Panic is growing as coronavirus is spreading faster outside China and rating agencies downgrade economic outlook. Besides rising tensions have put Turkey and Russia on a collision course in Idlib, Syria.

The Russian stock market has posted the largest drop on record in February. February is now the worst month for the Russian market, before it was August. However, oil rebound may partially support the Russian equities if OPEC+ agrees a further production cut on March 5-6.

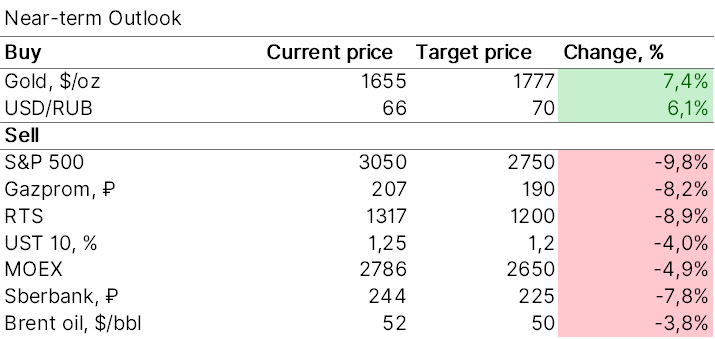

A downside bet that we have made earlier this week has paid off, but the decline rate has topped expectations. We have updated our forecast and now expect the market to post a decline seen in 4Q18.

That said, there’s no way for exponential decline or growth of the market, so we expect prices to consolidate at the current levels and a temporary rebound before further drop. Vaccine against coronavirus is seen as a major white swan now.

Why the market will keep falling? Because economic data and first quarter financial earnings of US companies are scheduled to be released in March and mid-April. Global quantitative easing (QE) will save the markets as always, but it will happen later, not now.

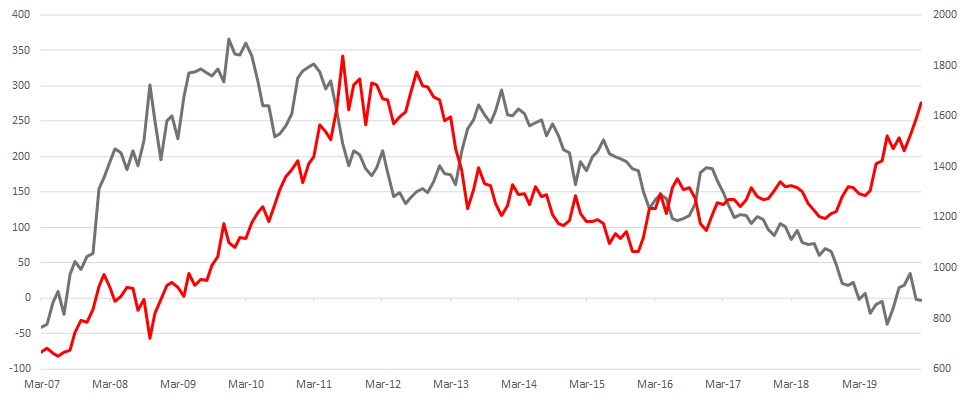

Impact on asset value and the economy will in many ways depend on the decline duration. Chinese economy has been in isolation since late January and massive sell-offs have been seen since February 20, 2020. According to our estimates, the trend may hold till late March and possibly till April with volatile dynamics (growth and decline).

Source: ITI Capital, Bloomberg

What the decline means for the stock market? A time-out ahead of a further decline

- This means that the S&P 500 may drop by about 20% by late March. The index has already plunged 10.3% over the week, therefore, it will be able to test 2,700 points after a while

- The decline rate seen today cannot be sustained for long, so we expect consolidation and growth ahead of a further decline the way it happened back in the fourth quarter

- The nearest S&P 500 resistance levels are 3,043 p., 3,000 p., 2,893 p., 2,865 p. and 2,687 p. Therefore, many US IT-companies will drop to the lows of October 2019

- The Russian stock market will fall to the lows of September 2019, and Gazprom will test the lows of July-August 2019, plummeting to 190 roubles

- Sberbank may decline to 230 roubles and thus the average price for six months as part of the offer to minority shareholders will go down to 240 roubles and lower from of the current 247 roubles

What the decline means for the bond market? Steeper sell-off

- The bond market is lagging behind in terms of reaction to panic, and this time is no exception. The U.S. Treasury yield curve inverted again, with 3-month Treasury bills holding a higher yield than 10-year Treasury notes. The pressure is set to build up further. The bond market, especially the high-yielding emerging market (EM), has been heavily overbought, just like the US equity market, in contrast to the EM stock market

- So far, the decline on the long curve of Latin America (LATAM) has been around 2%, of Ukraine - over 3%, and of the Russian market around 1.5-2%, and here perhaps more reliable than EM issuers and greater resilience of the Russian economy, which will falter if oil prices remain that low, are preventing from a larger decline

USDRUB set to hit 70 in the near-term

- The rouble has fallen only by 7% so far, while oil has already dropped by 24%

- A fall in oil prices below $50/bbl will be sensitive for the budget and the rouble/oil correlation will increase, which will certainly have an impact on OFZs and drive non-residents into the UST and trigger sales of FX-bond, which trade at levels comparable other EM. We believe that the fair USDRUB rate is 67 and 70 if oil stands at $50-51/bbl and $45/bbl respectively. Long end OFZ which have fallen by 7% from peak levels of 20 February 2020 could rise further in yield by 30bp

- The Finance Ministry expects 2020 budget oil and gas revenue at 7 472 trln roubles, the federal budget surplus at 876.05 bln roubles, Urals at $57.7/bbl and the average USDRUB rate of 65.1

- Brent prices have dropped to $50.52/bbl, Urals to $49/bbl, which means a decrease in oil and gas revenues by at least 15-20%, subject to increased spending on social and national projects in line with the presidential decrees issued in the beginning of the year

- Russia's budget will see deficit (assuming no further increase in spending), if Urals prices fall further by 18% to $40/bbl

Inverted yield curve