Russian dividend strategy – The sky is the limit

Key points:

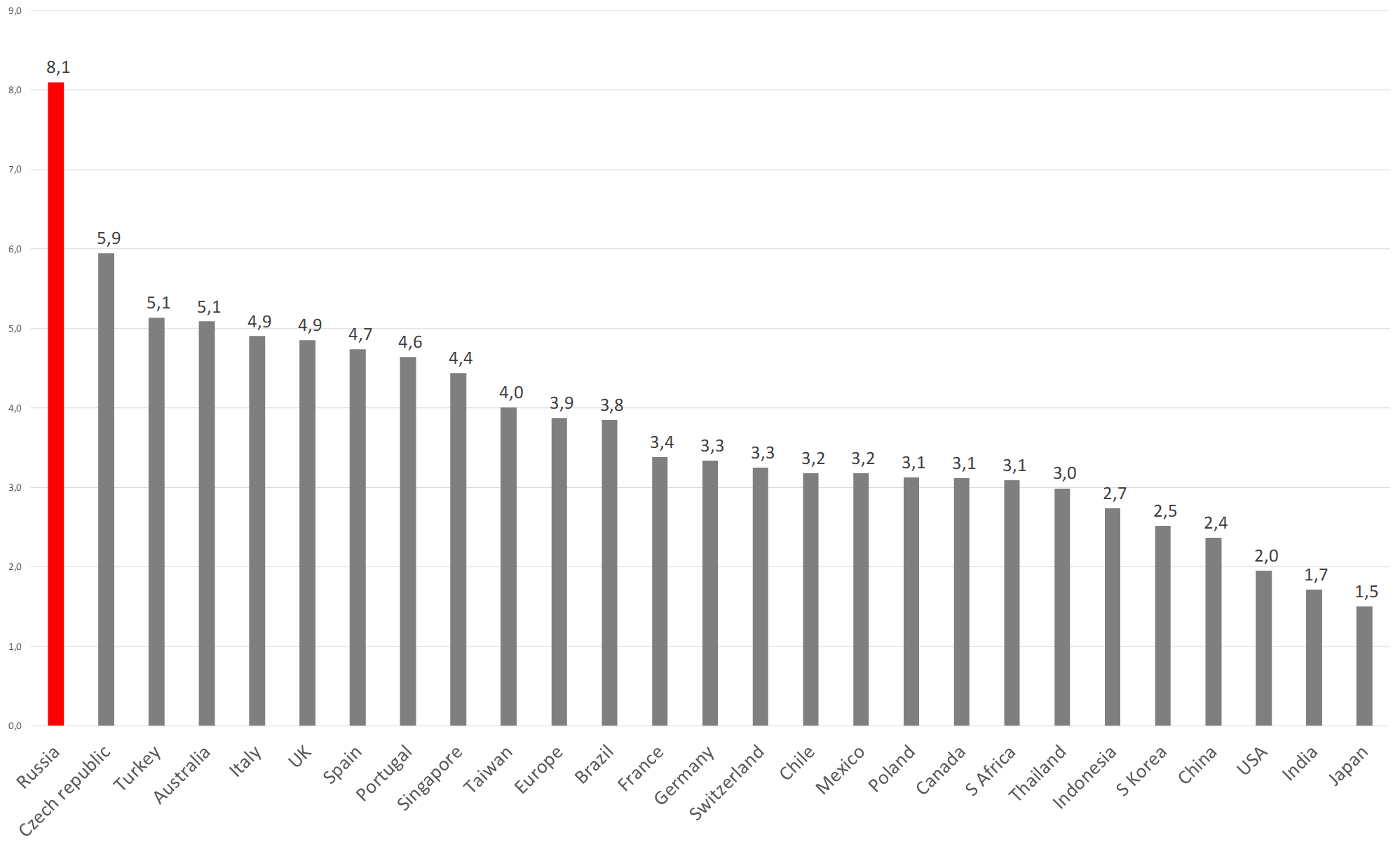

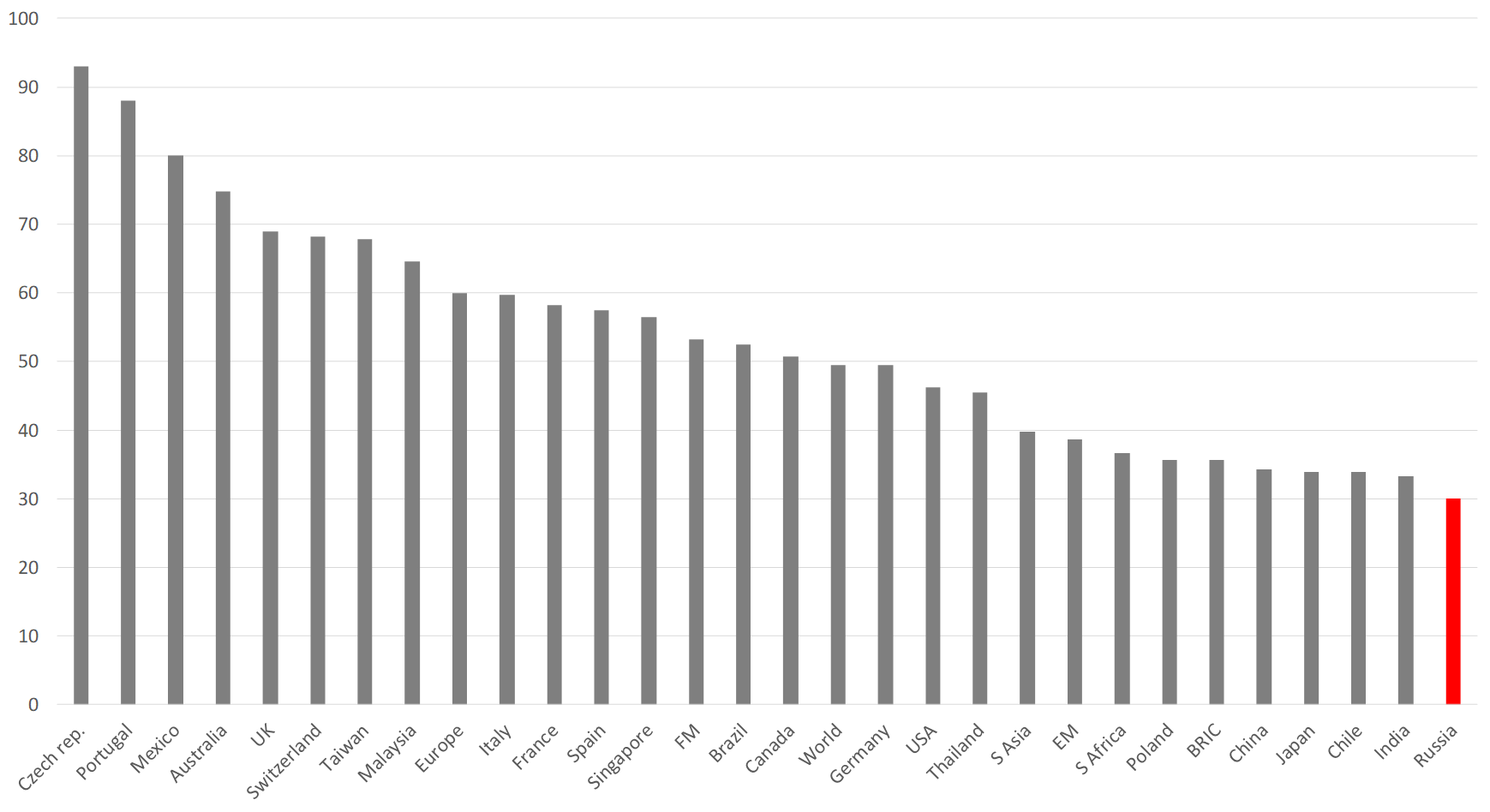

- Assuming no sanctions are looming, we expect a dividend rally, as market players are set to ramp up reinvestments in equities. It’s is clear that Russia’s growing dividend yields are appealing, they are officially are the world’s highest after surging to 8%. MICEX is expected to advance by 8% before the record date. Russia’s dividends payout ratio is the only dividend indicator that is lagging behind other markets. It averages 30% against 50% for other emerging markets and over 60% for developed markets

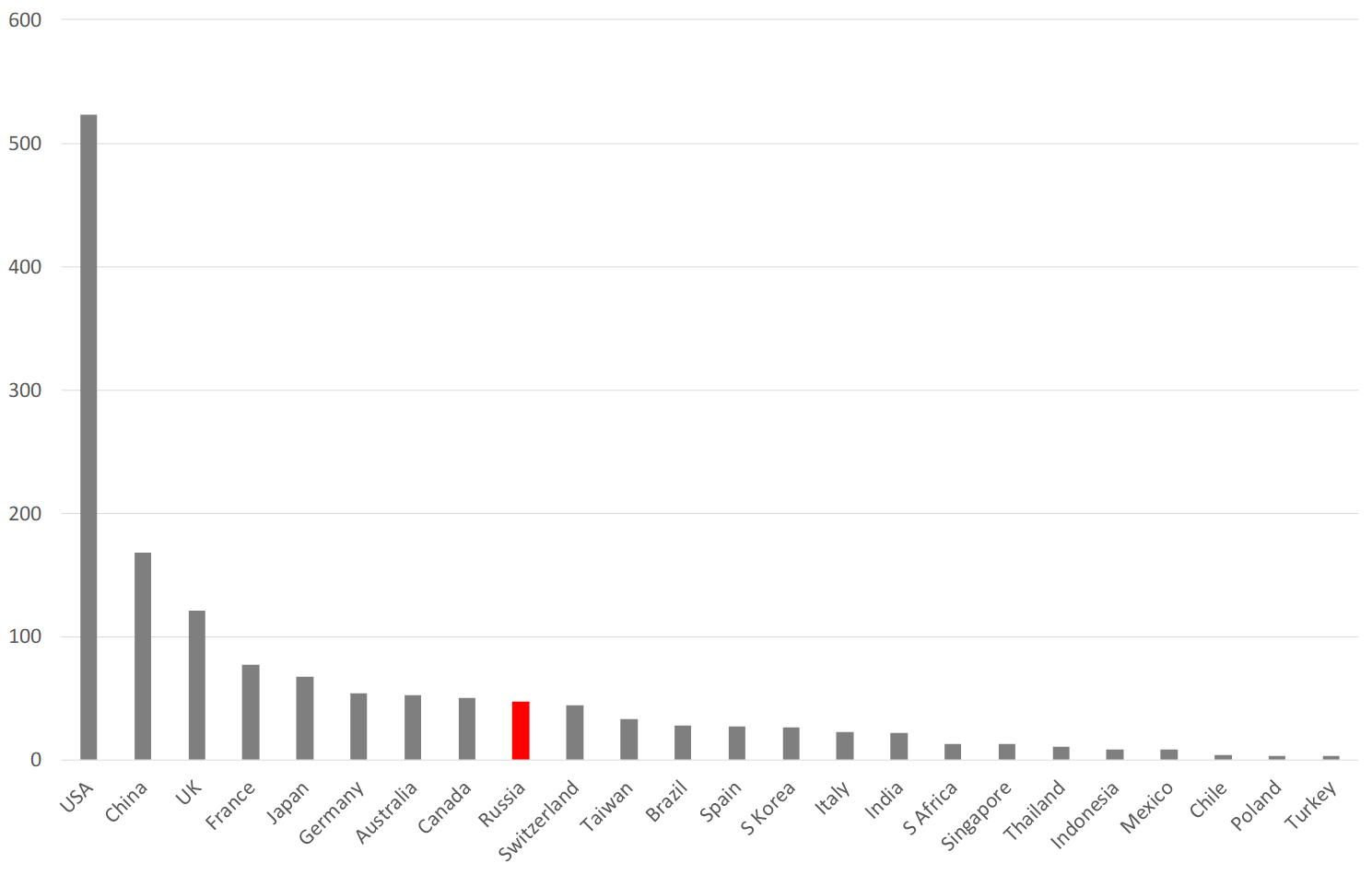

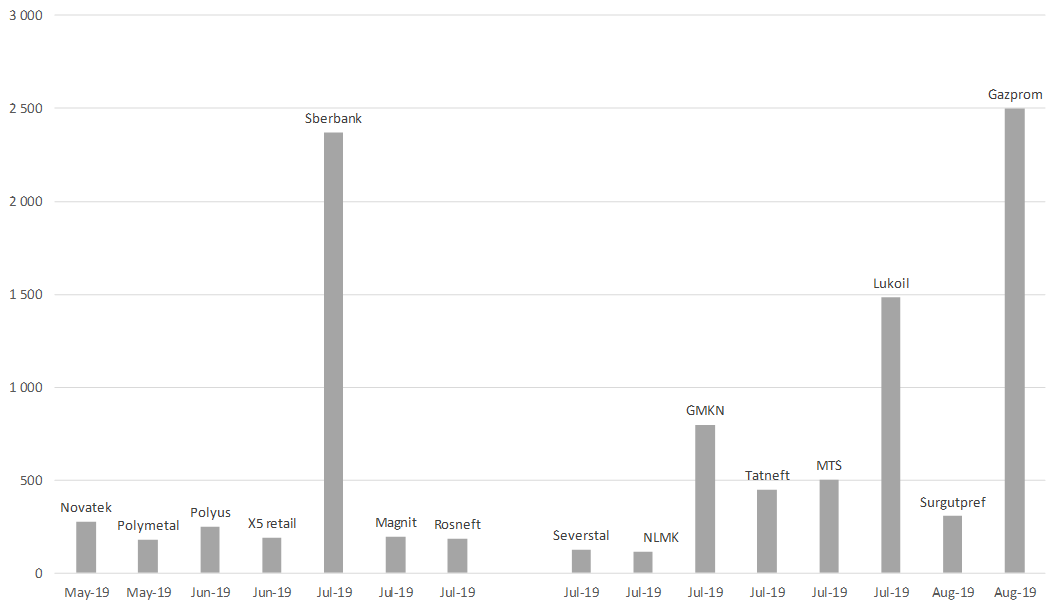

- Total dividends payments for 2018 may hit a record of 3,1 trln roubles ($47 bln), if we take top-50 companies in terms of liquidity. The biggest recent payments were announced by Gazprom (393 bln roubles) and Sberbank (345 bln roubles)

- Finally, Russia made it into the top-10 biggest dividends payers, catching up with Switzerland. Amongst EM it’s second after China

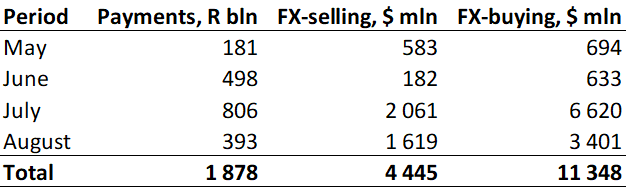

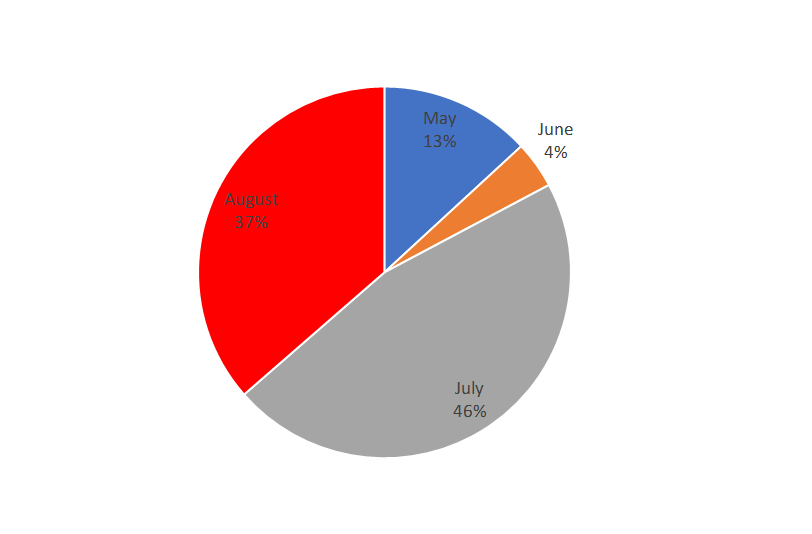

- Dividend payments for 2018 have been ongoing since 2H 2018 and reached 1,2 trln roubles, payments of the outstanding amount (1.9 trln roubles) ($29 bln) have just begun. The bulk of upcoming payments (45%) will come in July, 28% — in June, 16% — in August. The net effect of dividend payments for the rouble will be negative, based on the expected conversion amount for foreign holders of Russian stocks (read more in this report)

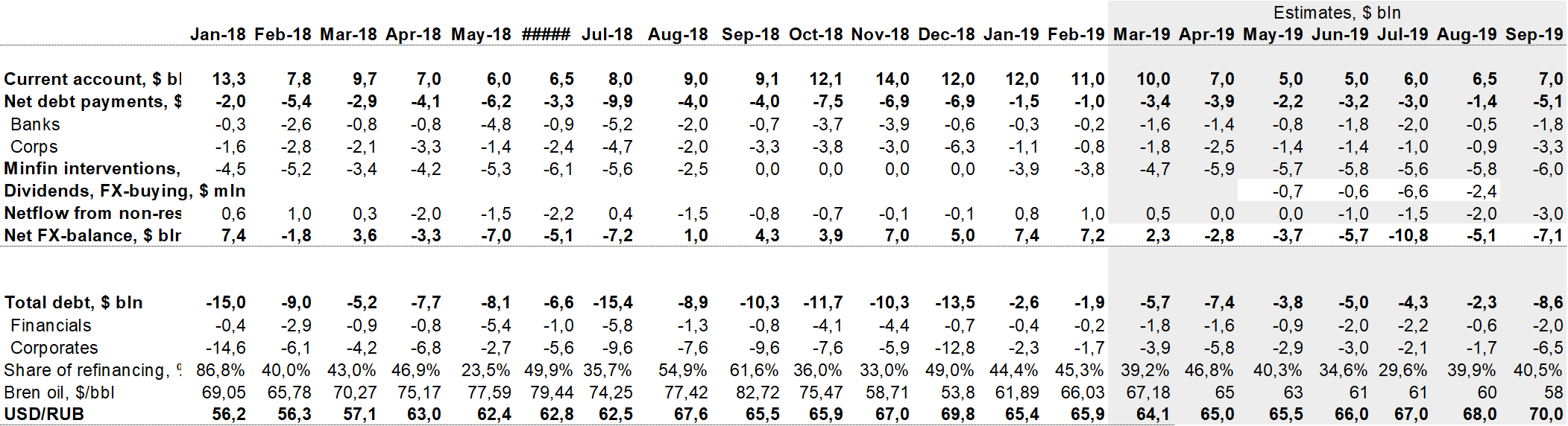

Our recommendations: The highest-yielding companies in 2018 and in terms of the nearest payments this summer

The top ten dividend yielders this summer will include Surgutneftegaz pref (19.3%), Enel Russia (13.1%), IDGC of Volga (12.5%), LSR (11.7%), NCSP (11%) , FGC (11%), Etalon (10.5%), Gazprom (10.2%), Mosenergo (9.4%), OGK-2 (9%) and Rostelecom pref (8.7%).

Highest dividend yielders in Russia, %

Source: Bloomberg, ITI Capital

Impact on Russia’s stocks

On the back of new sanctions risks, geopolitics and global economic uncertainty, high dividend payments and low multiples partially offset Russia's sovereign risks. Assuming that the global economy will not face a recession within the next two years, we believe that Russian companies should continue high dividends policy and work towards increasing market capitalization.

High dividends policy is the key feature of the Russian market, given that it lacks buy-back and M&A and other cash-generating events that are common for developed market such as US. For example, buy-backs, capex and M&As, in the U.S. amounted to $2.5 trln, or 10% of the market capitalization of $27 trln.

Assuming no sanctions are looming, we expect a dividend rally, as market players are set to ramp up reinvestments in equities, given rising dividend yields in Russia. MICEX is expected to advance by 8% up to the cut-off level.

Outlook for 2020

We believe that the interim and final dividend yields for 2019 will rise only marginally, to 9% at best, from the current 8.1%. At the same time, payments will increase, as the market capitalization will continue to grow and more companies, especially state-owned entities, will work towards increasing dividends payout ratio. The trend will in many ways depend on the oil and metals prices. It will clearly be harder to keep profit at the record levels seen in 2018.

The rouble performance that impacts exporters' revenues and total dividend payments will depend on sanctions and global volatility, but in general the rouble will weaken marginally against the dollar in the coming years.

Dividend yields beat new records

2018 dividends payments may hit a record of 3,1 trln roubles. ($ 47 bln), if we take the top-50 liquid companies on MICEX and other issuers listed overseas: Etalon, MD Medical Group and Veon. 1.2 trln roubles out of 3,1 trln roubles have already been paid out by Russian companies, payments of the outstanding amount (19 trln roubles) ($29 bln) have just begun.

Please see our forecast in Dividend Strategy for 2019 — Russia: The land of generosity. Our calculations rely on 95% of recommendations confirmed by the companies’ boards.

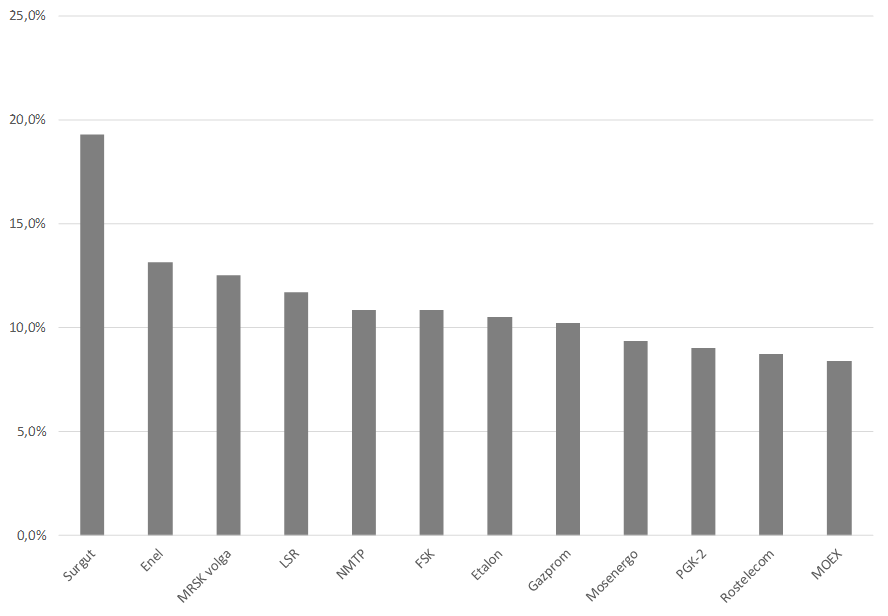

The average annual yield for 2018 will be an all-time high of 8% against 5.5% in 2017. Last year, total dividend payments, including interim dividends, for 2017 seemed huge and amounted to 1.5 trln roubles. This is twice as less than the new figure, particularly since our calculations for 2017 included 100 companies.

History of dividends payments in Russia

Source: ITI Capital

Russia dividends yields track record (MSCI Russia), %

Source: Bloomberg, ITI Capital

The Russian market has always offered generous dividend yields due to low price of equity and high earnings. Now they are officially the world’s highest as compared to MSCI countries. Russia remains the country with lowest multiples (P/E 5x and P/B <1). Net asset value of many Russian companies, such as Gazprom, is lagging way behind market capitalization.

Global dividends payments for 2018, bln $

Source: Bloomberg, ITI Capital

Dividend payout ratio, %

Source: Bloomberg, ITI Capital

What is the reason behind strong dividends for 2018 against 2017?

1. Rise in interim dividends

Our estimate of total dividend payments calculations include interim dividend payments for 2018 in the second half of 2018.The main reason behind such strong growth is record interim dividends payments. Before 2018 metal producers were the only reliable payers of interim dividends. In 2018, interim dividends reached a record of 900 bln roubles ($14 bln), according to our conservative estimates.

Interim dividends for 2018 amounted to 30% of the total dividend payments for 2018 and 60% of annual dividends for 2017 (that is, 900 bln roubles out of 1.5 trln roubles) that were paid out in summer of 2018. Interim dividend yield averaged 5.8% in 2018.

The number of interim dividends payers is growing, now they are paid by each third company. This has particularly been the case with the O&G companies, such as Rosneft. In October 2017, the company paid out interim dividends for 1H2017 for the first time in its corporate history, and in 2018, they became the second largest after Sberbank.

The bulk of interim dividends payments for 2018 (555 bln roubles) was made in the fourth quarter (October — November 2018), the remaining 345 bln roubles — in January 2019. O&G accounted for the bulk of payments (54%), metal sector — for 40%.

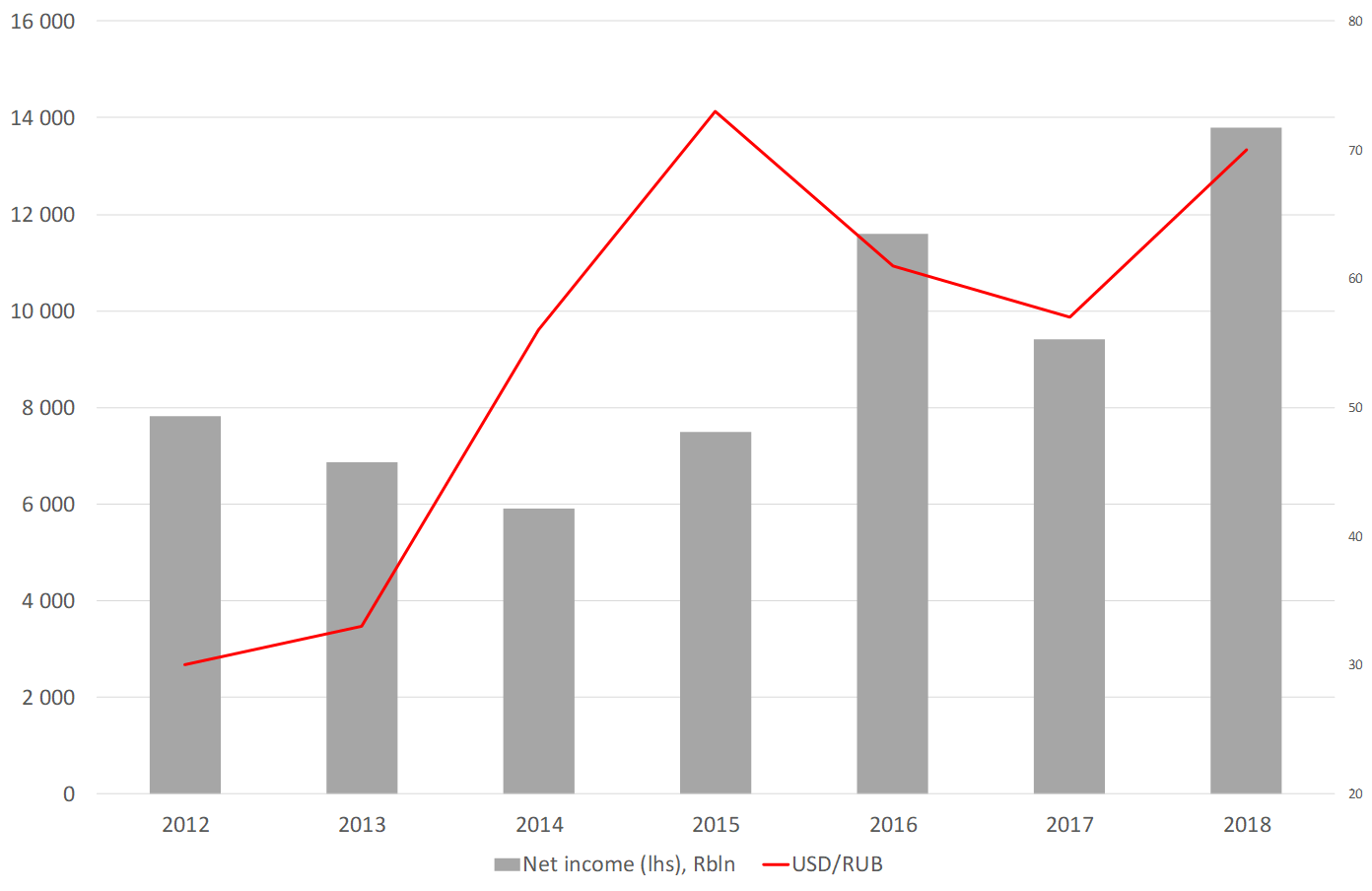

2. Record net profit growth and lower in-house investments

Dividend payments in the mining industry have been steadily rising over the recent years on the back of net profit (net financial result) growth and capex slowdown. Net profit growth over recent years has played an important role. According to Russia’s Federal Statistics Service (Rosstat) data, 2018 net profit will reach a record 13 trln roubles, a rise of 46% yoy. Rosstat largely relies on mining industry as a source of data. The main reasons behind export revenues growth are higher prices for raw materials (mainly oil and metals) yoy due to stronger global demand and weaker rouble (last year, the rouble slipped by 21% yoy against the dollar), triggering a record rise of Russia's current account in 2018, to $113 bln.

As a result, by the end of 2018, O&G and metal companies broke records in terms of profit growth and posted a record cash flow.

All Russian companies annual net profit, bln roubles

Source: Bloomberg, Russia’s Federal Statistics Service, ITI Capital

What is more, a decrease in operating expenses, namely a slowdown in wage growth, is leading to a decrease in real disposable income of the population. In 2018, nominal wages growth (up by 7.3%) was the slowest since 2015 , when the growth was 3.4%.

On the back of these factors, exporters’ share of dividend payments rose to 78%, the highest since 2014. In 2017 exporters’ accounted for 60% (all-time low) of all payments.

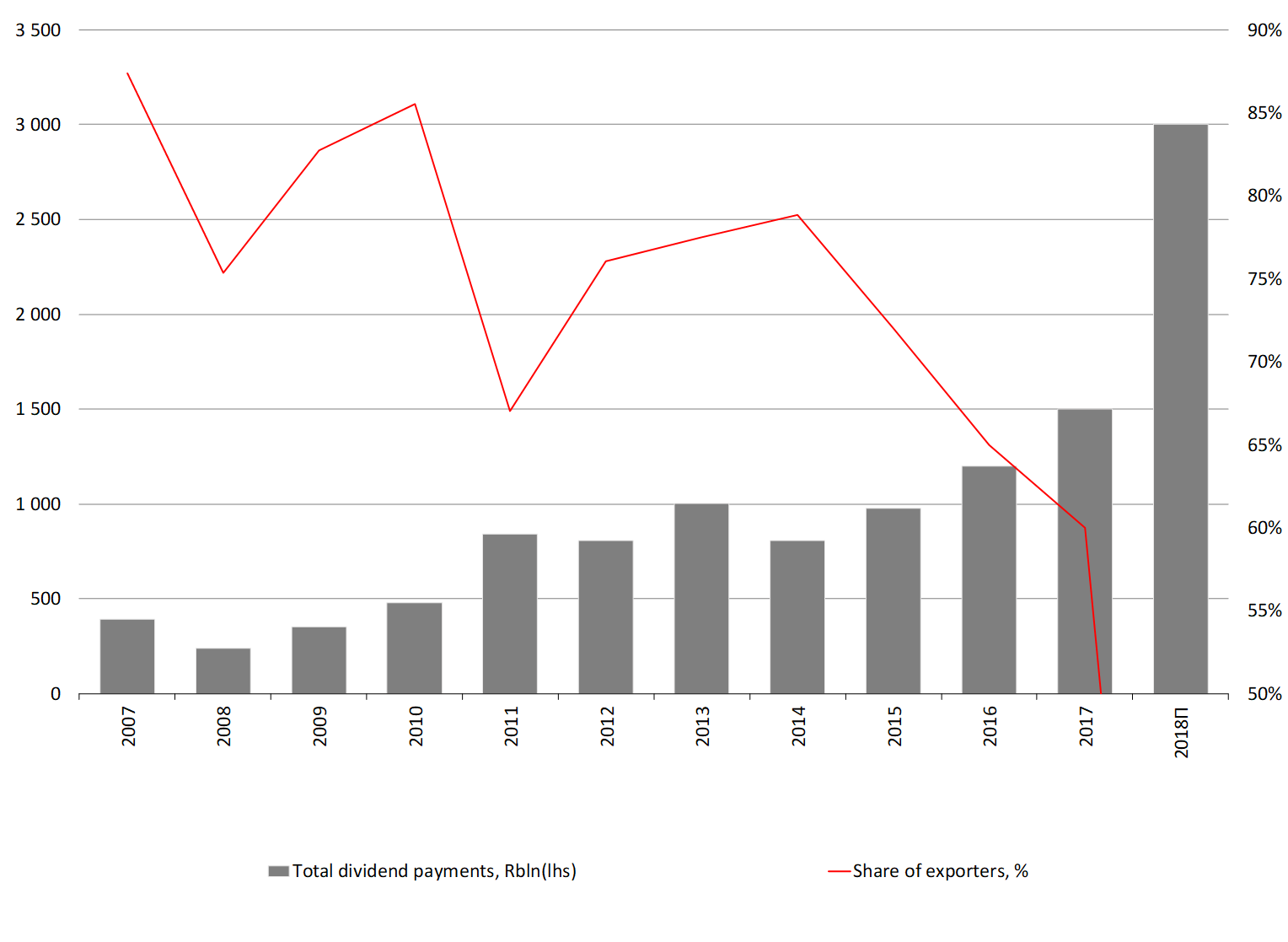

Dividend payments seasonality

Every year in April and May, the boards of directors of major companies approve annual dividend payments for the previous year.

The registry closure is made up of three stages — by 43% in June and July, 14% — in May.

Now the dividends payment amount is marginally below 10%, the bulk of payments (45%) will come in July, 28% — in June, 16% — in August.

Sberbank and mostly metal companies pay in June, O&G sector pays in July, in August almost all payments are made by Gazprom.

Estimated upcoming dividend flows

Source: Bloomberg, ITI Capital

Impact on the currency market and interbank rates

Our outlook for the currency market covers payments scheduled for this summer — 1.9 trln roubles ($29 bln).

Currency is usually sold at the end of the month when rouble dividends payments are made, the same principle as with taxes, short term synergy effect for local currency.

After that when ruble payments have been received, in second stage, roubles are converted by custodies into FX mostly USD and payments are made to foreign holders (holders of DRs and international institutions) at the beginning of the month.

In the first stage, FX-selling for dividends and taxes at the end of the month is expected to generate positive synergies for the rouble.

Hence, we recommend buying currency at the beginning of the month and selling it at the end of the month, to earn on cross selling.

First stage Rouble — positive

Payments are made in two stages. Payments in roubles is the first key stage if the company is registered in Russia. The impact on the rouble will be positive, as it will be the case with tax payments, assuming no negative effects from global volatility. Exporters may sell currency for dividend payments in roubles, the way they do for tax payments. Some $4.5 bln, or 6-8% of the average daily turnover on the MICEX, will be sold during the dividend season, mainly in July, according to our calculations.

The sales will not have a significant impact on the market. If oil trades at $65—70/bbl FX-buying may amount to >300 bln roubles, or $4.8 bln, that offsets FX-sales.

However, the effect from synergies of sales and tax payments is much stronger. Total synergies with account of tax payments may be over $10 bln, while the net effect with account of FX-buying by MinFin may reach $5.5 bln, which will be positive for the rouble at the end of July. However, the net effect will be softened by bigger FX-purchases at the second stage.

FX-selling timing

Source: Bloomberg, Russia’s Federal Statistics Service, ITI Capital

Second stage: Rouble — negative

The first stage of dividend payments may help the rouble in the short term, but this is followed by the second stage — rouble conversion into currency for payments to foreign shareholders. Conversion is carried out by international custodian banks (BNY, JPM, Citi) as soon as the dividends are received from the depositary (that must transfer the dividends within seven days).

According to our estimates, some $11.4 bln in rouble equivalent will be converted into dollars for foreign holders (holders of depositary receipts and institutional international funds). It cannot be ruled out that private persons will spend some of their funds (about $3 bln) to buy foreign currency. We assume most, or 70%, of individuals will reinvest their funds into the market.

Hence, the total amount of FX-buying may reach $14.5 bln against $4.5 bln of FX-selling for dividend payments in rubles.

Overall, the effect on the rouble in terms of net foreign currency flows will be negative, as so many times before, but we do not rule out that the Russian currency will enjoy support for some short periods.

Importantly, most of the FX-purchases will be made in early July, if conversion is not delayed.

There is another important factor that may lead to a decrease in the actual conversion amount — major companies, usually metal producers, such as Nornickel, prehedge — buy currency for dividends in advance through currency swaps, since their ownership structure is marked by offshore affiliation and common shareholders own other majors in the sector.

The largest conversions for foreign holders after dividend payments, mln $

Source: Bloomberg, Russia’s Federal Statistics Service, ITI Capital

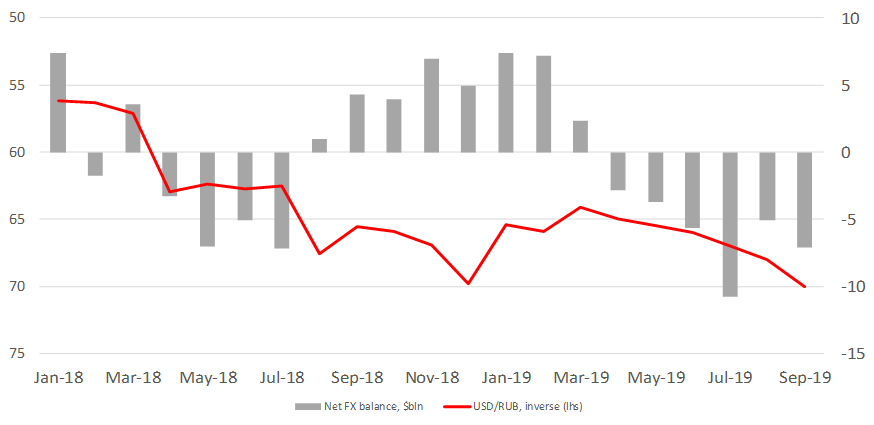

Net foreign exchange balance and impact on the rouble (since April 2019, estimate)