Russian upcoming dividends to trigger record inflow of investments this summer

Key takeaway

The dividend season in Russia continues, as of June 8, under 20% of all payouts were made with nearly 25% of cut-off dates passed. The high season is traditionally expected in July.

The Russian market continues to please investors with its generous dividend yield, in 2019 it topped 9% despite the pandemic and dividend suspension worldwide. Against this background, the Russian stock market will be able to attract substantial funds from both local and foreign investors. According to our estimates, inflows to the market will exceed $10 bln during the dividend season, the RTS will grow by 12% by the end of July, while the S&P 500 will post a 6% growth, twice as less. Most of the funds will come from reinvestments and new purchases by foreign holders, including international funds, with about 40% of the total amount coming from local investors. Overall, from late July until the correction in August, we expect stronger demand for Russian assets on the back of the growth of the market that will outpace the U.S., European and South-east Asian indices during this period. The Brent price is likely to rise above $50/bbl at the end of July, while the rouble will strengthen to 64, and possibly even more, narrowing the spread to the OFZ yield.

Total dividend payouts for 2019 may hit new record.

2019 dividend payouts, excluding suspended payments from Sberbank, may reach ₱2 trln 740 bln. ($45 bln, including issuers that make dollar payments only), according to our analysis of 74 companies. About 95% of all payments account for the top-20 companies in terms of capitalization and liquidity.

Dividends for 2019 cover payments from the second half of 2019 through August 2020. Dividends payouts for 2019 that began in March 2020, stand at ₱1 trln 500 bln ($23.4 bln, including companies that make dollar payments only. Out of this amount ₱257 bln have already been paid. ($5.7 bln including companies that make dollar payments only), just over ₱1 trln 238 bln are still due.

2019 annual dividend payouts including Sberbank

-875.png)

Source: ITI Capital

Sberbank moved traditional annual shareholders meeting from June to September 25, while according to Sberbank CEO German Gref an additional meeting may take place in mid-August to decide on the dividends. If Sberbank approves 50% of IFRS net profit, or ₱18.17/ share, for dividends, total payments for 2019 will increase by ₱410 bln, up to ₱3 trln 180 bln (new record), the payments include suspended payouts by VTB, Aeroflot and Rushydro, a total of ₱33 bln. ($52 bln, including companies that make dollar payments only). Dividend payments growth has been driven by emergence of interim payments of the oil and gas industry, a rise in dividend/net income ratio from 25-30% to 46%, and a 47% increase in net income in 2018 and by 17.5% in 2019 to a record of ₱15 trln 758 bln, mainly due to spike in the end of 4Q19.

All Russia corporate net income and USDRUB

-592.png)

Source: Russia’s Federal Statistics Service, ITI Capital

Under this scenario is implemented, dividend payouts will reach a record - last year's payments for 2018 amounted to about ₱3 trln, with about a half accounting for intermediate dividends. This record will be significant, since 2019 is the last return-generating year before the 2020 crash, and 2020-2021 will see much more moderate dividends.

Russia vs peers

High dividend yields and low valuation multiples, which is largely justified due to geopolitical risks, are the key advantages of the Russian market.

1. Reliability and stability

Most surprisingly, in Russia, dividend payments and yields have been hitting new high records, while falling sharply elsewhere, primarily in developed markets, such as U.S. and Europe, where 1Q20 payouts and calculations of further dividends have begun. In a best-case scenario, global dividends will drop by 15% to $1.21 trln this year, while in a worst-case scenario they could fall 35% to $933 bln, asset manager Janus Henderson said. We expect a decline to be somewhere in the middle, at 20%, to $1 180 bln. The calculations cover 1,200 major companies. Russia, including Sberbank, is seen to account for 4.5% of global dividend payouts. The U.S. accounts for the bulk, or 36% of payments.

An important point is that the bulk of global payments account for the financial sector (27%) and as little as 11% - for oil and gas, as compared to 52% in Russia, which highlights the gap in dividend yield between Russia and other countries. In Russia, exporters remain dominant and for 2019 payments will account for 78% (10-year average stands at 75%) of total payments.

Another important point is that more than global 200 companies have scrapped dividends payments since March, a negative trend second only to 2009 crisis, when as many as 316 corporations took such a decision. GM, Ford, Delta, Carnival, Boeing, Macy’s, and others were among the first to announce the cuts. Over the past 10 years, 55 companies have cancelled dividends, according to our previous review. All the dividend actions so far add up to savings of about $30 bln, according to S&P Dow Jones Indices, roughly 5% of all dividend payouts in the U.S. last year.

U.S., European and British companies have become the top-gainers, followed by Asian and EM peers. In Russia, as few as 27 companies have cancelled payments, four are weighing the option, and three companies have cut payouts.

Total annual dividend payments, $ bln

-793.png)

Source: Janus Henderson, ITI Capital

Annual dividend payments by countries, $ bln

-993.png)

Source: Janus Henderson, ITI Capital

2. The world’s highest dividend yields

- Against the backdrop of rising dividend payments, the weighted average annualized dividend yield stands at 9.2%, while at the lowest point of the March market decline it stood just under 11%. The current annualized annual dividend yield (9.2%) exceeds that of 2018 (8.5%) which relates to last year's payouts. The global average dividend yield, excluding Russia, is three times as less, at 3.4%. In Europe, the average dividend yield is as low as 3.1%, in developing countries - about 2.8%, in the U.S. - just under 2% based on MSCI country and regional indices.

- High dividend yield in Russia as a factor of low company value. The Russian market has always offered generous dividend yield, officially the world’s highest if compared to all MSCI countries, and had the lowest multipliers except for Turkey (P/E multiplier - 5.9x and P/B slightly above 1x), which reflects low value of companies that are truly considered industry leaders. Russian equities are traded at a 65% discount to the U.S. peers, 61% - to the global peers, 42%, - to the DM peers, according to MSCI indices metrics.

2019 annual dividend yield, %

-935.png)

Source: MSCI, Bloomberg, ITI Capital

Most expensive and cheapest markets by P/E (2019).

-705.png)

Source: MSCI, Bloomberg, ITI Capital

Past and due payments

Annual dividend payouts for 2019, excluding Sberbank suspended dividends, may reach ₱2 trln 740 bln. ($45 bln, including companies that make dollars payments only). They are of little importance for investors, the most important would be the nearest (interim and annual) dividends that make about half of the total - ₱1 trln 500 bln. Annual payments include those made in the second half of 2019 for other 2019 periods, and therefore considered a part of the total 2019 payments. What is important for us is the upcoming payments, some 90% of them account for balance of payments for 2019 if the company makes several dividend payouts a year. These payments are primarily made by metal producers, in particular, Norilsk Nickel, MMK, NLMK, etc., the utilities and consumer sector.

According to Federal Law “On Joint-Stock Companies”, dividend payments are made primarily in roubles if the company's shares are traded on the Russian stock exchange in addition to Western exchanges and if the company is a tax resident of Russia (companies in our list with no listing in Russia): Evraz, Headhunter, Highland Gold, Globaltrans (LSE), Qiwi and Mother and Child); such payments are made within two weeks from the cut-off date. To get a dividend, an investor must purchase a stock two trading days before the record date, which is followed by a dividend gap, that is the share price drops by the amount of the dividend paid. Then, all things being equal, the value is restored, as shareholders usually invest the income received back into the market.

The bulk of payments fall on July - about 60% and on June - 28%, the balance - on August. This graph has not changed since 2017, when in line with new regulations payments were shifted to an earlier date in July from August, when the bulk of payments was traditionally made.

The bulk of payments by months, excluding Sberbank

-11.png)

Source: ITI Capital, Company data, Bloomberg

Sector breakdown and largest payments

Oil and gas sector traditionally accounts for the bulk of total payments (the nearest payments are no exclusion). This year the share is set to reach 67% (if the financial sector payments are excluded from total, since Sberbank has not confirmed payments this year). Last year, the oil and gas and financial sector accounted for 43% of all 2018 payments.

This year, the oil and gas sector plans to pay just over ₱1 trln. (+30% y-o-y), out of which ₱361 bln will come from Gazprom, ₱242 bln from Lukoil, ₱191 bln from Rosneft, ₱54 bln from Novatek. ₱88 bln will come from Norilsk Nickel, ₱41 bln from MTS. Gazpromneft (+149%) and Lukoil (+110%) have recorded the largest growth in dividend payments this year, while Surgutneftegaz pref (-90%) y-o-y was the worst performer. Meanwhile, we expect the share of exporters in currency sales is set to shrink from 78% (peak level) to 45% this year.

It is also important to note that payments from metal producers, that accounted for 20% of last-year’s payments, dropped to 11%. The metal sector cut dividends most due to operating costs over the coronavirus, although the oil sector was the main victim, based on 2020 performance. If we take the nearest dividends, the worst performers y-o-y will include NLMK, Alrosa and Severstal.

Other top dividends payers include utilities and telecoms

Payments breakdown excl financial sector

-826.png)

Source: ITI Capital, Company data, Bloomberg

Impact on the rouble and interbank rates

1. FX-sales and demand for roubles

Payments impact the rouble in two ways. Firstly, the rouble benefits from export revenues conversion into roubles, in particular in July, when major dividend payments are made. According to our estimates, out of the remaining payments of ₱1.24 trln, equivalent to $19 bln, $4.5 bln will account for exporters' payments from late June to late July.

This is a big figure, given that under the budget rule the Central Bank is still selling currency on behalf of the Finance Ministry at ₱11 bln, or $160 mln, a day, or roughly $3.4 mln a month. But if our forecast for the end of June materializes, Brent rises to $47/bbl and Urals to $42/bbl, FX-sales will stop, and FX-buying will start amounting to $0.4 mln per day. Therefore, we exclude the synergy from FX-sales under the budget rule in our forecast. We expect the rouble to strengthen to ₱64-65 by the end of July driven by demand for risk and oil rally.

FX-sales estimates in the dividend season, $ mln

-437.png)

Source: ITI Capital, Company data, Bloomberg

2. FX-purchases and weaker rouble

At the second stage, companies purchase dollars, that is convert roubles into dollars, to pay dividends to holders of depositary receipts and other foreign investors such as international funds. Upcoming conversions slightly exceed $10.5 bln, out of which $6 bln are subject to dividend payments to receipts holders and $4.5 bln to international funds.

Some $4.5 bln can be purchased by individuals, who will get dividend payments as free-float stocks holders. Thus, the total volume of currency purchases (by issuers for conversion and individuals after receiving dividend payments) may reach $15 bln. Purchases from late July to late August may lead to a weaker rouble. August is traditionally considered a volatile month for global risk assets.

We expect the rouble to weaken to ₱67 by the end of August after strengthening to ₱64 in late July. Dividend payments traditionally have a negative impact on the rouble, and this time FX-purchases will be three times the FX-sales (record high ratio), resulting from weaker FX-sales due to a 35% oil prices drop y-o-y, despite the expected recovery.

FX-buying, $ mln

-813.png)

Source: ITI Capital, Bloomberg

Impact on the Russian stock market and 2021 outlook

Overall, we believe that the U.S. and European markets will become the top-gainers this year just as they are now, and emerging markets will lag behind. Developed countries have revealed stimulus packages to help the economy recover from the pandemic, and they have the largest amount of liquidity. About 67% of $17 trln, 13% of the world’s GDP, will be spent by developed countries to help the economy, mainly USA, Japan, and Europe.

The Russian market has been lagging behind the U.S. Market year-to-date but will offset some of the losses during the dividend season. Therefore, the Russian securities appear to be an attractive investment target amid scrapped dividend payments worldwide, especially in the U.S., where the number of issuers that have taken such a decision reached the highest since 2009.

According to our forecast, the Russian market will grow by 8%, adjusted for August correction, or 12% from current levels until the end of July. The growth is expected to peak in July. Therefore, we expect the inflow of funds for the entire two-month dividend season to exceed $10 bln.

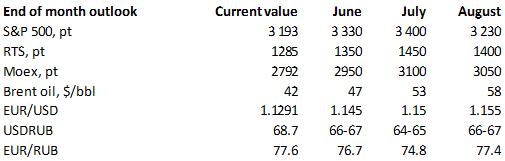

Outlook on key assets

Source: ITI Capital, Bloomberg

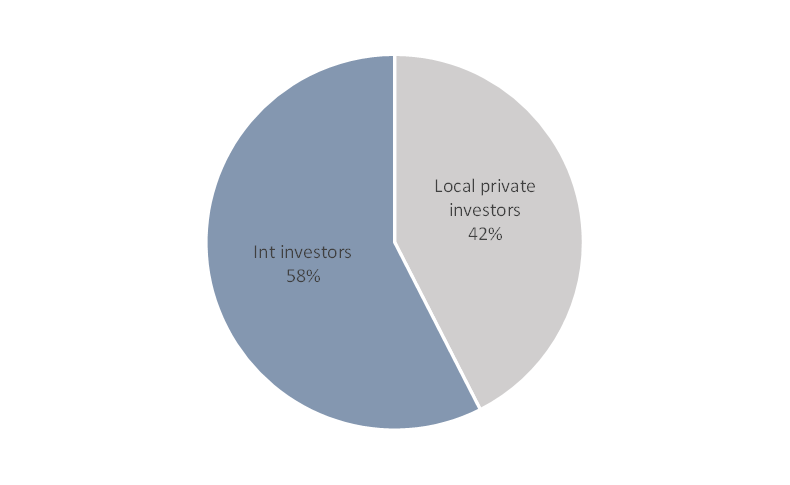

Structure of funds inflow to the Russian market in the dividend season

Source: ITI Capital, Bloomberg

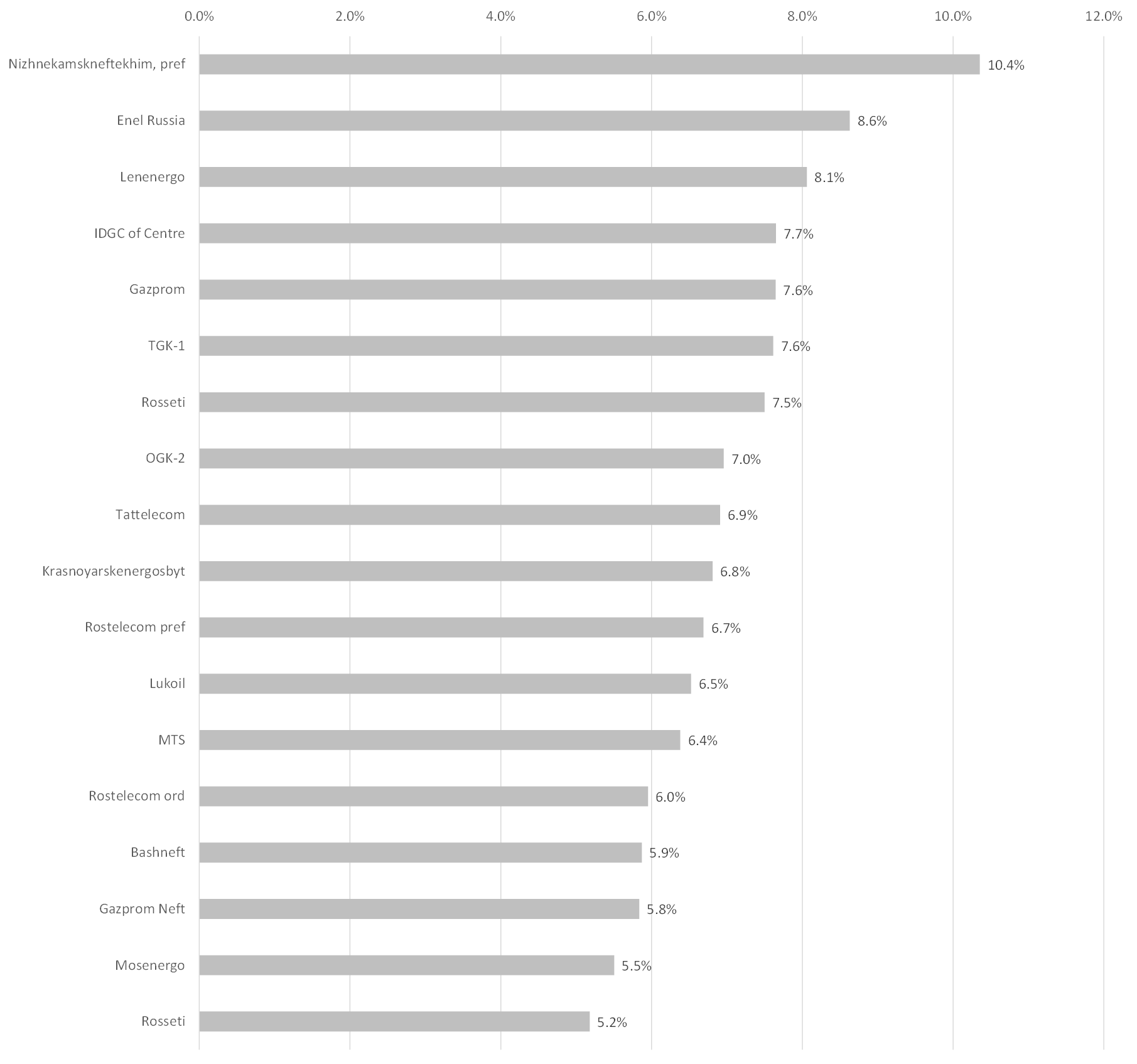

This year's most yielding ideas

Out of the nearest dividend payments this year, the stocks with the highest return will include: Nizhnekamskneftekhim Pref, Enel Russia, Lenenergo Pref, IDGC Centre, Gazprom, TGC-1, Rossetti, OGC-2, Rostelecom, Lukoil and MTS. Many of these securities are included in ITI Capital's dividend portfolio. Transneft's dividend yield exceeds 8%, but payments will be made in installments.

Source: ITI Capital, Bloomberg