What happened to oil prices?

- Oil prices have tumbled by more than 74% year-to-date. Before the expiration on April 21, May futures fell as low as -$40/bbl, i.e. the futures’ sellers had to pay the buyers due to excess supply. Prices on June futures are declining, dropping by more than 11%, to $17/bbl, to the lows of March 1999.

- Urals price fell below $10/bbl, to the lows of December 1998.

Why oil tumble?

- The decline in prices was due to a sharp drop in demand and filled storage facilities amid high production in the U.S. and other countries. Travel bans have erased one third of global oil demand in April as compared to pre-crisis levels.

- Drop in crude oil demand is estimated at 12-13 mbps, while global production of three largest market players, the U.S., Saudi Arabia, and Russia, stands at 35-40 mln bps.

- 10 mbps OPEC+ agreed production cuts will take effect on May 1, and demand will continue to fall at least until the end of June, when lockdown is expected to be lifted around the world.

- Crude oil is being held in floating storage in oil tankers due to lack of storage tanks.

- It is therefore unlikely that Brent price will top $20/bbl, and Urals’ - $15/bbl, the levels that carry high risks for the Russian economy.

What does cheap oil mean for the Russian economy and the rouble?

- The state does not levy mineral extraction tax (MET) from on oil and gas companies.

- Oil and gas companies will have to make massive production cuts ahead of the production season in May, as the average production cost at existing wells stands about $10/bbl Urals.

- Shortfall in oil and gas budget revenues will top $4 bln per month (300 bln roubles), i.e. 45% of total Russian budget revenues on average. Total Russian budget deficit, including the damping, may exceed 8% in 2020, according to our estimates.

- Oil and gas revenues drop by $8 bln per month and a sharp decline in Russia's current account surplus by at least 60-65% y-o-y or twice as much as in 1Q20.

- Therefore, the second quarter is likely to see a minimum inflow of funds or even a current account deficit - for the first time since 2Q1998. The economy will clearly suffer a heavy blow, since 65-70% of the Russian exports account for O&G and metals.

- With these oil prices and market climate, GDP may fall by 4% over the year, while inflation will triple to 6%, if the Central Bank lets the rouble to devaluate sharply. The IMF expects Russia's GDP to fall by 5.5% in 2020.

How can the Central Bank stabilize the rouble rate?

Since April 21, the MinFin’s daily FX-sales have increased to 17 bln roubles ($220 mln), or about $4.5 bln per day. At these oil prices, we expect interventions to increase to $300 mln per day, or about $6 bln per month ($72 bln per year), including the proceeds from the sale of Sberbank to the Ministry of Finance for 2.1 trln roubles ($28 bln).

Using the proceeds from the deal, the government will be able to double the current sales volumes, provided there’s no panic among non-residents, and further reduce the rouble's reliance on oil.

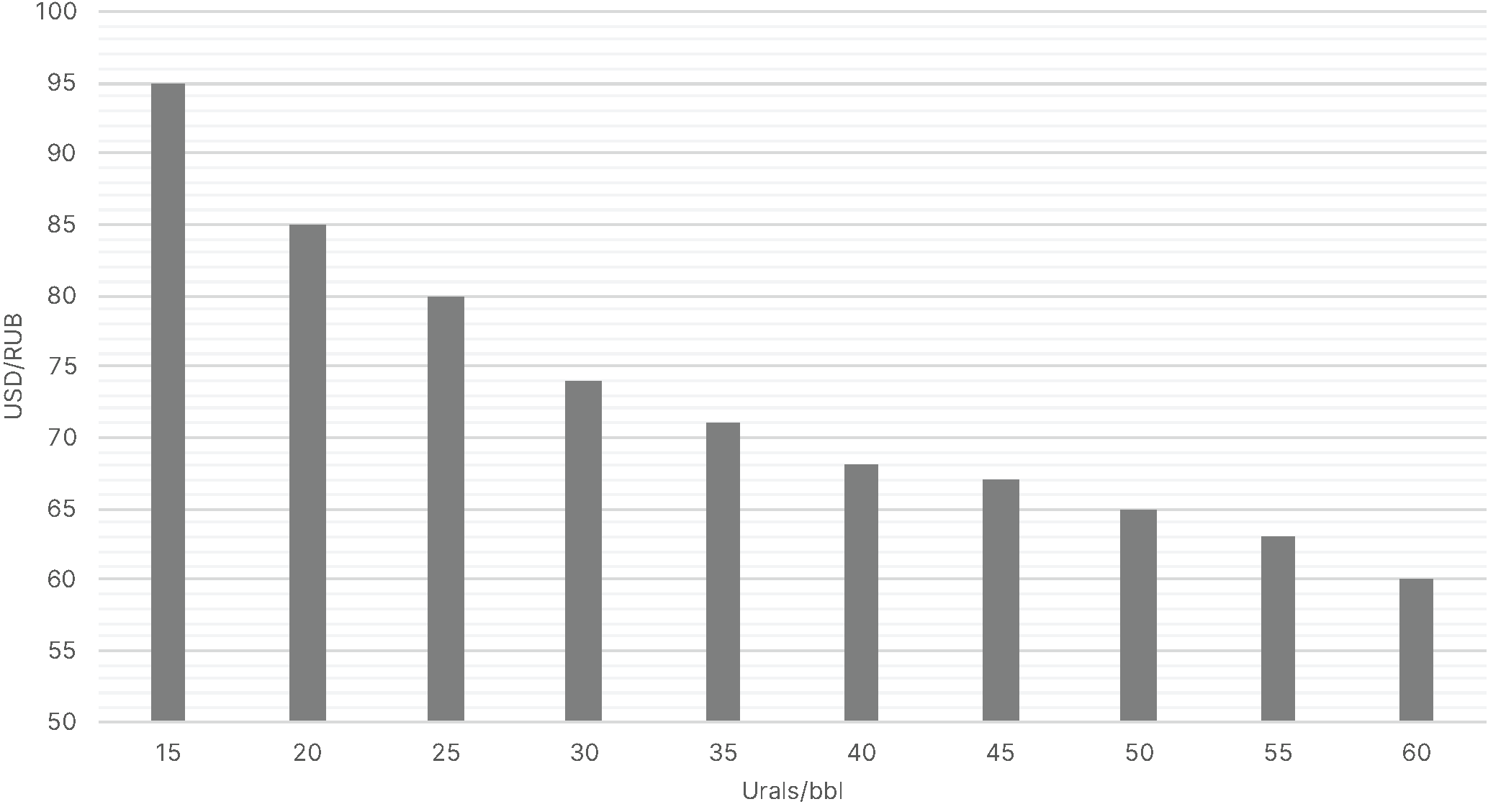

The rouble’s fair value at current oil prices

- Using the classical regression at current oil prices, we forecast the new rouble range to be 80-90 roubles per dollar with no interventions and conditional on active OFZs sales by non-residents, as was in August 2018.

- The longer the Russian economy will be in these conditions, the more likely it is that the rouble will weaken, since with massive interventions, even from $6 bln a day, will last for 2-2.5 years based on outstanding amount in in Russian Wellbeing Fund (RWF), which is equivalent to 10% of GDP, or all the RWF.

Balanced value of the rouble at various oil prices (Urals/bbl)

Source: ITI Capital, Bloomberg

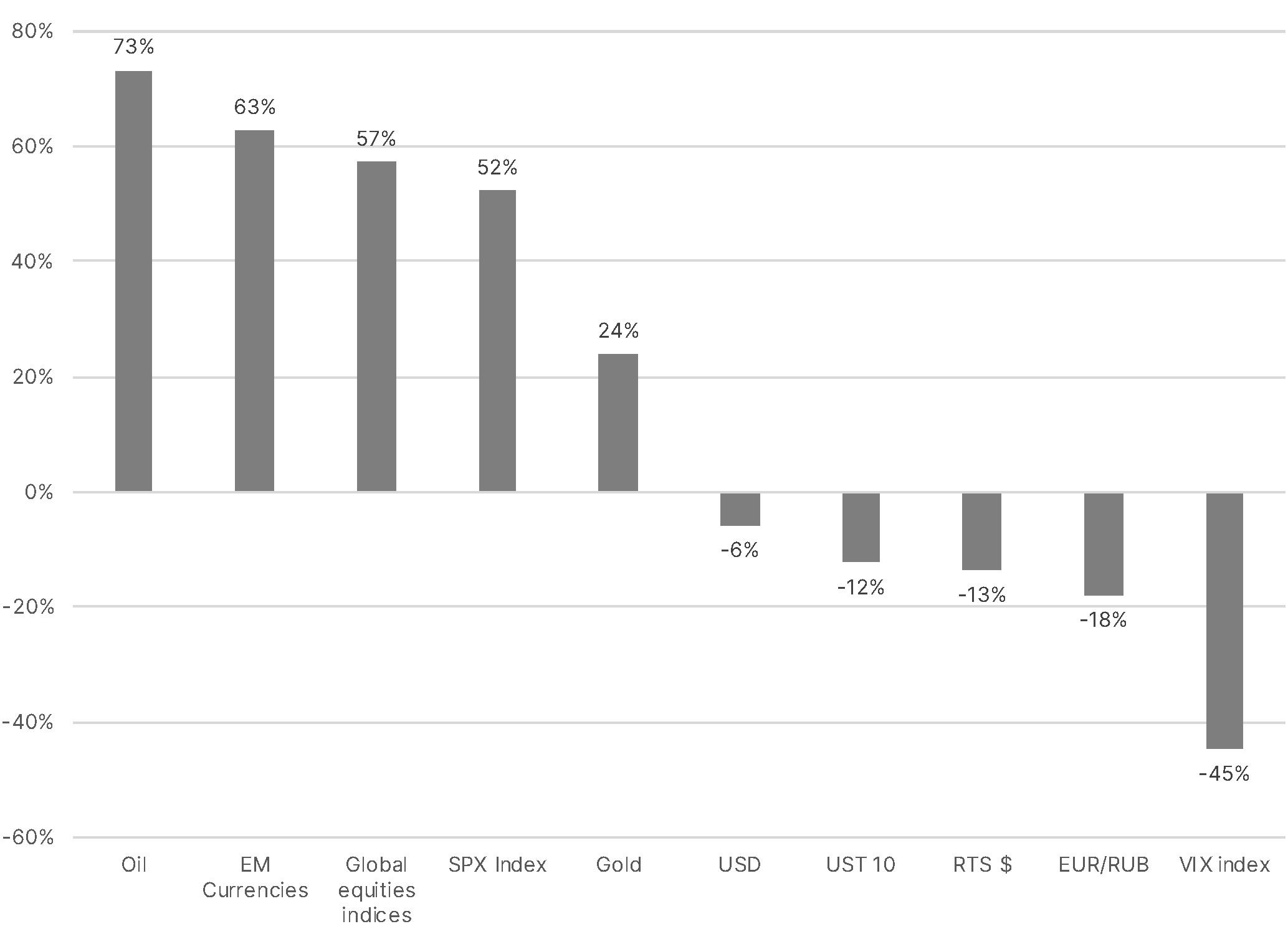

Moving correlation between the rouble and the key assets since the beginning of the Covid-19 pandemic

Source: Bloomberg, ITI Capital