Bank of Russia Governor Elvira Nabiullina has held yet another traditional weekly press-conference, making her final comments before the central bank’s black-out week ahead of a regular monetary policy meeting scheduled for April 24. Below are the key highlights.

Takeaway: Nabiullina's tone has not changed and remains dovish. Essentially, size of the cut - 50 or 25 bps - at the 24 April meeting is the only thing that is left unknown. Therefore, the OFZ market welcomed the soft tone and extended gains. The longest bonds advanced 2-2.5% since early trading. Short government bonds assume almost a 50-bps discount to the key rate. CBR will consider a key rate cut and its size at its next meeting.

Our take

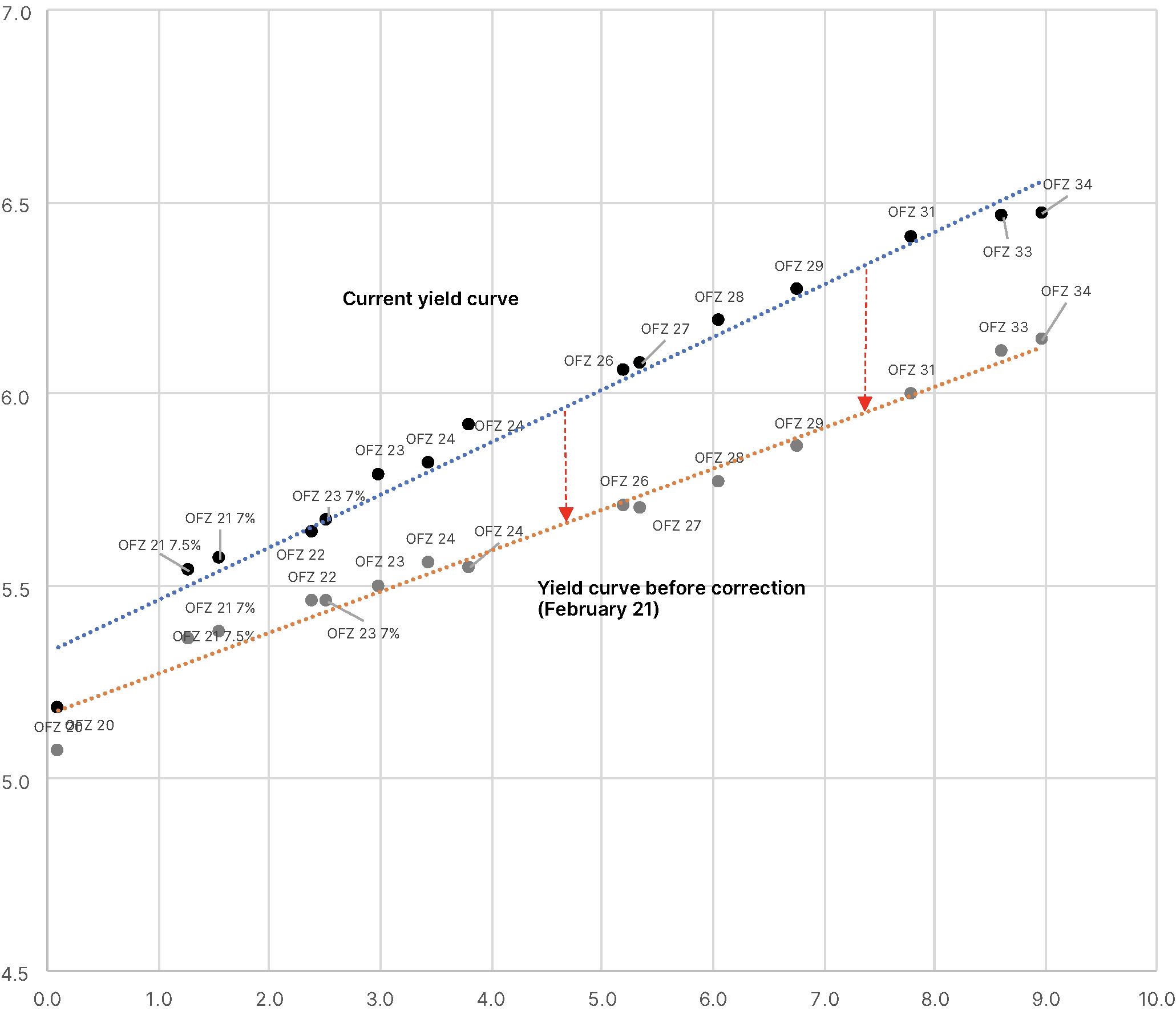

- We expect CBR to cut the rate by 25 bps, to 5.75%, and switch to more regular cuts as part of state stimulus and social programmes. Therefore, by the year-end we anticipate a 25-bps cut per meetings – on June 19, July 24, September 18 and December 18, in total - 100 bps to 4.75-5%. Based on the current yield, OFZ is expected to decline by 50 bps by the year-end.

- Over the next 75 days, until the end of June, we expect RUBUSD to strengthen to 69-70 and OFZ to return to pre-crisis levels of February 20, which will contribute to the rouble’s further strengthening, but the Russian currency will continue to lag behind OFZ yields due to low oil prices, that are unlikely to top $35/bbl by the end of June, according to our forecasts.

OFZ and the rouble performance

- The OFZ government bonds market stabilized, with non-residents resuming purchases of the bonds in April, the central banker said. According to the latest statistics for March, foreign holdings accounted for 31%.

- Over the next 75 days, till the end of June, we expect the OFZ market to recover the pre-crisis level (February 21), which implies a 40 bps yields decline of the long bonds, or a 3-4% price growth.

- Mid-term bonds downside stands at 30 bps, which implies a 1-1.5% price growth.

- RUBUSD is likely to strengthen to 69-70 by the end of June, up 5-6% from current levels. Further performance will depend on the price of oil, our estimate for the price range till the end of June is $25-35/bbl.

Russian OFZ local yield curve,%

Source: Bloomberg, ITI Capital

Comments made by Bank of Russia Governor Elvira Nabiullina on key topics during the press conference

Lower volatility and lockdown lifting

- The international markets have recently witnessed yet another volatility surge, but not as big as back in mid-March, and credit spreads have widened.

- The media reported lately that many countries are weighing easing restrictive measures, pushing the world economy smoothly towards recovery.

CPI growth slows down

- Russia’s annual inflation was 2.9% from April 7 through April 13, below the target. Annual inflation accelerated slightly in March, from 2.3% to 2.5%. Consumer prices increased by 0.2% during the week, which is lower than in the previous three weeks (0.3%), but still at the upper end of the range typical of this week of the year.

Inflationary expectations recorded modest growth

- Russians’ inflationary expectations are demonstrating a temporary rise, CBR said. Inflationary expectations were up 7.9% in March, observed inflation - 8.3%.

Money market

- Nabiullina said prospects of rise in loan rates very low.

- The central bank has decreased banks’ payments to the national deposit insurance system to 0.1% from 0.15% until the end of 2020.

- CBR sees no need for government to recapitalize banks by means of trillion-worth OFZ programme lime in 2015 during financial crisis.

- Quantitative easing (QE), and even more active, direct influence on the economy from funds of the CBR, so-called "helicopter money," are not relevant for Russia, as the regulator currently has enough standard monetary policy instruments at its disposal (primarily policy easing).