New rules of the oil market

Minimum price support is likely

The latest deal establishes a new mechanism for balancing the oil market. We are not inclined to overestimate the ability of a broader OPEC++ alliance to impact oil prices in the long run due to differences in interests of the agreement parties. Externalities associated with the spread of coronavirus and variability in estimates of the depth of demand decline will continue to dominate oil price formation in the short-term. The current crises, as compared to previous turmoils, is marked by a slowdown in transportation, a major consumer of oil.

However, the new mechanism is designed to prevent the prices from falling to $25-30/bbl, which is seen as a critical range for most countries of OPEC++. This deal will support the oil price.

Non-economic factors will continue to impact the market in the medium term

During economic turbulence, discipline within OPEC++, compliance with the targets will continue to influence the market. The oil price may remain under pressure in the short-term due to both macroeconomic conditions and competition, as major players will seek to use organically cheap oil to squeeze shale companies out of the market. OPEC members, whose influence on the market has decreased over the last decade, largely due to shale industry boom, may also willing to stick to this strategy in the long term. Many countries may be interested in relatively cheap oil to cut back on stimulus spending and speed up the recovery. The compromise mid-term price range could be $45-55/bbl.

Oil prices may see a speedy recovery due to monetary factors.

In terms of prospects for this year, it should be noted that a gradual increase in OPEC+ oil production starting from July indirectly implies an expected demand recovery. As always, money markets will be the first to respond to a possible improvement in the economy, which will translate into speculative support for the oil industry as well. State stimulus, cash-injections into the market will also support oil prices as soon as we see the first signs of the economic recovery.

The nearest price performance will play but a speculative role. In case of a drawn-out slump, a negative trend will dominate the oil market. However, it’s clear that the governments are seeking to open economies as soon as possible. That said, positive developments in the oil market should not be ruled out.

Speculative positive scenario of oil price growth

-261.png)

Source: ITI Capital estimates

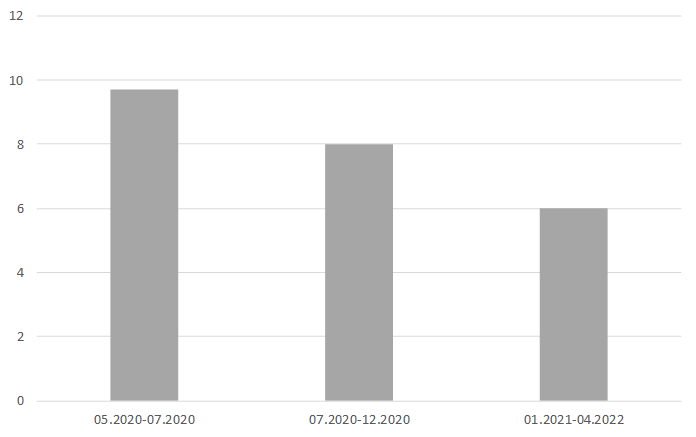

Deal timeline

On April 9, 2020 the OPEC+ video conference held to discuss actions to balance the market. OPEC+ agreed 10 mbpd production cut.

April 10, 2020. Saudi Arabia, which currently holds the G20 presidency, has called for the “virtual summit” of the group’s energy ministers. OPEC has been seeking a 5 mbpd cuts by the G-20 countries.

On April 12, 2020, OPEC held an extended meeting. As a result, OPEC+ agreed to cut production by 9.7 mln b/d from May to June 2020. After that, the group will steadily ramp up production until the agreement expires in April 2022. The total cut between OPEC+ and the G20 and buying from other countries will be 19-20 mbpd, which is close to 20% of global production, media reported. The move may bring a Brent support level to $30/bbl. Further prices will depend on the demand, if the latest cuts are not enough, the industry will have to agree additional cuts.

OPEC+ oil production cuts, mbpd

Source: Kommersant, Vedomosti, RBC

Oil prices going forward

Short-term support for oil

While it’s not clear how to control compliance with production cuts, it’s unprecedented that consensus has been reached and so many countries joined the deal.

9.7 mbpd cuts announced by OPEC+ was in line with market expectations, but possible 19-20 mbpd cuts were positive news.

Oil deal country cut targets, mbpd

-987.png)

Source: Kommersant, Vedomosti, RBC, Bloomberg

OPEC+ turned into OPEC++, got stronger

Production has a limited impact on prices, they are primarily determined by demand. This is due to (i) high capital intensity of the industry, (ii) a lag between the launch of new fields and changes in demand, and (iii) limited reserves capacity.

Against this backdrop, OPEC looks justified in terms of increasing market predictability.

Amid critical uncertainty about the depth of the global GDP decline and oil demand, the world leaders are less willing to be involved in increasing volatility and have joined the agreement. G20-countries agreed to cut production by 3.7 mbpd. These are Norway, Brazil, Canada and Argentina. They were followed by the African Petroleum Producers Organization (APPO). What is more, Kuwait, Saudi Arabia and the UAE will cut production by an additional 2 million bpd, RBC said.

Petroleum Producers, 2019 (mbpd)

-732.png)

Source: ITI Capital, IEA, OPEC, Bloomberg Intelligence

OPEC++: undivided and for long?

We do not tend to overestimate the ability of a broader OPEC++ to determine oil prices over the long term due to (i) differences in oil production costs between countries, (ii) limited impact of governments on the private oil sector, and (iii) differences in medium-term goals.

However, it appears that the OPEC++ members will show solidarity if there are risks that prices drop to $25-30/bbl.

Saudi Arabia and Russia have effectively ended the oil market price war. Although some analysts claim Russia has suffered a tactical defeat pledging to make greater cuts compared with the figures discussed back in March (1.5 mbpd vs. 2.5 mbpd), the important thing is that negotiations ended with a compromise. As for OPEC+'s cuts planned in March, it is obvious that they would have been not enough, and another meeting would have been needed. Medium-term phased production cuts announced in April are sufficient to contain the market collapse. Cuts may be adjusted at the June meeting.

It cannot be ruled out that an agreement reached in April 2020 may become the basis for the mechanism prevent prices from falling to critical level. However, this mechanism will not be able to maintain oil prices above these levels.

Further prices will be determined by relations between the main export countries - Saudi Arabia and Russia, active position of the U.S., and, above all, by the depth of the world economy decline.

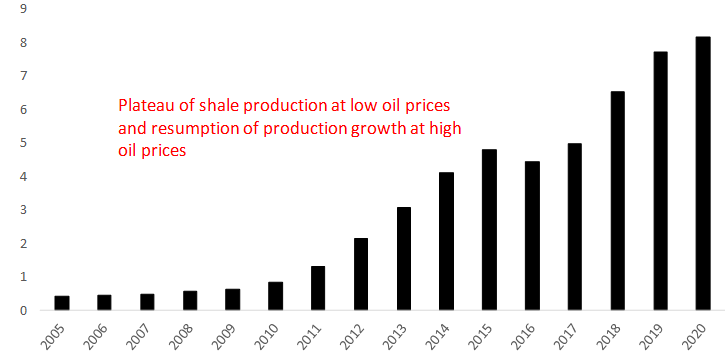

Oil production: U.S. market share vs. OPEC and Russia (‘000 bpd)

-865.png)

Source: BP

In an era of high prices, the U.S. became a powerful player in the oil market.

The efficiency of OPEC has changed over time. Thus, timely initiatives during the 2008 financial crisis helped to stabilize oil prices rather quickly. The shale oil industry, primarily in the U.S., made the most of it, and significantly ramped up production since 2010.

In 2014-2016 when oil prices fell, shale oil production stabilized and stopped growing.

Brent oil price ($/bbl)

Source: ITI Capital:

The OPEC Production cuts Agreement in 2017 again supported oil prices and contributed to shale oil production growth in the U.S.

This trend significantly undermines the efficiency of OPEC+. It is reasonable that initiatives to squeeze shale oil out of the market by restraining oil prices emerged.

Shale oil production, mbpd

Source: Energy Information Administration, U.S. Department of Energy

Coalition building will endure: with whom, against whom?

The U.S. has effectively lobbied the new OPEC+ agreement, and although they refused to cut oil production, they took on themselves the bigger portion of Mexico's cut quota. Such proactive stance reflects the U.S. efforts to preserve the recently established U.S. oil shale industry.

U.S. decision to target Russia, Rosneft's operations in Venezuela, may have triggered Russia's refusal to cut production under the OPEC+ agreement in early March 2020. Market players believe that additional shale oil production is a threat primarily to Russia's sales in Europe, due to limited mobility of the Russian exporters through the oil pipeline system (the main export destinations are Europe and China). It is therefore reasonable to assume that Russia is slightly more interested in cutting oil shale production than Saudi Arabia.

Theoretically, Russia could have withdrawn from OPEC+ in case it’s unwilling to production cuts. However, in our opinion, high volatility of oil prices has reduced the probability of this scenario, which also contributes to a certain support level for the oil price.

Despite historical cooperation between the U.S. and Saudi Arabia, shale oil production is also a long-term threat to the latter. We can assume that the alliance between Russia and Saudi Arabia looks justified in the long run, despite the tensions in March 2020.

The oil price is too important for Saudi Arabia and other oil players to remain a factor of the political game for long, especially when the oil price drops 50%.

With Saudi Aramco's IPO already behind, Saudi Arabia may show more flexibility in terms of adjusting production.

Can a tactical loss turn into a strategic victory?

Given that oil prices are organically under pressure, now is an opportune time to squeeze shale producers out of the market.

Given contracts for several months, government support measures, shale companies will be able to keep operations for two or three quarters, according to our estimates. After that some producers will face wells closures, and the sector will become unattractive for new investors amid severe recession.

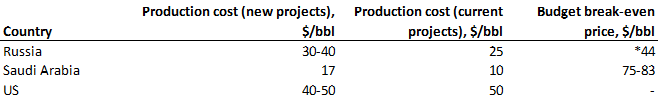

Oil production cost ($/bbl)

* Urals price

Source: Saudi Aramсo, Central Dispatching Department of Fuel Energy Complex (CDU TEK), ITI Capital

Excluding taxes, which may change during the crisis, oil production cost in Russia and other major producers is $10-25 against $40-50 for oil shale producers. If we’re right in our assumption that some countries will try to squeeze some shale oil from the market, the comfortable price should not exceed $40-50/bbl.

However, given the U.S. influence, it will ensure that its interests are taken into account. Washington has already threatened to impose tariffs on oil imports in the U.S. Against this backdrop, $45-55/bbl appears to be a compromise mid-term oil price range. This price range, coupled with the government support, will help some shale industry players to survive and lead to further consolidation of the sub-sector.

The crisis is marked by a characteristic. How deep the demand for oil may fall? Will the OPEC+ cuts be enough to offset expected drop in demand by 15-30 mln bps?

It’s hard to say, given that demand is largely formed by coronavirus externalities. The transport industry, in fact, grinds to a halt, which is typical for the current oil rout as compared to a 2008 financial crisis decline or a 2014-2016 slump.

That said there are risks that the demand recovery may take longer. Filling of oil storage facilities by early summer may add pressure on the market in the mid-term.

On the other hand, some analysts expect China's economic recovery. It should be noted that Russian and OPEC officials estimate excess supply in the second quarter at 10-15 mbpd. Phased increase in OPEC+ oil production starting from July indirectly implies expected demand recovery.

What is more, the governments have rolled out stimulus measures. Filling the markets with money will also support oil prices if the economic recovery forecasts materialize. Due to monetary factors, the recovery rate may top expectations.

Russian market impact

Record production decline in Russia

The agreement assumes that production in Russia will decrease by 2.5 mbpd, the same as in Saudi Arabia, the base of the cuts will be 11 mbpd (-23%). However, given that Russia's actual production in March was about 10.3 mbpd, the decline could be about 18%. It should be noted that this is the biggest cut possible as of today.

Oil production in Russia has its own specifics. In case wells are suspended at some fields production will be disrupted, there will be distortions with formation pressure and then it will be difficult to go back to normal production level.

At the same time, low oil prices reduce ROI from new projects even taking into account the state stimulus measures. Audit of the wells that may be closed will take 30-45 days. As a result, it may take some time to start real production cuts in Russia and as soon as audit ends the global oil market climate will be clearer, as well as details of further production adjustments.

The traded oil companies are the largest, and it is reasonable that they will take on the main burden of the cuts. Meanwhile, companies with a larger share of old fields in their assets portfolio are at risk. These include primarily Tatneft, to a lesser extent Lukoil and Rosneft. The latter is actively developing exports to China and may seek to avoid major cuts. Surgutneftegas operates old fields, but investors see it as a defence stock due to enormous cash pile the company is sitting on.

The positive thing is that the OPEC+ agreement does not affect gas condensate. Other things being equal, gas companies may find themselves in a more comfortable position relative to oil companies in the short term.

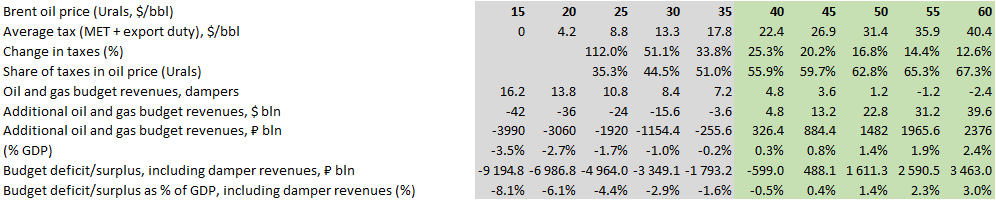

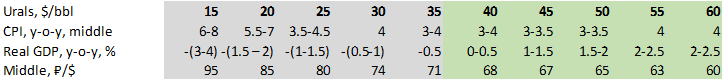

Macro simulation analysis

According to analysis of Russian macro indicators exposure to oil prices, the range of $30-55/bbl is relatively comfortable for Russia.

Macro projections exposure to oil price

Source: ITI Capital

Russia's 2020 budget is balanced at $45/bbl for Brent ($42/bbl for Urals). With these prices, the budget surplus will be 0.4% of GDP and additional oil and gas revenues will be 880 bln roubles. With $55/bbl, the surplus will be 2.3% of GDP, and oil and gas revenues will be 2,000 bln roubles.

Budget balance exposure to oil price

Source: Central Dispatching Department of Fuel Energy Complex (CDU TEK), Minfin, ITI Capital