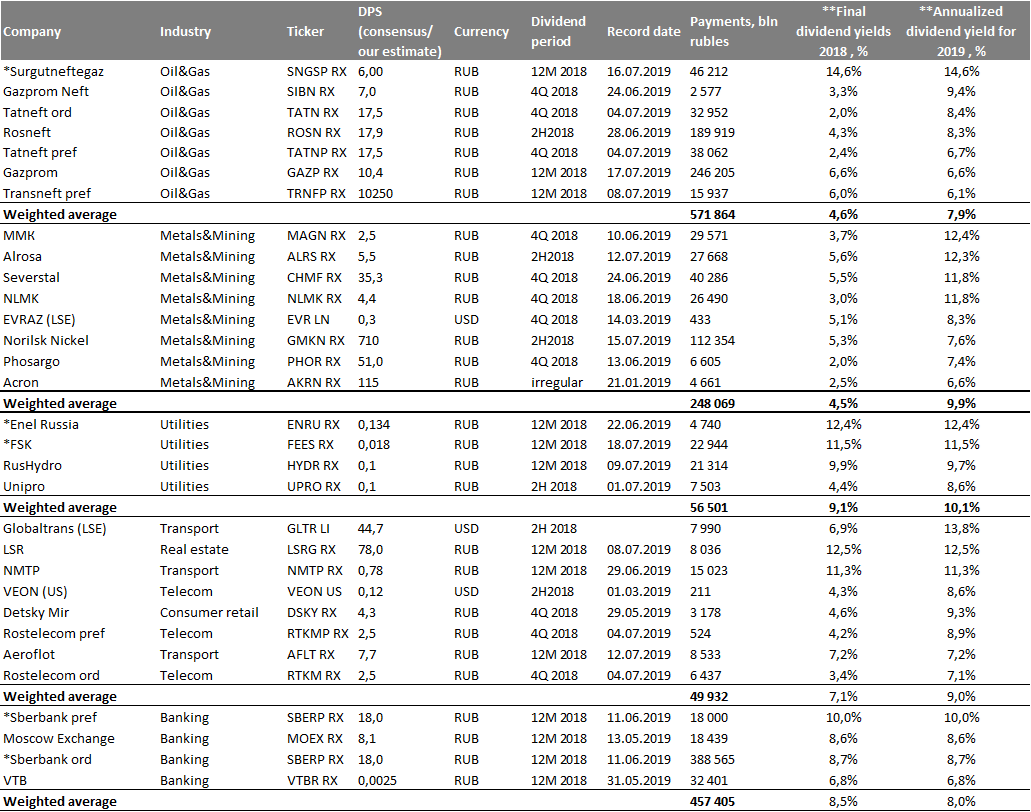

Russian company$B!G(Bs dividends are getting increasingly generous. The note focuses on the biggest high-yield names in 2019. Russian stocks dividends and yields are set to hit unprecedent high levels. Dividend payments could reach up to 10% of market cap, while dividend yield may hit an average of 7% (Russia$B!G(Bs record and world$B!G(Bs highest). Our top picks include Surgutneftegas, Alrosa, Norilsk Nickel, Severstal, FSK, Sberbank pref and Globaltrans. As part of dividend strategy we recommend ITI Funds RTS Equity UCITS ETF (RUSE:LN) which tracks RTSI $ index and is up by over 10% ytd in USD.

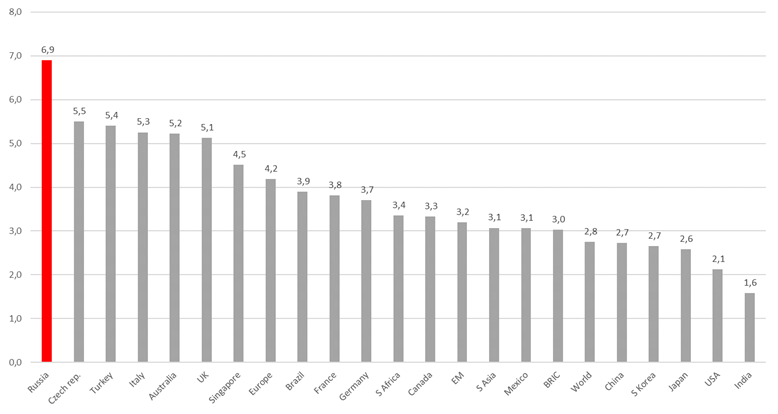

Russian stocks trade at a 50% discount to emerging markets (MSCI EM) based on their P/E ratio. Total payments look significant compared to emerging markets such as Brazil where the gauge is $30 bln against $45 bln projected in Russia for 2019. However, Russia$B!G(Bs average dividend pay-out ratio (30%) still lags behind the global average (50%), as it is the case with Brazil and other emerging markets, suggesting a strong upside potential in contrast to other markets. Still, Russia$B!G(Bs dividends payments are not comparable to developed markets. For example, the U.S. companies paid out as much as $500 bln in dividends, although their dividend yielded stockholders as low as 2%.

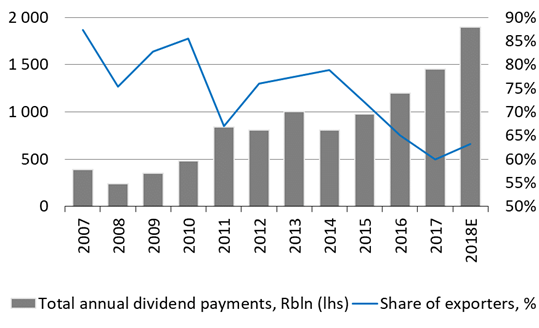

History of annual dividend payments in Russia, bln rubles

Source: ITI Capital, company data

Unprecedent rise in interim dividends

- Public companies$B!G(B interim dividends rose to an all-time high of 900 bln roubles ($13.5) in 2018, according to our calculations based on top-30 liquid stocks. This amounts to 65% of annual dividends for 2017 (1.4 trln roubles), paid out in summer 2018, according to our calculations based on top-30 liquid stocks. We expect 2019 interim dividends to remain unchanged at approximately 1 trln roubles

- Interim dividend yield averaged 4% in 2018

- The bulk of interim dividends (555 bln roubles) was paid out in Q1 (October – November 2018), the remaining 345 bln roubles – in January 2019. O&G accounted for the bulk of payments (54%), metal sector – for 40%. Hence, actual payments including annual and interim dividends excluding less liquid and non-public shares set a record, climbing above 2.3 trln roubles ($35 bln)

- The spike had an impact on the FX and money market and was clearly digested by investors. In 2018, to make dividend payments in roubles, exporters sold around $8 bln in FX, according to our estimates. After payments were made in roubles, custodies/nominees converted roubles worth $11 bln into U.S. dollars to make payments in favour of foreign investors and holders of depositary receipts

- Last year we have seen unprecedent rise in amount of interim dividend payments due to new comers such as Rosneft which have started paying its first interim dividends since second half of 2017. Before interim dividends in Russia were insignificant in actual amounts and dividend yield and were paid by limited number of companies mostly from retail, telecoms and metals& mining sectors

Global dividend yield estimates based on MSCI index, %

Source: ITI Capital, Bloomberg, MSCI

In 2019, dividend payments, including interim dividends, may hit new record high of 3 trln roubles ($45 bln)

- With a new dividend season kicking off in May, the board of directors will announce their annual dividend recommendations. Total payments may reach 1.9 trln roubles ($ 28.4 bln), up by 36% from a 2017 record. Total payments including interim dividends, may amount 3 trln roubles ($45 bln), or 8% of the top 100 names value on MICEX

- Exporters (O&G and metal companies) will account for the bulk of payments (slightly over 60%). O&G and metal companies posted strong earnings in 2018, O&G in particular posted record high cash flow due to spike in oil prices and significant rise in oil gas exports. Russia$B!G(Bs foreign trade surplus grew 1.7 times in 2018, while the current account surplus renewed new historical high of $115 bln, according to the latest CBR data

- The government's efforts to raise the dividends pay-out to a minimum of 50 percent of net income contributed to an increase in payments. Certain players, such as Rosneft, Transneft, etc., have started to comply with the requirement as recently as 2017. Sberbank also has been raising both dividends per share and payments volume. This year, Sberbank may post a record and pay over 380 bln roubles in dividends (the highest level in Russia), implying DPS of 18 roubles (back in 2015, DPS was as low as 2 roubles)

- The bulk of annual payments that usually support the rouble is due in July

- This year, annual dividends may break the world$B!G(Bs record (6% in 2017) and reach Russia$B!G(Bs all-time high of 7%. Hence, the Russian stocks, trading at a discount of 50% to emerging markets on the lowest multiples, also offer to potential investors the highest dividend yield - on average 70 bps below the average local deposit rate and OFZ short curve yield

- Surgutneftegaz pref 15% will clearly be one of the top gainers in terms of yields in 2018 on the back of the weaker rouble. Sberbank, that enjoys the highest ROE in the global banking sector, may post a double-digit dividend yield this year

Top dividend payments this year

Source: ITI Capital, company data