OFZ: Safe haven 2020

Key takeaway: since the start of sell-off two months ago OFZ has become the first Russian asset to return to pre-crisis levels due to CBR’s new dovish policy, which triggered both demand from local players and an inflow of non-residents in spite of the oil rout. We believe that the 10Y bonds yields may drop 130-140 bps, to YTM 4.7-4.8% per annum by the year-end. In this case, the long bonds’ price may add further 15-17%. The rouble may also get solid support from the debt market. Demand from non-residents largely depends on the real rate, still one of the world-highest (about 3%), which gives the Central Bank additional safety margin.

OFZ performance before the pandemic

The local debt market has been steadily growing year-to-date due to favourable sentiment, expected monetary easing in Russia and consistent inflow of non-residents' funds. Against this backdrop, the OFZ yields fell to the all-time lows. Thus, the 10-year benchmark issue, OFZ-26228, fell to YTM 5.93%. OFZs have become the top-gainers among local currency bonds.

The current price levels in the Russian sovereign debt market was witnessed only once, back in spring 2013. Non-residents’ OFZ-holdings increased by 315 bln roubles in January-February, bringing the share of foreign investments from 31.2% at the beginning of the year to 34.9%, a new all-time high (the previous record was reached in April 2018 and amounted to 34.5%, or 3.185 trln roubles).

OFZ performance since the start of the pandemic

However, after February 20, 2020 the environment began to change dramatically. The fast-spreading COVID-19 pandemic and global government preventive measures have had an extremely negative impact on the appetite for risk. Massive sell-offs affected a wide range of global assets, including OFZs.

As a result of increased market volatility and outflows of non-residents' funds, yields of the rouble-denominated sovereign securities advanced approximately 250 bps in less than a month, bringing the price down by 25%, to its lowest since the beginning of 2019.

The first foreign players’ funds outflow began back at the end of February (-7.1 bln roubles). According to the National Settlement Depository (NSD)'s data, the net outflow increased, reaching 161 bln roubles in March. As a result, the non-residents holdings, which was at its local minimum at the end of March, fell to 30.8% (in other words, it effectively was back to level of the beginning of the year).

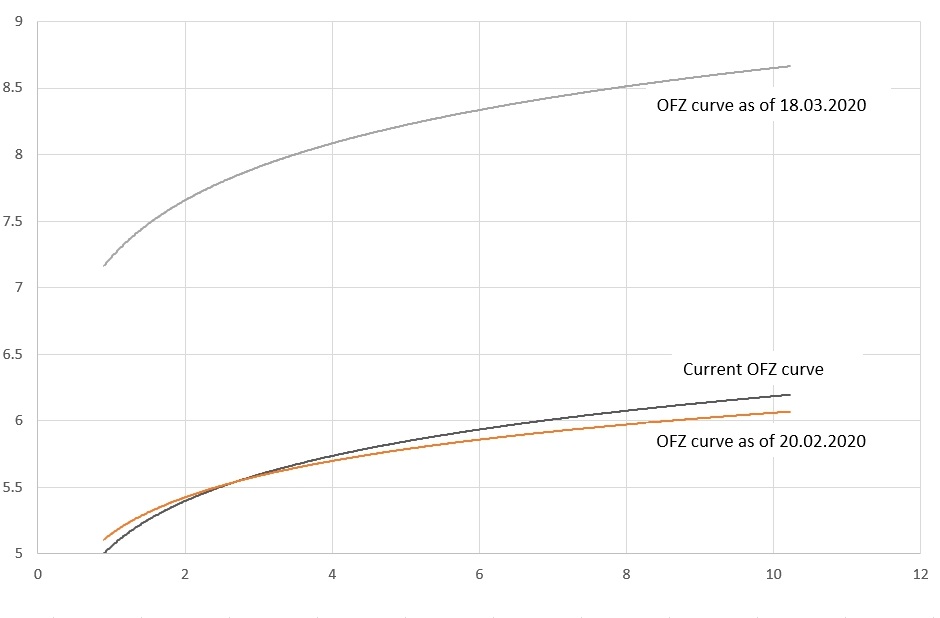

Not only the position, but also the form of the sovereign curve underwent significant changes due to increased uncertainty of investors with respect to further actions of the Central Bank. Thus, the overall steepness at the maximum by March 18, 2020 increased by 58 bps, and the gap between the rates along the curve was 150 bps. By that moment the longest benchmark yield reached YTM 8.71%. We also note that the curve has become much “steeper” in the near section - the 2-5Y spread widened from 20 bps in late February to 51 bps in mid-March. In turn, the difference in rates between the middle and the far sections has not changed much.

Fast recovery and CBR stimulus

At the same time, the sell-off did not last long. Coordinated actions of the world's largest CBs, i.e. comprehensive stimulus measures, contributed to curbing capital outflow from risk assets. The OFZs market got additional support from the limited volatility of the rouble exchange rate due to the budget rule, since following the Brent fall from $50/bbl to $19.33/bbl FX-purchases increased by 50%, from 14 bln roubles to 21 bln roubles per day. Thus, the OFZs have offset nearly two thirds of losses by the end of March, and the prices returned to the pre-sanctions level of 2018. In a new positive twist, non-residents suspended rouble bonds sell-offs: NSD recorded a net 12 bln roubles inflow on its foreign accounts in the first decade of April for the first time since the beginning of turbulence. On the back of a more dovish stance of the CBR, which led to a 50-bps rate cut on April 24 (down to 5.5%) and the official switch to a dovish policy, the OFZs have almost returned to the highs seen before February 20, 2020.

Evolution of OFZ curve in February-April 2020

Source: Bloomberg, ITI Capital

The MinFin is highly likely to fulfil its borrowing plan for 2020

Improved market conditions allowed the MinFin to return to the primary market - no auctions have been held since late February for five consecutive weeks. The Ministry's overall borrowing plan for 2020 is estimated at 2.3 trln roubles. Taking into account redemptions, the net borrowing volume should amount to 1.7 trln roubles. According to the 1Q20 data, the plan was implemented by 83%, the OFZ placements reached 501 bln roubles out of planned 600 bln roubles. According to the placement data, most of the sales accounted for the mid-term bonds. They were in the highest demand (bid/cover ratio) during auctions as well. Resumption of weekly primary offering of government bonds started in 2Q20. In April-June, the ministry expects to attract further 600 bln roubles through OFZs sales. The plan has already been implemented by 34.3% over the past three auction days. According to the NSD data, the foreign investors are still most interested in the mid-term bonds now. If we assess the results of this month's auctions, the non-residents' share in the OFZ-PD 26229 series purchases has been at least 40% for two consecutive weeks. At the same time, the 10-year benchmark 26228 has seen demand only from local players.

The long OFZs may go up more than 15% by the end of the year

We expect the OFZ market to grow further in the near future. Positive prospects primarily stem from a recent CBR’s shift to a stimulating monetary policy. The regulator’s dovish tone during the press conference following the April meeting suggests further key rate cuts to 4.5% by the end of 2020.

Combined with the stability of the rouble, which is supported by the execution of the budget rule, this will provoke increased demand from non-residents. In particular, the NSD has been recording a net inflow of foreign funds to its accounts since the beginning of April, for the third week in a row. Total new funds now amount to approximately 81 bln roubles.

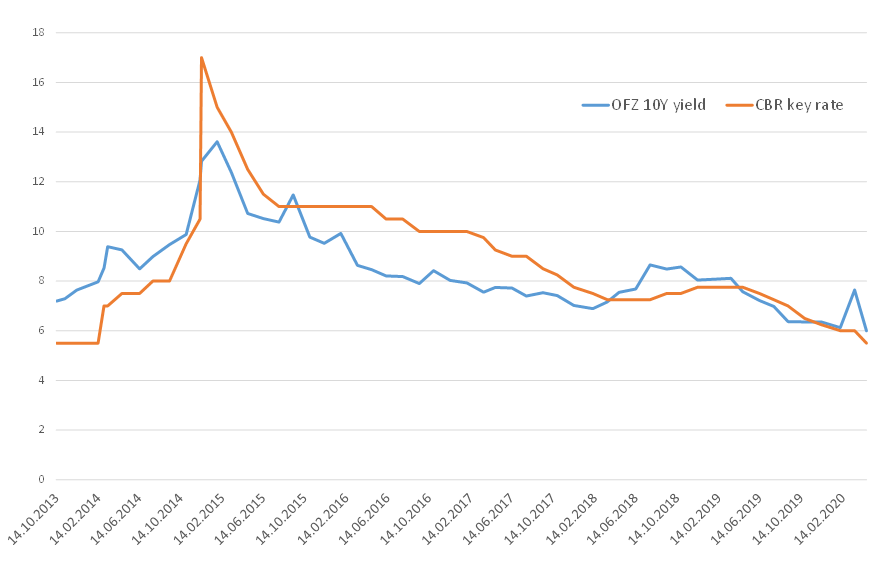

In turn, the Russian investors are also likely to continue to actively buy OFZs against the background of high liquidity in the banking sector, gradual cash outflow from the CBR’s coupon bonds, given that securities are no longer sold below par (the current amount of investments in the CBR bonds is about 1.5 trln roubles), as well as reduced opportunities for high-quality corporate lending since the crisis is starting to take its toll on the real economy. We analysed the gap between the OFZs 10Y yield and the key interest rate recently. The average premium since early 2019 has been around 20 bps (currently stands at 50 bps). Thus, provided market sentiment remains stable, the 10-year benchmark yield may drop by further 130-140 bps, to YTM 4.7-4.8% by the end of the year. In this case, the long bonds’ price may advance 15-17%.

Given the rouble’s lagging behind the OFZ due to oil rout, the Russian currency upside is at least 10%, up to 64 roubles per dollar. At the same time, as soon as the real rate upside potential is exhausted (according to our estimates, the rate stands at 3% now), the rouble will depreciate again. This will happen if the key rate of CBR falls below 3%, provided the CPI ratio remains intact.

OFZ 10Y yield and CB key rate performance, %

Source: Bloomberg, ITI Capital

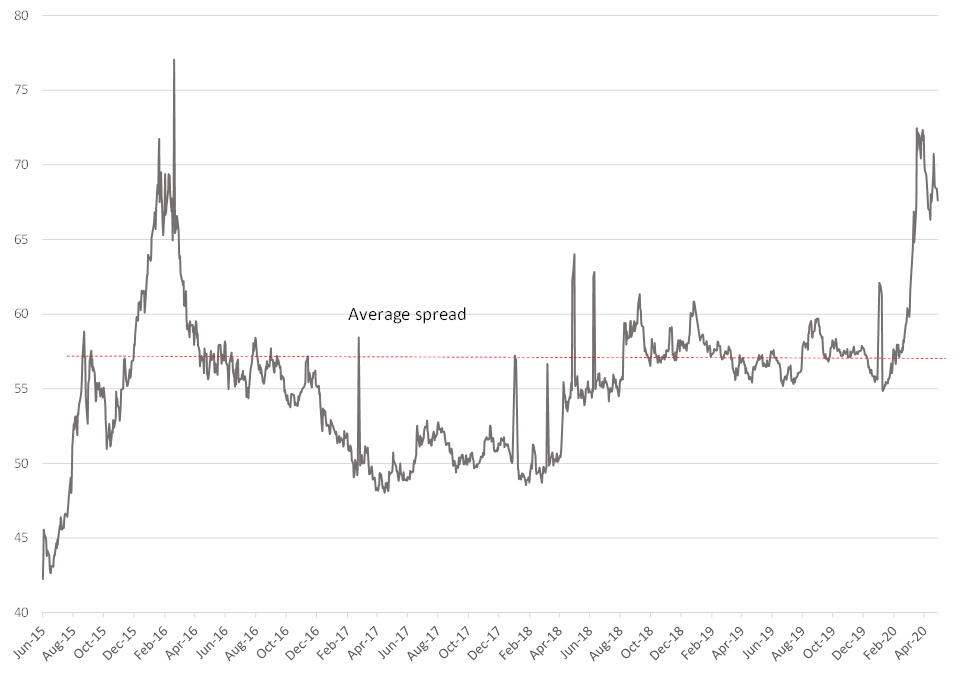

OFZ 10Y yield index and USD/RUB exchange rate (five-year average is 55 pt. against current 68 pt.)

Source: Bloomberg, ITI Capital