We maintain our Petropavlovsk 22 Eurobonds (YTM6.1%) idea despite the notes reaching our 104.5% target. We raise our short-term price growth estimate to 106% amid strong global demand for risk as well as ongoing optimization of the company's credit profile. The next trigger for further positive revaluation may be publication of Q419 operating results scheduled for Thursday, 23.01.2020.

Recently, the issuer’s credit profile went through some additional changes:

- Pressure Oxidation facility (‘POX Hub’) launched in late 2018 keeps ramping up production, processing both own and third-party raw materials. Concentrate offtake contracts have been signed with companies from Russia (Polyus) and Kazakhstan. The total concentrate volume purchased from third parties in 2019 will stand at 38,000 tonnes. The management is actively working on new supply contracts. The 2020 target is 130,000 tonnes

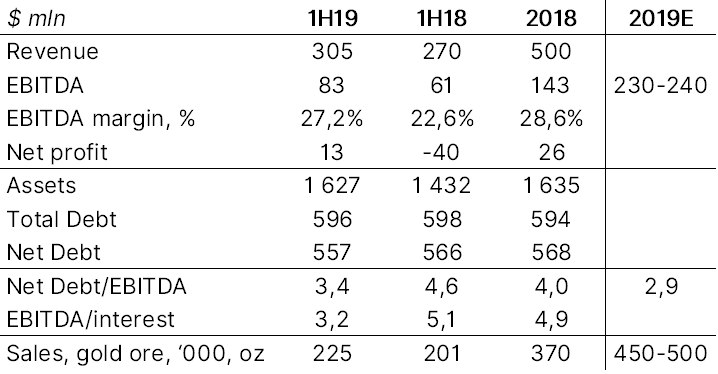

- Deleveraging is going smoothly. As of 2019, the net debt/EBITDA ratio fell to 2.9x against 4x in 2018, according to the management's estimates. Petropavlovsk is seeking to reduce the leverage to 2x (by net debt/EBITDA) within the next two years. Reducing investments after successful launch of several major projects and increasing operational performance amid persistent favourable price environment will contribute to this goal

- The company is still seeking to sell a stake in IRC (31.1%). At the same time, the subsidiary's operational performance has recently increased, allowing IRC to service its obligations on its own. Therefore, Petropavlovsk’s shareholders will consider a potential transaction only if it brings them additional speculative profit. Deconsolidation of IRC will improve the rating agencies’ assessment of Petropavlovsk’s credit quality as it will reduce the company's total debt (currently, the IRC loan guarantee overstates total debt under the rating agencies’ methodology)

- Petropavlovsk has significantly improved its corporate governance. The company has formed a new investor relations team and enhanced information transparency

- The issuer is taking a number of steps to increase shares’ liquidity. In particular, shareholders structure has recently undergone changes. Sothic has reduced its share in the equity capital from 9.36% to 0.54%. Abu Dhabi sovereign fund (ADIA) bought a stake in the company. Its share in recent months has varied from 4.5% to 2.91%. Moreover, Petropavlovsk is considering a listing on MICEX

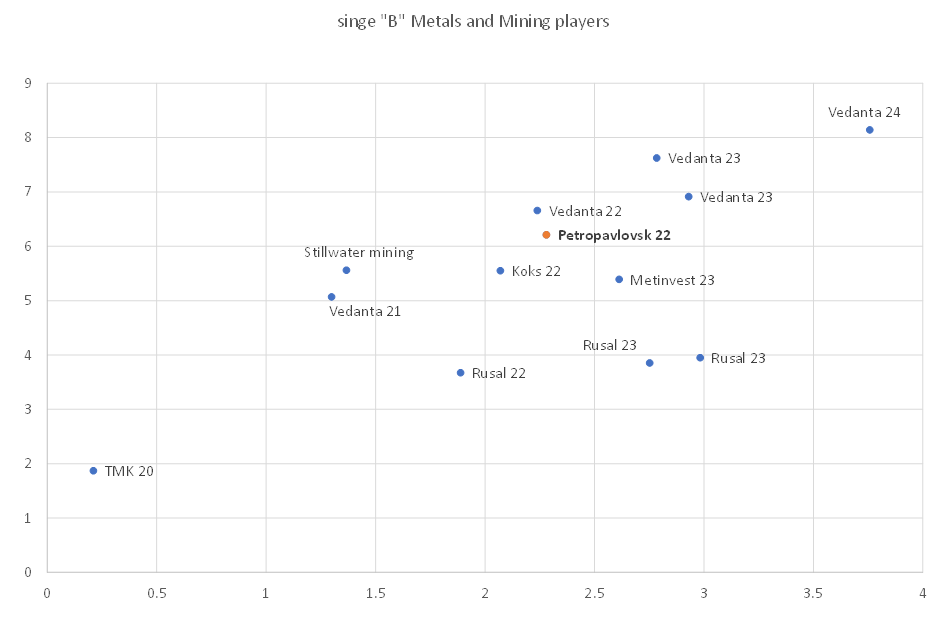

Against this backdrop, we expect positive rating with respect to Petropavlovsk soon. In 2H19 S&P and Fitch already assigned "positive" outlook to the company. Thus, if upcoming earnings results for 2019 show further strengthening of the company’s financial profile, they may be followed by a rating upgrade to "B". This will certainly have a positive impact on market participants’ risk perception. Thus, we expect that positive revaluation of Petropavlovsk 22 will continue. Our new price target is 106%.

Petropavlovsk key financial and operational performance

Olga Nikolaeva,

Senior Fixed Income Analyst