Which Russian companies will benefit from new cabinet? These are mainly companies linked to infrastructure projects, public companies — primarily metal producers. Below is a brief overview of the Russian infrastructure projects (past, present and future), sources of financing, etc.

As soon as the new Russian government in formed, metal and IT-companies (Yandex) will be major winners.

Rusal advanced 16% (possible inclusion in the MSCI Russia index is an advantage), MMK — 9%, Nornickel — 8%, Mail.ru — 7%, Severstal and NLMK — 4% and 5%, Yandex — 2% over the week. The main reason is speculation that as soon as the new government is formed, optimization of infrastructure projects spending will accelerate. Increased spending may, among other things, contribute to the country's economic growth. For a long time, the average level of the unspent funds allocated for the national projects exceeded 60%.

Putin highlighted endemic problems of the national projects at the meeting of Council for Strategic Development and National Projects. The national projects called for a readjustment of the governance system, but not everyone was ready to adopt new approaches. Cooperation between federal and regional bodies is not good enough, one of the problems is the irregularity of financing for the national projects, the inflexibility and sometimes the rigidity of this mechanism. Resources are provided irregularly and shifted towards the end of the year.

What to BUY? (short-term targets)

MMK RX (short-term targets — 50 RUB)

Rusal RX (short-term targets — 40 RUB)

Severstal RX (short-term targets — 1000 RUB)

Yandex RX (short-term targets — 2 900 RUB and higher)

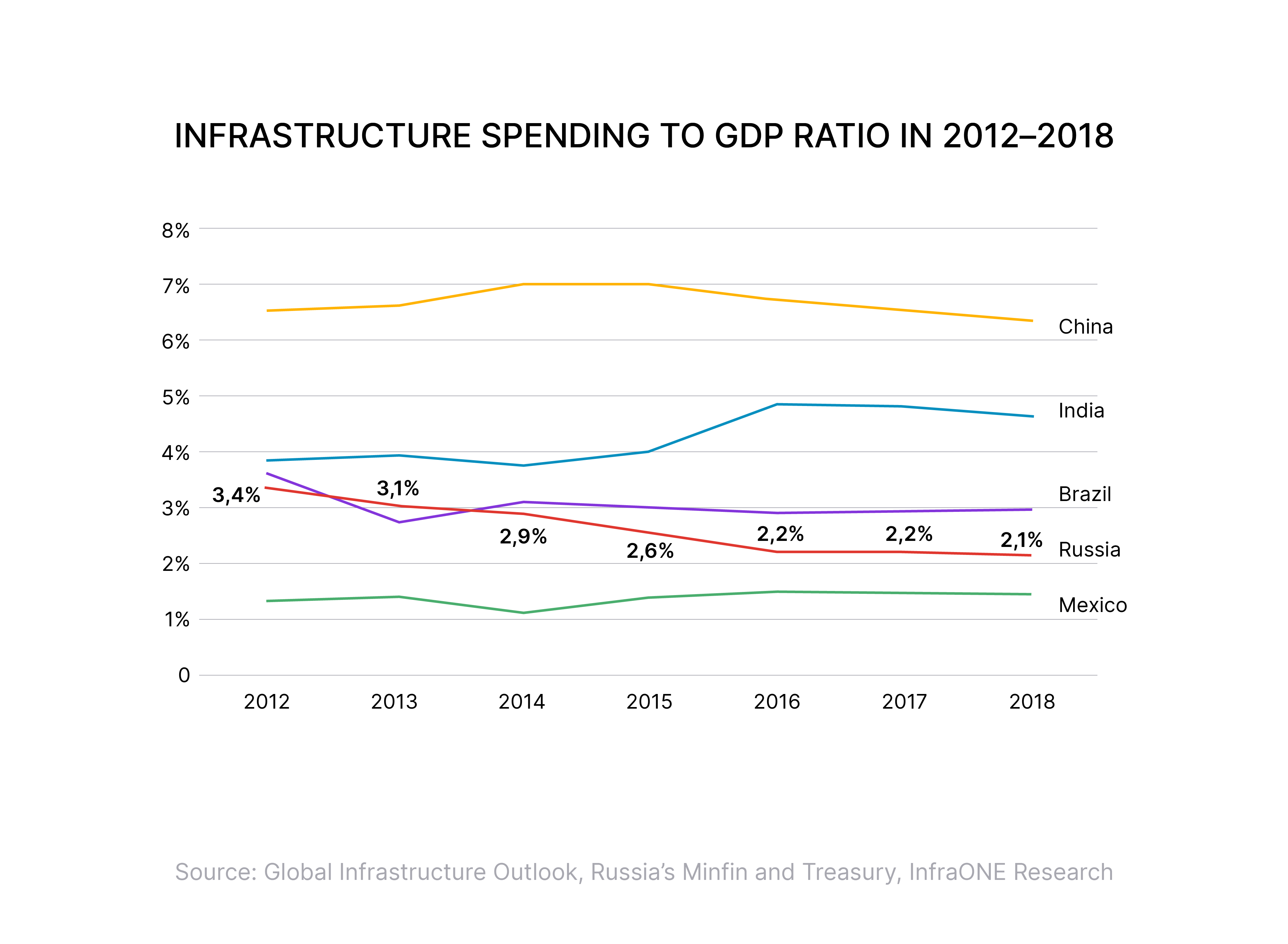

The pace of infrastructure spending in Russia is among the lowest in the world.

- State infrastructure spending dropped from 660 bln roubles to 640 bln roubles in 2018, which is 778 bln roubles lower than projected

- In 9M19 the situation changed dramatically, with unspent funds amounting to 62%, or 1 trln roubles. (out of 1 750 bln roubles projected on infrastructure only 760 bln were spent — roads, bridges, buildings and facilities), but in Q419 additional 840 bln roubles were spent, according to the Finance Ministry data. National projects spending in 2019 ultimately amounted to 1.6 trln roubles, or 91.4% of the target! At the same time, according to our estimates, the critical underfunding that hampers economic growth amounts to additional 1.6 trln roubles

Infrastructure spending to GDP ratio in 2012 — 2018

Source: Global Infrastructure Outlook, Russia’s Minfin and Treasury, InfraONE Research

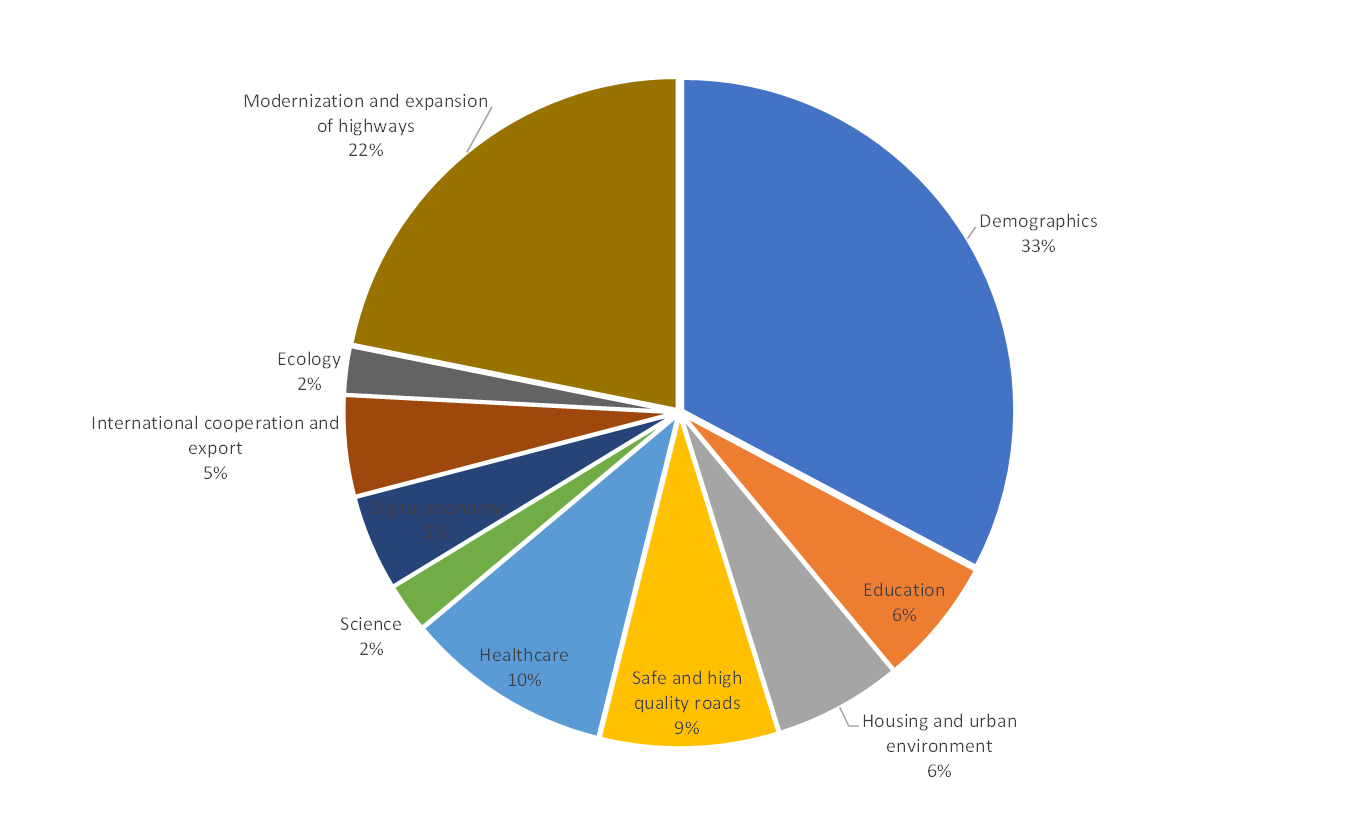

National projects spending breakdown in 2019

Source: Russia’s MinFin, ITI Capital

Is the new government reliable? S&P's economic growth forecasts suggest moderately positive trend going forward

- Since the government will be formed on January 21, no updated data on the amount of funding for national projects is available. According to the latest comments of Finance minister Anton Siluanov, total infrastructure spending will amount to almost 2 trln roubles in 2020 (2% of GDP), in 2021 — 2.2 trln roubles (2.3% of GDP) in 2022 — 2.7 trln roubles (2.8% of GDP) in 2023 — 2.5 trln roubles (2.8% of GDP) in 2024 — 2.3 trln roubles. According to the minister, the total amount of resources for six years will increase, while the total national projects funding will amount to 26.1 trln roubles, out of which 13.5 trln roubles account for the funds of the federal budget

- Some expenditure items, which are considered to be infrastructural, do not relate to this category: for example, one third of a 1 trln roubles backbone infrastructure development plan relates to subsidies for air carriers, state enterprises and Rosavtodor, while real investments amount only 670-705 bln roubles

- If the government does not increase expenditures, the GDP growth in 2020 will be less than 1% against an adjusted Economy Ministry outlook of 1.7%. According to S&P's latest forecasts, the growth of Russia's GDP is expected to be 1.8% in 2020, which is slightly above the state outlook on the back of monetary and fiscal policy easing. Real GDP growth will not reach 3% through 2024, according to S&P projection which is below Economy and Finance ministries outlook. A 3% GDP growth is crucial to upgrading Russia’ credit rating, S&P says

Source of national projects funding

- There are many sources, mainly the National Wealth Fund (NWF), federal budget revenues, dividends of state companies and privatization projects

- NWF funds will increase to 11.1 trln roubles in 2020 from the current 8 trln roubles, in 2021 — to 13.7 trln roubles, in 2022 — to 16.2 trln roubles, according to materials of the draft federal budget

- Officially, the federal budget surplus in 2019 was 3.2 trln (3.1% of GDP) and will remain at this level in the coming years

- Russia's budget revenues from dividends of state-owned companies are projected at 760.6 bln roubles in 2020, 930.9 bln roubles — in 2021 and 1.079 trln roubles — in 2022

- Under the draft privatization programme, by 2022 stakes at Rushydro, Sovkomflot, Transneft, Rostelecom, Rosseti and OZK are expected to ne sold, materials to the draft budget suggest