politicians about the scope for further sanctions against Russia.

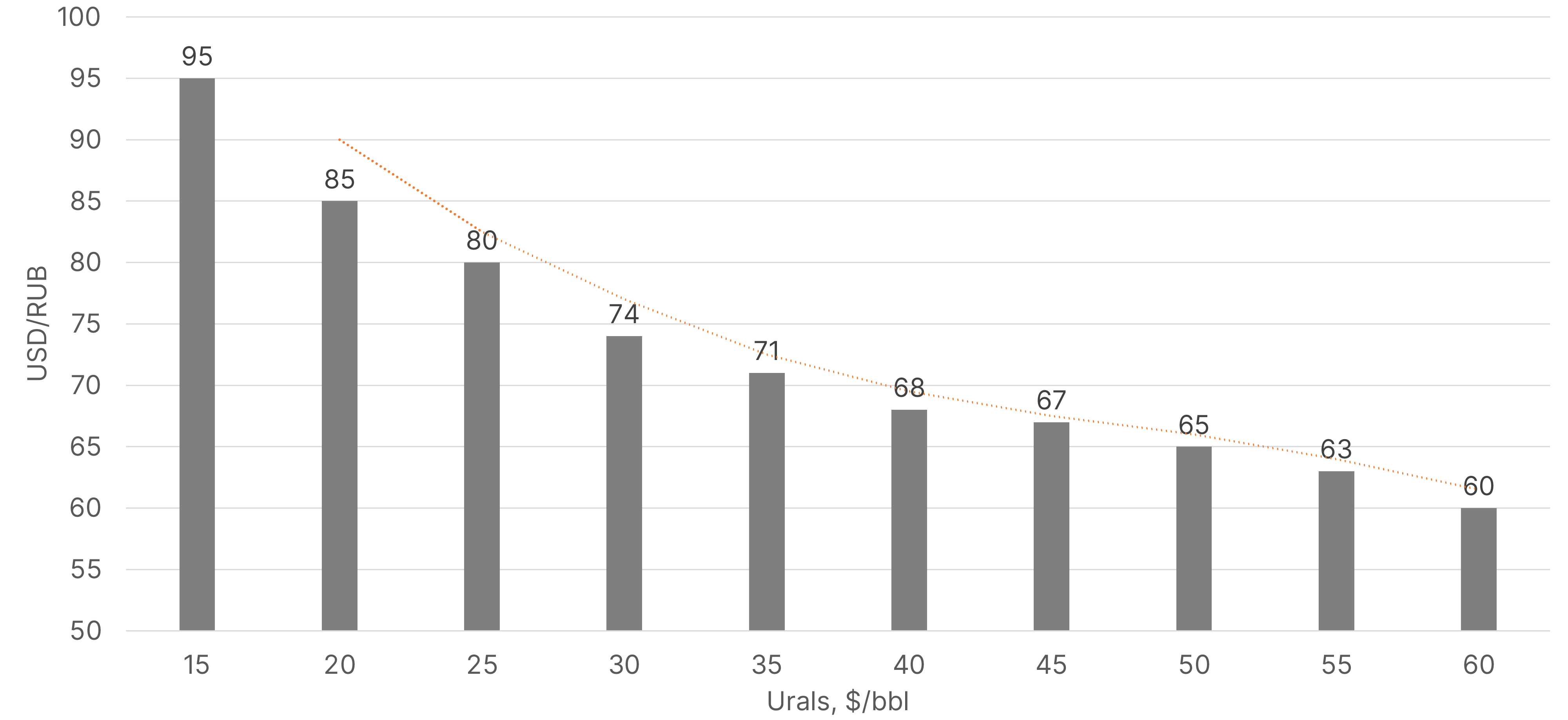

Rouble fair value estimates and oil prices

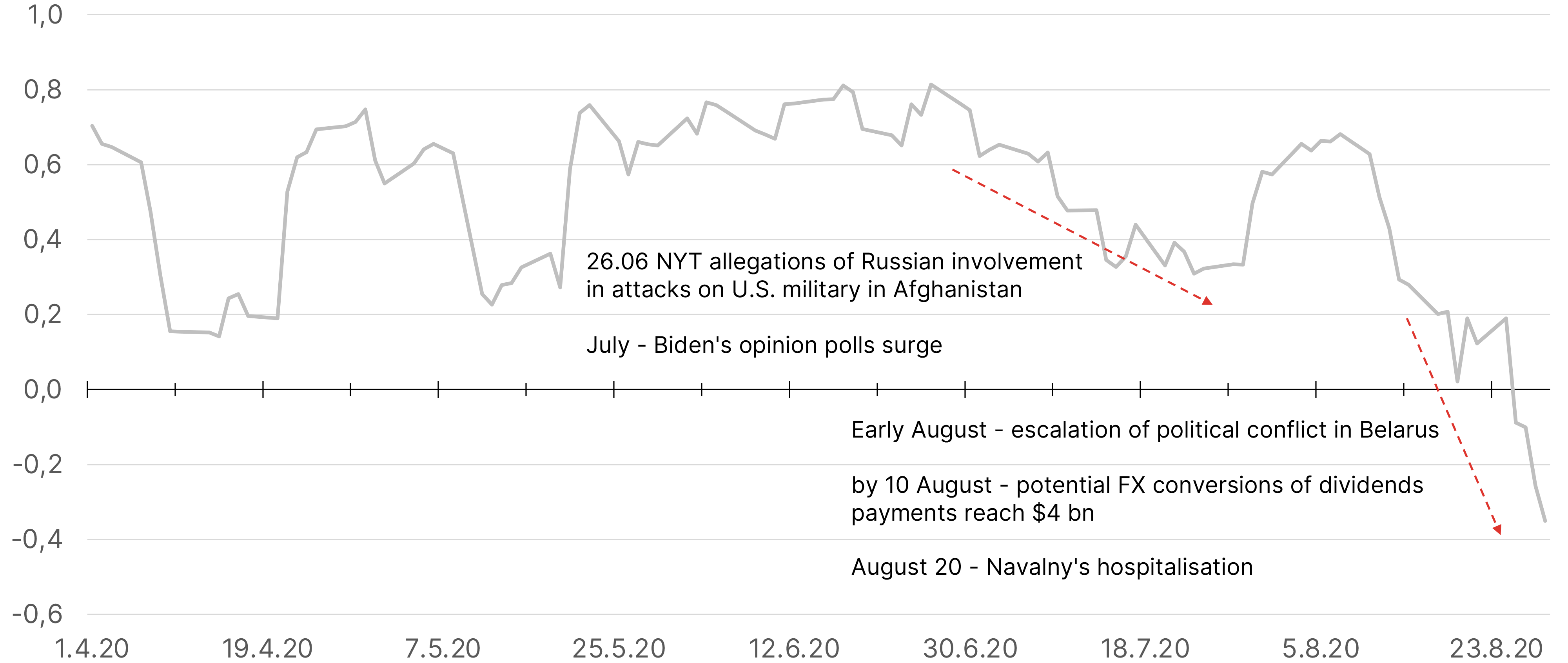

Geopolitical turbulence has led the 14-day correlation between the rouble and the oil prices to turn negative, dropping to -35% in late August, from 80% in the second half of June.

14-day correlation between the rouble and the oil prices

Source: ITI Capital, Bloomberg

By the end of August, we estimate the rouble-dollar pair was “oversold” by about 11% compared to its long-term correlation with the Urals price.

Source: ITI Capital, Bloomberg

In absence of geopolitical factors, such deviation between the rouble’s exchange rate and the price of Russia’s key export commodity should contribute to sustained upward pressure on the Russian currency. However, the rouble’s recovery has been hindered by the global political calendar, in particular the forthcoming US presidential elections (and their outsized impact on bilateral relations with Russia including the scope for harsher sanctions in the event a Democratic administration comes to power in 2021).

Superior indicators of Russia’s current account, international reserves and public sector indebtedness, reflected in the sovereign credit ratings, also suggest that the rouble has been oversold compared to emerging markets peer currencies. However, the geopolitical risk premium in the Russian assets is likely to remain in place for the foreseeable future, regardless of the outcome of the U.S. elections.

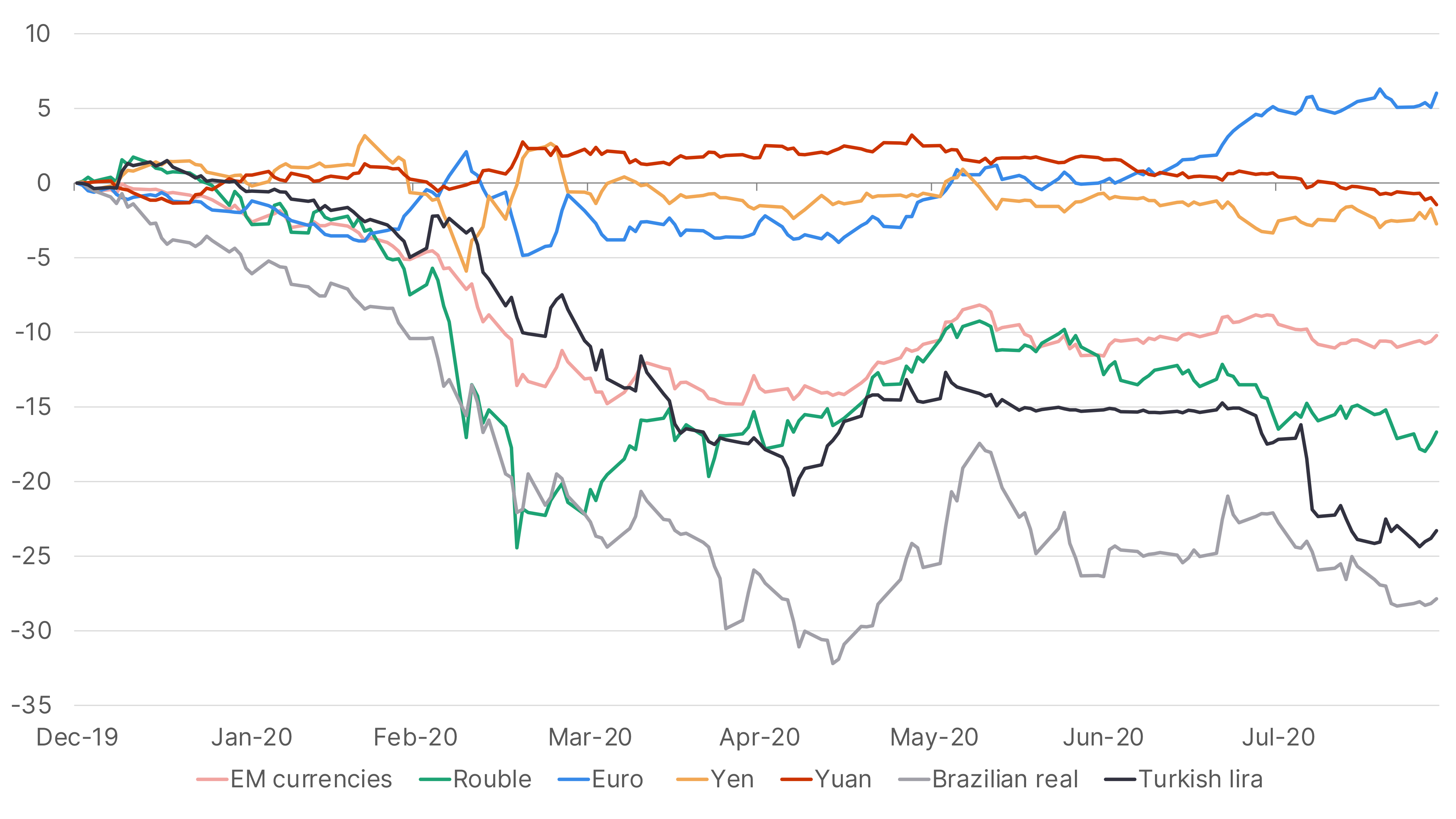

Indices of key currencies vs the US dollar (nominal terms, Dec 2019=100)

Source: ITI Capital, Bloomberg

The rouble has suffered heavy losses alongside other EM currencies

The rouble has slumped against the dollar by 17.4% so far this year, posting a bigger drop than the Mexican peso (another major oil exporter currency, -12.3%) and the South African rand (-15.8%), even though its economy is more vulnerable than that of Russia, and outperformed only the currencies of Argentina (-19.5%), Turkey (-20.0%) and Brazil (-23.9%).

Since 8 June (when the rouble climbed to 68/$, its highest level with the oil price in the $42-43/bbl range), the Russian currency depreciated by more than 8% to 75.1/$, outperforming only the Brazilian real (that was undermined by the authorities’ failure to bring the covid-19 outbreak under control). Between 8 June until end-July, the rouble has been the worst performer among global currencies (-8.3% against the U.S. dollar), even though the US dollar index fell by 3% against the basket of major currencies during the period. In August (when Urals advanced by 3.6%) the rouble was little changed against the dollar, close to a median outcome in this period for 24 most liquid EM currencies).

Thus, over the summer, the rouble’s performance against the dollar decoupled from both the oil prices and the path of other EM currencies. Against the backdrop of a sizable current account surplus, reasons for this trend are to be found on the capital account side, since the summer months are traditionally marked by greater capital outflows driven largely by repatriation of dividends by non-residents. This year, these customary outflows have been accompanied by other - both from residents (including recipients of dividend payments) and foreign portfolio investors (in the rouble market).

Non-residents’ activity in the OFZ market is reflected in the regular CBR data: in June and July, foreign OFZs holdings have been gradually declining (to 29.8% in July from 31.8% in May). However, even a material drop in non-residents’ holdings in the rouble-denominated sovereign bonds in July (by ₽15 bn) cannot fully explain that month’s poor performance of the Russian currency – capital outflows associated with the seasonal peak in dividend payments were very likely the decisive factor in this respect.

By the end of the first decade of August, FX conversions of dividend payments could have reached nearly $4 bn. This estimate reflects conversions for payments to (individual) depository receipt holders totalling $1.5 bn, foreign institutional funds in the amount of $2 bn, as well as conversion operations by local minority shareholders totalling $0.9 bn. Given that the conversions were made within ten business days, they might have reached 12% of the trading turnover on the MICEX TOM+TOD.

Therefore, total FX purchases since the beginning of July (by issuers for FX conversion and individual investors after receiving dividend payments) might have reached $10 bn, roughly 23% of all dividend payments for 2019.

Estimates of conversions for dividend payments, $ mln

-959.png)

Source: ITI Capital estimates

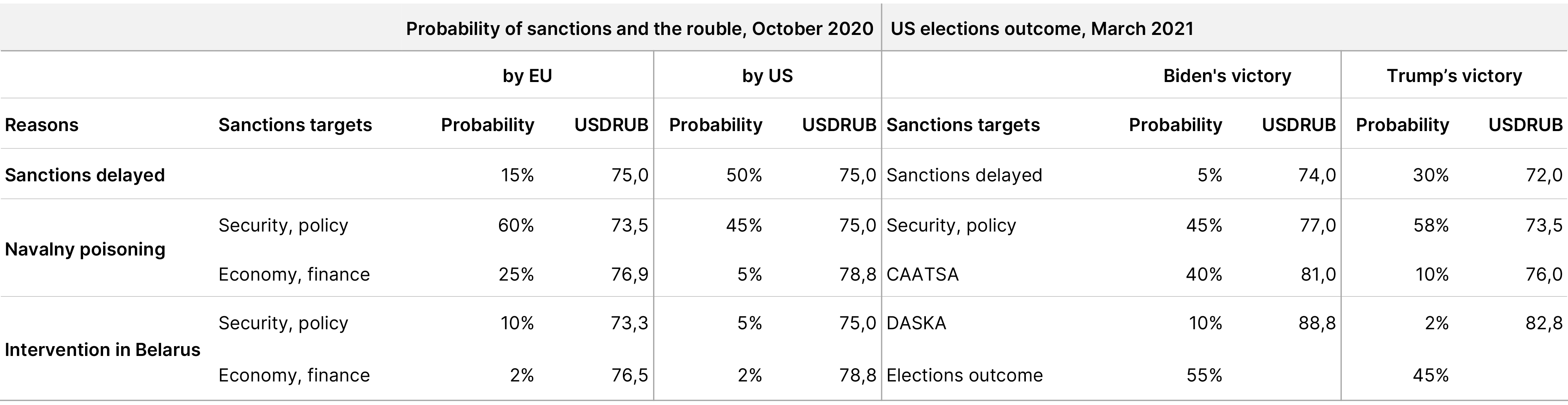

How justified are the concerns about new sanctions?

Concerns over new US and EU sanctions were one of the key factors that affected behaviour of foreign holders of rouble-denominated assets in recent months (especially in August), besides the increased conversions into FX of dividend payments this year. These concerns were fuelled by the improved chances of victory for Democrats in the presidential elections (and gaining majority in the Senate) in the November elections, sharp escalation of the internal political conflict in Belarus and the poisoning of Alexei Navalny.

In the case of the conflict in Belarus, following President Vladimir Putin's statement on 27 August, it became clear that Russia was ready to intervene on behalf of the current leadership in Minsk in case of a threat of a regime change. Given the peaceful nature of protests against the official results of the presidential election, the risks of an armed conflict in Belarus still seems low (within 10%, according to our estimates). Since Russia’s armed involvement in an internal political conflict in Belarus (in absence of a threat to the country's territorial integrity) would be regarded as a violation of the collective security treaty and Russia's OSCE commitments, we believe the EU sanctions would be very likely under this scenario. If the protests are overwhelmed by force but without Russia's official involvement, we believe it would be difficult to reach a consensus in favour of sanctions within the EU.

The case of Navalny’s poisoning poses far greater risks to the Russian assets, in our view. Given the statement made by the German authorities on 2 September, it's increasingly likely that European countries (members of the EU, the UK and Switzerland) will adopt sanctions against Russia (85% likelihood within the next 2 months). Under most scenarios (60%) such measures will target technology, security and political cooperation. If this is the case, risks facing the Russian financial assets are likely to decline for a while and the rouble is likely to strengthen somewhat (to about 73.5/$, according to our estimates). The likelihood of such (less severe) sanctions will hinge on Russia' willingness to investigate the incident and on improvement in Navalny's health. Economic sanctions (such as suspension of Nord Stream-2 construction) are much less likely to be imposed (likelihood about 25%). Further weakening of the rouble (to the next significant support level, of around 77/$) can be expected under this scenario. If sanctions are postponed, but the risk of their introduction remains in place, the rouble will trade close to the current levels.

The risk of U.S. sanctions over the Navalny case is lower than that of the EU (about 40%, including only 5% for financial and economic sanctions). U.S. political sanctions over Navalny would reflect the U.S. policymakers’ intention to maintain sanctions pressure on Russia, and the rouble will likely trade close to the current levels (35% probability). Under an unlikely scenario of financial sanctions before the US elections (5% probability), the rouble is expected to weaken to about $79/$.

All eyes on the US elections

Following the US elections in early November, holders of the Russian assets will fully focus on the policies of the new administration (primarily as regards the domestic economy which will impact investors’ appetite for risk and the dollar’s performance against key currencies). They will also follow closely implications of the elections for the US-Russia bilateral relations.

Chances for a Democratic victory in the elections rose sharply in the first half of the summer, reflecting dissatisfaction of Americans with the federal government’s handling of the coronavirus response and of the fallout from the outbreak for the economy. According to data from Predictit (reflecting actual monetary predictions on the outcome of elections), the Democrats’ lead has become palpable since the beginning of June, topping 20 points in mid-July (peaking on 18 July, at 62-38). In the second half of the summer, the gap narrowed, reaching 10 pts as of 1 September. Most political observers in the U.S. still consider Joe Biden’s chances for victory to be higher than 55% (since he has kept an edge in some of the battleground states), but we prefer to rely on market valuations of the odds (in this case, the betting market).

How likely are sanctions against Russia to be tightened under President Biden? We believe such an outcome to be almost inevitable: the Democrats have pledged to add pressure on Russia from the onset of their campaign, making it one of the key points of their foreign policy programme. At least, further implementation of the CAATSA law that targets Russia seems very likely. The bill was adopted by Congress (in 2017) and signed into law by Trump. This will imply risks of additional restrictive measures against Russian entities and individuals, most likely excluding state assets. Such steps by the US government would increase the risks for Western holders (primarily American) of the Russian assets but is unlikely to trigger a massive flight from such assets. The rouble could weaken to about $77/$ after Biden’s victory and ahead of new sanctions. However, under half of the scenarios (50%), these will come in the form of (delayed) political and security sanctions. In this case, the rouble may strengthen slightly in the first quarter (to 75.7/$). The probability of much stricter financial penalties (through CAATSA or additional measures) is seen at 40%, and the rouble could decline to 81/$ in this scenario.

A much more serious development for investors would be the adoption (and implementation) of the DASKA bill, providing for a complete ban for U.S. investors on transactions with any Russian sovereign debt. Under this scenario (about 5% probability), extremely harsh financial sanctions could send the rouble initially lower to some 88/$, turning it into the worst-performer among liquid currencies in emerging markets. Several powerful U.S. government agencies, including the U.S. State Department and the Treasury, have expressed opposition to the bill’s provisions arguing that they would harm cooperation with Russia on strategically important issues. In our view, the Democrats’ victory per se (in the absence of new triggers for serious bilateral tensions with Russia) would not accelerate the adoption (let alone implementation) of the DASKA bill.

If Trump wins the November elections, we do not expect a significant change in the U.S. policy towards Russia, although additional sanctions pressure (through further implementation of CAATSA, for example) cannot be ruled out. At the same time, Trump's victory will most likely strengthen the dollar against other currencies, which should prevent the rouble from excessive strengthening. If the unlikely scenario when U.S. election results are contested, appetite for risk, including the rouble assets, may ease for a while. In the absence of financial sanctions, the rouble could strengthen to $72/$ under a particularly favourable set of circumstances. If bilateral relations deteriorate (because of the events in Belarus or Ukraine, for example), we assume that tougher anti-Russian sanctions will be very likely, which may weaken the rouble somewhat, to abot 76/$, though a drop against the euro would not be as large as against the strengthening dollar. If Trump wins and the DASKA is adopted, which is the least likely scenario (2%), the rouble may weaken to about 83/$.

Our main scenarios are summarised below

When weighted against these scenarios, the rouble’s projections for the next six months are approximately in line with the RUB forward curve, indicating that the market is assessing risks for the rouble broadly accurately. The problem is that the high concentration of risks in several unlikely scenarios may not allow investors to again feel comfortable about their RUB exposure for quite some time. Сomfortable about being exposed to the rouble risk for a long time to come.

Given the recent events, we currently see no reason to increase positions in OFZ

Appetite for emerging markets risk reversed in the second half of August. With no new reasons for correction, investors kept focusing on traditional factors such as risks of a global lockdown 2.0, tensions between the U.S. and China, and monetary easing cycles coming to an end in quite a few countries. However, the dollar’s fresh weakening round (that accelerated after the Fed Chair’s speech on 27 August) has strengthened demand for risk, including emerging market assets.

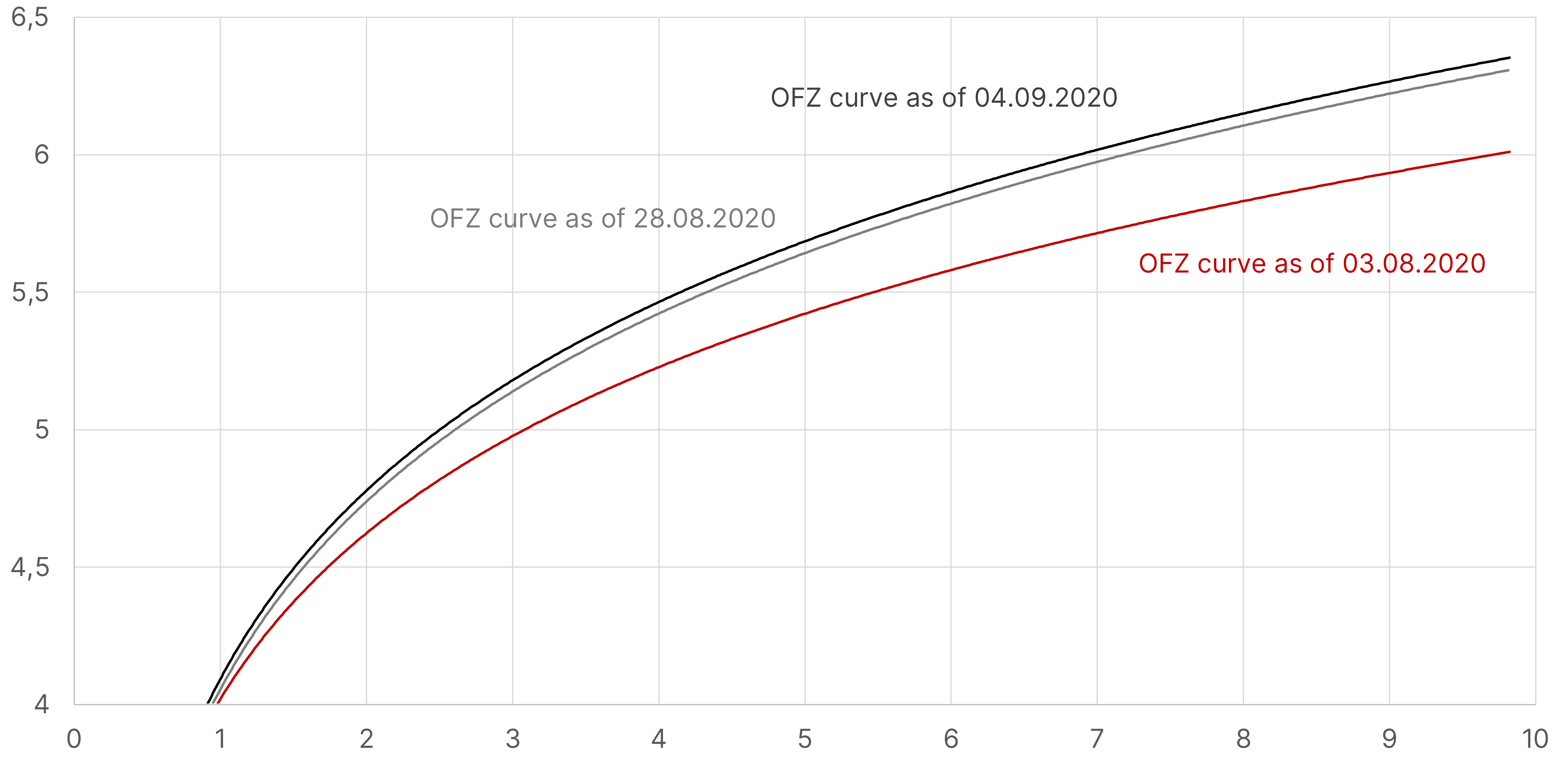

The Russian debt market also lost positive momentum in August, in line with the general trend. Prices for long OFZs dropped 4% amid the sell-off. The yield curve for short OFZs widened by 10-12 bps, and by 20-30 bps for the belly of the curve and the longer bonds. It is important to note that the curve’s slope kept steepening - the gap has already exceeded 240 bps (+15 bps since early August). At the same time, prices for rouble securities posted a bigger drop as compared to most other EM peers. Additional pressures came from the negative geopolitical news described above (holders of the Russian assets have traditionally been sensitive to such developments). The scaling down of non-resident positions in OFZs accelerated. The outflow of funds from foreigners’ accounts amounted to ₽15 bn in July, according to the CBR data. The outflow was ₽4 bn in the week to 21 August.

Sovereign curve since 03.08.2020

Source: ITI Capital, Bloomberg

Geopolitical risks will certainly remain key to the Russian assets pricing in the short run. This can be illustrated by the spike in volatility after reports that traces of a strong toxin were found during Navalny’s tests in the German clinic. Downward pressure on sovereign bond prices increased sharply, with gains of the previous trading sessions wiped out. We have revised our earlier forecast calling for a 10% increase in prices of long bonds amid expectations of further policy easing).

The negative impact of political events on the national currency, coupled with a hard-to-predict further developments, leads us to assume that the CBR’s monetary policy parameters in our new baseline scenario will remain unchanged for the rest of the year. A policy rate cut of even 25 bps over the next three months can only materialise under a combination of favourable circumstances (such as reduced sanctions risks and a U.S. election outcome favourable for Russia) which is currently seen as unlikely. This conclusion was underpinned by Elvira Nabiullina's recent speech at the Russian banking congress. The CBR governor highlighted record high outflows of funds from deposits as they became much less attractive while stressing that transition to neutral policy was “inevitable”.

We have now adopted a cautious view on OFZs in the near future and do not recommend ramping up positions yet, especially in longer securities. At the same time, we do not expect a deep correction either, since demand from local players should support prices at least at current levels. We cannot rule out that the CBR will return to the final stage of the monetary easing cycle in early 2021, ultimately cutting the key rate to 3.75% (in line with our earlier forecast). In this case, opening long positions in medium-term OFZ issues would be the best option, and we believe that investors should adopt this strategy once volatility subsides.