Inflows into Lukoil stocks will amount to $200 mln, out of which $120 mln have already been invested

On Friday, January 31, MSCI index provider completed a review of Lukoil, raising the company's weight in the MSCI Russia index. The changes will be implemented on February 3. Under the MSCI rules, if the weight is up by 5% or more, the changes may be implemented the next working day, which in his case is Monday, February 3. Otherwise, the changes should have been implemented on March 2, 2020, after the February quarterly review.

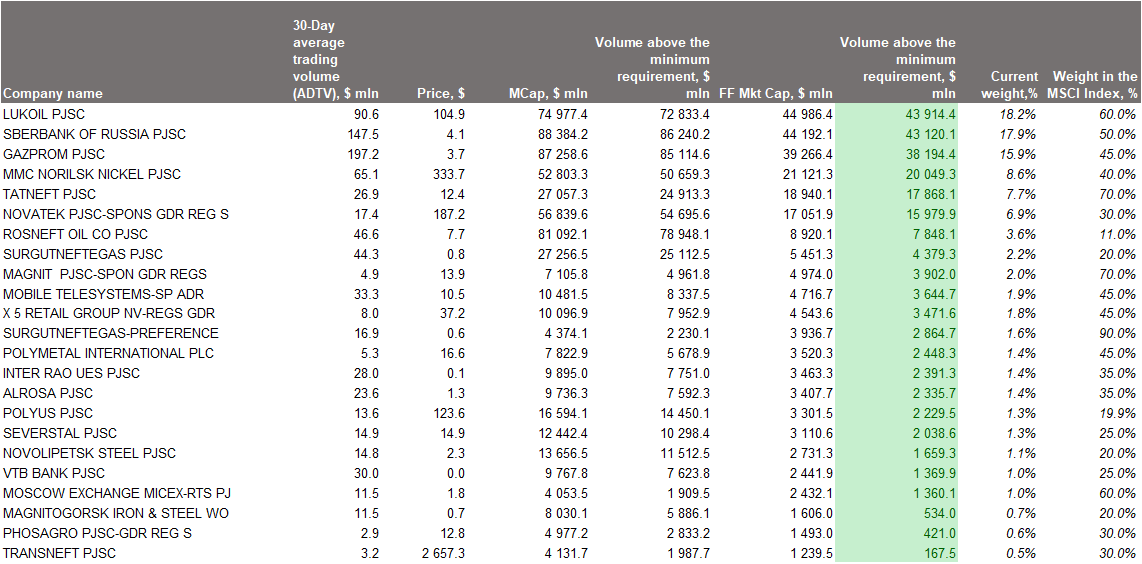

According to our estimates, MSCI Russia will increase its FIF (foreign inclusion factor) estimate from 55% to 60%, pushing Lukoil's weight in the MSCI Russia index up by 1.2%, from 17% to 18.2%. Lukoil will therefore top MSCI Russia index by weight, triggering technical decrease of Sberbank’s and Gazprom’s weight, which will result in a small outflow from these securities. Lukoil’s MSCI Russia 10/40 weight may decrease, as Lukoil’s MSCI Russia weight increases.

On February 3, following Lukoil’s weight increase, inflow of passive funds may reach $80 mln, or about 90% of the average daily volume per month. A one-off inflow may reach as much as $120 mln of active funds, which is 133% above the daily average volume for a month, as we have been witnessing in the morning trade.

MSCI Russia Structure

Source: MSCI, ITI Capital