Last year, corporate and sovereign issues with a junk rating below BB- and up to B- were the highest-yielders. EM bonds were the best-performing assets in the global bond market, yielding 15% on average. Country-wise, sovereign bonds of Costa Rica (BB-) (+31%), Ukraine (+30%), Senegal (+22%), Oman (+18%), Bolivia and Gazprom 2047 (+17%) were the best-performing assets. Russian sovereign bonds grew in line with Gazprom 2047, followed by Uzbekistan (+15%). Argentina (-35%) and Tajikistan (-6%) were the biggest losers.

- High-yield bonds have been in high demand since the beginning of the year, as was the case in 2019, on the back of low dollar rates and excess foreign exchange liquidity in the market

- Reassessment of the economic prospects, i.e. lowering recession risks is a key fundamental factor for the bond markets and keeping low dollar rates for full-year 2020 on hold

- Ukraine's sovereign bonds have been the top gainers among the high-yield EM bonds

- Nearly all Ukrainian bonds advanced 1.8-2.1% (the bonds’ yields were down 37-40 bps) year-to-date after Gazprom paid $2.9 bln to Ukraine at the end of 2019, as new gas supply contracts are expected to be signed soon

- We maintain a positive outlook on the Ukrainian bonds

- Naftogas 2026, sovereign Ukrainian bonds and securities of certain issuers, such as Metinvest, have been outperforming other securities in the bond market

- Naftogas bonds’ prices rose more than 2%, yield dropped by 60 bps

What to buy now?

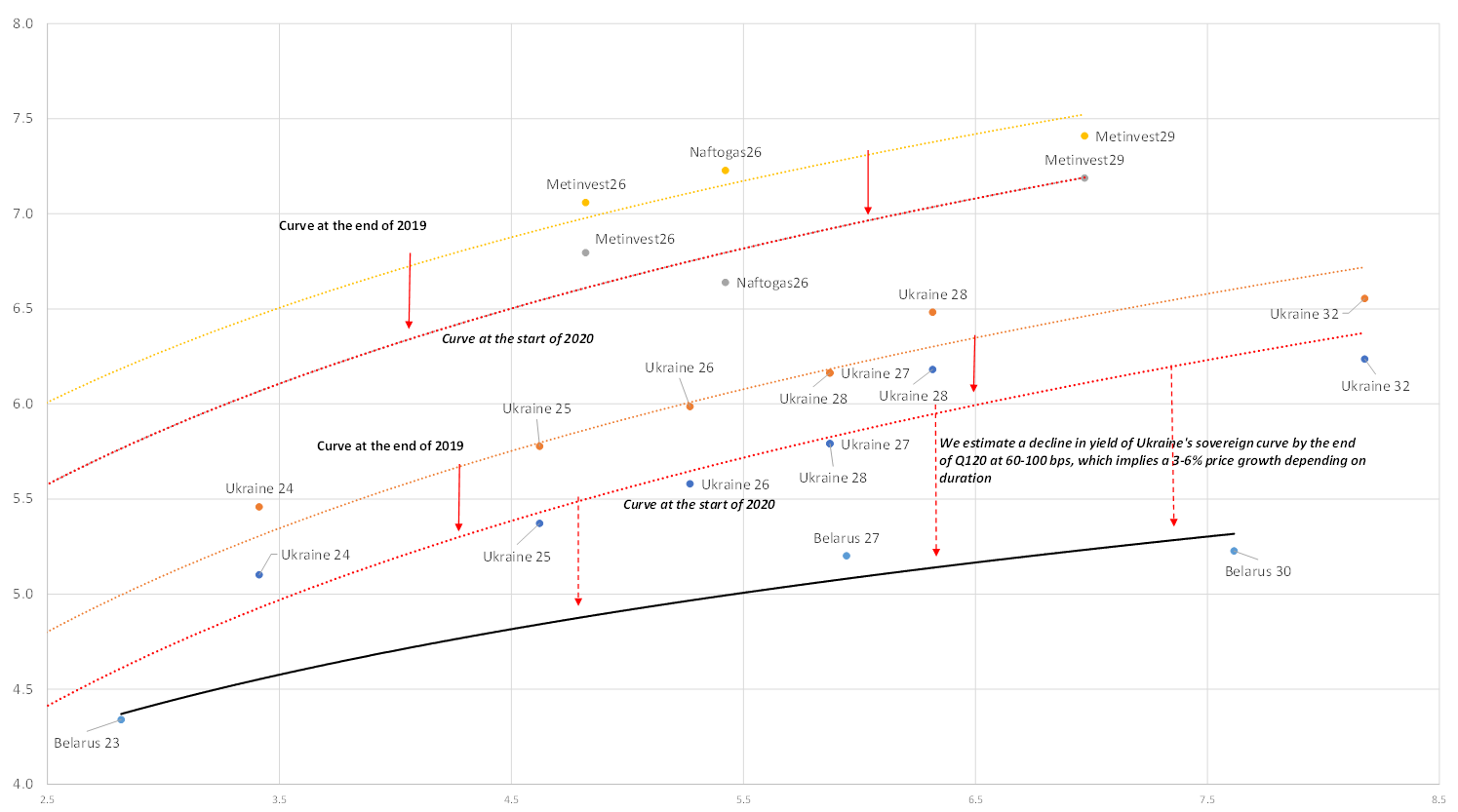

Ukraine's sovereign bonds upside assessment

- We believe that Ukraine’s sovereign curve will approach closely to the sovereign curve of Belarus

- Belarus sovereign bonds is one notch higher than that of Ukraine in terms of credit quality, but the chances of Ukraine's rating upgrade are higher than those of Belarus

- Therefore, yields’ downside by the end of Q1 is 60-100 bps, which implies a 3-6% price growth depending on duration

The reason for credit rating upgrade and growth of Ukraine's sovereign bonds

- Demand on risk due to upcoming U.S. - China trade agreements

- Limited supply of new issues in the bond market. The last placement took place in November 2019, but some issuers, such as Ukreximbank, Kernel and the Ukrainian Railway are placed at long intervals, and the outstanding issues amount $18 bln, 90% of which account on sovereign issues

- International reserves of Ukraine increased five times over the last four years

- Lower local currency volatility and keeping high real rates

- Inflation drop from 9% in 2019 to 5.8%, according to the IMF forecasts

- Current account deficit reduction

- GDP growth in 2020 by more than 3%, according to the IMF forecasts, which is one of the highest rates in the CIS

- Upcoming $1 bln tranche from the IMF and discussion of further loans

Further rating upgrades’ constraints

- Low reserve adequacy ratio (75%) which is coverage of short-term liabilities by international reserves

- The highest public debt/GDP ratio among CIS countries – about 70%

- Second after Georgia in terms of external debt/GDP ratio – about 92%

- Higher political risks and aggravation of relations with Russia

Ukraine's international reserves, $ bln

en-536.png)

Sources: Bloomberg, ITI Capital

Ukrainian yield curve, YTD

Sources: Bloomberg, ITI Capital

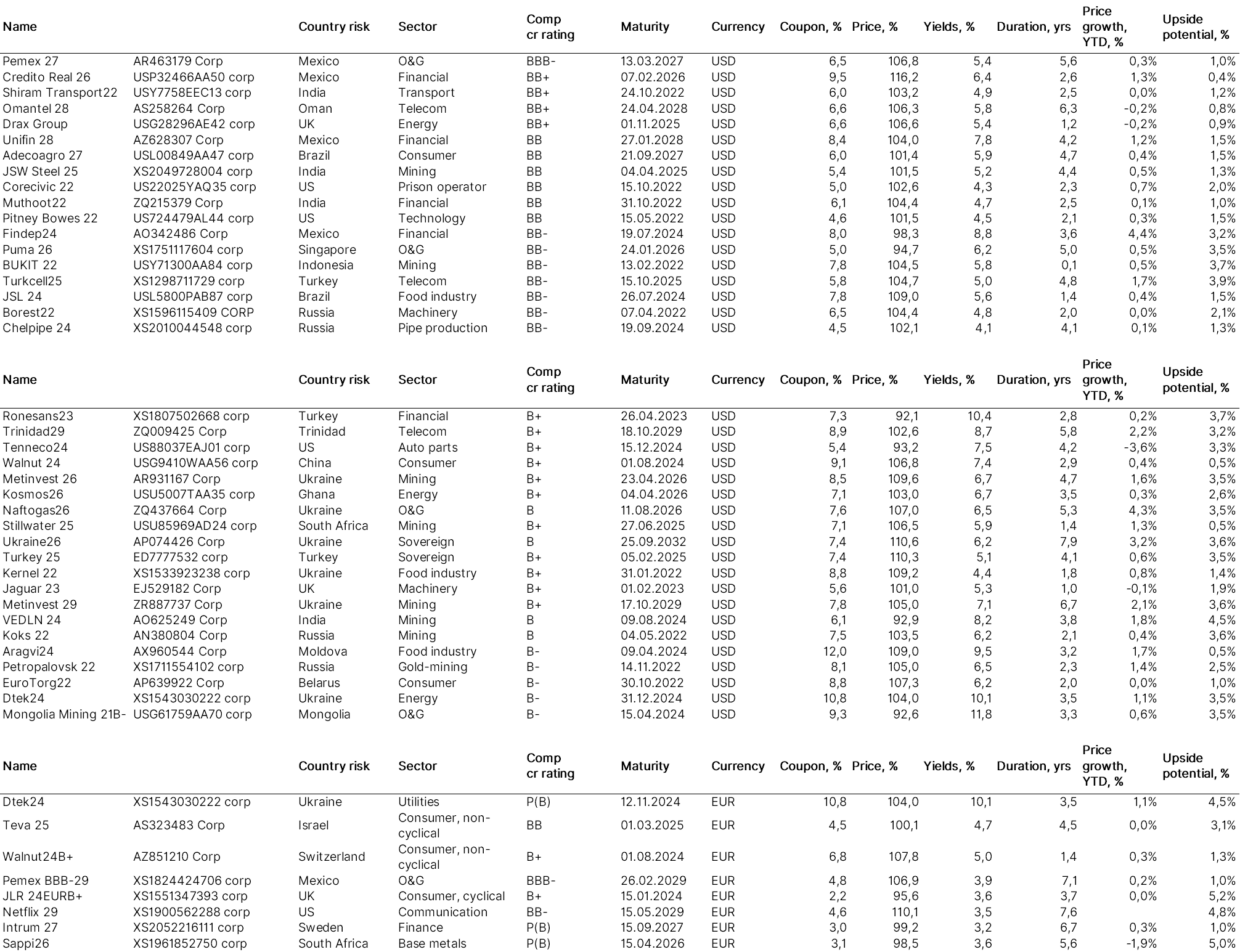

Other latest trade ideas

- Mexico’s financial organizations, such as Unifin 2028, are also advancing

- Among our current ideas, Vedanta 24 has grown by 1.8% year-to-date. The idea was released on December 19, 2019