ITI Capital: Why USDRUB won’t strengthen to 75?

Bottom line

We believe that the market has passed the first bottom, but we do not rule out another much slower decline. Against this backdrop, it is already possible to open some long positions in the Russian equities, especially due to high dividend payments, which on average rose to 11% from 8% the previous week.

Global volatility will stay at least through June, the epidemic is expected to stop spreading by that time. The US administration and global Central banks will keep the market from prolonged fall, so buying opportunities will arise.

We believe that OPEC+ participants will be able to come to an agreement in the near future, since current prices are hurting Saudi Arabia’s weak economy. Meanwhile, Russia is more vulnerable to cheap oil from ambitions spending announced over next three years for the social and demographic projects local currency rate and Putin’s January decrees’ target. Now is not the time to buy the USD/RUB, on the contrary, it is a sell, but the strengthening will be limited. We do not expect the Central Bank to raise the rate on March 20, however the regulator may change its tone. The Fed is expected to cut the rate by 50 bps on March 18 (out forecast is a 25-bps cut), while ECB is projected to agree a 10 bps-cut on March 12. If the coronavirus problem doesn’t get any worse, the bulls will get the room for temporary growth.

The decline is caused by two factors:

- Faster coronavirus' spreading over the weekend. The number of infections worldwide is more than 125,5, the WHO says, with nearly 4,607 deaths. Italy has become the first country to place its entire national territory under quarantine. US coronavirus cases surpass 1,300, New York has declared state of emergency. Apart from to China, there are three major outbreak centres: Korea, Italy and Iran

- Oil prices rout caused by two factors. First, Russia quit OPEC+ production cut deal. The current agreement between the 20 nations to remove as much as 2.1 mln barrels a day of oil from the market was not extended. After the deal collapsed oil prices fell from $51 to $46/bbl. Secondly, Saudi Arabia announced massive discounts to its official selling prices for April, Reuters reported, with the kingdom preparing to ramp up production above the 10 mln barrels per day (bpd) mark. On March 9, prices fell from $46 to $32/bbl and then partially recovered. Riyadh currently pumps 9.7 mln bpd, but it has the capacity to increase production up to 12.5 mln bpd. The Saudi Arabia - Russia price war is triggering a massive negative oil demand shock (lower consumption due to coronavirus) and positive supply shock (production growth). Following OPEC+'s fail the oil prices posted the largest intraday decline since the Persian Gulf War in 1991

Our take on key assets

Oil market

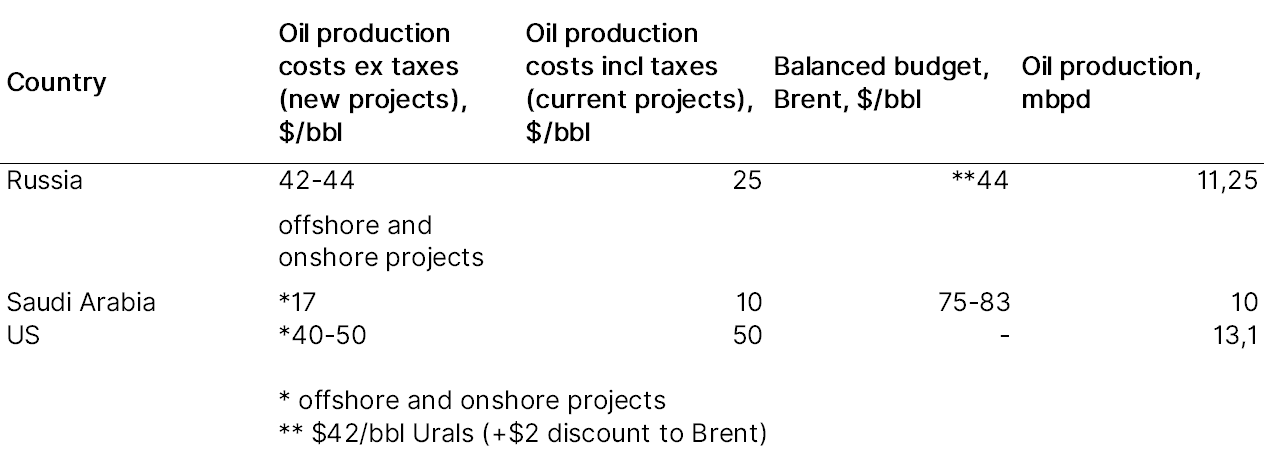

- Following a series of setbacks in the oil negotiations, we expect Russia and Saudi Arabia to resume discussions, as current prices are hurting Saudi Arabia. As we can see from the table, the current oil prices are higher than production costs in the Saudi Arabia, but way lower than the production cost in Russia, given that total taxes stand at 68% on top of capital, operating and transportation costs

- Russia is lagging behind Saudi Arabia and Kuwait in terms of production costs, mainly due to depletion of reserves and remoteness from major markets

- But even if oil prices fall below $30/bbl, this will not necessarily freeze production, since the tax is not levied if Urals price falls to $15/bbl. Under the current Russian taxation, when oil prices drop, the government's share in the “oil and gas pie” shrinks, while the share of companies grows. Moreover, the companies get subsidies and benefit from the RUBUSD weakening

- Russia's balanced budget is the only advantage over Saudi Arabia at current prices, while the U.S. is a loser by any measure

Key indicators

Source: Minfin, Saudi Aramco, Central Dispatching Department of Fuel Energy Complex (CDU TEK)

What to buy?

- Oil futures with a $45-50/bbl target, overall oil will remain under pressure, given economic implications of the coronavirus for the global supply and demand

RUBUSD may strengthen to 67

- After the oil prices collapse USD/RUB traded near 75, the highest year-to-date. Russia and the rouble are no longer a safe haven, which suggests high exposure of the Russian assets due to unabated dependence on commodities prices

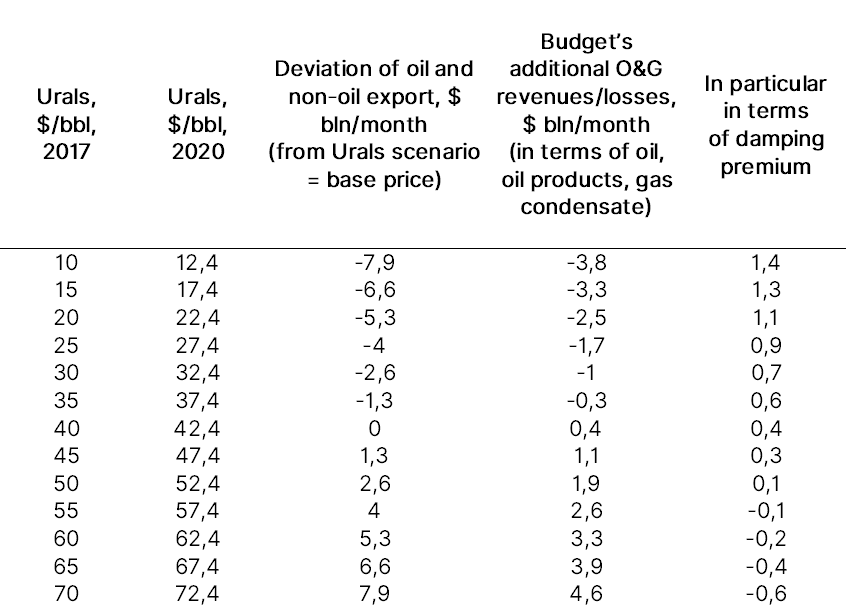

- We believe that the Central Bank will be able to keep USDRUB rate in tight range 70-73 at $36-40/bbl, using three effective tools. The rouble exchange rate will depend on how long the oil prices will stay at the current levels. If they stay at the current levels for at least a year, the lost oil and gas budget revenues may exceed 1% of GDP, or slightly over $16 bln, according to Russia’s Finance Ministry

1. Under the fiscal rule, revenues from sales of Urals oil above $42 per barrel (Brent above $44 per barrel) are used to buy foreign currencies and are stashed in Russia’s National Welfare Fund (NWF), while when prices slip below the benchmark, the NWF starts selling reserves and buying roubles instead. Therefore, if oil prices don’t change, the Central Banks will be able to offset budget losses by selling around $2 bln of foreign reserves a month. The funds are sufficient to cover the shortfall in income from falling oil prices for six years.

As of March 1, 2020, liquid funds of the National Welfare Fund and funds deposited on the additional oil and gas revenues account topped 10.1 trln roubles. ($150.1 bln), or 9.2% of GDP, excluding suspended FX-purchases due by the end of June, which will add $20 bln to the total revenues and bring them to $170 bln.

2. Dropping FX-purchases under the budget rule. Recent purchases fell to $2.5 bln amid oil prices slump. Purchases are automatically cancelled when the Urals price falls below $42, and the rule of raising budget revenues comes into effect.

3. FX-sales ramp-up by exporters was the most effective means to stabilize the exchange rate during the rouble crash in late 2014 and early 2015. Back then the exporters sold over $30 bln during the week, calming the market more effectively than the rate rise.

4. Raising the key rate despite deflation in the local market and the general global trend, especially as the market is waiting for the Fed's rate to drop to 0% by the end of 2020; for the Central Bank it is the most effective monetary tool to support the rouble and money markets.

Russia’s budget’s additional O&G revenues/losses,

Source: Minfin

What to buy?

- The rouble and long OFZs, if OPEC agrees production cuts ahead of March 20 meeting, the rate will be left unchanged. Otherwise, the Central Bank will have to raise the rate by 25 bps or even higher for the first time year-to-date instead of a pledged cut, which is not priced in by the market, since it expected a 50-75 bps cut this year. Under the high case scenario, it is necessary to buy short and long OFZs and increase exposure to the rouble

- Long OFZ 5Y will drop 7%, which implies a 50-60 bps yields increase

Why we expect a short-term rebound

- The New York Fed said Monday it will increase the amount of money it is offering to banks for their short-term funding needs. To make sure the funding, or repo, markets are working properly, the central bank said it will up the amount it offers in overnight operations from $100 to $150 bln through Thursday

- What is more, the Fed may deliver yet another 50-bps cut at a March 17-18 meeting, bringing its benchmark to 0.75%. The move, although already priced in, may support the market for now. However, we believe the cut is useless as long as the virus keeps spreading

- We assume that Russia did not expect the Saudis to retaliate and is likely to return to negotiations. It’s a lose-lose situation, although Russia is clearly more resilient - it has a fully convertible currency and its economy is highly exposed to imports. Therefore, further volatility could undermine political and social stability, which would go against Putin’s January decrees aimed at improving the country’s living standards

- Mainland China reported no new locally transmitted coronavirus cases outside the epicentre of Hubei province for the second day running on Monday, but a top Communist Party official warned against people dropping their guard