Final assessment: newcomers will join the index for the first time since 2018

On May 12, MSCI will announce the results of the 2020 Semi-Annual Index Review for the Global Equity Indices. The effective date is June 1, 2019. Major changes are expected in May, which will affect certain stocks and the entire MSCI Russia.

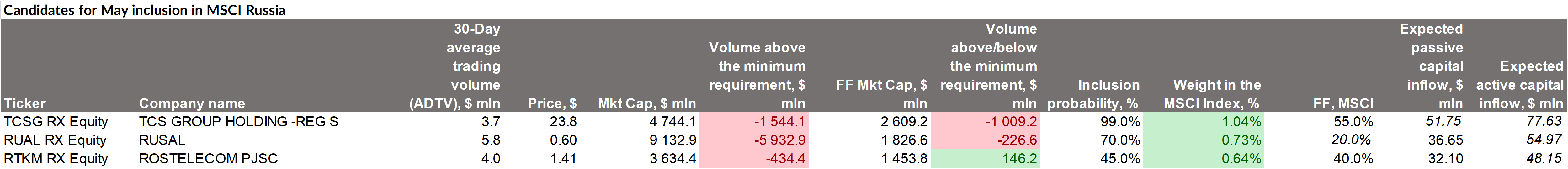

In May, we expect three companies to join the index: TCS Group (TCSG RX), Rostelecom (RTKM RX) and Rusal (RUAL RX), their total weight amount to 2.1%, inflow of more than $110 mln of passive and $160 mln of active funds. This is a very significant figure for such companies — the total trade turnover of their stocks is about $10 mln. We therefore expect Russia's share in the MSCI EM index to increase to 4% with additional inflows coming from non-residents. According to ITI Capital's upbeat scenario, the number of companies in the index will rise from 23 to 26, if Transneft is not excluded.

During the May review, there’s a 99% probability of inclusion of TCS Group stocks with a weight of 0.9% and $40+ mln passive funds inflow, probability of Rusal inclusion is lower, about 70%, as free float-adjusted capitalization exceeded the minimum requirement by only 14%, liquidity level remains high and meets the MSCI AVTR requirement. In case of inclusion, the weight may reach 0.7%, the inflow of passive funds — $30 mln or more.

The probability of Rostelecom inclusion is lower than that of Rusal — about 45%, because free float-adjusted capitalization is 10% below the required level, the weight could reach 0.7%, and the inflow of passive funds may exceed $30 mln.

In case of active funds inflow — the inflow will be 1.5 times greater, the exact figure is difficult to determine, as the data on funds are limited.

Our assessment of MSCI calculations as a key review factor

The standard data cut off dates for the prices used for calculating minimum requirements including minimum free float market capitalization requirement are any one of the last business days of April (April 20 — 30) for the May Semi‐Annual Index Review (SAIR).

The minimum market capitalization required for inclusion in MSCI Russia is $3.2 bln, the minimum free-float adjusted capitalization is $1.6 bln, according to our estimates.

MSCI may slightly raise the minimum capitalization requirement

Given the market growth in 2019 and at the start of 2020, it is possible that the minimum requirement will be slightly higher — around $3.3 bln for market capitalization and $1.65 bln — for minimum free-float adjusted capitalization.

In this case, Rusal and Rostelecom inclusion is less likely , but liquidity requirements will not change. The minimum capitalization level has not changed significantly over the past three years, from November 2016 to November 2019, having increased by only $300 mln despite the market growth of more than 60%. MSCI Russia market has therefore grown by more than 20% since November 2019, and the minimum total market capitalization may increase by more than $100 mln.

The minimum capitalization level for exclusion will be $2.14 bln and $1.07 bln respectively, or adjusted in case the minimum level picks up.

What to buy ahead of May review?

- TCS Group (TCS RX) at the current price, we estimate upside at 20% at the time of inclusion

- Rusal (RUSAL RX) at the current price, we estimate upside at 10% at the time of inclusion

- Rostelecom (TCS RX) at the current price, we estimate upside at 15% at the time of inclusion

When to buy?

- Before the results are announced. The announcement will take place on May 12, 2020, the calculation date is between April 20-30, 2020

- What is more, Transneft is still likely to be excluded because the company trades only 26% above the minimum free float capitalization level. But before the calculation period in April, the stock may advance by 10% or more, as was the case in October, depending on how low the price will be before the calculation period

1. TCS Group — shares may rise by more than 20% if the company is included in the MSCI Russia index. The case of TCS Group is similar to X5 Retail Group — the stock was added to the index in May 2018 after receipts were sold on the local exchange.

2. Rostelecom meets liquidity requirements, the key issue is free float capitalization, which is expected to add only 7%, while the gap at the end of the year was 20%!

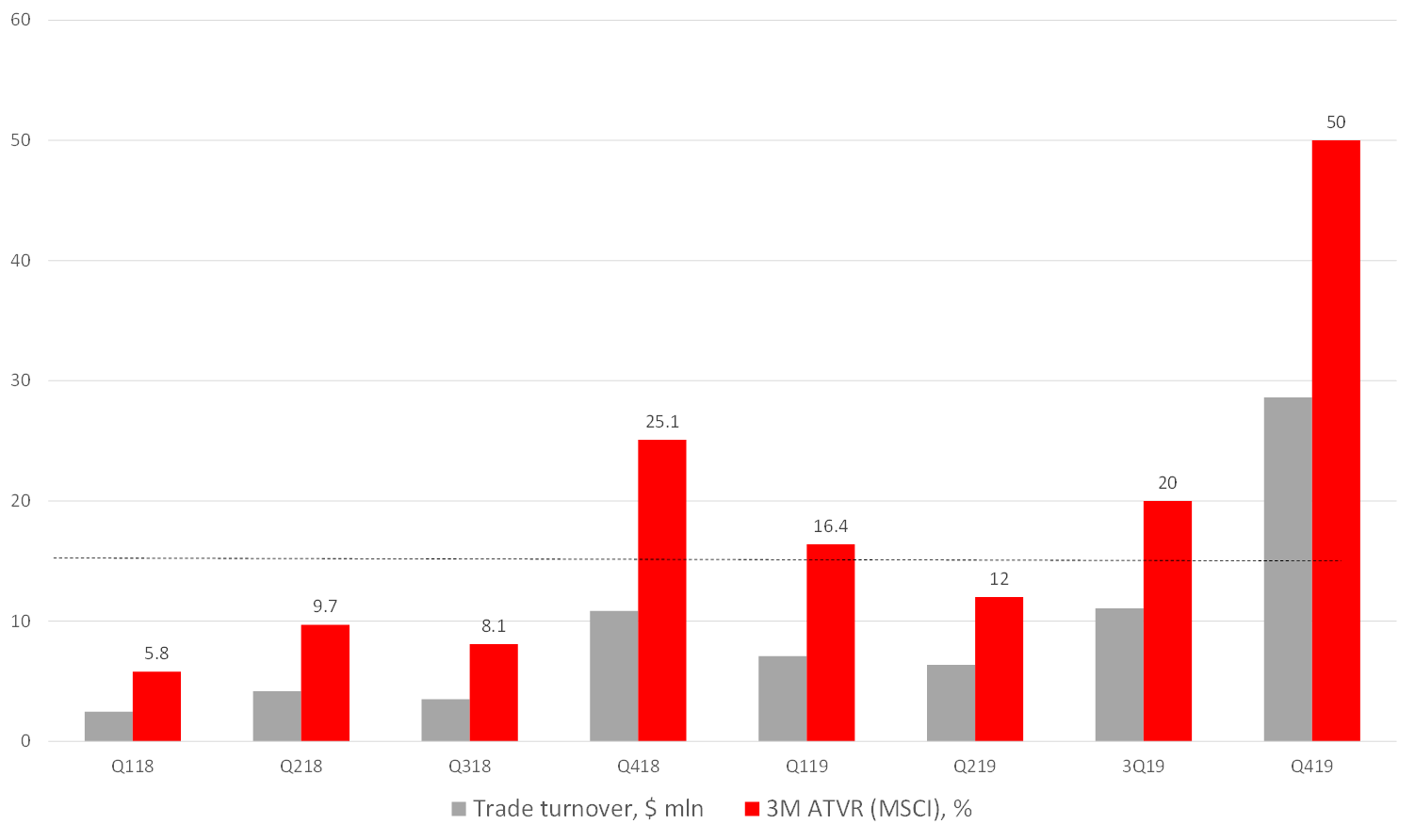

3. Rusal meets all the requirements for minimum liquidity and free float capitalization. Throughout 2019, Rusal has been meeting the minimum liquidity requirements and its ATVR ratio exceeded 15%; the current free float capitalization exceeded the minimum of $1.6 bln.

-718.png)

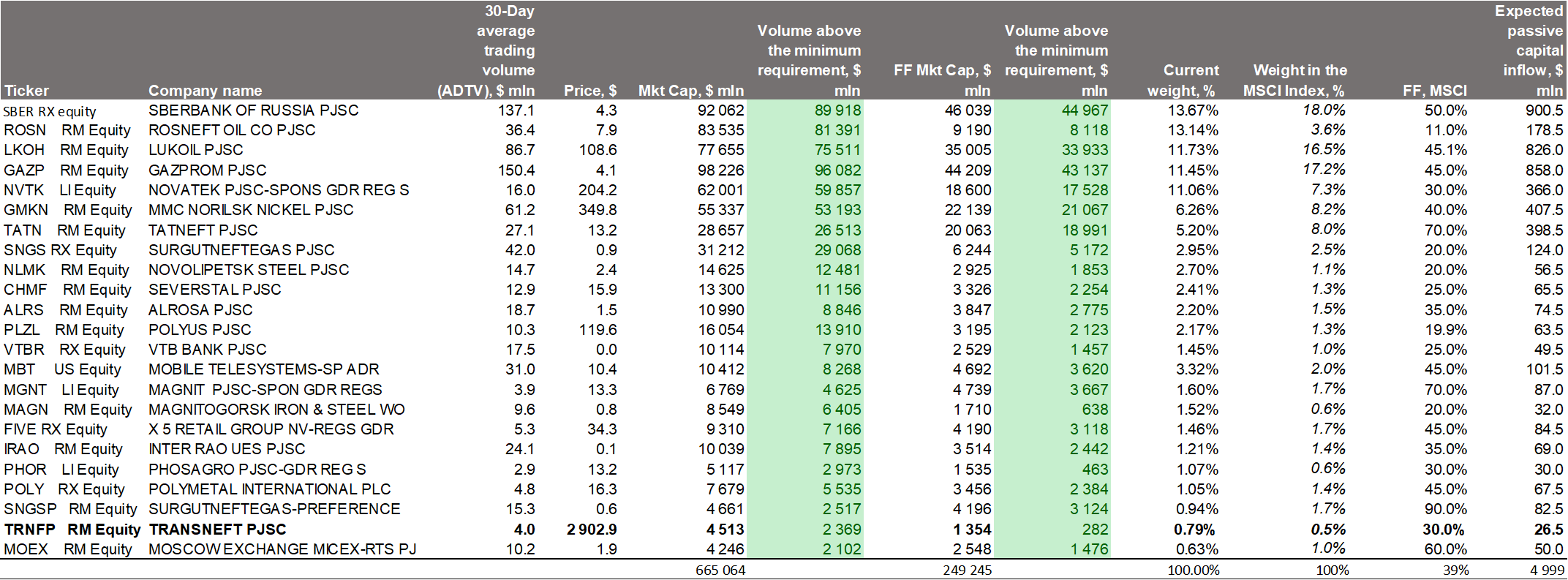

Transneft is facing yet another risk of exclusion. Therefore, we expect the stock to rally in April ahead of the May review, as was the case last time. Free float capitalization is the company’s weakest point. It stands at $1,349 mln, just $277 mln above the minimum requirement (25%). Transneft exclusion may trigger an outflow in $50 mln, that is 5-6 times as large as the ADTV in USD.

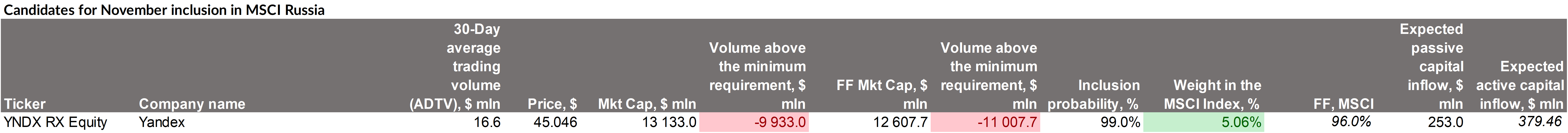

Yandex — inclusion not earlier than November 2020.

We believe Yandex is still the most promising candidate for November inclusion, but the company has seen an adequate level of local liquidity, which meets the MSCI Russia requirements due to high free-float (96%), only since Q319. According to our estimates, the average daily liquidity level for each quarter should not drop below $6 mln, so the current trend began only in the third quarter and should continue until the third quarter of 2020. As you can see from the chart below, volumes are only growing!

MSCI Russia Analytical table

Rusal — liquidity level (ATVR)

-854.png)

Rostelecom — liquidity level (ATVR)

-647.png)

Yandex — liquidity level (ATVR)

Iskander Lutsko,

Chief investment strategyst