ITI Capital: Why the global bear market is likely to last?

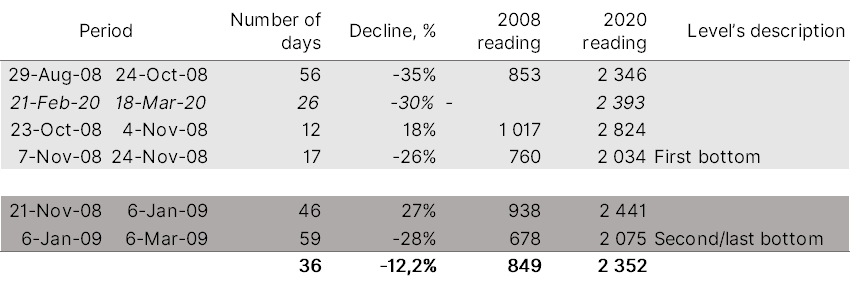

We believe that the global financial climate is likely to deteriorate further, but the decline is expected to be patchy. Against this backdrop, the US markets (S&P 500) may slide by another 15% from current levels, to 2 034 pt (please see the table below, if we are to replicate dynamics of 2008 which have been less volatile than now), so after a technical rebound it is reasonable to close some positions within a few days and switch to buying on the local lows. Meanwhile, the Russian dividend yields look attractive, as do certain sectors and US corporations, such as air carriers, transport, entertainment and oil and gas companies. We believe that before the V-shaped recovery which is unlikely to come anytime soon, USDRUB will remain within the 73-76 range, long OFZ yields - 7.8-8.5%, and Brent - $30-35/bbl which will result in Russia’s budget 0,9 trln roubles deficit, or 0,8% of GDP, excluding additional 2 trln roubles social spending which is also well covered by the National Wealth Fund (NWF) and proceeds from acquisitions of majority stake in Sberbank.

Global markets: what happened?

- The S&P 500 is down 30% from its local peak of February 21. Therefore, the U.S. stocks have lost at least $8 trln in market value over a month, global stocks - $12 trln, roughly 85% of China's GDP

- Since the highs of January 21 the RTS dropped by 47%, from 1,641 pt to 860 pt, the lowest of June 2016. Therefore, the Russian market slump accelerated on the back of delayed S&P 500 and European markets decline, as coronavirus continued to spread across the world

- Coronavirus panic fuels volatility as cities and countries are being locked down and authorities order home isolation and quarantine. Following restrictions on people's movement supplies of goods and commodities may face ban soon

- Europe is on coronavirus lockdown, as all major European countries and cities take unprecedented measures to fight the virus with no vaccine expected anytime soon. All flights between continents are restricted

Market dynamic of S&P 500 in 2008 vs now

Source: Bloomberg, ITI Capital

What will stop the decline?

- Any statistics that indicates the virus spread is slowing down. As the fight against the Spanish flu and other epidemics shows, only quarantine and isolation are effective. It will become apparent in Italy and in European cities within couple of months

- Stimulus and monetary measures will not stop markets from falling and only partially stabilise it as long as coronavirus will be spreading but it would service as major boost to risk appetite when pace of infection spreading will decline

- Recession is well expected but there is strong vaccine against it as opposed to coronavirus

- Therefore, heads of G7 governments and Central banks must adopt stimulus measures, support the poor, increase subsidies to small and systemically important strategic enterprises. Such steps will show ordinary citizens and investors that a cash pile is formed to confront the upcoming economic crisis which will primarily hit the service and industrial sectors

- So far, the $160 bln-worth fiscal measures announced by the leading countries are aimed only at fighting the coronavirus

- President Trump is pushing major fiscal stimulus worth over $1 trln which includes expansion of unemployment insurance and placing a moratorium on foreclosures and evictions, the Trump administration is eying suspending the payroll tax and offering relief to certain industries. Other ideas in the mix on both sides of the aisle are providing capital relief to small businesses and giving Americans direct cash assistance those who are in need. The House already passed an emergency relief package that includes a number of waivers to allow the costs of tests to be covered by insurance and federal government programmes

- US Fed is playing a leading role in promoting monetary stimulus due to market dislocation, in particular global rates cuts, provision of short-term FX-funding (worth nearly $1.5 trln) and huge incentives (although ineffective in the midst of an outbreak) that can limit further decline of the stock market (stabilization measures). In an emergency move on Sunday, the Federal Reserve announced it is dropping its benchmark interest rate to zero and launching a massive $700 bln quantitative easing programme that the regulator is set to ramp up further

When will crisis be over?

- The critical stage of the epidemic will last at least another couple of months, after which the spread is likely to slow down. The markets will approach the second bottom, the decline will slow down, everyone will start analysing the implications and assessing the losses of the global economy, countries and sectors. By that time, stimulus measures will be worked out and adopted which, as in 2009, will ensure rapid growth and the market will be able to offset most of the losses by August 2020 if active rebound of financial markets starts in June/July

Global markets: what next?

- As panic grips global markets the coronavirus has already triggered a financial crisis on the back of depreciation of high-quality assets and liquidity leakage not seen in 2008

- We believe that the S&P 500 is on track to slide further; the rate of the current decline is faster than back in 2008, when the market lost more than 35% in 56 days, from August 29 to October 24, 2008

- In our view, the S&P 500 will make a first stop at 2,034 pt, which implies a further 15% decline

- We believe that the S&P 500 has not yet passed the first bottom, although the RTS, according to the oversold indicator, has clearly reached it.

- The second bottom will be around on the same levels as the first. Our forecast does not take into account consolidation and rebounds, which are inevitable, but the market may still decline further

Our scenarios

1. Base case. According to our most pessimistic scenario, the first bottom is likely to stand at 2 034 pt (down 15% from the current levels), implying a VIX growth to 80+ pt, which allows us to bet on the growth of volatility with the leverage such as UVXY US Equity.

The decline is likely to be fast; consolidation is unlikely. The spread of coronavirus is accelerating around the world, and the only way to fight the epidemic is to maintain international isolation and border closures.

By the time the second bottom is reached, or after a 15% decline from the current levels, the situation is likely to improve and provide drivers for a rebound, but the slide will continue due to the economic implications, which can be overcome by prepared measures.

2. Low probability. The optimistic forecast implies a consolidation and moderate growth from the current levels if there are signs of the virus spread slowing down around the world. In any case, the bottom is formed against the background of economic problems, the scale of decline will be smaller.