ITI Capital: Russia and EM Investment Ideas Wrap-Up for 2018 and 2019

Рынок Акций

Рынок Облигаций и Валюта

Рынок Акций

Рынок Облигаций и Валюта

Investment summary:

- 2018 was a record year in terms of black swan events faced by investors across international markets

- Health care stocks from S&P 500 and Internet retailers, as well as currency cash investments were the biggest gainers across dollar-denominated assets. Russian O&G was the biggest gainer across local currency assets. Venezuelan bolivar, Argentine peso, Turkish lira, Russia’s consumer sector and oil were the biggest losers

- Donald Trump's policy has been the key trigger of unexpected events during the year, weighting heavily on traditional hedge and risk assets. Key developments in Europe (including the UK), the US — China trade spat and the Fed's rhetoric in the first half of the year will be the key sources of volatility throughout the coming year. Emerging markets have been outperforming other assets YTD, in line with our 2019 outlook, and will continue to do so over the next six months, according to our expectations

- According to market consensus, this year, markets with biggest upside are Japan (+25%), S Korea (+25%), China (+24%), Germany (+22%), France (+21%), Italy and Russia (+20%)

- The report focuses on the most promising ideas

Top picks Promising specific ideas in equities

- Promising ideas for the Russian market in 2019 Detsky Mir, Yandex, Lukoil, Surgutneftegaz and Norilsk Nickel

- Our ideas for the U.S. market in 2019: Nvidia Corp, Align Technology, AMD, Netflix, Textron, IBM and VISA Inc

- There is a high likelihood of lower yields among the most high-yielding bonds across emerging markets (such as Pemex (Mexico), VEB (Russia), Brazil, South Africa, Turkey and Argentina) and higher yields across the low-yielding securities of these markets (Hungary, Indonesia and China)

- Investors may choose between Ishares index (ETF) through China and SKorea ETF or AsiaPacific ETF. However, specific issuers, including Japanese companies, look more promising: Samsung, Nintendo, Softbank, Sony, SK Hynix, Vipshop holdings, Tencent, Alibaba, China Petroleum and LG

2018 Financial Wrap Up

- The year 2018 was marked by a bulk of political and geopolitical changes. Hawkish Federal Reserve rhetoric, signaling further rate hikes, trade tariffs on Chinese exports and the closest U.S. allies such as the E.U., Canada and Mexico, unprecedented sanctions against Rusal and EN+ (SDN) and the ongoing political mess in the White House have been the main drivers of market volatility in the first half of 2018

- Despite the negative environment, emerging and European markets outperformed the U.S. in the first half of 2018. In the second half of 2018, the US stock market have performed way better. At least until the end of September the U.S. stocks were seen as a hedge against global volatility, given increased pressure on China and Europe due to trade tariffs, slowing growth in the emerging markets and a further dollar rates growth on the back of material improvement of the U.S. economic indicators. S&P 500 went down on September 21 plunging by more than 20% by the end of the year and losing as much as ca $5 trillion in market capitalization, roughly the size of Japan's GDP for 2017. This fall was primarily driven by the political crisis in the U.S. (White House reshuffle, administration’s pressure on the Fed, probability of the U.S. Attorney General resignation, etc.) and downbeat guidance by leading US corporates

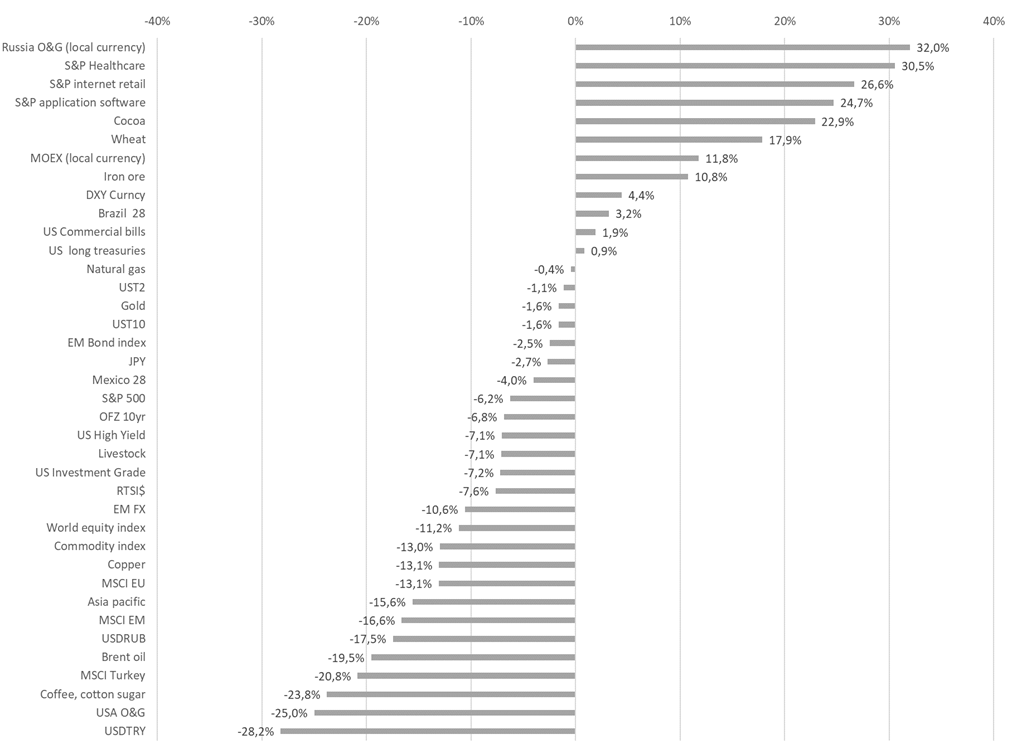

Top global gainers across local currency assets: Russian O&G — leader across global markets

- Russian O&G yields topped 32%, or roughly 16% in dollar terms

- Novatek (+67%), Tatneft (+54%), Lukoil (+50%) and Rosneft (+48%) were the top gainers

- As a result, the Russian stock market ended up with of the fastest-growing yields (+12%)

- All national indices ended the year down in dollar terms

- Top losers across local currency assets: China's telecommunications services sector (-40%), the Russian consumer sector (-39%) and the Turkish real estate sector (-16%)

Top global gainers across dollar-denominated assets: Health care stocks from S&P 500

- Dollar-denominated health care stocks from S&P 500 retain the highest yields (+31%) followed by Internet retailers (+27%), software developers (+25%)

- Indian IT (+23%) and consumer goods (+20%) in dollar terms

- Futures on agricultural raw materials (i.e. wheat and cocoa beans) (+22%), iron ore (+12%), and dollar index DXY +4.4% were the top gainers, when it comes to other financial instruments

- Dollar was the top gainer across global assets, and it is not surprising, given current volatility

Top global losers across dollar-denominated assets: Russian consumer sector

- According to MSCI sector indices, Russia’s consumer sector (-48%), China’s communications services sector (-44%) and Turkey’s real estate sector (-43%) were the top losers

- Oil market (-20%), soft currencies such as Argentine peso and Turkish lira (-29%) were among the assets that took a significant dive in 2018

- The US O&G fell by 25% on the back of weaker oil prices

- Chile (-21%), Turkey (-21%) and China (-20%) are the biggest decliners across country markets. Germany and South Korea are also among the top-5 losers. Therefore, it is highly likely that the countries would be back to growth this year

- Meanwhile the yields relating to gold and classic 60/40 portfolios were negative back in 2018 as US T-bills and corporate bonds fell by 2% and 7% respectively.

- Investments into gold declined by 2% in 2018

Top global Equity gainers and losers in USD:

- AMD was the best-performing name in 2018, growing as much as 80%. Abiomed (+73%), Advanced Auto Parts (+58%) and Tripadvisor (+57%) also posted solid gains. Coty (-67%), Mohawk Industries (-58%) and GE (-57%) were the worst-performing stocks

Top global FI gainers and losers in USD:

- Treasury bills were the biggest gainers (+2%) in global bonds, Essentially, investments in these securities amount to investments in dollar cash. Long treasury bills climbed by 1%

- Most of the global bonds fell into negative territory in 2018. Certain issues such as Sistema 19’ (+1.3%), Gazprombank perps (-0.3%), Petrobras 19’-20’ (-0.5%) were the least affected

- Longest Pemex (40’-47’) issues, that declined by more than 18% in dollar terms, VTB perps (-15%), Mexico 31’ (-14%) and Russia 47 (-11%) were the biggest losers

2019 Financial Outlook

- Major events of 2019 are expected in its first half of the year. The deadline for reaching a U.S. — China trade agreement expires on March 1, Brexit is scheduled to officially take place on March 29

- So far, the market is seeing encouraging signs in the US-China trade negotiations

- Presidential elections in Ukraine are scheduled to take place at the end of March, and in April Russia is widely expected to face yet another round of sanctions. In the first half of 2019, the citizens of many European countries, such as Slovakia, Finland, Ireland, Germany, etc. will take part in municipal and parliamentary elections that would result in the most dramatic transfer of power in recent years

- In 2019, Europe could be the major source risks for global markets: in April, Italy may face sanctions, unless a 2019 budget deficit deal is reached with the European Commission. The gauge currently exceeds 2% of GDP required by the E.U. standards. Besides, ECB chief term expires in October

- In addition to European elections, investors are expected to follow presidential elections in South Africa. The market players will also follow regular meetings of global central banks. The Russian market will primarily focus on the Fed and the CBR policy decisions. The pace of rate tightening in the U.S. and dollar-denominated treasury bills yields growth will be among the main drivers of global volatility in 2019. According to our 2019 strategy, it will be moderate. We expect the Fed to stick to dovish rhetoric in the first half of the year, with no rate hikes looming ahead, at least until June. That said, the appetite for risk assets is expected to grow in the first half of 2019

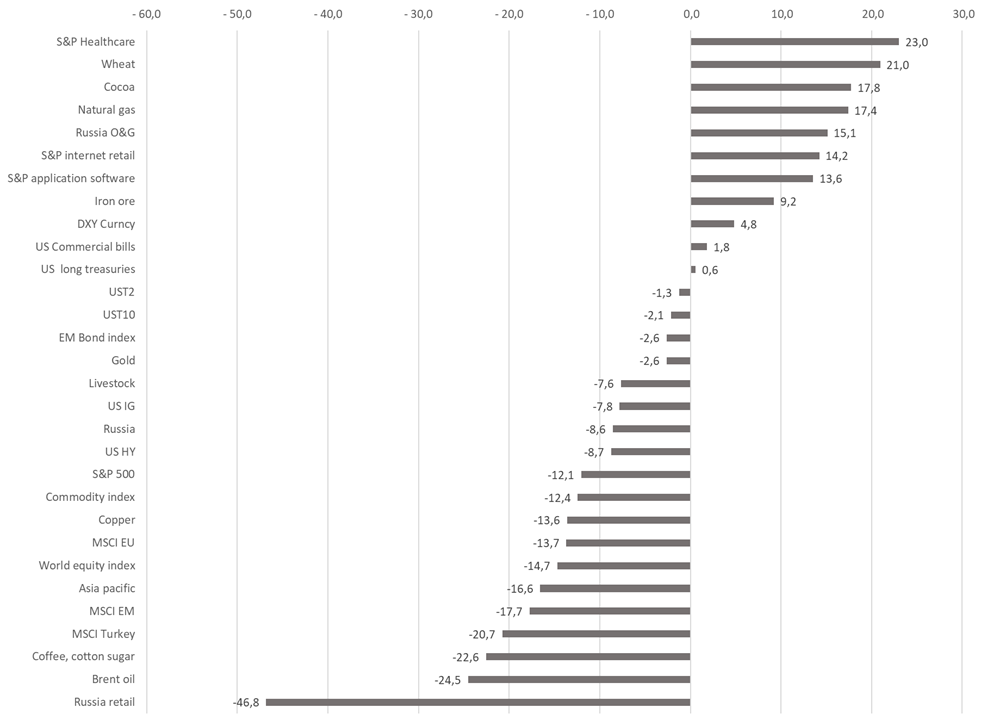

Top global performance YTD in USD:

- MSCI Brazil (+12%), MSCI Chile (+10%), MSCI Russia (+10%) and MSCI Mexico (+9%)

- Subsectors are posting even greater gains, Brazil O&G (+26%), Brazil utilities (+25%). Oil is the main growth driver for many sectors. Oil has advanced by more than 16% YTD and is the top gainer now

- Against this background, EM exporting currencies, such as Russian ruble (+5%) and S Africa rand (+4%) have been strengthening. S&P 500 O&G (+15%), S&P 500 Financial (+10%) and communication services sectors (+9%) have been the top gainers on developed markets

The worst-performing dollar-denominated assets YTD

- The Turkish lira (-4%), soft commodities (-3%) and the U.S. dollar (-0.5%) have been the biggest losers given current crude strength so far

- MSCI Korea (-1.2%), MSCI S Africa (-1.2%) and MSCI India (-0.9%)

Top global Equity gainers and losers in USD:

- S&P 500 companies such as Celgene (+37%), Nektar Therapeutics (+24%), Hess Corp (+20%), Netflix (+19,6%) and Incyte (+18%) are the top-performing stocks now

- X5 Retail Group (+9.3%), Mail.ru (+6.2%), MTS (+5.3%) and Magnit (+5%) are posting solid gains. Not surprisingly, consumer sector is a major gainer, given the last year’s massive drop in the industry

Top global FI gainers and losers in USD:

- Overbought long PEMEX 41-47 issues are the best-performing asset, followed by Russia 47 (+4%), Mexico 48 (+3.7%) and the most actively traded bonds in 2018

- Long sovereign bonds issued by PEMEX, Petrobras, Gazprom 37, Russia 47, VTB perps and VEB 25 are rapidly picking up, in line with expectations

- Turkey’s dollar-denominated sovereign debt is under pressure, long bonds are declining by more than 2%. Banks bonds are trading slightly stronger

Key assets performance in 2018

Source: Bloomberg, ITI Capital

Key assets performance YTD

Source: Bloomberg, ITI Capital

Author: Iskander Lutsko, Chief Investment Strategist, ITI Capital