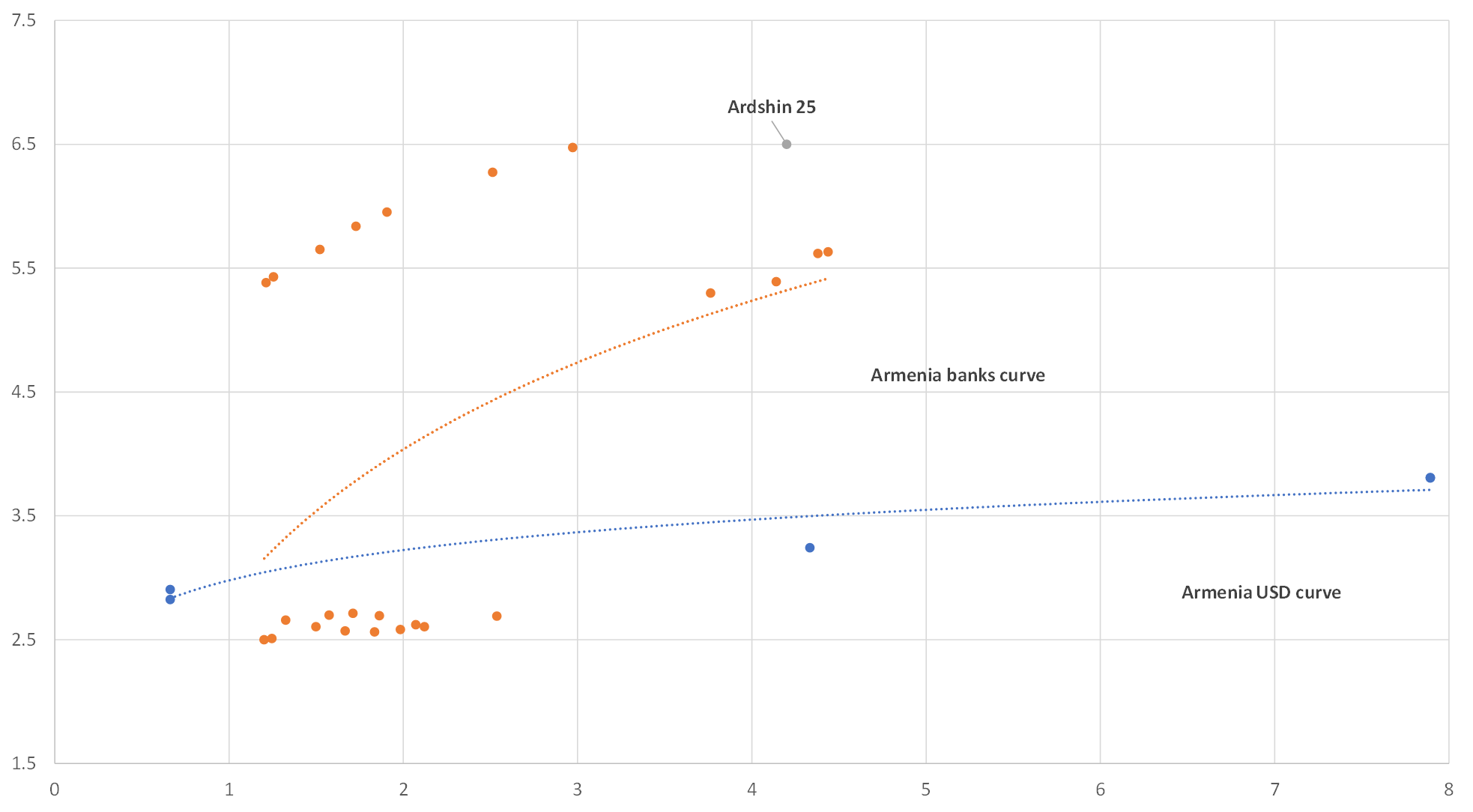

The order book of Ardshinbank’s 5Y Eurobonds opened on January 21. The proceeds from the bond issues are intended to refinance short liabilities of the financial institution. The organizer’s guidance stands at 6.5-6.75%, implying a 490-515 bps premium to swaps (premium to Armenia's sovereign USD curve — 325-350 bps). We believe the yields look quite appealing, particularly given that the bank’s rating is at the same level as the sovereign one. Globally, financial institutions with a similar set of ratings on average offer a 200-400 bps premium to swaps. Recently placed Uzpromstroybank’s bonds are trading now above par value with YTM of 4.8% (swap premium of about 320 bps). Given the state ownership and larger scope of business, it would be fair for the issuer to offer a discount to Ardshinbank. The discount should not exceed 100 bps, according to our estimates. Therefore, the fair yield of the new Ardshinbank 25 issue approximately stands at 5.9-6% per annum.

Ardshinbank (Ва3/-/B+), founded in 2002, is the third-largest private bank in Armenia by assets. The Financial institute is lending mainly to corporate clients (46% of the portfolio), but also to retail customers (38%) and SMEs (16%). Total gross loans to customers in 9M19 were $934 mln (-1% from 01.01.2019), roughly 66% of total assets. NPL ratio stood at 5.6% (up from 4.7% in 9M18) in September 2019, slightly above Armenia’s banking sector’s average. Some 9% of assets are placed in securities. The rest of the balance sheet accounts for free liquidity ($220 mln as of 9M19).

The main components of the funding base are term deposits (46%), customer transaction accounts (18%), funds from international development institutions (i.e. EBRD, BSTDB, etc.). The bank's equity capital stands at $156 mln.

The sole beneficiary of Ardshinbank is Karen Safaryan. Previously, IFC owned a 10% stake in the bank. The bank’s retail network includes 63 branches.

The key risks include:

- low margins. Net Interest Margin (NIM) is as low as 4.2% and is declining

- tier capital adequacy ratio (TCAR 15.3% against regulatory minimum of 12%) lacks sustainability

- relatively small business size

- large share of FX-loans in the portfolio. In 9M19, FX-loans accounted for 53% of the portfolio

- high exposure to a single client — 14.7% with a regulatory maximum of 20%