MTS: defensive stock with healthy dividends

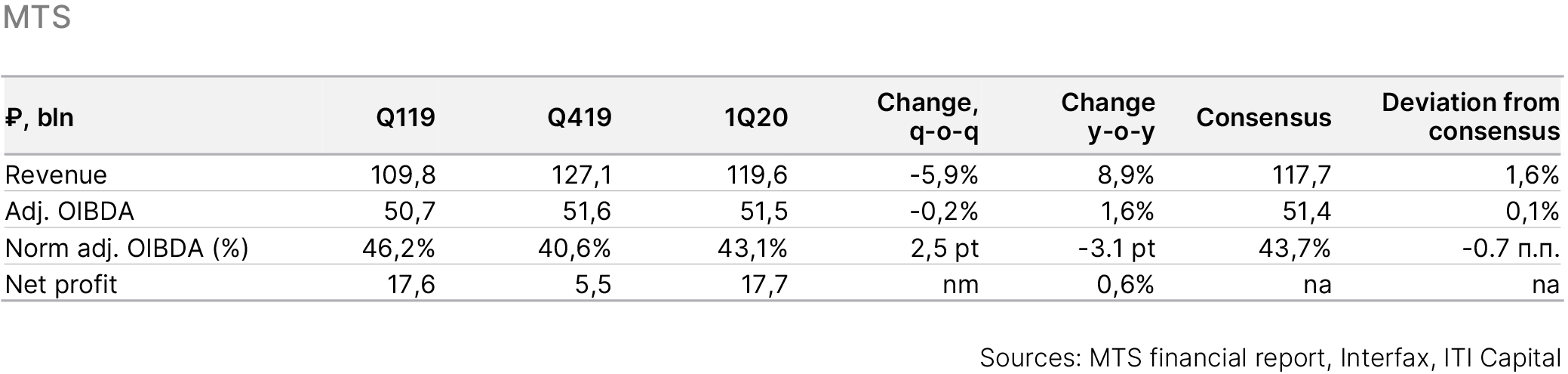

1K20 revenue topped expectations. MTS 1Q20 IFRS revenue was above consensus. Revenue was 120 bln roubles. (+8.9% y-o-y; -5.9% q-o-q), OIBDA - 51.5 (+1.6% y-o-y; -0.2% q-o-q), net profit - 17.7 bln roubles. (+0.6% y-o-y vs. 5.5 bln roubles in 4Q19).

Defensive features

Top management comments suggest the stock may be seen as a defensive asset, which is one of the most important points made during the results webcast

- 2020 outlook

- Stable dividend payouts

- Share buyback programme

Amid volatility and low oil prices, it is still reasonable to opt for defensive stocks.

1. 2020 Outlook assumes relative stability:

- Revenues will grow by 0-3% y-o-y in 2020.

- OIBDA may decrease by 2% y-o-y or remain unchanged in 2020.

We believe the forecast looks positive, underscoring the sector’s stability amid crisis. Telecom services and access to content are the last things consumers may drop. The company has also sold its assets in Ukraine in 4Q19, countering these risks.

- FY2020 cash CAPEX spending is estimated to be around 90 bln roubles, including required investments under the Yarovaya Law, total required investments are expected to amount 50 bln roubles in 2018 - 2023. We suggest the capex outlook is relatively aggressive, roughly the level of 2019 (91.5 bln roubles), but it is reasonable to take into account the rouble’s devaluation and the need to develop 5G solutions.

It should be reminded that MTS’ net debt is under control and amounted to 284 bln roubles in 1Q20, up from 280.5 bln roubles in 4Q19. Almost the entire debt (98%) is denominated in roubles. Net debt/LTM OIBDA was 1.6x in 1Q20, up from 1.5x in 4Q19.

2. Dividends.

MTS said it has no plans to revise its dividends due to coronavirus.

The MTS Board of Directors approved the dividends policy for 2019-2021 that sets the payouts at 28 roubles per common share (56 roubles per ADR) annually at least.

A) We would like to remind that the board recommended that the AGM approve dividends of 20.57 roubles per ordinary MTS share (6.1% dividend yield). The record date for shareholders and ADR-holders entitled to receive dividends for the 2019 fiscal year is set for July 9, 2020.

B) It is likely that the level of dividends may decline, but it will remain decent in 2020, at around 8% (traditionally, a lower dividend may come in the first half of the year and a higher one in the second half).

In 2019, MTS paid 29.3 roubles per share (8.6% dividend yield), a total of 58 bln roubles (excluding special dividends), half of which were paid to Sistema. Dividends for 1H20 may be announced in August, the end of 2Q20.

We would like to remind that the controlling shareholder - Sistema - needs MTS dividends: (1) 23 bln roubles and 10 bln roubles of debt needs to be paid in 2020 and 2021 respectively; (2) Commercial and management costs in 2019 amounted to about 13 bln roubles.

In the current crisis, investors opt for high dividend stocks. After cut-offs for 2019, dividends may remain on investors' radars in 2020 too. However, new sectors may take over leadership in terms of attractive dividend yields, as most cyclical industries may suffer during the crisis. MTS is one of those stocks that will provide an attractive dividend yield in 2020 as well.

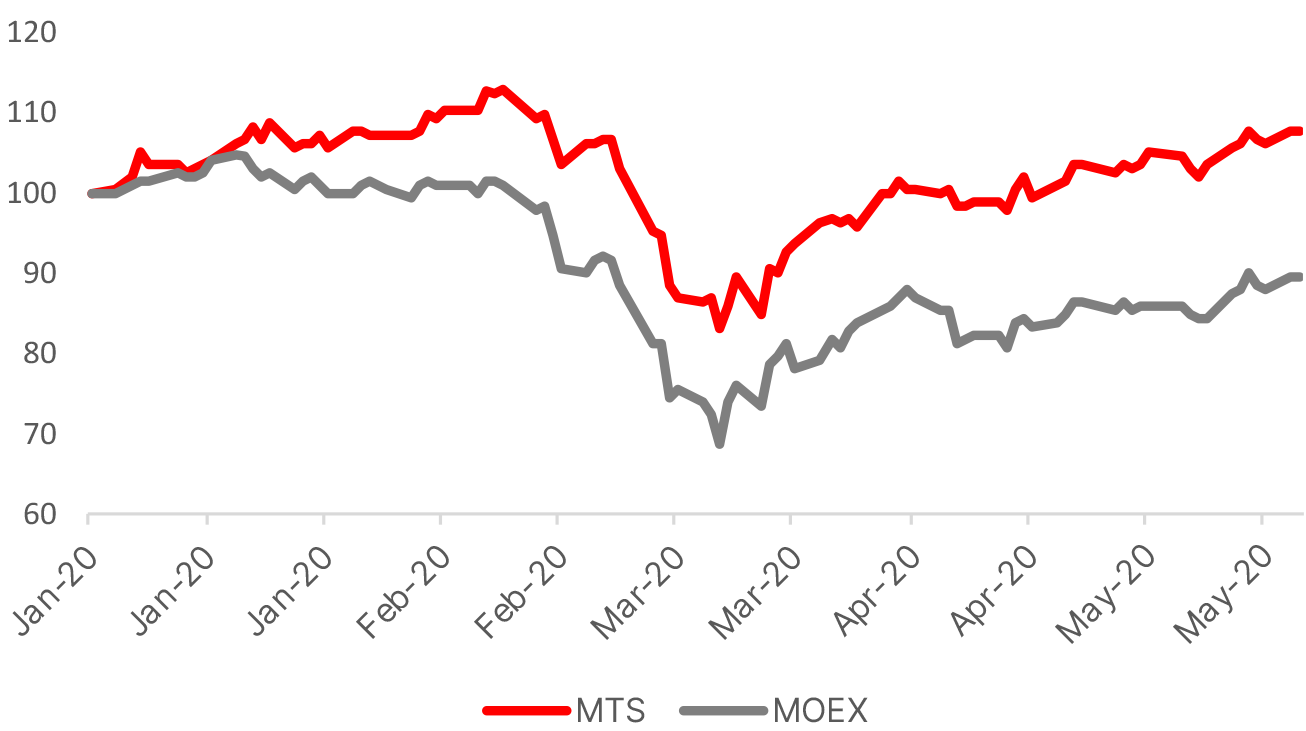

MTS: above the market amid crisis

Source: The Moscow Exchange

3. Share buyback

The company repurchased 0.08% of its shares in 2Q20 (as of May 22) at an average price of 308.5 roubles per share (current price 336 roubles), having spent 480 mln roubles. On March 31, the company launched a buyback programme worth 15 bln roubles. The buyback provides for the purchase of shares from Sistema Finance (a parent company) as well.

Market trends in the industry are generally positive

Competitive climate on the telecom market improves

Several telecom operators, including Rostelecom, Veon and MTS, said in the recent weeks market players have been acting reasonably during the crisis. The companies have made a bet on efficiency and business profitability instead of subscriber base ramp-up. The market will benefit if companies continue to act in a unified manner.

The operators may opt for a moderate increase in telecom services tariffs.

After completion of the merger with Rostelecom, Tele2, which has traditionally pursued an aggressive subscriber base growth policy, plans to gradually move away from the discounter model.

All these measures will help to offset the negative trends of the crisis: migration from mobile Internet to fixed-line telephony, outflow of people from cities into the regions with a lower 4G availability, a decrease in high-yield roaming.

Optimization of the retail network is a necessary response to the crisis

MTS is planning to close some 400 retail outlets in 2020 to optimize its business. In 1Q20 the company wound down 170 stores. The company closed more retail outlets than originally planned due to the pandemic.

The operational reduction of the retail chain is a positive development in terms of profitability management. An alternative would be to support a loss-making retail chain during the crisis.

By the mid-May SIM-cards sales dropped 20% against March, smartphones sales tumbled 25%. In April, the sales were down 35% and 40% respectively. In April, 55% of MTS shops were closed, by the mid-May 75% of MTS retail outlets were opened. The current retail environment will slow down subscribers growth and will have a negative impact on revenue, which was probably reflected in the company's lower forecast. Nevertheless, this is a common trend for the entire market.

Earlier media reported that Veon may drop retail business in Russia and transfer it to franchise partners. The trend to reduce participation in the retail business began in 2019: MTS and Megafon have also announced closures of several hundreds of shops.

Attractiveness of retail business will only decrease following rouble depreciation in 1Q20. Online sales of smartphones is also in line with the current retail trends, which came to the fore amid total quarantine.

Potential for development of proprietary ecosystem: looking into the future

MTS develops various businesses - from fintech to online retail and online TV. Business diversification will provide further support to the operator's growth in the future, after the crisis is over, when defensive qualities of the sector will no longer be an advantage, and the issue of moderate growth rates will arise.

However, it should be noted that due to the increased reserves in MTS bank OIBDA and net profit in 2Q20 will come under some pressure. In our opinion, the management's lower OIBDA forecast already reflects this moderate negative trend.

MTS Board names strong new candidates

At the meeting of the Board of Directors held on May 21, 2020 the following candidates from different prospective new business areas were nominated for election to the Board at the Annual General Meeting (AGM) of shareholders scheduled for June 24, 2020:

- Alexander Galitsky, Independent Director;

- Felix Evtushenkov, Member of the Board of Directors, PJSC Sistema, and Chairman of the Board, MTS;

- Artyom Zasursky, Vice President for Strategy, PJSC Sistema.

- Alexey Kornya, Executive Director, MTS President & CEO;

- Shaygan Kherapdir, Independent Director;

- Thomas Holtrop, Independent Director;

- Nadia Shouraboura, Independent Director;

- Konstantin Ernst, Independent Director;

- Valentin Yumashev, Independent Director.