Russia’s Central Bank to cut rate, but to take a longer pause for the next one

We expect the CBR to cut the key rate by 25 bps, to 6% from 6.25%, amid slowing inflation and lower inflationary expectations and switch from a neutral to a more hawkish tone. Our expectations are in line with general market view and are already priced in based on OFZ yields - they are below 6% for bonds with up to five-year maturity. It should be noted that that after the 2019 rally OFZ have been underperforming as compared to other local currency bonds year-to-date.

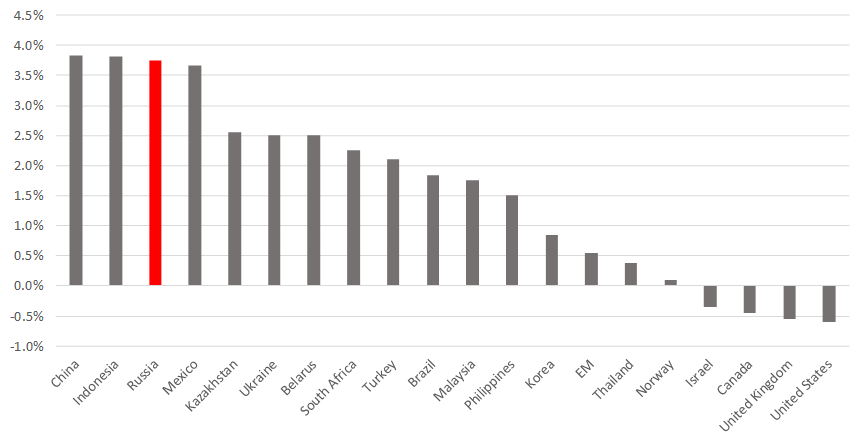

Against this backdrop, the share of foreign OFZ holdings has been growing and reached 32.2%, the highest since March 2018. If the rate is left on hold, we expect a slight yield pick-up, by 10 bps at the middle and long end of the curve. Among the countries with high budget surplus and current account to GDP ratio, Russia still has one of the most attractive carry-trade amid low debt and moderate growth. Russia has the third-highest real rates in the world (3.8%).

The previous CBR's meeting was held on December 13. During the press conference, Elvira Nabiullina said that a further rate cut in 1H20 will depend on the following major factors:

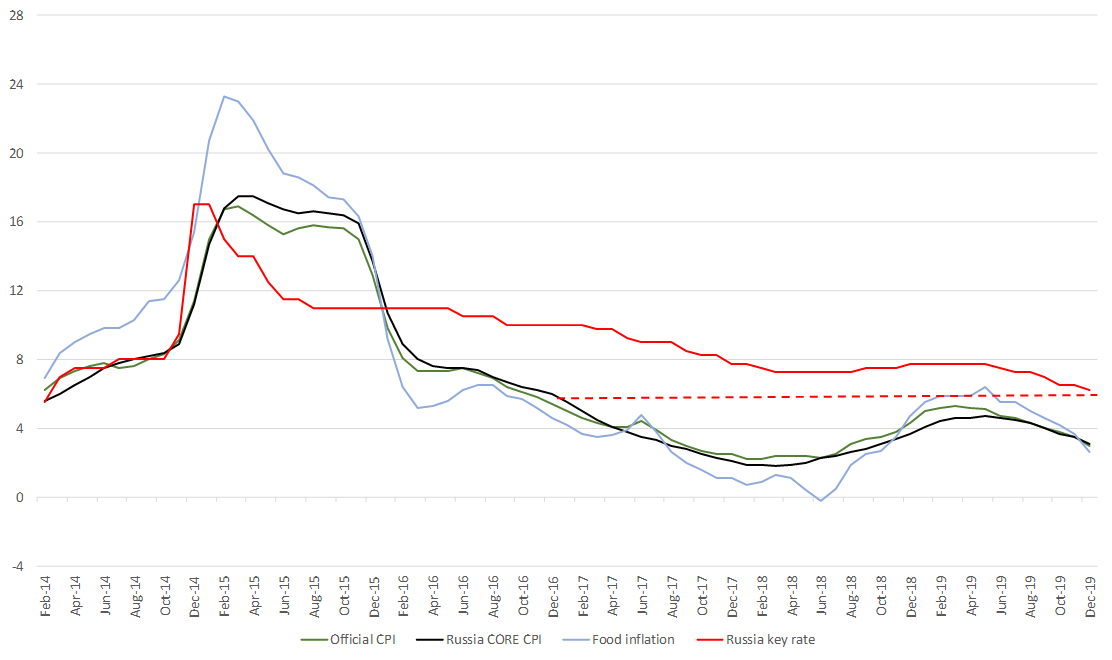

1. Inflation slowdown. According to last press conference held during December CBR meeting, CBR expects inflation to range within 3.5–4.0% by the end of 2020. Moving forward, the monetary policy pursued will keep annual inflation close to 4%, Nabiullina said. CBR inflation forecast for the first quarter to fall below 3% due to the drop in effect of the VAT rate increase. In the second half of the year, inflation will be returning to around 4%, according to CBR forecast.

Our outlook: In January, inflation is expected to hit 2.5% amid falling consumer demand and sluggish retail sales growth. Weekly inflation has been flat at 0% the second week in a row despite long New Year holidays.

Therefore, the gap between the real CPI and a 4% CBR target will widen further if rates will not be cut correspondingly.

Source: Bloomberg, ITI Capital

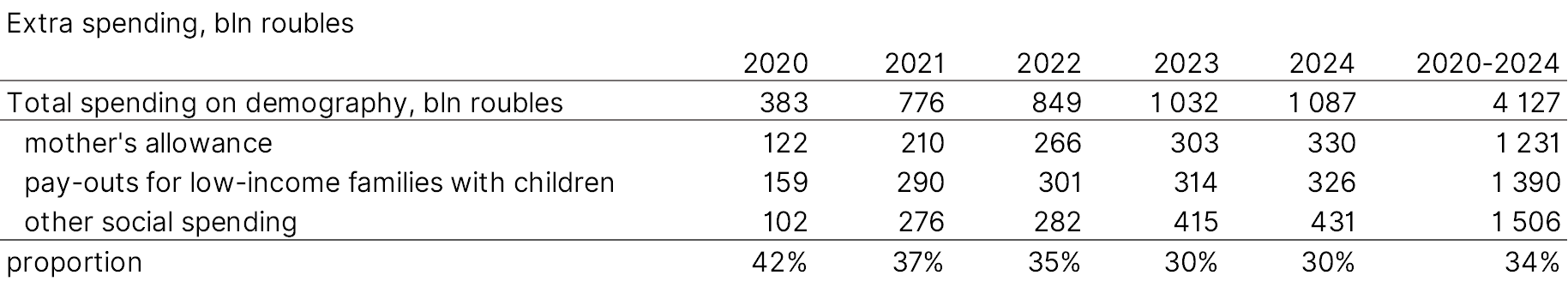

2. Will social spending spur inflation this year? According to Finance Minister Anton Siluanov, Russia plans to spend an extra 4.13 trln roubles to support demography by 2024, out of which 1.4 trln roubles (the bulk) will account for payments to poor families with children aged from three to seven and 1.2 trln roubles for "mother's allowance.” In 2020, an extra 383 bln roubles are planned to be spent for demography projects, out of which 159 bln roubles will go to poor families with children, which will directly affect consumption, but will not notably affect inflation. Total pay-outs in 2020 on demography will amount to 518 billion roubles., including extra spending. The ratio of payments to poor families to total spending will be 42% in 2020 and 35% on average in the following years.

Source: Ministry of Finance RF, ITI Capital

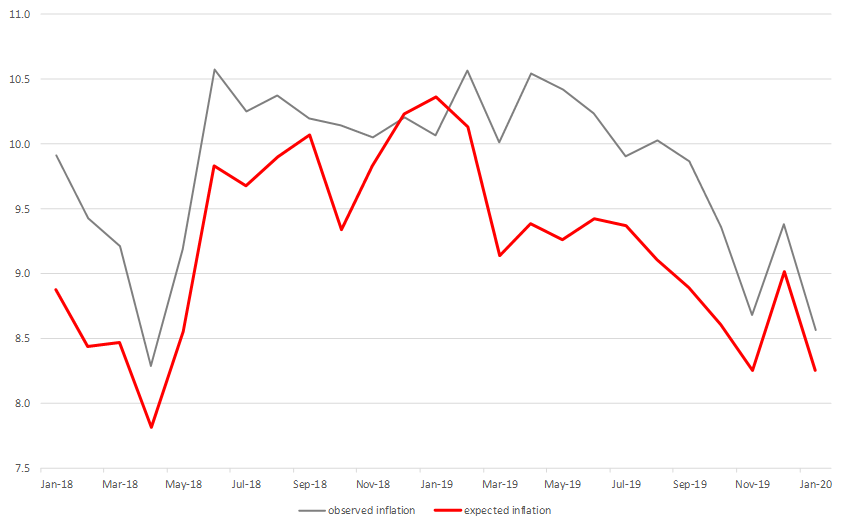

3. Households inflation expectations are weakening. At the CBR December press-conference Nabiullina said that household inflation expectations decline but stay above the lows registered in April 2018. Since the December press conference, expected inflation dropped by 0.7%, to 8.3%, is still above the April levels as is perceived inflation. We believe that a decline in inflation expectations will accelerate over time, as well as inflation observed by enterprises.

Source: CBR, ITI Capital

4. Economic barometer. The CBR expected the GDP growth rate in 2019 reach the high end of the 0.8-1.3% range (our forecast). GDP growth in 2019 slowed down to 1.3% (in line with CBR expectations) from 2.5% in 2018, the Russian statistics service said. Thus, the 2019 growth rate fell to the lowest since 2016.

The biggest contribution to physical GDP growth was due to a 2.7% value addition in extractive industries and a 1.6% in manufacturing. We assume the GDP growth rate is low and the economy requires fiscal policy easing (DCP) from the CBR. The CBR expects economy to grow 1.5-2% in 2020, 1.5-2.5% in 2021 and 2-3% in 2022.

5. Softer monetary policy and impact on rates in the deposit and credit market. In December, mortgage rates hit new lows of 9%, but the gap between them and the real rate remains record high and exceeds 3%. Therefore, there is still room for further decline, as Russia remains one of the few countries with a big gap between the loan rate and the key rate.

Global real rates, %

Source: ITI Capital, Bloomberg

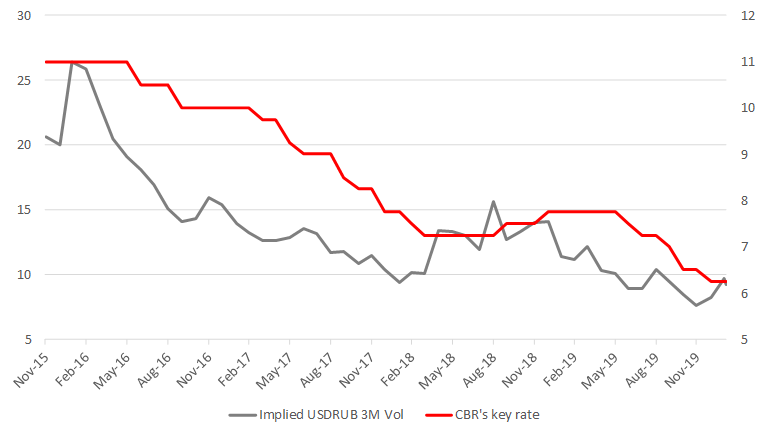

6. Volatility of Russian rouble. The rouble has dropped by 2% ytd along with EUR vs USD thanks to recent recovery and is the lease worst-performing currency among the EM, comparing to likes of South African rand, Brazilian real, the Norwegian krone and others. Even during oil turmoil (Brent oil was down by 14% ytd) and global sell off, Russian rouble highlights strong resilience. The Central Bank adopt a long-term approach in assessing volatility, while the current level of expected one-month and three-month volatility remains in the low 9%, with no material changes over the past year. The implied three-month volatility has increased from 8.75% to 9.25%. As of today, the rouble volatility exceeds that of the Turkish lira but is lower than that of the South African rand and Brazilian real.

Source: ITI Capital, Bloomberg

Major risks:

- The recent reshuffles in the Russian government have increased uncertainty in the budget policy. An increase in budget spending to accelerate implementation of national projects will increase inflation risks. Therefore, the Russian watchdog may opt for adopting a wait-and-see stance and delay further easing of fiscal policy

- At the first meeting of the Federal Reserve System this year, the federal funds rate was left unchanged. The Fed committee judged that the current stance of monetary policy is appropriate to support the market conditions and should not be adjusted in the short run. Although the move met market expectations, it may support keeping the key rate on hold

- Increased global uncertainty due to coronavirus proliferation and implications for China and the world economy. This threat increases market volatility, triggering a flight into quality assets, increases the risks to Russian assets and the rouble